The company’s co-CEOs, Ted Sarandos and Greg Peters, said the deal, which values Warner Brothers Discovery at $83 billion, will accelerate its own core streaming business while helping it expand into TV and the theatrical film business.

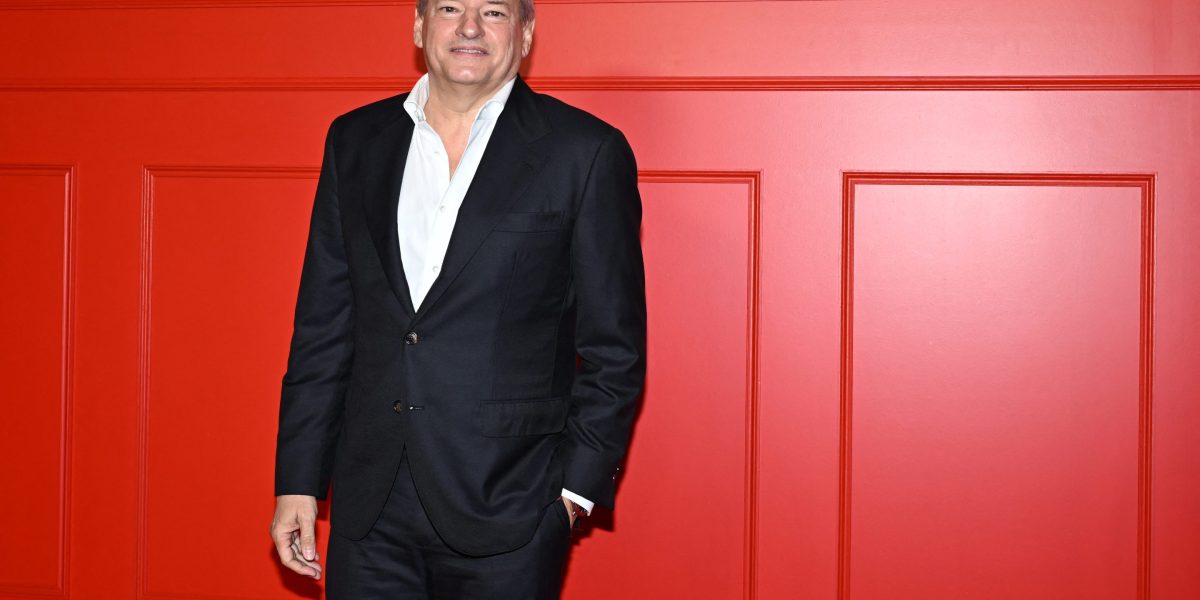

“This is an exciting time in the business. Lots of innovation, lots of competition,” Sarandos enthused on Tuesday’s earnings conference call. Netflix has a history of successful transformation and of pivoting opportunistically, he reminded the audience: Once upon a time, its main business entailed mailing DVDs in red envelopes to customers’ homes.

Despite Sarandos’ confident delivery, however, the pitch didn’t land with investors. The company’s stock, which was already down 15% since Netflix announced the deal in early December, sank another 4.9% in after-hours trading on Tuesday.

Netflix’s financial results for the final quarter of 2025 were fine. The company beat EPS expectations by a penny, and said it now has 325 million paid subscribers and a worldwide total audience nearing 1 billion. Its 2026 revenue outlook, of between $50.7 billion and $51.7 billion, was right on target.

Still, investors are worried that the Warner Bros. deal will force Netflix to compete outside its lane, causing management to lose focus. The fact that Netflix will temporarily halt its share buybacks in order to accumulate cash to help finance the deal, as it disclosed towards the bottom of Tuesday’s shareholder letter, probably didn’t help matters.

And given that there’s a rival offer for Warner Bros from Paramount Skydance, it’s not unreasonable for investors to worry that Netflix may be forced into an expensive bidding war. (Even though Warner Brothers Discovery has accepted the Netflix offer over Paramount’s, no one believes the story is over—not even Netflix, which updated its $27.75 per share offer to all-cash, instead of stock and cash, hours earlier on Tuesday in order to provide WBD shareholders with “greater value certainty.”)

Investors are wary; will regulators balk?

Warner Brothers investors are not the only audience that Netflix needs to win over. The deal must be blessed by antitrust regulators—a prospect whose outcome is harder to predict than ever in the Trump administration.

Sarandos and Peters laid out the case Tuesday for why they believe the deal will get through the regulatory process, framing the deal as a boon for American jobs.

“This is going to allow us to significantly expand our production capacity in the U.S. and to keep investing in original content in the long term, which means more opportunities for creative talent and more jobs,” Sarandos said.

Referring to Warner Brothers’ television and film businesses, he added that “these folks have extensive experience and expertise. We want them to stay on and run those businesses. We’re expanding content creation not collapsing it.”

It’s a compelling story. But the co-CEOs may have neglected to study the most important script of all when it comes to getting government approval in the current administration; they forgot to recite the Trump lines.

The example has been set over the past 12 months by peers such as Nvidia’s Jensen Huang and Meta’s Mark Zuckerberg. The latter, with his company facing various federal regulatory threats, began publicly praising the Trump administration on an earnings call last January.

And Nvidia’s Huang has already seen real dividends from a similar strategy. The chip company CEO has praised Trump repeatedly on earnings calls, in media interviews, and in conference keynote speeches, calling him “America’s unique advantage” in AI. Since then, the U.S. ban on selling Nvidia’s H200 AI chips to China has been rescinded. The praise may have been coincidental to the outcome, but it certainly didn’t hurt.

In contrast, the president went unmentioned on Tuesday’s call. How significant Netflix’s omission of a Trump call-out turns out to be remains to be seen; maybe it won’t matter at all. But it’s worth noting that its competitor for Warner Bros., Paramount Skydance, is helmed by David Ellison, an outspoken Trump supporter.

It’s a storyline that Netflix should have seen coming, and itmay still send the company back to rewrite.

Politics8 years ago

Politics8 years ago

Entertainment9 years ago

Entertainment9 years ago

Politics9 years ago

Politics9 years ago

Politics8 years ago

Politics8 years ago

Entertainment9 years ago

Entertainment9 years ago

Entertainment9 years ago

Entertainment9 years ago

Business9 years ago

Business9 years ago

Tech8 years ago

Tech8 years ago