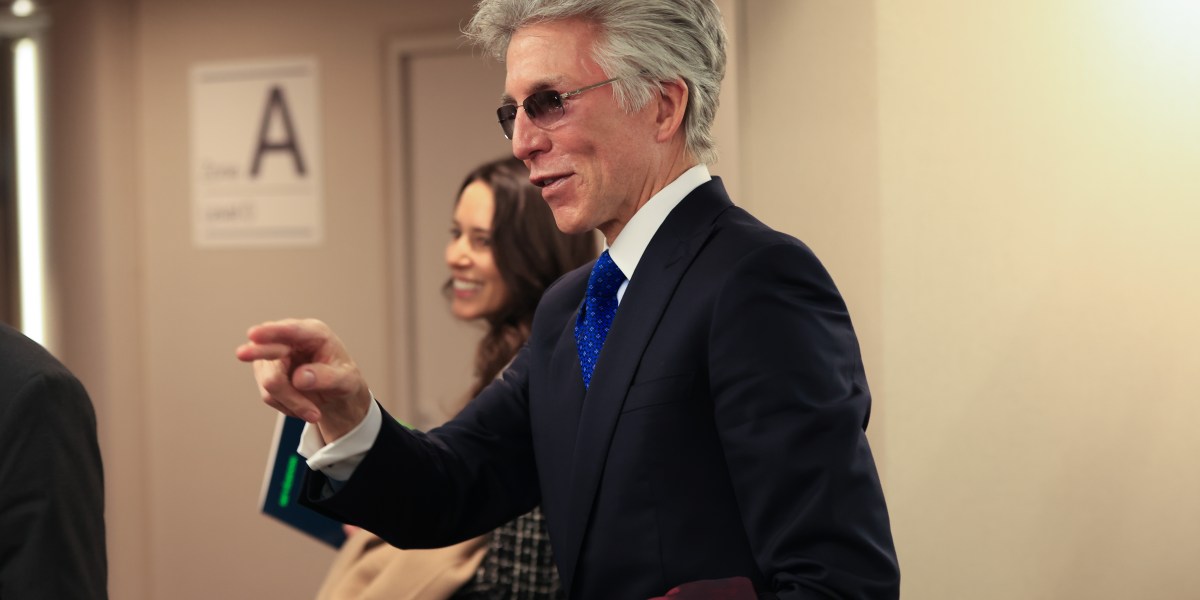

Ford CEO Jim Farley has been ringing the alarm bell for months about what he sees as a “crisis” in what he calls “the essential economy“: everyday industries that build and fix things. In other words, he thinks the blue-collar backbone of America is being ignored, even with all the hype about artificial intelligence (AI) eating up entry-level jobs. (Farley himself has famously predicted that AI will destroy up to half of white-collar employment.)

Onstage at the Ford Pro Accelerate summit earlier this week, organized by Farley to bring together business leaders to discuss big-picture solutions, the Ford leader revealed that his own son was openly questioning whether to go to college, having really enjoyed his summer job as a mechanic. “Dad, I really like this work,” Farley recalled hearing from him, “I don’t know why I need to go to college.” In a podcast appearance with The Verge‘s Nilay Patel published around the same time, Farley talked more about the journey that he and his son Jameson are taking.

Speaking on the Decoder podcast, Farley argued that “we all need to look at ourselves and decide what kind of society we want to build in America.” His son is 17 and a senior in high school and Farley, who receives well over $20 million in compensation per year, acknowledged that his son has “got every opportunity that you could ever imagine. He doesn’t have to worry like most people.” Still, Farley said he made sure that Jameson “had a summer job where he learned how to weld, to fabricate, to really work with his hands, and relate to people.” If he goes on to pursue a career in the trades, Farley added that he will be “so thrilled as a parent.”

The challenge: A national skills gap

The Ford CEO’s comments come amid ongoing debate about the U.S. skills gap and the future of manufacturing. In his public appearances, Farley has lamented the shortage of young Americans entering the skilled trades, a concern echoed by many business leaders and economists. Ford itself faces a shortfall of repair technicians, even as demand for new vehicles—and the maintenance of electric vehicles—continues to rise.

“Our governments have to get really serious about investing in trade schools and skilled trades,” Farley said in an interview with journalist Walter Isaacson at the Aspen Ideas Festival in June, pointing out that in industrial powerhouses like Germany, apprenticeships start as early as junior high school and provide a steady pipeline of skilled workers. In contrast, the American system, Farley argues, funnels too many young people toward white-collar paths, overlooking the lucrative and essential blue-collar economy.

At Ford Pro Accelerate on Tuesday, Farley’s guest Mike Rowe of the Mike Rowe Works Foundation, a former TV host on blue-collar jobs and longtime vocational advocate, argued that “nothing in the history of Western civilization has gotten more expensive, more quickly … not energy, not food, not real estate, not even health care, [nothing has been inflated more] than the cost of a four-year degree.” Rowe added that his own college degree cost $12,200 in 1984, he said, whereas today it would cost something above $90,000, which is in fact the rough sticker price for a college education, per the Associated Press. Several Gen Z blue-collar entrepreneurs told Fortune over the summer that they skipped college and don’t regret it, as they’re able to become their own bosses in their 20s and make over six figures, although there isn’t much time for vacation and they are young and able to do the physical work without much pain—yet.

Personal and corporate action

Farley’s personal approach—insisting on a welding summer job for his own son—mirrors Ford’s institutional initiatives. The automaker has recently expanded its apprenticeship programs and partnered with nonprofits to create new training opportunities, hoping to combat the persistent stigma and pay challenges attached to trade work. Many entry-level Ford workers, Farley also recounted at Ford Pro Accelerate, have had to take multiple jobs just to get by before the company moved them to full-time status, raising wages and offering more security.

Farley has also drawn a direct line to the company’s founding vision: Henry Ford doubled wages to $5 a day, an unprecedented step. The company paid workers enough to actually afford the products they built, believing that dignified, well-paid manual work was crucial both to the company’s success and to the health of the middle class. Historians believe it was central to the rise of the middle class in the early 20th century.

In conversation with Patel, Farley harkened back to this legacy and argued that the early 21st century isn’t so different from the early 20th, and America is facing a very big choice. “Now, we’re having critical issues. The average ambulance is 15 years old. We do not have enough emergency care people. Look at what firemen are having to go through in California with smoke and their own health.” There is a shortage for these “very dangerous jobs,” he argued, and “it’s going to affect all of us in a lot of annoying ways.”

Farley issued a call to action, urging America to “really get serious about readjusting our expectations for our kids, younger people, and our country to give them opportunities to grow.” The stigma against blue-collar work is keeping people from “great jobs,” the Ford CEO argued, noting that a factory job at Ford can make over $100,000 a year. His own grandfather, he added, was a Ford factory worker. “He never went to college. It didn’t matter to him.” The direction that we all choose to go in, Farley added, is crucial. “It’s a much bigger problem than fixing Ford and making it a world-class company. It’s important for our country. We need to focus on this just as much as the new exciting AI and the new social media dance on Instagram.”

Politics8 years ago

Politics8 years ago

Entertainment9 years ago

Entertainment9 years ago

Politics9 years ago

Politics9 years ago

Politics8 years ago

Politics8 years ago

Entertainment9 years ago

Entertainment9 years ago

Entertainment9 years ago

Entertainment9 years ago

Business9 years ago

Business9 years ago

Tech8 years ago

Tech8 years ago