Business

What bubble? Asset managers in risk-on mode stick with stocks

Published

2 days agoon

By

Jace Porter

There’s a time when investments run their course and the prudent move is to cash out. For global asset managers who’ve ridden double-digit gains in equities for three straight years, that time is not now.

“Our expectation of solid growth and easier monetary and fiscal policies supports a risk-on tilt in our multi-asset portfolios. We remain overweight stocks and credit,” said Sylvia Sheng, global multi-asset strategist at JPMorgan Asset Management.

“We are playing the powerful trends in place and are bullish through the end of next year,” said David Bianco, Americas chief investment officer at DWS. “For now we are not contrarians.”

“Start the year with sufficient exposure, even over-exposure to equities, predominantly in emerging market equities,” said Nannette Hechler-Fayd’herbe, EMEA chief investment officer at Lombard Odier. “We don’t expect a recession in 2026 to unfold.”

Those assessments came from Bloomberg News interviews with 39 investment managers across the US, Asia and Europe, including at BlackRock Inc., Allianz Global Investors, Goldman Sachs Group Inc. and Franklin Templeton.

More than three-quarters of the allocators were positioning portfolios for a risk-on environment through 2026. The thrust of the bet is that resilient global growth, further developments in artificial intelligence, accommodative monetary policy and fiscal stimulus will deliver outsize returns in all fashion of global equity markets.

The call is not without risks, including simply its pervasiveness among the respondents, along with their overall high degree of assuredness. The view among the institutional investors also aligns with that of sell-side strategists around the globe.

Should the bullishness play out as expected, it would deliver a stunning fourth straight year of bumper returns for the MSCI All-Country World Index. That would extend a run that’s added $42 trillion in market capitalization since the end of 2022 — the most value created for equity investors in history.

That’s not to say the optimism is without merit. The artificial intelligence trade has added trillions in market value to dozens of firms plying the industry, but just three years after ChatGPT broke into the public consciousness, AI remains in the early phase of development.

No Tech Panic

The buy-side managers largely rejected the idea that the technology has blown a bubble in equity markets. While many acknowledged some pockets of froth in unprofitable tech names, 85% of managers said valuations among the Magnificent Seven and other AI heavyweights are not overly inflated. Fundamentals back the trade, they said, which marks the beginning of a new industrial cycle.

“You can’t call it a bubble when you’re seeing tech companies deliver a massive earnings beat. In fact, earnings from the sector have outstripped all other US stocks,” said Anwiti Bahuguna, global co-chief investment officer at Northern Trust Asset Management.

As such, investors expect the US to remain the engine of the rally.

“American exceptionalism is far from dead,” said Jose Rasco, chief investment officer at HSBC Americas. “As artificial intelligence continues to spread around the globe, the US will be a key participant.”

Most investors echoed the sentiment expressed by Helen Jewell, international chief investment officer of fundamental equities at BlackRock, who suggested also searching outside the US for meaningful upside.

“The US is where the high-return high-growth companies are, so we have to be realistic about that. But those are already reflected in valuations, and there are probably more interesting opportunities outside the US,” she said.

International Boom

Profits matter above all else for equity investors, and huge bumps in government spending from Europe to Asia have stoked estimates for strong gains in earnings.

“We have begun to see a meaningful broadening of earnings momentum, both across market capitalizations and across regions, including Japan, Taiwan, and South Korea,” said Wellington Management equity strategist Andrew Heiskell. “Looking into 2026, we see clear potential for a revival of earnings growth in Europe and a wider range of emerging markets.”

India is one of the most compelling opportunities for 2026, according to Goldman Sachs Asset Management’s Alexandra Wilson-Elizondo, global co-head and co-chief investment officer of multi-asset solutions.

“We see real potential for India to become the Korea-like re-rating story of 2026, a market that transitions from tactical allocation to strategic core exposure in global portfolios,” she said.

Nelson Yu, head of equities at AllianceBernstein, said he sees improvements outside of the US that will mandate allocations. He noted governance reform in Japan, capital discipline in Europe and recovering profitability in some emerging markets.

Small Cap Optimism

At the sector level, the investors are looking for AI proxies, notably among clean energy providers that can help meet the technology’s ravenous demand for power. Smaller stocks are also finding favor.

