Now, the debate over which company will end up owning Warner Bros. — Netflix Inc. or Paramount Skydance Corp. — is carving up the country along political lines.

In Republican circles, it’s become fashionable to root against Netflix. Paramount is run by David Ellison, who has close ties to the White House and whose bid for Warner Bros. is backed by Jared Kushner, son-in-law of President Donald Trump. Some prominent Democrats, on the other hand, are voicing objections to the Paramount bid, crying foul over the $24 billion that’s coming from Middle East sources.

President Trump added drama on Wednesday when he said that any deal for Warner Bros. should include the sale of its CNN cable news network.

“It should be guaranteed that CNN is part of it or sold separately,” he said. The network is run by “a very dishonest group of people.”

Warner Bros. and Paramount declined to comment. Netflix didn’t respond to requests for comment.

Few mergers in recent memory have been as polarizing at the battle for Warner Bros., which combines the glamour of Hollywood, the influence of TV news, foreign intrigue tied to Middle Eastern funds and the specter of White House favoritism.

Trump’s comment triggered even more uncertainty. He had previously raised antitrust concerns about Netflix buying Warner Bros.

After a months-long auction, Warner Bros. agreed last week to sell its studios and streaming business, including HBO, to Netflix for $27.75 a share. Under the Netflix deal, Warner Bros. would move forward with its plan to spin off its cable networks, including CNN and TNT, into a separate company called Discovery Global.

Paramount, which kicked off the sale process by making several unsolicited offers for the company, responded on Dec. 8 by launching a $30-a-share hostile tender offer for all of Warner Bros., including the cable networks.

Paramount released a letter to shareholders on Wednesday reiterating that its offer is superior and more likely to win approval in Washington.

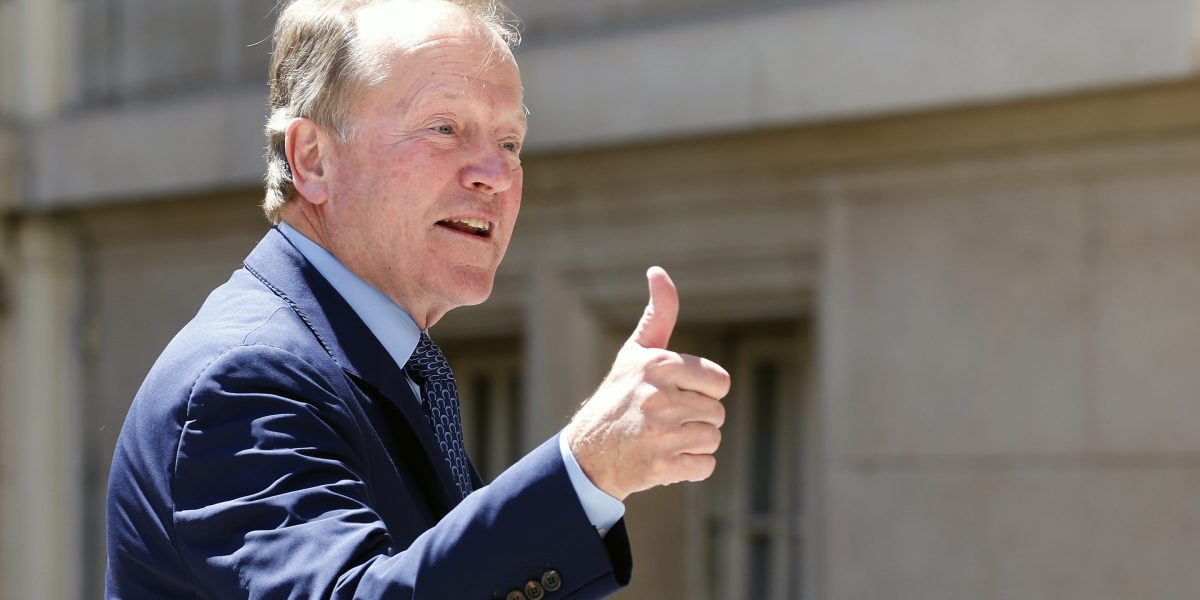

Ellison has spoken publicly about having a good relationship with the Trump administration. His father Larry Ellison, the cofounder of Oracle Corp. and world’s second-richest person, is a Trump ally.

