And now he is seeing potential signs of the cycle repeating with another transformative technology as a whirlwind of investments and excitement about artificial intelligence has propelled the stock market to new highs.

Chambers took a similarly meteoric ride in his early days running Cisco, which had a market value of about $15 billion in 1995, when networking equipment suddenly became must-have components for the buildup of the internet. The feverish demand briefly turned the firm into the world’s most valuable company — worth $550 billion in March 2000 — before the investment bubble burst. The crash caused Cisco’s stock price to plunge more than 80% during a period that Chambers still recalls as the worst of his career.

Cisco bounced back to deliver consistent financial growth to help establish Chambers as one of Silicon Valley’s most respected leaders before he stepped down as CEO in 2015, but company’s stock price has never approached the peak it reached a quarter century ago.

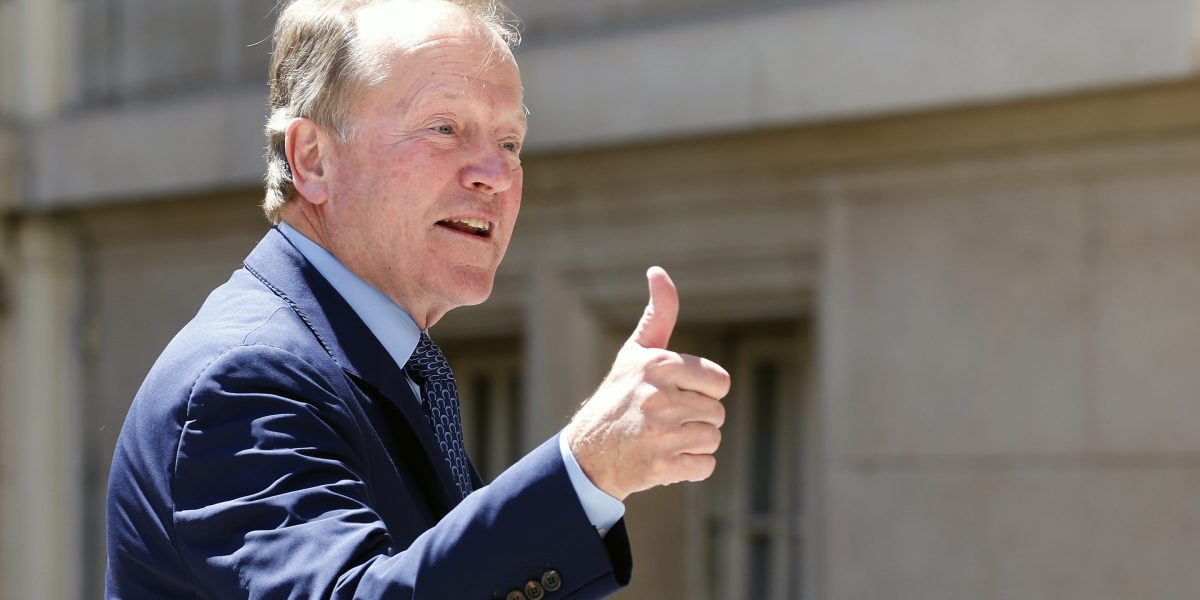

While remaining Cisco’s chairman emeritus, Chambers is now as fascinated by the AI’s transformative powers as he once was by the internet revolution. Only this time he is advising CEOs as a venture capitalist investing in AI startups rather than running a company himself. Chambers, 76, recently discussed the promise and perils of the AI boom with The Associated Press. The interview has been edited for clarity.

Q: Does the current AI mania remind you of the internet boom of the 1990s?

A: Absolutely. There are a lot of parallels but there are also some spectacular differences. AI is moving at five times the speed and will produce three times the outcomes of the internet age. In the internet age, a startup would develop products for two years and then in year three, they would take that out into the market. Today, AI startups develop the product in a month and sometimes in a week, and then they bring it to market in one or two quarters.

In the internet age, there was an irrational exuberance on a really large scale. In this AI one, there is a lot of tremendous optimism that does indicate a future bubble for certain companies. Is there going to be train wreck? Yes, for those that aren’t able to translate the technology into a sustainable competitive advantage, how are you going to generate revenue after all the money you poured into it?

Q: Do you think AI is going to eliminate a lot of jobs?

A: It happened with the internet. The problem this time is that if I am right about AI moving at five times the speed of the internet, we are going to destroy jobs faster than we can replace them. Will we be able to replace them over time? Yes, but there is going to be a drought while we have to re-educate lots of people.

Q: Does that worry you?

A: Big time!

Q: What do we need to be doing to be prepared for this upheaval?

A: We need to change education. Entry-level jobs, both white and blue collar, are going to disappear fast. We are creating more productivity, but we have to create more jobs as well. If companies start making more money, they are either going to increase the dividend or invest in new areas. Hopefully, the majority will invest in new areas to create new jobs.

You will see successful companies expand and grow dramatically, but you are probably going to see 50% of the Fortune 500 companies disappear and 50% of the executives of the Fortune 500 disappear. They won’t have the skills to adjust to this new innovation economy driven by AI because they were trained in silos they were trained to move at the speed of a five-year cycle as opposed to a 12-month cycle.

Q: Do you think this is one of the most uncertain times you have ever seen?

A: It’s the most uncertain time on a global basis, ever. I would argue that this is the new normal. With the speed the market is moving at now, you have to be able to reinvent yourself, which most CEOs and business leaders don’t know how to do, especially with AI.

Q: What’s your view of how Big Tech has been working with President Donald Trump during his second term in office?

A: Let’s be realistic. Silicon Valley moved right, there shouldn’t be any doubt. They did it for economic reasons. And practicality, they did it for their shareholders but also regulation was getting out of control. They weren’t able to grow and China was plainly beating us.

Q: How worried are you about China?

A: I think China has full intention to win at the U.S.’s expense. In China, there are no rules, there is no intellectual property, there are no issues about misusing the power. They intend to blow past militarily, economically, and in every other way. I do not view them as a partner, I view them as a serious competitor on all fronts and someone I don’t trust. I think over time people are going to recognize it’s in the U.S.’s best interest and it’s in China’s best interest for us to get along. So go out 10 years, and that’s the most likely outcome. But I think the next five years are going to be really bumpy and dangerous. We should have no illusions that they intend to crush us.

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Business8 years ago

Business8 years ago

Tech8 years ago

Tech8 years ago