Business

How Warren Buffett’s Geico fell behind Progressive in the auto-insurance race

Published

2 hours agoon

By

Jace Porter

Warren Buffett’s failure to capitalize on the economy’s digital shift over the last two decades has hurt his otherwise enviable track record as an investor. His blind spot regarding tech didn’t stop at the stock market: It bled into how he ran Berkshire Hathaway’s operating companies as well. Across many of his wholly owned businesses, Buffett neglected technological upgrades, and Berkshire’s business value has suffered as a result.

It’s important to understand this because the majority of Berkshire Hathaway’s assets are invested not in publicly traded securities, but in operating subsidiaries like Burlington Northern Santa Fe Railroad, Berkshire Hathaway Energy, and Geico. While it’s true that Buffett invested aggressively in wind energy, that was largely because of government tax incentives. In the main, he preferred to milk his operating subsidiaries for cash rather than reinvest in them for the digital age. Exhibit A is Geico, which thanks to a lack of IT investment has fallen behind Progressive as the nation’s leading for-profit auto insurer.

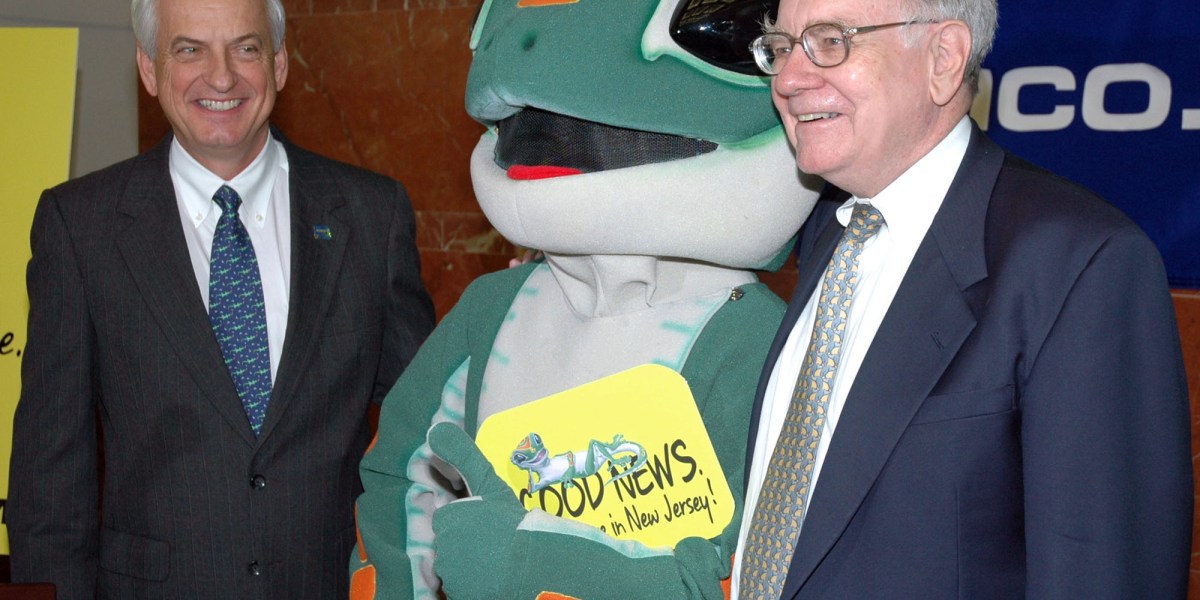

Buffett has called Geico his favorite child, and for good reason. Since it began in the 1930s, the auto insurer has used a direct-sales model to keep operating costs the lowest in the industry. In a commodity business like insurance, that’s a major competitive advantage. In the 1990s, after he bought all of Geico, Buffett found a second moat when he began to brand Geico as a trusted, even beloved American company. The gecko, the caveman, the camel who celebrated hump day—all these were marketing masterstrokes, ones directly derived from Buffett’s deep understanding of the mass brand-mass media industrial complex. The mascots also highlight how, while Buffett was comfortable investing in marketing, he was deeply uncomfortable with, and therefore didn’t understand, investing in tech.

When Buffett took control of Geico in 1996, he octupled its marketing budget. This wiped out almost all of Geico’s profits from a GAAP accounting standpoint, but Buffett was confident that increasing advertising outlays today would lead to more profitable customers tomorrow. And so it was: Under Buffett’s leadership, Geico’s market share grew from under 3% in 1996 to 12% in 2020, and it went from the No. 7 auto insurer to the #2 auto insurer, behind only State Farm.

