The CEO of the world’s most valuable company didn’t learn about America through elite universities or tech incubators. His education started in a rural Kentucky boarding school where the students smoked, carried knives, and the youngest student on campus, at 9 years old, was assigned to clean the toilets.

That student was Jensen Huang.

In a recent podcast appearance with Joe Rogan, the Nvidia CEO traced that improbable starting point back to his parents, who had sent him and his brother to the United States in the mid-1970s with almost nothing. The family had been living in Bangkok during one of Thailand’s periodic coups, and his parents decided it was no longer safe to keep the children there. They contacted an uncle they had never visited in Tacoma, Wash., and asked him to find a school in America that would accept two foreign boys with almost no savings.

He found one: Oneida Baptist Institute in Clay County, Ken., one of the poorest counties in the country then and now. The dorms had no closet doors, no locks, and a population of kids who smoked constantly–Huang said he also tried smoking for a week, at 9 —and settled disputes with knives. Huang’s roommate was a 17-year-old wrapped in tape from a recent fight; the “toughest kid in school,” he said. Every student had a job. His brother, was sent to the tobacco fields the school ran to fund the school—“kind of like a penitentiary”—while Huang became the janitor, cleaning the bathrooms for a hundred teenaged boys (“I just wished they would be a bit more careful” in the bathroom, he joked.)

That indefatigable cheerfulness, even when describing scenes that sound brutal to almost anyone else, ran through the entire interview.

Huang said most of his memories from that period were good, and remembers the time he told his parents his amazement after eating at a restaurant: “Mom and dad, we went to the most amazing restaurant today. This whole place is lit up. It’s like the future. And the food comes in a box and the food is incredible. The hamburger is incredible.”

“It was McDonald’s,” Huang laughed.

Indeed, these memories were relayed to his parents late; the boys were navigating all of this alone. International phone calls were too expensive, so his parents bought them a cheap tape deck. Once a month, they recorded an audio letter describing their lives in coal country and mailed it back to Bangkok. Their parents taped over the same cassette and mailed it back.

Two years later, Huang’s parents finally made it to America, with just suitcases and only a bit of money. His mother worked as a maid. His father, a trained engineer, looked for work by circling openings in the newspaper classifieds and calling whoever picked up. He eventually found a job at a consulting engineering firm designing factories and refineries.

“They left everything behind,” Huang said. “They started over in their late thirties.”

He still carries one memory from those early years that he said “breaks my heart.” Not long after his parents arrived in the U.S., the family was living in a rented, furnished apartment when he and his brother accidentally broke a flimsy particle-board coffee table.

“I just still remember the look on my mom’s face,” he said. “They didn’t have any money, and she didn’t know how she was going to pay it back.”

For Huang, moments like that define the stakes his parents accepted when they came to the U.S. “with almost no money”.

“My parents are incredible,” he said. “It’s hard not to love this country. It’s hard not to be romantic about this country.”

Jensen Huang’s humble beginnings inspired Nvidia principles

That way of seeing America—as a place where people will give you a chance if you’re willing to take one—is how Huang explains Nvidia’s early, unlikely bets.

Huang came up with the idea for Nvidia while sitting in a booth at a Denny’s, where he had worked first as a dishwasher and then a busboy. He wanted to build a chip that could power 3D graphics on a personal computer, and it was at that Denny’s booth that he met two friends to sketch out what would become the company.

Long before the company became synonymous with the AI boom, Huang kept steering it toward ideas that few people understood and even fewer believed in. CUDA was one of them. When Nvidia introduced it in 2006, the cost of the chip roughly doubled, revenue did not move, and the company’s valuation fell from about $12 billion to between $2 and $3 billion.

“When I launched CUDA, the audience was complete silence,” he said. “Nobody wanted it. Nobody asked for it. Nobody understood it.”

CUDA is the software layer that turns the graphics chips into general purpose compute engines, making them capable of large neural networks. Now, of course, nearly every major AI model today runs on hardware that depends on CUDA.

The same thing happened when he introduced Nvidia’s first AI supercomputer, the DGX1. The launch drew “complete silence,” he said, and there were no purchase orders. The only person who reached out was none other than Tesla CEO Elon Musk, who told him he had “a nonprofit AI lab” that needed a system like this.

Huang assumed that meant the deal was impossible.

“All the blood drained out of my face,” he told Rogan. “A nonprofit is not buying a $300,000 computer.”

But Musk, the world’s richest man, insisted. So Huang boxed up one of the first units, loaded it into his car, and drove it to San Francisco himself.

In 2016, he walked into a small upstairs room filled with researchers— Berkeley robotics pioneer Pieter Abbeel, OpenAI cofounder Ilya Sutskever, and others—working in a cramped little office. That room turned out to be OpenAI, long before it became the most discussed AI organization in the world. Huang left the DGX1 with them and drove home.

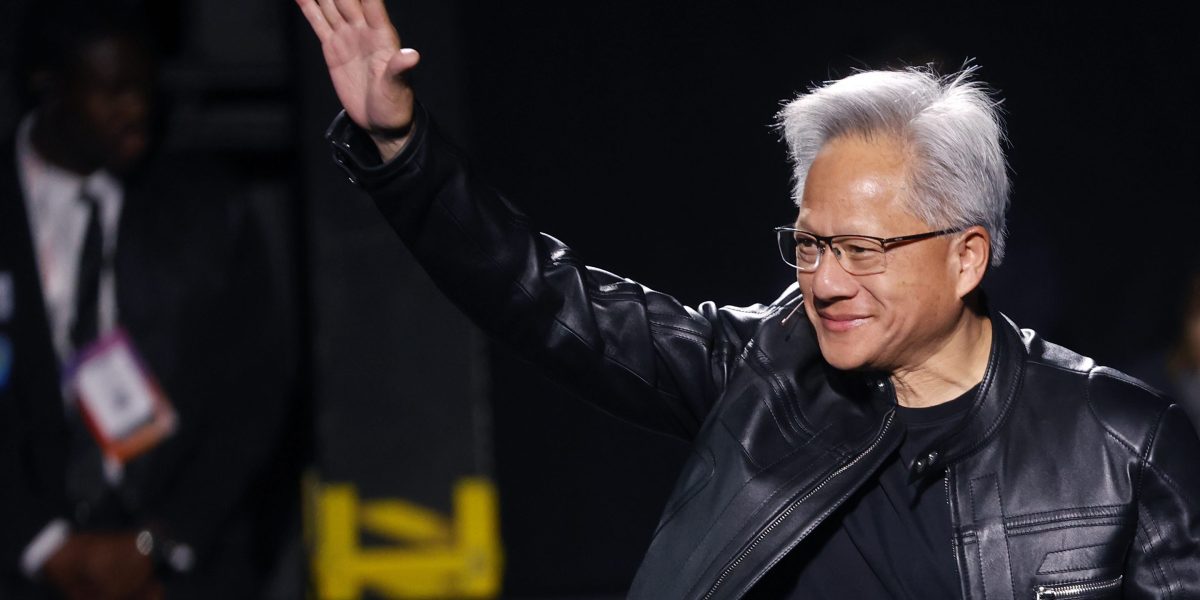

Looking back, even as the CEO of a $4.5 trillion company who now draws crowds and autograph-seekers wherever he goes, he doesn’t describe any of this as foresight or heroism. To him, it’s simply the continuation of the risks his parents took when they sent two boys across the world with almost nothing.

“We really believed it, and so if you believe in that future, and you don’t do anything about it you’re going to regret it for your life,” Huang said.

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Business8 years ago

Business8 years ago

Tech8 years ago

Tech8 years ago