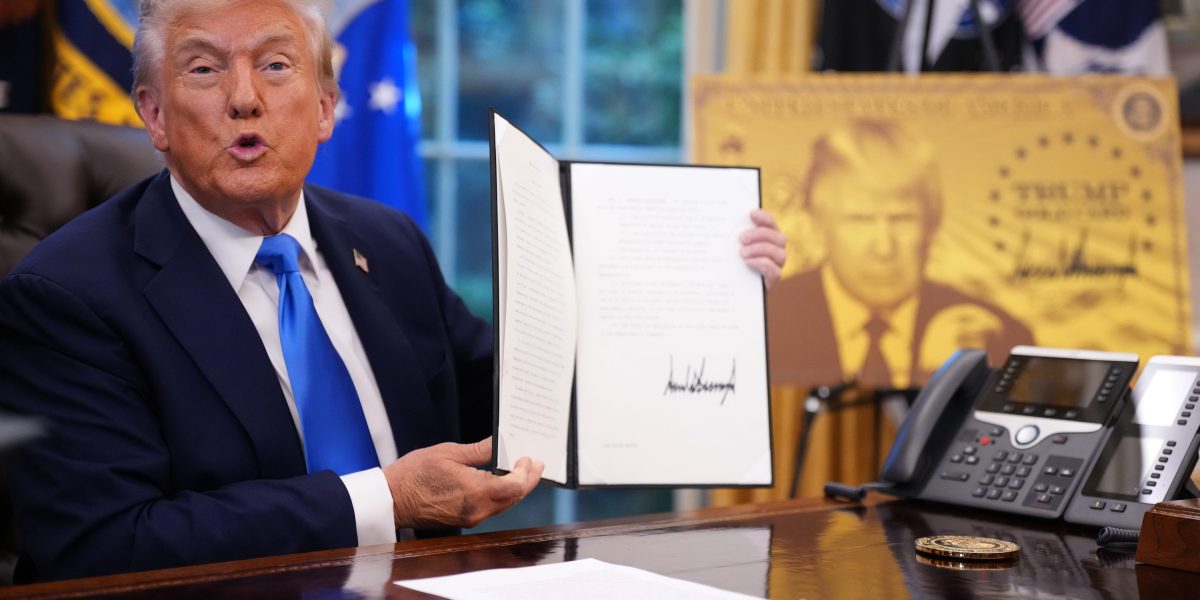

The president on Friday, with Commerce Secretary Howard Lutnick by his side, signed a proclamation that will require the new fee for what are known as H-1B visas — meant for high-skilled jobs that tech companies find hard to fill.

“Those who already hold H-1B visas and are currently outside of the country right now will NOT be charged $100,000 to re-enter,” White House press secretary Karoline Leavitt said in a posting on X. “This applies only to new visas, not renewals, and not current visa holders.”

The fee takes effect at 12:01 a.m. ET Sunday. It is scheduled to expire after a year. But it could be extended if the government determines that is in the interest of the United States to keep it.

The White House in a social media post also sought to make clear the new rule “does not impact the ability of any current visa holder to travel to/from the U.S.”

But immigration attorneys said that the White House move threatened to upend the lives of many skilled workers and has far-reaching impact on American business.

Kathleen Campbell Walker, an immigration attorney with Dickinson Wright based in El Paso, Texas, said in a posting on LinkedIn that the White House move “inserts total chaos in existing H-1B process with basically a day’s notice.”

Lutnick on Friday told reporters that the fee would be an annual cost for companies.

But a White House official said Saturday that it’s a “one-time fee.” Asked if Lutnick’s comments sowed confusion, the official, who was not authorized to comment publicly about the matter and spoke on the condition of anonymity, said the new fee “currently does not apply to renewals but that policy is under discussion.”

Meanwhile, India’s government expressed concern Saturday that the Trump administration move would dramatically raise the fee for visas that bring tech workers from there and other countries to the United States.

Trump also rolled out a $1 million “gold card” visa for wealthy individuals. The moves face near-certain legal challenges amid widespread criticism he is sidestepping Congress.