So far, so good—but while Geico was investing in marketing, its rival Progressive was investing in technology. Founded only a year after Geico, Progressive began to upgrade its IT systems as early as the late 1970s. In the 1980s, it bought its agents computers and sent them floppy discs so they could better match price with risk. In 1996, Progressive became the first auto insurer to allow consumers to buy insurance online, and it continually streamlined its backend systems so that it could accurately quote new business. Today, Progressive brags that it has tens of billions of price points and that its tech stack allows the company to adjust its rates much faster than its competition—nearly once every business day. “We are a tech company that happens to sell insurance,” is one of Progressive’s internal mantras.

Driving the company’s tech investment was an insight that was perhaps even more astute than Buffett’s marketing insight. Thanks to its no-agent, no-commission model, Geico enjoyed a six-percentage-point cost advantage vs. Progressive in its operating costs. Because half of its business is through insurance agents, Progressive is unlikely ever to catch up here. But Progressive CEO Peter Lewis, who led the company from 1965 to 2000, understood that an auto insurer’s biggest cost center is the claims it must pay policyholders—four to five times bigger, in fact, than its administrative and advertising costs. If Progressive could manage these “loss costs” better than the competition, Lewis reasoned, then it could become the de facto low-cost auto insurer.

The key to managing loss costs was technology in all its glorious variety. Back-end systems at headquarters that could parse price and risk for each driver were important, but so were front line innovations like Snapshot, a shoebox-sized device that in the 1990s Progressive began installing into the cars of willing customers. Snapshot, now an app on your mobile phone, tracks a customer’s driving behavior; more than one in three Progressive customers buying insurance directly from the company opts in for “usage-based” premiums. Thanks to Snapshot and other innovations, Progressive simply knows more about its drivers than any other insurer, and this creates a virtuous circle in which the company knows which to reward with discounts, which to punish with surcharges, and which to purge altogether.

Thus, while Progressive’s operating costs have historically been six points worse than Geico, its loss costs have been 11 points better, which means that Geico’s low-cost moat has been breached by tech. In contrast to Progressive’s streamlined system, Geico has more than 600 legacy IT systems. It didn’t start working on a Snapshot-like product until 2019, twenty years after Progressive began.

Buffett liked to say that when the tide goes out, you see who’s swimming naked, and COVID was the perfect storm to reveal how little Geico had paid attention to its digital wardrobe. During COVID, people suddenly stopped driving, and then, when the pandemic ended, they drove more than ever and more recklessly than ever. At the same time, the worst inflation in forty years hit all sectors of the economy, including auto-repair shops. Such rapidly changing conditions favored insurers with robust tracking tools, like Progressive, and punished insurers without them, like Geico. Since 2020, Progressive has almost doubled its personal auto policy count—but Geico has lost nearly 15% of its personal insurance base. Progressive, not Geico, is now the nation’s number two auto insurer.

It turns out that while the branding of the gecko was important, it wasn’t nearly as powerful as employing sophisticated digital tools. Geico is a good example of what happens when a company, even a powerful one, fails to reinvest in its future. Rather than a virtuous cycle—tech investment leading to better pricing and better products, which drives more profits, which can then be reinvested to drive the cycle on—Geico seems caught in the same vicious cycle that afflicts General Motors, Macy’s and other legacy companies.

You may like

Business

Putin ally Alisher Usmanov agrees to pay $11.8 million fine to resolve German federal probe

Published

26 minutes agoon

December 30, 2025By

Jace Porter

German prosecutors say they will drop an investigation of Russian oligarch Alisher Usmanov, a close ally of President Vladimir Putin, over possible breaches of sanctions and money laundering rules after he agreed to pay a 10 million euro (about $11.8 million) fine.

The Uzbekistan-born Russian billionaire and metals magnate, who was reelected as the president of the International Fencing Federation last year, has been facing European Union sanctions imposed after Russia’s full-scale invasion of Ukraine in 2022.

The Munich prosecutors office said Tuesday the probe of Usmanov, which prompted police raids of dozens of properties in Germany linked to him three years ago, will be dropped upon receipt of payment of the fine.

Some funds and assets linked to Usmanov had been frozen under the EU sanctions.

Prosecutors said Usmanov was suspected of transferring about 1.5 million euros through foreign-based companies for management of two properties in the lakeside town of Rottach-Egern south of Munich, in the months after the sanctions were imposed.

He was also alleged to have failed to declare valuables including jewelry, paintings and wines to authorities. Usmanov’s defense team had challenged the allegations about his ties to the companies and valuables and the applicability of EU law in the case.

The prosecutors said the discontinuation of the investigation upon payment of a fine was authorized under German criminal law.

This story was originally featured on Fortune.com

Business

Television is a state of mind: why user experience will define the next era of media

Published

57 minutes agoon

December 30, 2025By

Jace Porter

I struggle with the word television. Although we continue to use that term, recent market-definition debates – including in Netflix’s acquisition of Warner Bros. Discovery (WBD) assets – make it abundantly clear that what we call television is much more than a screen in a room where we lean back to watch professionally produced, long-form content delivered linearly at an appointed time.