“The earnings outlook has brightened for small-capitalization stocks, industrials and financials,” said Stephen Dover, chief market strategist and head of Franklin Templeton Institute. “Small-cap stocks and industrials, which are typically more highly leveraged than the rest of the market, will see profitability rise as the Federal Reserve trims interest rates and debt servicing costs fall.”

Over at Santander Asset Management, Francisco Simón sees earnings growth of more than 20% for US small caps after years of underperformance. Reflecting the optimism, the Russell 2000 Index of such equities recently hit a record high.

Meanwhile, the combination of low valuations and strong fundamentals makes health care one of the most compelling contrarian opportunities in a bullish cycle, a preponderance of managers said.

“Health-care related sectors can surprise to the upside in the US markets,” said Jim Caron, chief investment officer of cross-asset solutions at Morgan Stanley Investment Management. “This is a mid-term election year and policy may at the margin support many companies. Valuations are still attractive and have a lot of catch up to do.”

Virtually every allocator struck at least a note of caution about what lies ahead. The top worry among them was a rekindling of inflation in the US. If the Fed is forced by rising prices to abruptly pause or even end its easing cycle, the potential for turbulence is high.

“A scenario — which is not our base case — whereby US inflation rebounds in 2026 would constitute a double whammy for multi-asset funds as it would penalize both stocks and bonds. In this sense it would be much worse than an economic slowdown,” said Amélie Derambure, senior multi-asset portfolio manager at Amundi SA.

“The way investors are headed for 2026, they need to have the Fed on their side,” she added.

Trade Caution

Another worry is around President Donald Trump’s capriciousness, particularly when it comes to trade. Any flareup in his trade spats that fuels inflation through heightened tariffs would weigh on risk assets.

Oil and gas producers remain unloved by the group, though that could change if a major geopolitical event upends supply lines. While such an outcome would bolster those sectors, the overall impact would likely be negative for risk assets, they said.

“Any geopolitical situation that can affect the price of oil is what will have the largest impact on the financial markets. Clearly both the Middle East and the Ukraine/Russia situations can impact oil prices,” said Scott Wren, senior global market strategist at Wells Fargo Investment Institute.

Multiple respondents flagged European autos as a “no-go” area for 2026, citing intense competitive pressure from Chinese carmakers, margin compression and structural challenges in the transition to electric vehicles.

“Personally I don’t believe for a minute that there will be a rebound in the sector,” said Isabelle de Gavoty at Allianz GI.

Outside of those worries, most asset managers simply believe that there’s little reason to fret about the upward momentum being interrupted — outside, of course, from the contrarian signal such near-uniform bullishness sends.

“Everyone seems to be risk-on at the moment, and that worries me a bit in the sense that the concentration of positions creates less tolerance for adverse surprises,” said Amundi’s Derambure.

You may like

Business

The ‘forever layoffs’ era hits a recession trigger as corporates sack 1.1 million workers through November

Published

6 minutes agoon

December 9, 2025By

Jace Porter

Jobs website Glassdoor warned of “forever layoffs” in mid-November, as a small drip-drip-drip of cuts throughout the year flew under the radar of most newspaper headlines while instilling fear throughout white-collar ranks. Now, the recruitment firm Challenger, Gray & Christmas has added a crucial bit of insight and one big number: 1.1. million. That’s how many layoffs have been announced year-to-date, only the sixth time since 1993 that threshold has been breached. With the notable and understandable exception of the pandemic year of 2020, you have to go back to 2009 to find a year with greater layoffs, and that was in the very depths of the Great Recession.

Technology remains the hardest-hit private-sector industry, with more than 150,000 job cuts announced so far this year as firms continue to reset headcount after the boom years while they increasingly lean into automation. Telecom providers, food companies, services firms, retailers, nonprofits and media organizations are all shedding workers as well, in many cases at double- or triple-digit percentage increases over last year.

Specifically, U.S.-based employers announced 1,170,821 job cuts in the first 11 months of 2025, up 54% from the same period in 2024. That makes 2025 one of only six years since 1993 in which announced layoffs through November have topped 1.1 million, putting it in the company of 2001, 2002, 2003, 2009 and the pandemic shock of 2020. November alone saw 71,321 cuts, the highest for that month since 2022 and well above typical pre-pandemic November levels.

