At age 73, after a career already spanning 51 years, I’m still working. Please, no standing ovation necessary. Nor, for that matter, pangs of pity, either. I plug away at my trade because I like to.

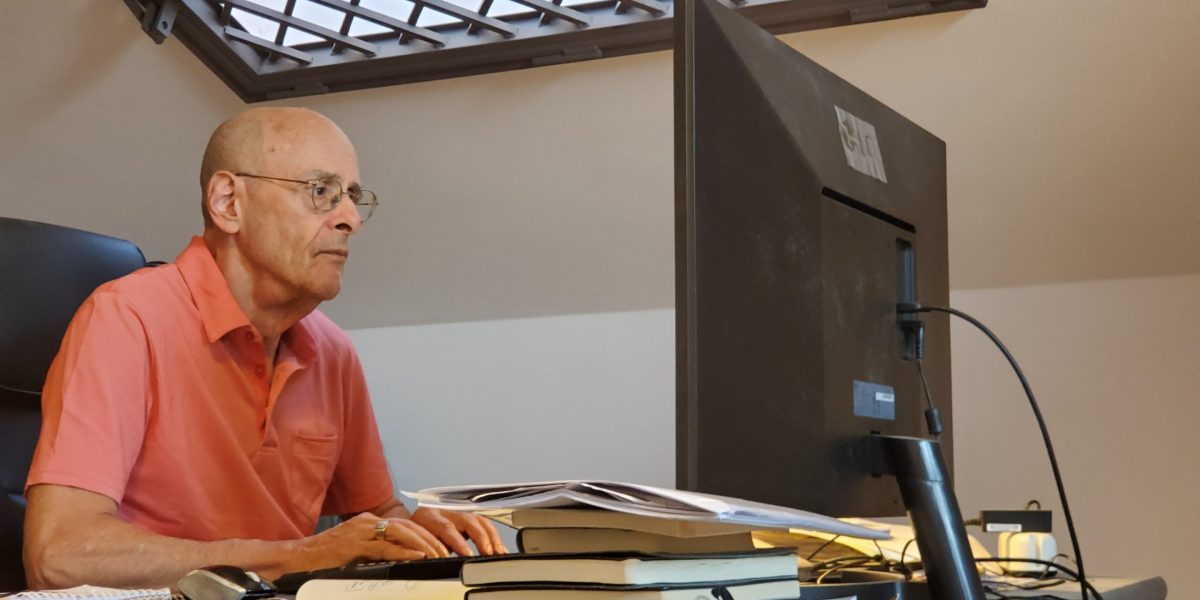

I left my last job at age 67, after 28 years in senior management at high-pressure, bill-by-the-hour public relations firms and set up shop as an independent consultant. Today I’m part-time, logging about 25 to 30 hours a week, about half of my previous workload. I go at it almost every day, putting in an average of about four hours at my desk, mostly in the morning.

Only recently have I learned what I’ve long suspected, namely that practicing my profession as a senior is good for my health physically, mentally, socially, and spiritually.

Skipping retirement has advantages

In general, research shows, working past standard retirement age may offer multiple health advantages. The brain is kept active, maintaining cognitive function and diminishing the likelihood of dementia. You stay connected socially, boosting emotional well-being and staving off loneliness. You might even prevent chronic illness and live longer.

More of us than ever before are working past age 65 and even into our eighties and nineties. This phenomenon is happening mainly because we’re living so much longer. If we retire tomorrow at 65, we may live another 15 or 20 years, leaving us a lot of time to occupy in a fulfilling way.

We also keep going longer because we’re generally staying healthier longer, plus we’re better educated than ever. We increasingly do jobs that are more cerebral than physical, taking place at a computer keyboard rather than on an assembly line.

My lighter work schedule these days frees me to pursue other, equally valuable priorities. Playing soccer with our two grandchildren. Hanging out with newfound friends in our community. Learning to converse in Italian with locals where I now live in Italy. All of which activities I strongly suspect promote robust health.

But does working longer and later in life always boost your health? No. Beware the flip side to the whole work-health equation. Working as a senior can strain you physically, raising the risk of injury and aggravating chronic conditions such as arthritis. Chugging along for too many years can amp up your stress—especially in an intense workplace environment—as well as disrupt your sleep and limit time available for leisure, cutting into rest and relaxation.

Most people who reach my age have retired—and well they might. Maybe they racked up 20 years as a cop, or 30 years as a public-school teacher, or 40 as a physician. As they near retirement they’ve had quite enough, thank you very much—they’re just going through the motions and repeating themselves. The knees are shot, the brain is fried, and it’s time to stop.

My neighbors here in Italy—local and expat alike—automatically assume I’ve quit the workforce. To a person, they’re surprised, equally so, to learn I’m still reporting for duty. Eyebrows go up. Jaws drop. It’s understandable: After all, I now live here, in a small farming town more than 4,000 miles away from my former headquarters in rock-around-the-clock New York City.

‘Work is the best medicine’

But I get a lot out of clutching my work close. Intellectual stimulation. Social connection. A sense of identity and importance. The opportunity to contribute to society.

Besides, I suspect retirement would literally be the death of me. As a writer, I tend to take literally the aphorism “publish or perish.” I’m in sync with 81-year-old Rolling Stones guitarist Keith Richards. “Music is a necessity,” he once said. “After food, air, water, and warmth, music is the next necessity of life.” I’m also simpatico with fashion designer Giorgio Armani, now 91, who recently declared, “Work is the best medicine.”

Some decades back, I had occasion to interview baseball pitcher Nolan Ryan. He was already 44, long past the customary expiration date for professional athletes in any sport. Yet Ryan had just pitched his seventh no-hitter, still the most in Major League Baseball history. I asked him how he felt about always being asked about his age. “It gets old,” he said.

Deciding whether you should keep working or stop can be a dilemma. No one answer is right for every individual. It depends on a lot of factors: your current health, financial status, level of education, the nature of your work, and your attitude toward getting older. You should also consider—perhaps above all—what gives your life the most meaning and purpose.

I persist in my labors for other reasons, too. The addictive sense of accomplishment. The ambition to harvest all my experience to the fullest. A curiosity about how much longer I can go and still live up to the highest standards.

Ultimately, I subscribe to the philosophy espoused by playwright George Bernard Shaw. “I want to be thoroughly used up when I die, for the harder I work, the more I live,” he wrote. “Life is no ‘brief candle’ to me. It is sort of a splendid torch which I have a hold of for the moment, and I want to make it burn as brightly as possible before handing it over to future generations.”

At the very least, working as I approach the three-quarter-century mark is a matter of performing basic maintenance that keeps me functional. But at its best, my work thrills me with the feeling that I’m still fully alive.

The opinions expressed in Fortune.com commentary pieces are solely the views of their authors and do not necessarily reflect the opinions and beliefs of Fortune.

Read more:

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Business8 years ago

Business8 years ago

Tech8 years ago

Tech8 years ago