To be certain, if the moves survive legal muster, they will deliver staggering price increases. The visa fee for skilled workers would jump from $215.

India’s Ministry of External Affairs said Saturday that Trump’s plan “was being studied by all concerned, including by Indian industry.″ The ministry warned that ”this measure is likely to have humanitarian consequences by way of the disruption caused for families. Government hopes that these disruptions can be addressed suitably by the U.S. authorities.″

More than 70% of H-1B visa holders are from India.

Critics say the H-1B visas undercut American workers

H-1B visas, which require at least a bachelor’s degree, are meant for high-skilled jobs that tech companies find difficult to fill. Critics say the program undercuts American workers, luring people from overseas who are often willing to work for as little as $60,000 annually. That is well below the $100,000-plus salaries typically paid to U.S. technology workers.

Trump on Friday insisted that the tech industry would not oppose the move. Lutnick, meanwhile, claimed “all big companies” are on board.

Representatives for the biggest tech companies, including Amazon, Apple, Google and Meta, did not immediately respond to messages for comment. Microsoft declined to comment.

“We’re concerned about the impact on employees, their families and American employers,” the U.S. Chamber of Commerce said. “We’re working with the Administration and our members to understand the full implications and the best path forward.”

Lutnick said the change will likely result in far fewer H-1B visas than the 85,000 annual cap allows because “it’s just not economic anymore.”

“If you’re going to train people, you’re going to train Americans,” Lutnick said on a conference call with reporters. “If you have a very sophisticated engineer and you want to bring them in … then you can pay $100,000 a year for your H-1B visa.”

Trump also announced he will start selling a “gold card” visa with a path to U.S. citizenship for $1 million after vetting. For companies, it will cost $2 million to sponsor an employee.

Trump offers ‘Platinum Card’

The “Trump Platinum Card” will be available for $5 million and allows foreigners to spend up to 270 days in the U.S. without being subject to U.S. taxes on non-U.S. income. Trump announced a $5 million gold card in February to replace an existing investor visa — this is now the platinum card.

Lutnick said the gold and platinum cards would replace employment-based visas that offer paths to citizenship, including for professors, scientists, artists and athletes.

Critics of H-1Bs visas who say they are used to replace American workers applauded the move. U.S. Tech Workers, an advocacy group, called it “the next best thing” to abolishing the visas altogether.

Doug Rand, a senior official at U.S. Citizenship and Immigration Services during the Biden administration, said the proposed fee increase was “ludicrously lawless.”

“This isn’t real policy — it’s fan service for immigration restrictionists,” Rand said. “Trump gets his headlines, and inflicts a jolt of panic, and doesn’t care whether this survives first contact with the courts.”

Lutnick said the H-1B fees and gold card could be introduced by the president but the platinum card needs congressional approval.

Visas doled out by lottery

Historically, H-1B visas have been doled out through lottery. This year, Amazon was by far the top recipient of H-1B visas with more than 10,000 awarded, followed by Tata Consultancy, Microsoft, Apple and Google. Geographically, California has the highest number of H-1B workers.

Critics say H-1B spots often go to entry-level jobs, rather than senior positions with unique skill requirements. And while the program isn’t supposed to undercut U.S. wages or displace U.S. workers, critics say companies can pay less by classifying jobs at the lowest skill levels, even if the specific workers hired have more experience.

As a result, many U.S. companies find it cheaper to contract out help desks, programming and other basic tasks to consulting companies such as Wipro, Infosys, HCL Technologies and Tata in India and IBM and Cognizant in the U.S. These consulting companies hire foreign workers, often from India, and contract them out to U.S. employers looking to save money.

___

Ortutay reported from Oakland, Calif. Associated Press writers Adriana Gomez Licon in Ft. Lauderdale, Florida, Elliot Spagat in San Diego and Paul Wiseman in Washington contributed to this report.

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Business8 years ago

Business8 years ago

Tech8 years ago

Tech8 years ago