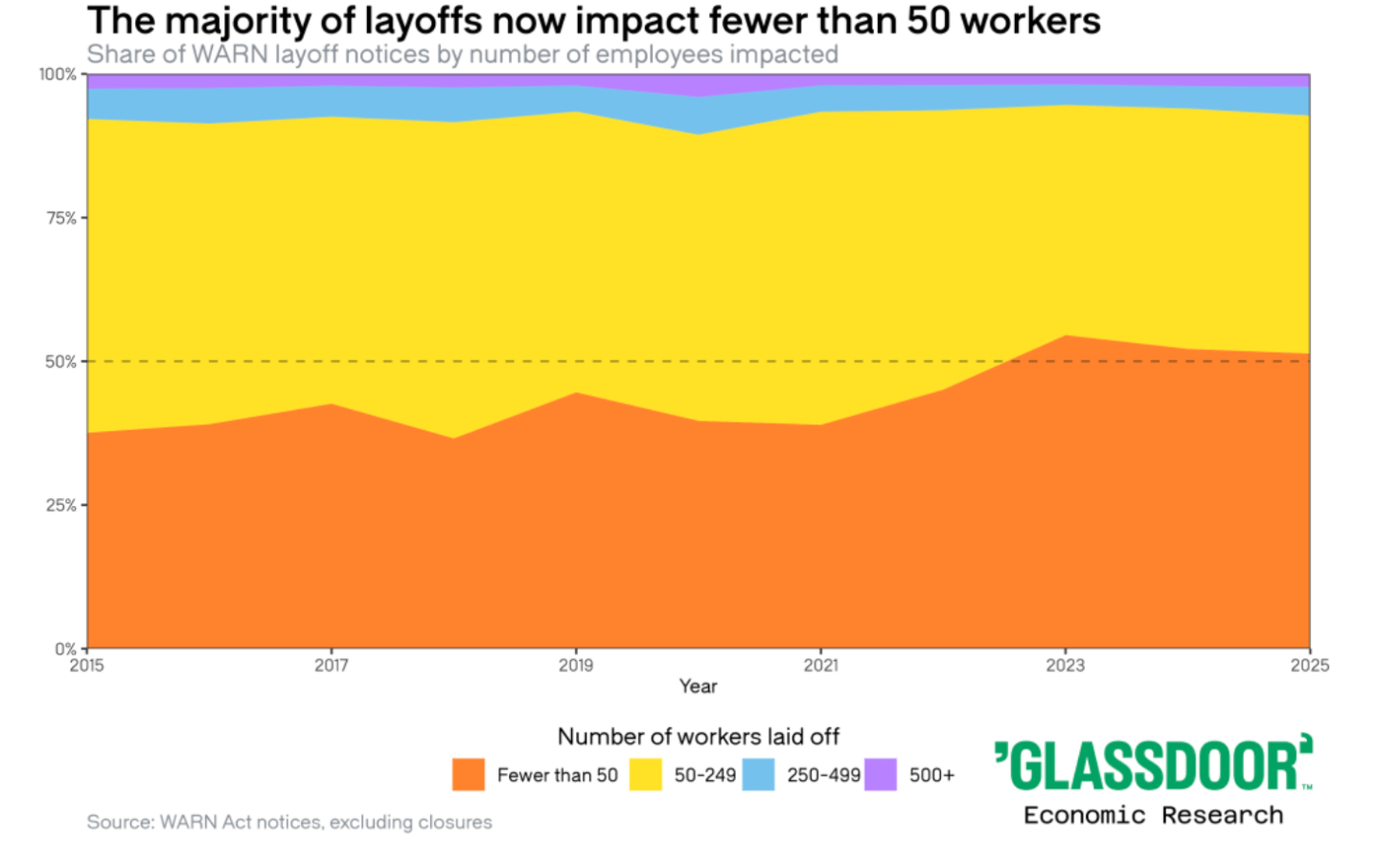

Daniel Zhao, chief economist for Glassdoor, noted in an interview with Fortune that this actually understates the typical, true number of layoffs, citing federal data from the JOLTS survey that roughly 1.7 million people had been laid off over the same period. “The interesting thing that we saw in our research is that the shape of these layoffs is changing,” he said. “So instead of these large one-off layoffs, we’re seeing rolling layoffs and even some smaller layoffs as well.”

