After a half-century immersed in the world of trade, customs broker Amy Magnus thought she’d seen it all, navigating mountains of regulations and all sorts of logistical hurdles to import everything from lumber and bananas to circus animals and Egyptian mummies.

Then came 2025.

Tariffs were imposed in ways she’d never seen. New rules left her wondering what they really meant. Federal workers, always a reliable backstop, grew more elusive.

“2025 has changed the trade system,” says Magnus. “It wasn’t perfect before, but it was a functioning system. Now, it is a lot more chaotic and troubling.”

Once hidden cogs in the international trade machine, customs brokers are getting a rare spotlight as President Donald Trump reinvents America’s commercial ties with the world. If this breathless year of tariffs amounts to a trade war, customs brokers are its front lines.

Few Americans have been exposed as exhaustively to every fluctuation of trade policy as the customs broker. They were there in the opening days of Trump’s second term, when tariffs were announced on Canada and Mexico, and two days later, when those same levies were paused. They were there through every rule on imports of steel and seafood, on cars and copper, on polysilicon and pharmaceuticals, and on and on. For every tariff, for every carve-out, for every order, brokers have been left to translate policy into reality, line by line and code by code, in a year when it seemed every passing week brought change.

“We were used to decades of a certain way of processing, and from January to now, that universe has been turned kind of upside-down on us,” says Al Raffa, a customs broker in Elizabeth, New Jersey, who helps shepherd containerloads of cargo into the U.S. packed to the brim with everything from rounds of brie to boxes of chocolate.

Each arrival of products imported to the country requires filings with U.S. Customs and Border Protection and often, other agencies. Importers often turn to brokers to handle the regulatory legwork and, with a spate of new trade rules unleashed by the Trump administration, they’ve seen their demand grow alongside their workloads.

Many shipments that entered duty free now are tariffed. Other imports that had minimal levies that might cost a company a few hundred dollars have had their bills balloon to thousands. For Raffa and his crew, the ever-expanding list of tariffs means a given product could be subjected to taxes under multiple separate tariff lines.

“That one line item of cheese that previously was just one tariff, now it could be two, three, in some cases five tariff numbers,” says 53-year-old Raffa, who has had jobs in trade since he was a teenager and who has a button emblazoned with “Make Trade Boring Again.”

Government regulations have always been a reality for brokers, and the very reason for their existence. When thick tomes of trade rules changed in the past, though, they typically were issued long ahead of their effective dates, with periods for comment and review, each word of policy crafted in an attempt to project clarity and definition.