What we now call television is an experience that adapts to the viewer. It’s about how, when, and where we connect to content across moments, moods, and devices. Television is the moment we decide to be carried by a story: comfort, curiosity, escape, connection. That moment can happen on a couch, in an Uber, in the kitchen, or between meetings—across any screen, any length, any format. Television has become a state of mind.

When Product Experience Becomes Strategy

Coming back to the U.S. after working in satellite television for News Corp. in India, I could see that digital streaming was the future. That feeling turned into a reality when I moved into the internet portfolio of News Corp./Fox during the MySpace era. My first big lesson was humbling: media companies don’t “go digital” by declaring a strategy. They go digital when the product experience is the strategy.

At MySpace, we signed what looked like a genius deal: Google guaranteed roughly $900 million over three years to serve ads on the Myspace platform. Wall Street applauded. Users did not. The interface and pages got cluttered, load times slowed, and the very vibe that made MySpace culturally dominant began to erode. When Facebook arrived with a cleaner, more intuitive design, people didn’t debate the switch. They simply left.

That moment clarified something the industry still struggles to accept: users vote with their behavior, not with their loyalty.

You Can’t Litigate Your Way to Relevance

MySpace also taught me you can’t litigate your way back to relevance. When music rights pressure intensified with Universal’s Music’s high stake litigation, a partnership was built in place of a war—structuring a Hulu-like joint venture with major labels that licensed catalogs and aligned incentives. The takeaway wasn’t “we won.” It was that the winners in disruption stop fighting the new behavior and start building an ecosystem around it. Disney’s recently announced partnership with OpenAI is a perfect example of this.

Engineers as Storytellers

Those lessons followed me into launching direct-to-consumer products for a major telecom platform and later for HBO Latin America. Inside big organizations, everyone understands technology matters. What’s harder is funding it, attracting talent to buy into the vision, and giving it the runway to pay off. Streaming “wars” are often narrated as content wars, but they’re increasingly product wars: discovery, personalization, and the quiet reduction of friction that keeps people in the experience.

To get closer to how that machine is built, I joined a PE-backed digital engineering services company as CLO and CPO and lived through the COVID era of forced digital transformation. I realized something that reshaped how I think about media: engineers are storytellers, like their counterparts on the content side. They don’t write the plot but they tell a story of how we live our lives online—how we find content, connect with others to share it, and return to continue engaging. The way we consume content becomes part of the content experience.

Future of TV

That’s the real power shift I wrote about recently: control is moving from whoever owns the most content to whoever delivers the best experience. YouTube is the clearest case study. It meets users in almost every “TV state of mind”—short bursts, deep dives, background listening, big-screen sessions—with a seamless product layer and a data flywheel that keeps audiences engaged. It also keeps creators engaged not by giving away equity, but by sharing advertising revenue at scale.

Netflix internalized the same idea early: one global product, one recommendation engine, one continuous engagement loop—and the willingness to invest heavily in technology so that the value of the company compounds. Now the industry is testing whether consolidation can accelerate that advantage. If Netflix’s pursuit of Warner Bros. Discovery’s studio and streaming assets signals anything, it’s that media deals should be judged less by “how much content did we buy” and more by whether the combined company can deliver a better experience, globally.

TV As a State of Mind

So what does the future look like when we treat television as a state of mind?

Theatrical doesn’t fade, It evolves from “watching a movie in an uninteresting venue” to showing up: a high-quality social ritual built on community and connection.

The winners will think like great hospitality brands and premium experience operators — designing nights people crave, delivering them consistently, and scaling them into repeatable, franchise-ready formats based on business models that create value and opportunity.

Home viewing becomes the default theater, but only if it’s designed, not delivered. “User-first” means personalization that recognizes mood, not just taste. Discovery that feels like curation, not an infinite shelf. Social layers and advertising opportunities are either optional or integrated in a seamless way into the user experience. Continuity that lets you start anywhere and finish anywhere.

The future of television is the feeling of being understood—and the platforms that earn that feeling will define what we call TV in the next decade ahead.

The opinions expressed in Fortune.com commentary pieces are solely the views of their authors and do not necessarily reflect the opinions and beliefs of Fortune.

This story was originally featured on Fortune.com

Business

Warren Buffett’s blind spot: Did Big Tech and the digital economy leave him behind?

Published

1 hour agoon

December 30, 2025By

Jace Porter

Warren Buffett is to investing what Einstein was to physics, Edison was to invention, and Mozart was to music. There will never be another one like him, and you should pity anyone who says they aspire to be “the next Warren Buffett.” Whenever I hear someone talk about “the next Warren Buffett,” I think of Antonio Salieri, Mozart’s inferior rival, played brilliantly by F. Murray Abraham in the movie Amadeus. In the film’s climactic scene, Mozart dictates his Requiem to Salieri from his deathbed. As Salieri struggles to keep up with the genius pouring forth, his face is equal parts awestruck and ravaged. It is the face of a person who knows he is doomed—not to failure, but to something perhaps even worse: mediocrity.