The “rolling layoff” must be considered amid the many conflicting signals of the economy of 2025, when “affordability” politics emerged to reflect mass unrest among vulnerable workers. Fears of a bubble in artificial intelligence have coincided with worker anxiety and Gen Z despair over an elevated unemployment rate and a dearth of entry-level positions.

Earnings reports increasingly reveal, as many executives call it, a “bifurcated” or “K-shaped” economy, used to describe the different trajectories of rich and poor. The wealthier cohort is spending freely, with the upper 10% accounting for nearly 50% of consumer spending (and absorbing elevated costs passed through from tariffs), while the lower-income consumer shows increasing signs of strain. Morgan Stanley analyst Mike Wilson believes a “rolling recession” was tearing through different sectors of the economy and that, from April onward, a “rolling recovery” has been underway in 2025.

Analysts at both Goldman Sachs and Bank of America Research have noted that this recovery is a financial one, reflected in stock prices and soaring profits—and increasingly in less workers required in white-collar positions. The era of “jobless growth” and process over people is emerging into view, thanks to the forever layoff.

Inside the ‘forever layoff’ model

Glassdoor’s 2026 Worklife Trends analysis describes a structural shift away from rare, large-scale reductions toward frequent layoffs affecting fewer than 50 workers at a time. These “forever layoffs” now account for a majority of cuts in some data, with the share of small layoffs rising from well under half in the mid-2010s to more than half by 2025. The new model allows leaders to continuously adjust headcount in response to markets and AI adoption without the reputational and morale shock of a single blockbuster layoff event.

Consultants say rolling layoffs give executives maximum flexibility and can lower severance and restructuring costs, while keeping operations running by redistributing work slowly instead of wiping out entire teams overnight. But what looks efficient on paper, Glassdoor warns, creates a slow bleed culture in which coworkers quietly disappear, workloads creep up for survivors and no one ever feels truly safe in their role.

Zhao described it as “keeping workers in suspense, where they’re constantly worried about their job security and they can’t focus on their work.” Even though these forever layoffs might sneak under the radar and not generate quite as many negative headlines, “people internally know what’s up, they’re going to recognize what’s happening.” Ultimately, he said he believes it has a really negative impact on culture and morale and hence productivity.

Zhao cited the job-rejection rate that appears in Glassdoor data, which has been declining for two years. “I think what’s going on there is job seekers recognize that they don’t have the leverage to negotiate, as much leverage to negotiate on an offer, or they don’t feel confident in their ability to find a better offer elsewhere.” The end result is more people “settling” for just any job, not the right job.

Glassdoor’s review data shows employee mentions of “layoffs” and “job insecurity” in company ratings are now higher than they were in March 2020, when the pandemic first shut down the global economy. That suggests workers in late 2025 feel more anxious about losing their jobs than they did at the onset of a once-in-a-century public-health crisis. Trust in senior leadership has eroded as well, with negative descriptions of executives—such as “misaligned” or “hypocritical”—rising sharply since 2024.

Hiring plans are not offsetting the damage. Through November, per the Challenger report, employers have announced 497,151 planned hires, down 35% from the same point last year and the lowest year-to-date total since 2010. With hiring at a decade low and serial layoffs becoming normalized, many job seekers are taking roles they would once have rejected simply to regain a foothold in a less forgiving market.

Zhao pushed back on the idea of a “jobs recession,” although he acknowledged that hiring has been “very sluggish” for much of the last two years and there is some evidence of job growth slowing significantly and reaching negative territory, including some months with job losses.

“I think you would want to see more evidence before declaring an actual jobs recession,” he said. “A month here and there of negative jobs growth is not good, but we don’t want to declare a new trend based on just a month or two’s worth of data.”

AI, restructurings, and the new power balance

Behind the cuts, a cluster of forces is reshaping corporate staffing decisions. Challenger’s report shows restructuring, business unit closures, and market or economic conditions have driven the bulk of 2025 layoffs, with tens of thousands of jobs also explicitly tied to AI adoption. Since 2023, employers have blamed artificial intelligence for more than 70,000 announced job cuts as they automate routine work and reorganize teams around new tools.

Glassdoor’s analysts say this environment has shifted bargaining power back to employers after several years when workers could demand flexibility, higher pay, and faster advancement. Remote and hybrid staff now report declining career opportunity ratings as promotions increasingly favor in-office employees, forcing many to trade flexibility for perceived security.