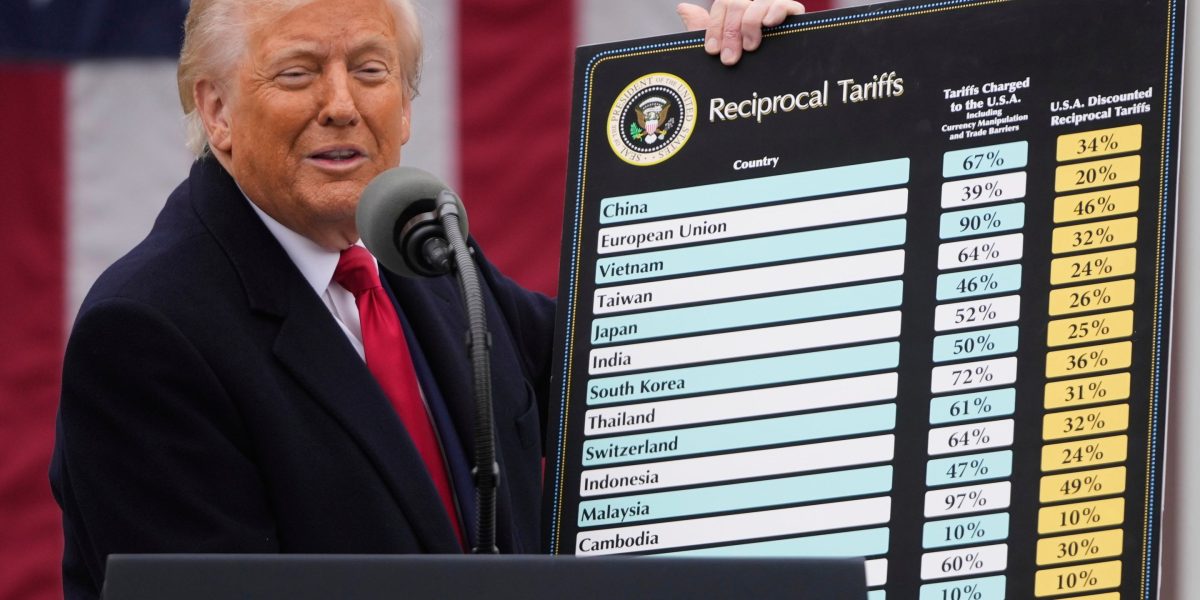

With Trump, word of a major change in trade rules might come in a Truth Social post or an oversized chart clutched by the president in a Rose Garden appearance.

“You’d be remiss not to be looking at the White House website on a daily basis, multiple times a day, just to see what executive order is going to be announced,” Raffa says.

Each announcement sends brokerage firms into a scramble to attempt to dissect the rules, update their systems to reflect them and alert their customers who may have shipments en route and for whom any shift in tariffs could mean a major hit to their bottom line.

JD Gonzalez, a third-generation customs broker in Laredo, Texas, and president of the National Customs Brokers and Forwarders Association of America, says the volume and speed of changes have been challenging enough. But the wording of White House orders has often left more unanswered questions than brokers are accustomed to.

“The order is kind of vague sometimes, the guidance that’s being provided is sometimes murky, and we’re trying to make the determination,” 62-year-old Gonzalez says.

Gonzalez rattles off 10-digit tariff codes for alcohol and doors and recites the complicated web of rules that determine the duties on a chair with a frame made of steel produced in the U.S. but processed in Mexico. As brokers’ work has grown tougher, he says some of their firms have begun charging customers more for their services because each item they’re responsible for tracking on a bill of lading takes longer.

“You double the time,” he says.

Brokers can’t help but see the imprints of their work everywhere they go. Gonzalez looks at a T-shirt tag and thinks of what a broker did to get it into the country. Magnus sees Belgian chocolate or Chinese silk and is awed, despite all the things that could have kept something from landing on a store shelf, that it still arrived. Raffa walks through the supermarket, picks up a can of artichoke hearts, and considers every possible regulation that might apply to secure its import into the country.

It has been heartening for brokers, who existed in the gray arcana of hidden bureaucracy unseen by most Americans, to now earn a bit more recognition.

“It was maybe taken for granted how that wonderful piece of gourmet cheese got on the shelf, or that Gucci bag,” says Raffa. “Up until this year, people were clueless what I did.”

Magnus, who is in her 70s and based on Marco Island, Florida, spent 18 years at U.S. Customs before starting at a brokerage in 1992. She came to find comfort in the precision of rules governing every import she cleared the way for, from crude oil to diamonds.

“We don’t like to have any doubt, we don’t like to leave anything up to interpretation,” she says. “When we ourselves are struggling, trying to interpret and understand the meaning of some of these things, it is a very unsettling place to be.”

It’s not just the White House orders that have complicated her work.

The Department of Government Efficiency cost-cutting blitz under billionaire Elon Musk led to layoffs and retirements of trusted government workers that brokers turn to for guidance. A shutdown slowed operations at ports. And fear of being out of step with the administration has some federal employees cautious about decoding trade orders, making answers on interpretation of tariff rules sometimes tough to come by.

Magnus was befuddled by moves that seemed at odds with everything she knew of trade policy. Canada as adversary? Switzerland subjected to 39% tariffs? It defied how she had come to see the choreography of cargo and what it says about the world.

“It’s like an incredible ballet to be able to trade with all these countries all over the world,” she says. “In my own mind, I always felt that as long as we were trading and we were friendly with each other, we were reducing the chance of war and killing each other.”

Work has been so hectic this year that Magnus hasn’t managed to take a vacation. Weekends have so frequently been upended by Friday afternoon edicts announcing a tariff is going into effect or being taken away that it has become an inside joke with colleagues.

“It’s Friday afternoon,” she says. “Is everybody watching?”

A couple hours after Magnus repeats this, the next White House order is posted, undoing a slew of tariffs on agricultural products and sending brokers into another scurry.

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Business8 years ago

Business8 years ago

Tech8 years ago

Tech8 years ago