As we pause to honor the master’s legacy, however, it’s clear that Buffett’s oeuvre is in fact divided into two distinct periods. The first lasted from shortly after he graduated from Columbia Business School in 1951 as Ben Graham’s star pupil to the end of the dot.com bust. If you had invested in Buffett’s partnership in the early days and then rolled your money into Berkshire Hathaway when that old textile company became his investing vehicle, over the next fifty years you would have nearly 500 times more money than if you’d invested in the S&P 500.

You don’t get a sense of how awesome, in the original sense of the word, that figure is until you translate the difference into actual dollars. A million dollars invested in the S&P from 1957 through 2007 would have been worth $166 million—but a million invested with Buffett would have been worth almost $81 billion. Fast forward another 18 years, and your $1 million with Buffett is now worth almost $428 billion.

This is where the legend of Buffett’s genius rightly springs. What is less well known, however, and even less discussed, is that these first five decades account for more than 100% of Buffett’s career outperformance. While he beat the S&P by a factor of almost 500 in his first fifty years, he has underperformed it in the eighteen years since. As the chart below shows, a million dollars invested in the S&P from the end of 2007 through mid-December 2025 would today be worth $6.6 million, almost 25% more than the $5.3 million you would have earned in Berkshire’s stock.

The data lead to an obvious conclusion. For most of the 21st century, Buffett’s record was mediocre—Salieriesque, one might say.

How could this happen? How could a practitioner as driven and imaginative as Warren Buffett produce such genius, then become slightly below average?

These questions are worth pursuing. To understand why Buffett excelled in the 20th century but hasn’t in the 21st will help us understand two things. First, what once made his style of value investing so good. Second, why he faltered, and how value investors must change if we want to excel in the digital age.

I realize that by calling attention to these facts I am violating one of value investing’s cardinal commandments: Thou shalt have no other gods beside Warren Buffett. To those deeply immersed in it, value investing, invented by Ben Graham more than a century ago and passed directly to Buffett, resembles a religious order in many ways. It has many principles and precepts and a long list of dos and don’ts. Our discipline, we believe, distinguishes us from growth investors and momentum investors, whom we look down on as heathens. Unlike them, we think, we aren’t stock jockeys or herd followers. We have rules. We trust that these rules will lead us to outperform. And when we do outperform, we believe it is not a matter of luck, but of patiently applied skill.

This fixity of purpose can lead to stilted and dogmatic thinking. To suggest that Buffett was Mozart in the first three-quarters of his investing career and then Salieri in his last quarter represents a kind of heresy to many in the value church. Fortunately, one of the many salutary things about value investing is that recourse to hard facts is another of its cardinal principles. Value investing has had one major reformation in its 100-year history, a reformation driven by Buffett himself. As Buffett’s two disparate records suggest, if we are to succeed in the digital age, value investors must again evolve.

From ‘cigar butts’ to mass brands

Like Buffett’s overall record, his magisterial performance in the late 20th century is in fact composed of two discrete periods. The first comes from what Chris Begg at East Coast Asset Management calls Buffett’s Value 1.0 days, when he invested in Ben Graham-like “cigar butts,” companies that were cheap not on the merits of their business quality but on their asset liquidation value. Early on, Buffett scored big with such fire-sale investments as Dempster Mill Manufacturing and National American Fire Insurance. His purchase of Berkshire Hathaway, a dying New England textile mill he bought because it was worth more dead than alive, was the very distillation of Ben Graham’s quantitative, defensive style.

Berkshire in fact survives only because Buffett began to listen to his acerbic partner, Charlie Munger. Munger loathed Graham’s cigar-butt approach, referring to it over the years as “madness,” “a snare and a delusion,” and a discipline that “ignored relevant facts.” From the early days of their collaboration, Munger pressed Buffett to look at a business’s earning power rather than its liquidation value, and to use Berkshire as a holding company to invest in such companies. The real money, Munger argued, lay not in a business’s fire-sale value but in its ability to generate growing profits over its lifetime. Buffett embraced Munger’s style, and thus Value 2.0 was born.

With its focus on good, growing businesses, Value 2.0 was as suited to the postwar world as Graham’s defensive Value 1.0 was suited to the Depression. The United States in the 1950s was prosperous and remarkably stable, and its business dynamics were resistant to material change. Television, for example, became the dominant mass medium after World War II, and TV itself was dominated by only three national networks for nearly forty years. The same was true of print media. Earlier in the 20th century, major cities like Washington, D.C., had more than 100 newspapers. By 1981, the city had only one, The Washington Post, and Berkshire was a major shareholder.