Combined with the drumbeat of forever layoffs, those trade-offs are ushering in a workplace defined less by pandemic-era empowerment than by chronic insecurity and a “do more with less” mandate that shows no sign of easing in 2026.

The squeeze is showing up not just in corporate restructuring plans, but also in real-time payroll data. ADP’s November report, released Wednesday, found private employers shed 32,000 jobs last month—but nearly all of the losses came from small businesses, which cut 120,000 positions, while large corporations actually added 90,000 workers.

ADP chief economist Nela Richardson, in the report, called the decline “broad-based,” but emphasized that small firms with limited cash flow and thin margins “are really weathering an uncertain macro environment and a cautious consumer.” Small employers have faced rising operating costs from tariffs, utility bills, and a Fed hesitant to cut rates, a burden that larger companies have been far better positioned to absorb.

The divergence underscores the widening K-shape in the labor market. White-collar and corporate jobs are being trimmed through rolling, under-the-radar layoffs, while small businesses are facing outright contraction as they struggle with tariffs, higher utility bills, and softer consumer demand. Small firms are almost always the first to lay off workers in a downturn because they feel the pullback in spending sooner and have far less room to absorb rising input costs, Richardson toldAxios. Larger companies have the cash flow, scale, and financing to wait out uncertainty, even as they quietly restructure teams, but small employers simply run out of margin.

However, Howard Lutnick, Trump’s commerce secretary, blamed the data on the “Democrat shutdown,” rather than tariffs, during an interview on CNBC. The Cabinet secretary also said those figures will “rebalance and they’ll regrow,” claiming “this is just a near-term event.”

Zhao said he thinks the forever layoffs are contributing to the “malaise” that workers feel about the economy of 2025. “There’s a significant amount of uncertainty and anxiety that workers are feeling around job security and the the risk that another layoff might be coming in just a month or two.” It means, he added, that “workers are constantly on edge.”

Business

I’m a leader in private equity and see a simple fix for America’s job-quality crisis: actually give workers a piece of the business

Published

37 minutes agoon

December 9, 2025By

Jace Porter

My dad spent 40 years operating heavy machinery on construction sites around Chicago. He was proud of his work and of his union card, but I wouldn’t call what he had a quality job. No one listened to him. He didn’t feel respected. He could never get ahead financially. Around the dinner table, he’d tell stories about fighting over wages or whether the lunch hour was paid or unpaid. What stayed with me wasn’t just the frustration; it was how obviously bad that dynamic was for everyone involved. I remember wondering why work had to feel like a fight.

Decades later, I see those same tensions playing out across the U.S. economy. The new American Job Quality Study, conducted by Gallup and developed by Jobs for the Future, The Families & Workers Fund, and the W.E. Upjohn Institute for Employment Research, aims to measure what makes a job “good.” It looks at five things: financial security, safety and respect, opportunities to grow, a voice in decisions, and a manageable schedule. By that definition, only around 40 percent of American workers have quality jobs.

As an investor, I evaluate hundreds of companies every year, and this data squares with what we see on the ground. Many companies don’t even measure employee engagement or quit rates. And what isn’t measured certainly isn’t managed. We routinely see companies that have such high turnover that they rehire their entire frontline every few years. Inevitably, the impact of all this churn spills into other areas like safety, given that less experienced workers are far more likely to get hurt. In one particularly ironic case, a safety equipment manufacturer had injury rates that were triple the OSHA benchmark.

For workers, the consequences are obvious. People in quality jobs are healthier, happier, and more satisfied with their lives. But it matters just as much for companies. Every “human” statistic has a business consequence. When you’re replacing your entire frontline every few years, you’re wasting resources on recruiting, training, and onboarding. If you have a safety problem, that’s clearly horrible for workers, but you’re also wasting money on workers’ comp and missed days of work. And if safety is poor, product quality usually is too because both are the direct result of weak processes and disengaged colleagues.

This new study puts all these elements together in one clear, data-driven picture. And it shines a light on reality: we’re stuck in a perilous cycle. High turnover discourages investment in people – things like upskilling, cross-training, and career development. Workers sense that and give the bare minimum in return. Leaders start to see employees as “heads” – interchangeable units of labor. Empathy erodes. Companies focus their attention on the next quarter, and workers keep their eyes open for a better offer. Everyone gets trapped in short-termism.

