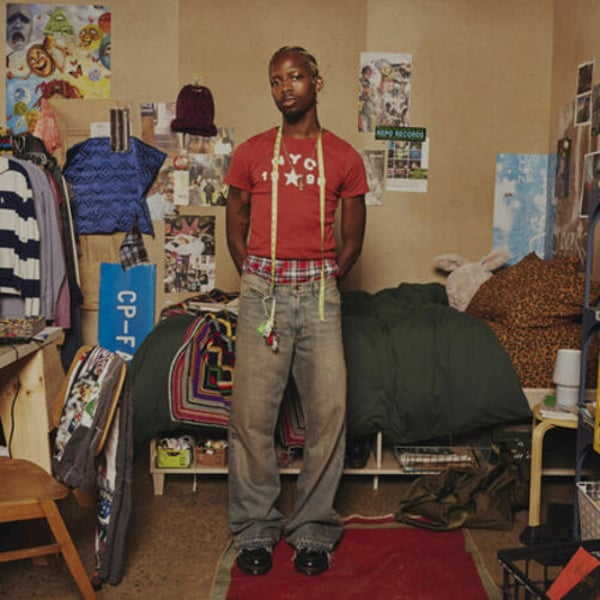

Fashion

Urban Outfitters posts record annual profits, sales surpass $5.5bn

-

Entertainment8 years ago

Entertainment8 years agoThe final 6 ‘Game of Thrones’ episodes might feel like a full season

-

Entertainment8 years ago

Entertainment8 years agoMod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Politics8 years ago

Politics8 years agoCongress rolls out ‘Better Deal,’ new economic agenda

-

Tech8 years ago

Tech8 years agoMicrosoft Paint is finally dead, and the world Is a better place

-

Tech8 years ago

Tech8 years agoHulu hires Google marketing veteran Kelly Campbell as CMO

-

Tech8 years ago

Tech8 years agoFord’s 2018 Mustang GT can do 0-to-60 mph in under 4 seconds

-

Entertainment8 years ago

Entertainment8 years agoNew Season 8 Walking Dead trailer flashes forward in time

-

Politics8 years ago

Politics8 years agoIllinois’ financial crisis could bring the state to a halt