As the 1950s became the 1960s, Buffett and Munger’s key insight into this ecosystem was as simple as it was brilliant. They didn’t label it as such, but in hindsight we can say they diagnosed and then invested in what might be called the mass brand-mass media industrial complex. Only a few outlets dominated the media, giving them a chokehold on advertising dollars. Using these channels, dominant consumer-product companies could take incremental market share simply by outspending their rivals. If a company like Budweiser or Coca-Cola began with 50% more revenue than its nearest rival, Bud or Coke could spend the same percentage of revenue on advertising as Miller or Pepsi and still outspend them by 50%.

Buffett and Munger understood and exploited this more quickly and more deeply than anyone else. Media companies like Disney and ABC and consumer product companies like General Foods became major Berkshire investments in the 1960s, 1970s, and 1980s, as did the few big advertising agencies that supported the mass brand-mass media industrial complex.

Looking back, it’s remarkable how slow-moving and static competitive dynamics were in the late 20thcentury. Of course there was technological innovation—the silicon chip was commercialized in the 1950s, and on its back the transistor radio and then the mobile phone—but the companies that won in the marketplace were steady, grind-it-out growers in sectors where the battle lines had been drawn and it was easy to identify the commanding players. These sectors included not only media and consumer products but also banks, which often dominated their markets. Buffett loved banks and invested in them profitably for decades, and he extended his interest in financial services to other companies like American Express and GEICO, which combined the best of consumer product companies—brand identity—with the raw scale economies of large financial institutions.

Given this, it’s no wonder Buffett came to land on the medieval term “moat” to describe competitive advantage. Buffett learned early on in Value 2.0 that companies with a solid, entrenched competitive position won, and kept winning—slowly but surely, year by year. Likewise, he learned to favor smart, cautious executives who deepened their moat but didn’t try to expand into new territory. Eisenhower, pushing the U.S. Army slowly but surely toward Germany in 1944, was the right archetype for Buffett. Napoleons made for good copy but almost always overreached.

In the late 20th century, investing with this template proved extremely lucrative. Markets rewarded plodders and punished risk takers and innovators. When in 1985 Coca-Cola announced it was changing its formula to “New Coke,” its customers were so angry that Coke went back to the same mixture John Pemberton had come up with in 1886. As one of the three major national television networks, all ABC had to do was produce reasonably good programming to keep its hold on millions of American eyeballs. My favorite example of all is that of Scotch Tape, which was invented during the Depression by an engineer at 3M named Richard Drew. Despite its enormous mass-market appeal, no competitor tried to improve upon Scotch Tape for more than a generation after its introduction. Scotch Tape thus had the profitable niche of consumer adhesive to itself for thirty years. Can you imagine a company today maintaining its lead for thirty months, let alone thirty years, absent any innovation?

Technology challenges Value 2.0

As for investment in technology, Wall Street regarded it for much of the 20th century as a kind of social utility: It was wonderful for civilization, but it was terrible for stockholders. All too often, research and development spending in semiconductors and related technologies was deemed speculative or, just as bad, easily copied and therefore moatless. As a result, even into the late 1980s, good Value 2.0 investors like Peter Lynch dismissed tech stocks as a reliable way to make money. “For every single product in a hot industry,” Lynch wrote in One Up on Wall Street, “there are a thousand MIT graduates trying to figure out how to make it cheaper in Taiwan.”

Then, sometime around the turn of the millennium, the world began to change.

Ironically, the tipping point came right after the dot.com crash, which was the ultimate proof point to “good investors” that investing in tech stocks always ended poorly. What these investors failed to account for was the ineluctable power of Moore’s Law. Moore’s Law is as simple as it is profound: It stipulates that roughly every two years, computing power becomes twice as powerful with minimal incremental cost. Moore’s Law guaranteed that by the year 2000, computing power had become 30 million times more powerful than when semiconductors were commercialized in the 1950s. Thirty million times is a lot, but it wasn’t enough to generate the critical mass of a digital ecosystem. In 2000, for example, only 1% of the world’s population could access broadband internet, and only 15% could afford a cellphone. This goes a long way to explaining the dot.com crash—there simply wasn’t enough computing power to support the connected world we see around us today.

However, Moore’s Law didn’t stop during or after the dot.com crash. Computing power became 30 million times more powerful between 2000 and 2002, then 60 million times more powerful between 2002 and 2004, and so on until sometime around 2010, it became strong enough to enable the technology-rich environment we now inhabit. Today, well more than half of the world’s population has both broadband access and a powerful smartphone. Today, much of the world searches, shops, chats, banks, and performs many other everyday activities online. Because consumers tend to standardize on a single application—Facebook for social media, Microsoft for office tools, Google for search—you also have tech companies that possess the customer loyalty and predictability that Buffett rightly craved.