How to break the cycle? Change the way companies operate; empower workers to think and act like owners.

That’s why my work as an investor has increasingly focused on broad-based employee ownership as a tool to both lift up workers and shift corporate cultures. Over the past fifteen years at KKR, we’ve partnered with more than eighty companies to give equity ownership to about 180,000 frontline employees. When done well, it changes everything.

I’ve seen factory workers start tracking quality yields with the intensity of CFOs. Engagement scores rise, quit rates fall, and productivity climbs because people finally feel respected, trusted, and included. They have a stake and a voice. They can see how the business works, and how their effort moves the numbers.

Just last month, we completed our investment in an insurance services company called Integrated Specialty Coverages. Employees who had been there at least three years earned stock worth 100 percent of their annual income – a reward that didn’t replace any of their regular pay. More tenured workers did even better, some earning three years of wages. In addition to significantly enhancing its growth rate and profitability, the company was rewarded with engagement scores reaching the top decile of its peer group and quit rates dropping by more than half.

Sharing equity isn’t a magic wand. Employee ownership only works when paired with education, transparent communication, financial literacy training, and worker voice. It’s also not a replacement for wages or other benefits – and it’s not charity. It’s a tool for cultural alignment and improved performance. And it’s one of the few structural levers we have to shift incentives away from short-termism and toward shared success.

The American Job Quality Study matters because it gives us a data-backed picture of what too many Americans already know from experience: most jobs don’t offer dignity, stability, or a path forward – and we all reap the consequences. Let’s take the lessons from this study and apply them. It’s time to start rethinking how value is shared, so that the people creating it can share in it. I’ve seen what happens when they do. My dad would’ve called that a quality job.

The opinions expressed in Fortune.com commentary pieces are solely the views of their authors and do not necessarily reflect the opinions and beliefs of Fortune.

Business

Kushner, Ellison and Apollo back hostile Warner Bros. bid

Published

1 hour agoon

December 9, 2025By

Jace Porter

The US president’s son-in-law. One of the largest alternative-asset managers. The CEO’s father who fleetingly commanded a fortune exceeding Elon Musk’s.

Paramount Skydance Corp.’s hostile takeover bid Monday for Warner Bros. Discovery Inc. brought together an array of banks, billionaires and sovereign-wealth funds, all with the aim of torpedoing Netflix Inc.’s deal last week.

Bank of America Corp., Citigroup Inc. and Apollo Global Management Inc. are providing the debt commitment, according to filings. RedBird Capital Partners and Larry Ellison — at one point this year the world’s richest person — will backstop the $40.7 billion of equity which will in part be provided by Saudi Arabia’s Public Investment Fund, the Qatar Investment Authority, Abu Dhabi’s L’imad Holding Company PJSC and Jared Kushner’s Affinity Partners.

The names are notable as much for their size as well as their proximity to President Donald Trump, who even before Paramount went public with its bid warned of potential antitrust concerns around Netflix’s planned $72 billion acquisition of Warner Bros. Trump, speaking to reporters on Sunday, said he would be personally involved in the decision-making process that now includes a close family member and wealth funds in countries he’s courted to make investments in America. On Monday, he downplayed that involvement, saying neither Paramount nor Netflix were “great friends” of his. Play Video

In a letter to the Warner Bros. board, Paramount Chief Executive Officer David Ellison said the financing partners his firm had lined up — which agreed to forgo governance rights — should help assure of its ability to clinch the deal.

“We are providing you with funds certain from one of the wealthiest families in the world, a domestic counterparty, while also eliminating any cross-conditionality, which should give WBD’s board complete comfort and certainty as to our ability to close in a timely fashion,” he wrote.

The latest financing package follows months of negotiations and reworked proposals as Paramount sought to win over Warner Bros. In all, Paramount made six overtures over 12 weeks. In one case, Ellison went to the Beverly Hills home of Warner Bros. CEO David Zaslav, the filing showed.

The iteration now on the table, submitted Dec. 4, includes a $54 billion so-called bridge loan split equally between Bank of America, Citigroup and Apollo. For the equity portion, the entirety will be guaranteed by the Ellison family and New York investment firm RedBird in “a radical simplification” of a previous plan after the Warner Bros. board expressed concerns, according to the filing.