Still, Trump hasn’t fully endorsed Paramount’s bid. He bashed the company on Monday over a 60 Minutes interview with Republican Congresswoman Marjorie Taylor Greene, who has become a vocal critic of the president. He also said that neither Netflix nor Paramount “are particularly great friends of mine.”

Other politicians have been much clearer about who they’re rooting against in the bidding war.

In November, Republican Congressman Darrell Issa of California wrote a letter to Attorney General Pam Bondi asking whether a Netflix deal with Warner Bros. would give the streaming leader too much market power.

“Netflix is already the dominant streaming platform in the United States and permitting it to absorb a major competitor raises antitrust concerns that could result in a harm to consumers,” Issa wrote.

Democratic Representatives Sam Liccardo of California and Ayanna Pressley of Massachusetts sent a letter to Warner Bros. CEO David Zaslav on Wednesday raising concerns about the participation of foreign investors in Paramount’s bid, which includes backing from sovereign wealth funds in Saudi Arabia, Qatar and Abu Dhabi.

“These investors, by virtue of their financial position or contractual rights, could obtain influence — direct or indirect — over business decisions that bear upon editorial independence, content moderation, distribution priorities, or the stewardship of Americans’ private data,” the lawmakers wrote.

Like many in Hollywood, Democratic Senator Elizabeth Warren of Massachusetts would prefer no sale at all. She called Paramount’s offer a “five-alarm antitrust fire” on Monday after previously branding Netflix’s bid as an “anti-monopoly nightmare.”

Within the pro-Trump MAGA-verse, influencers and media commentators called on Trump to block a Netflix-Warner Bros. deal. Conservative commentator Laura Loomer zeroed in on Netflix’s ties to former President Barack Obama and his wife Michelle. They signed a deal with the company in 2018.

“If Netflix is allowed to buy Warner Bros. and Trump’s administration doesn’t kill off the merger, CNN will be transformed into the Obama News Network, featuring shows hosted by Michelle Obama @MichelleObama where she lectures Americans about how racist and sexist we are,” Loomer wrote on X.

Right-wing podcaster Benny Johnson said combining Netflix with Warner Bros.’ streaming and studios asset would be “the most dangerous media consolidation in American history” and deliver “a monopoly on children’s entertainment” to “the Democrat super-donors that run Netflix.”

Former US Representative Matt Gaetz, who was previously nominated for attorney general by Trump before withdrawing, wrote “TRUMP MUST STOP THIS!” in a post on X shortly after the Netflix deal was announced.

“The most massive content distributor lashing to a massive content producer / catalog will create a homogenized, woke nightmare for the media landscape,” he wrote.

For Hollywood, much of the focus has been on how each deal would impact an industry already facing job losses, production cuts and the threat of artificial intelligence.

With Netflix co-CEO Ted Sarandos previously deeming the experience of going to a movie theater to be “outdated,” some in the industry are concerned his company’s takeover of Warner Bros.’s streaming business would spell disaster for theater chains and film production.

Michael O’Leary, CEO of movie theater trade group Cinema United, said in a statement last week that the Netflix deal “poses an unprecedented threat to the global exhibition business.”

“Netflix’s stated business model does not support theatrical exhibition,” he wrote. “In fact, it is the opposite.”

The Producer’s Guild of America urged protection for producers’ livelihoods and theatrical distribution.

“Our legacy studios are more than content libraries – within their vaults are the character and culture of our nation,” the guild said.

Actress Jane Fonda spoke out against the Netflix deal last week calling it “an alarming escalation of the consolidation that threatens the entire entertainment industry, the democratic public it serves and the First Amendment itself.”

Other creatives commented on how the consolidation might affect consumers. In a skit from Morning Brew’s YouTube Channel Good Work, a movie viewer starts to stream a film at home, only to be barraged by a series of studio logos that include Netflix, Warner Bros., Paramount, HBO, Pixar and the Saudi Arabia Public Investment Fund. The viewer quickly gets bored before grabbing the remote.

“Let’s turn this off,” he says.

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Business8 years ago

Business8 years ago

Tech8 years ago

Tech8 years ago