Suddenly, entire economic sectors became existentially threatened by digitally driven alternatives, and these threats extended to most of the hunting grounds that Buffett and Munger had for so long favored. Mass media, already disrupted by the advent of cable television, became even more fragmented as Google, YouTube, and Facebook usurped television’s dominion. In a fragmented media landscape, powerful brands like Coke and Budweiser could no longer press their advantage; it’s easy now to launch a niche brand using TikTok and Instagram. One of banks’ central pillars, its network of brick-and-mortar branches, is increasingly less relevant in a world that does much of its business digitally.

JOHANNES EISELE/AFP—Getty Images

Buffett and Munger found it hard to adjust to such changes—and at their age, who wouldn’t? Buffett was 73 when Google IPO’d. It’s difficult to fault him for not quite tuning in to the new narrative. On the other hand, at times Buffett demonstrated an almost willful resistance to the changes brought on by the digital age. He never learned how to use email, for example, and he gave up his flip phone for a smartphone only in 2020, thirteen years after the advent of the iPhone and four years after he invested in Apple. Exquisitely comfortable in the late 20th century ecosystem, he loved reading physical newspapers every morning and talking on the telephone from his office in the Midwest. Every year, he’d take the stage in Omaha for his annual meeting and drink his Cherry Cokes and eat his Dilly Bars. Munger would make a wisecrack, break off a chunk of See’s peanut brittle, and it was all good—until it wasn’t.

Still, Buffett was too brilliant a business analyst not to grasp what was happening. He and Munger saw how digital businesses like Google were radically better businesses than even his best Value 2.0 investments. Coke sold sugar water, which had big margins, but to get to market Coke had to build bottling plants and establish a network of trucks and vending machines. When a software company wants to enter a new geographic market, its engineers simply write new code, hit “deploy,” and voila—the product is available around the globe, instantaneously and with almost no incremental costs. The result has been the rise of the most successful companies ever produced. Even though Coke was incorporated in 1892 and Alphabet was incorporated more than a century later, Alphabet now makes more than $100 billion in annual profit—nearly ten times more than Coca-Cola.

In what amounted to an extemporaneous master class on the power of digital economics, Buffett acknowledged this superiority at his 2017 meeting.

“This is a very different world than when Andrew Carnegie was building a steel mill and then using the earnings to build another steel mill and getting very rich in the process, or Rockefeller was building refineries and buying tank cars and everything,” Buffett told the crowd. “I don’t think people quite appreciate the difference.

“Our capitalist system was built on tangible assets, but this asset-light model is so much better,” he continued. “Andrew Mellon would be absolutely baffled by looking at the high-cap companies now. I mean, the idea that you could create hundreds of billions of value, essentially without assets…”

“Fast,” Munger interjected.

“Fast, yeah,” Buffett agreed. “You literally don’t need any money to run the five tech companies that are worth collectively more than $2.5 trillion in the stock market, who have outpaced any number of those names that were familiar, if you looked at the Fortune 500 list 30 or 40 years ago, you know, whether it was Exxon or General Motors, or you name it.”

The road not taken

This is all standard, brilliant Buffett stuff—but why, aside from Apple, did he never pull the trigger on these stocks? Over the last twenty years he has been consistently underweight technology stocks, and he forewent hundreds of billions of dollars of value creation in doing so. Having evolved so well from Value 1.0 to 2.0, why did he fail to evolve to Value 3.0? And if he had, would it have made his record better?

The second question is easier to settle than the first. The answer to it is unquestionably yes—Berkshire Hathaway’s stock performance would have been materially better had he followed through on his observations about the superiority of tech’s business models and invested in more of them. When Buffett started buying Apple nearly a decade ago, if he had deployed excess cash (the cash he didn’t need for potential insurance claims) into each of the three mega-tech stocks besides Apple that he knew best—Alphabet, Amazon, and Microsoft—I estimate that Berkshire Hathaway’s market cap would not be the $1 trillion it is now, but at least $1.6 trillion. It’s important to note that this calculation incorporates only the market appreciation of these three stocks. If the market had capitalized Buffett’s “getting tech” and given Berkshire Hathaway’s stock a greater premium as a result, then Berkshire’s gain would have been greater. (Berkshire did buy $6.5 billion worth of Alphabet’s stock earlier this year, though it’s not clear whether it was Buffett or his lieutenants who pulled the trigger on the purchase).

While rough, my estimates are not crazy. Buffett understood all three stocks well. He was close friends with Bill Gates, Microsoft’s founder, who explained the company’s competitive advantages to Buffett many times. At his 2017 annual meeting, Buffett admitted that he “blew it” by not investing in Amazon and Alphabet. Investing a big slug of his cash in these liquid, mega-cap stocks would have solved the “problem of large numbers” that some who seek to rationalize Buffett’s average latter-day record point to. And my estimate assumes that Buffett bought only a single slug of each.