Larry Ellison, the 81-year-old father of David and founder of Oracle Corp. who counts Trump as a friend, briefly became the world’s richest person in September after his fortune rose by an unprecedented $89 billion in a day, according to the Bloomberg Billionaires Index. Oracle shares have since slid, and he’s worth $277 billion, according to the wealth index.

His trust “has financial resources well in excess of what would be required to meet its commitments,” according to Paramount’s filing, citing 1.16 billion shares of Oracle worth about $252 billion. As of September he had already pledged about one-quarter of those as collateral against personal debt, according to the index.

Paramount had made other salvos to Warner Bros. too: The cast of financing partners no longer includes China’s Tencent Holdings Ltd. — which an earlier proposal listed as providing $1 billion — after the Warner Bros. board raised questions about the involvement of another non-US equity financing source.

That proposal from Dec. 1 also specified an $11.8 billion commitment from the Ellison family, a combined $24 billion from three Gulf-based sovereign wealth funds as well as pledges from RedBird and Affinity Partners. It wasn’t immediately clear from the filings on Monday whether those allocations had changed.

Kushner, PIF

The Paramount bid marks the second time this year that Saudi Arabia’s Public Investment Fund has partnered with Kushner on an eye-catching deal. Affinity Partners was part of the consortium that agreed to buy Electronic Arts Inc. in September in a $55 billion transaction. Kushner brokered the initial connection between the video game maker and PIF, and for months acted as a central figure in the talks, Bloomberg reported at that time.

In addition to the Qatar Investment Authority, a relative newcomer is joining the melee — L’imad. The company — wholly owned by the Abu Dhabi government — has only publicly disclosed one major deal: It agreed in late October to buy a controlling stake in Modon Holding PSC, an Emirati property developer with a $15 billion market value.

The PIF, Affinity Partners, L’imad and QIA have agreed to forgo any governance rights or board seats, which Paramount said would eliminate potential scrutiny from the US Committee on Foreign Investment in the United States.

Credit Ratings

Paramount’s bid at $30 a share in cash comes after Netflix agreed to buy Warner Bros. for $27.75 in cash and stock in a deal backed by $59 billion of unsecured financing from Wells Fargo & Co., BNP Paribas SA and HSBC Plc. Paramount’s bid is for the entirety of Warner Bros., while Netflix is only interested in the Hollywood studios and streaming business. Warner Bros. announced plans in June to split into two separate publicly traded companies by mid 2026.

Paramount’s debt package — secured by some of its assets — was designed with an eye on obtaining the combined company an investment-grade rating, according to people familiar with the matter who asked not to be identified discussing private information. Paramount is currently rated at BB+ by S&P Global Ratings, one level below investment grade, and BBB- by Fitch Ratings, which is on the cusp of junk.

Paramount’s interim Chief Financial Officer Andrew Warren said on a call Monday that the company expects ratings firms to grade the debt as investment grade, based on deleveraging plans in the roughly two years following the acquisition’s close. Chief Operating Officer Andy Gordon said about $17 billion of the $54 billion debt commitment is reserved to take out and extend an existing bridge loan that Warner Bros. already has.

The ‘forever layoffs’ era hits a recession trigger as corporates sack 1.1 million workers through November

Superfan Who Rushed at Ariana Grande Kicked Out of Lady Gaga Concert

ModaPortugal Links will showcase 18 European design talents in Porto on December 11

Trending

-

Politics8 years ago

Politics8 years agoCongress rolls out ‘Better Deal,’ new economic agenda

-

Entertainment8 years ago

Entertainment8 years agoNew Season 8 Walking Dead trailer flashes forward in time

-

Politics8 years ago

Politics8 years agoPoll: Virginia governor’s race in dead heat

-

Entertainment8 years ago

Entertainment8 years agoThe final 6 ‘Game of Thrones’ episodes might feel like a full season

-

Entertainment8 years ago

Entertainment8 years agoMeet Superman’s grandfather in new trailer for Krypton

-

Politics8 years ago

Politics8 years agoIllinois’ financial crisis could bring the state to a halt

-

Business8 years ago

Business8 years ago6 Stunning new co-working spaces around the globe

-

Tech8 years ago

Tech8 years agoHulu hires Google marketing veteran Kelly Campbell as CMO