To those who say, “Buffett didn’t miss tech—he had Apple,” I would say two things. First, thank goodness Buffett invested in Apple—can you imagine what his recent record would look like if he hadn’t? Second, I would argue that by the time he invested in Apple the company was acting more like one of his mature, moated consumer products companies than it was a company we would recognize as a “tech company:” ambitious and forward-looking in its investment and R&D spending. When Buffett first bought Apple shares in 2016, it had transformed into a business that had much more in common with Coke and Gillette than it did Amazon or Alphabet.

People forget that two important things happened in the years immediately before Berkshire began to buy Apple. First, Steve Jobs became terminally ill and was replaced in 2011 by Tim Cook. Suddenly, the design visionary was out, and the man whose main achievement was perfecting the company’s supply chain was in. While Jobs brought us the iPod and the iPhone, he also was responsible for the Lisa and the Newton, and he once almost bought Universal Music, a purchase that would have meant handing over cash or stock worth nearly Apple’s entire market capitalization at the time. That wasn’t going to happen under Cook. The quartermaster had replaced the field marshal. Salieri replaced Mozart, and this suited Buffett fine.

Then, two years after the management change, Carl Icahn launched a proxy fight to force Apple to stop accumulating cash and start returning it to shareholders via massive share buybacks. Icahn never said it exactly like this, but the subtext was clear: With the genius gone and the iPhone bringing in billions, it was time to act like a mature consumer products company. Cook had already begun buying back stock, but Icahn wanted him to do much more, and Cook eventually obliged. By 2015, Cook was saying things like, “By and large, my view is for cash that we don’t need, with some level of buffer, we want to give it back. We’re not hoarders.” The next year, Buffett started buying shares.

Post-Jobs, Apple was exactly the kind of company Buffett understood and loved. It had a moat, it worked hard to expand that moat, but beyond that it wasn’t terribly ambitious. A technocrat, not an innovator, was in charge. You can easily see this in not only the tone of Cook’s remarks but in his actions. What is Apple’s biggest innovation since Jobs died in 2011? The Apple Watch and—it’s almost sad to say it—AirPods? As you can see from the accompanying chart, Apple ranks near the bottom of the Magnificent Seven in terms of research and development spending as a percentage of sales. Alphabet and Amazon spend nearly twice as much, and Meta spends three times more.

It’s hard to argue that Cook’s plan hasn’t worked. The stock has risen more than tenfold since Buffett began buying it, and Apple remains the second-most-valuable company in the world. But Microsoft is up eight-and-a-half times since Buffett began buying Apple; Amazon is up nearly sevenfold; and Alphabet has octupled. All have dramatically outperformed the market, and Buffett had plenty of evidence almost a decade ago that they would. He understood their competitive advantages ago; he admitted he blew it by not buying them; but he didn’t. Why?

Because like other good late 20th century investors, Buffett learned that reinvestment, especially in technology, leads to heartbreak rather than value creation. In his era, companies that reinvested often destroyed value rather than created it. But that is not the era we live in today. Alphabet, Amazon, Microsoft and hundreds of other smaller and lesser-known companies all reinvest a double-digit percentage of their revenues in research and development. The superiority of digital business models permits them to. Without a cost of goods sold—zeros and ones are metaphysical rather than physical—what an average tech company spends on R&D exceeds the entire profit margin of the average American corporation by 50%.

Today, unlike a generation ago, there’s abundant evidence that companies which invest in the future will and should be rewarded. Amazon’s average P/E multiple has averaged more than 200x since it went public, but the stock continues to appreciate. Why? Because investors continue to believe that Amazon is depressing current profits to maximize future ones. It’s a “jam tomorrow” company rather than a “jam today” one.

Apple is more jam today. It continues to return capital, which is fine, but you don’t get something for nothing. Microsoft, Amazon, and Alphabet have plowed billions of profits into new industries like cloud computing, driverless cars, quantum computing, and artificial intelligence; Apple is not a major player in any of these mega-trends. The iPhone accounts for most Apple’s profits. What happens if geopolitical friction impairs the company’s smartphone supply chain, which is still heavily dependent on China? And what happens to Apple if worldwide demand for the iPhone falters, which it perhaps already has? Economic nationalism has begun to cause the Chinese to turn to domestic devices, and China accounts for 20% of the company’s sales. If the courts rule that Google can no longer pay Apple to be its default search engine, almost a quarter of Apple’s profit evaporates.

These vulnerabilities illustrate the wisdom of Elon Musk’s 2018 dictum that “moats are lame. If your only defense against invading armies is a moat, you will not last long. What matters is the pace of innovation.” The wonderful thing about the early 21st century is that, unlike Buffett, we don’t have to choose between mature, moated companies on the one hand and high growth but speculative ones on the other. Today, in a Value 3.0 world, we can have moats and brands and high growth as well. Despite its enormous size, big tech continues to grow its topline at multiples of the growth rate of the American economy. Amazon has been in business for more than a generation but it still has only a single-digit domestic market share of both retail sales and computing operations. The company’s market cap is so large that we tend to forget such statistics, but like age, market cap turns out to be just a number.

The investment landscape changed once after World War II, when American business was stable and slowly growing and Buffett could invest with confidence in dominant, moated enterprises. It has now changed again with the advent of huge, winner-take-most digital platform companies—not just the mega-tech companies, but dozens of others like Intuit and Adobe, ARM and Atlassian, Uber and Airbnb. All these companies dominate their niche as much as Coke and Bud did in their day.

Because the economy has changed, as value investors we must change with it. Part of this recalibration needs to be quantitative. We need to adjust our metrics to account for companies like Amazon, who spend on the future through the income statement. Such spending penalizes current earnings and makes its stock appear more expensive, but, as GEICO did when Buffett bought the company 30 years ago, the spending boosts future earnings.

There’s another, broader recalibration we must also undertake. Just as Munger told Buffett when they were young men, Value 1.0 was useful in its time but, as business and markets evolved, it ignored certain relevant facts. With its emphasis on milking a business rather than reinvesting in it, isn’t it time to say the same regarding Value 2.0?

The best way to honor Warren Buffett

In the end, whether Buffett “missed tech” or not is irrelevant. He has now all but removed himself from the great arena of the stock market, and the best requiem we can give him is to ask how we should proceed ourselves.

The only thing more pitiful than hearing about “the next Warren Buffett” is hearing his disciples parroting Buffetisms as if were still 1967, 1987, or even 1997. Many of these disciples have failed to apply the maestro’s maxims to the present day’s radically altered business landscape. “My favorite holding period is forever,” Buffett has said, and it’s a good axiom—but should we be holding businesses like Coke and Wells Fargo, whose best days are likely behind them, or ones like Alphabet and Microsoft? “Price is what you pay, value is what you get,” Buffett has said, and that’s also true—but what does the saying mean in the context of a tech company’s ambitious spending and consequently high P/E ratio? Conversely, what does it mean for a business like Kraft Heinz, a Buffett holding that has systematically failed to reinvest and has thus systematically eroded its business value? Kraft Heinz has so thoroughly failed, in fact, that it’s resorting to the ultimate refuge of corporate scoundrels: a breakup.

When I go to Berkshire meetings these days or am around value investors generally, I hear these axioms endlessly repeated, but with little thought to their contemporary meaning. It’s like members of an old, established religion mumbling a catechism without thinking about its relevance to their world today. Buffett and Munger never meant their wisdom to be suspended in amber. They were far more flexible and sophisticated thinkers than that. Value investors need to be, too.

Fortunately, as the 21st century enters its second generation, more and more value investors are adapting their templates to a Value 3.0 world. For every holdout like David Einhorn of Greenlight Capital, who continues to rail against tech’s high valuations while owning coal miners and annuity companies, there are investors like Tom Gayner at Markel, Bill Nygren at Oakmark, and Bill Ackman of Pershing Square Capital. They have all used a value-based discipline to make successful investments in tech. My favorite is Lew Sanders, the former CEO of Value 1.0 paragon Sanford Bernstein. During the Great Financial Crisis, Sanders bought banks because they looked cheap using traditional value metrics. Many were in fact worthless, and Bernstein fired him. Forced to start over with his own firm, Sanders decided that the world had changed. He changed with it: His top positions now include Meta, Microsoft, Alphabet and Taiwan Semiconductor.

Gov. DeSantis pushes back on effort to build AI data centers in Florida

Putin ally Alisher Usmanov agrees to pay $11.8 million fine to resolve German federal probe

Munich Wants A Summer Olympics in near future

Trending

-

Politics8 years ago

Politics8 years agoCongress rolls out ‘Better Deal,’ new economic agenda

-

Entertainment8 years ago

Entertainment8 years agoNew Season 8 Walking Dead trailer flashes forward in time

-

Politics8 years ago

Politics8 years agoPoll: Virginia governor’s race in dead heat

-

Entertainment8 years ago

Entertainment8 years agoThe final 6 ‘Game of Thrones’ episodes might feel like a full season

-

Politics8 years ago

Politics8 years agoIllinois’ financial crisis could bring the state to a halt

-

Entertainment8 years ago

Entertainment8 years agoMeet Superman’s grandfather in new trailer for Krypton

-

Business8 years ago

Business8 years ago6 Stunning new co-working spaces around the globe

-

Tech8 years ago

Tech8 years agoHulu hires Google marketing veteran Kelly Campbell as CMO