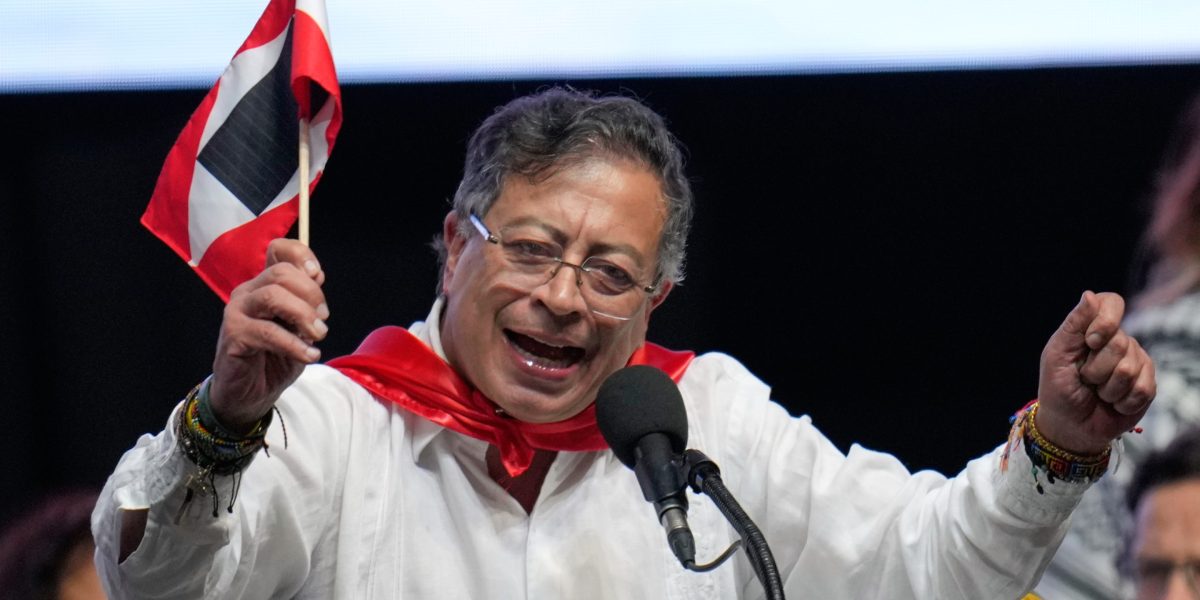

In a social media post, Trump referred to Colombian President Gustavo Petro as “an illegal drug dealer” who is “low rated and very unpopular.” He warned that Petro “better close up” drug operations “or the United States will close them up for him, and it won’t be done nicely.”

Trump, while at his Mar-a-Lago resort in Florida, wrote on his Truth Social platform that Petro is “strongly encouraging the massive production of drugs, in big and small fields” across Colombia, which the Republican president initially misspelled as Columbia before deleting his post and replacing it the correct spelling of the country. “Petro does nothing to stop it, despite large scale payments and subsidies from the USA that are nothing more than a long term rip off of America,” Trump said.

“AS OF TODAY, THESE PAYMENTS, OR ANY OTHER FORM OF PAYMENT, OR SUBSIDIES, WILL NO LONGER BE MADE TO COLOMBIA,” Trump said. He also said Petro had “a fresh mouth toward America.”

Earlier Sunday, Petro accused the U.S. government of assassination and demanded answers after the latest American strike in Caribbean waters. The U.S. said on Saturday it was repatriating to Colombia and Ecuador two survivors from that attack, the sixth since early September. At least 29 people have been killed in strikes that the U.S. has said are targeting alleged drug traffickers.

In September, the Trump administration accused Colombia of failing to cooperate in the drug war, although at the time Washington issued a waiver of sanctions that would have triggered aid cuts. Colombia is the world’s largest exporter of cocaine, and the cultivation of the critical ingredient of coca leaves reached an all-time high last year, according to the United Nations.

More recently, the State Department said it would revoke Petro’s visa while he was in New York for the U.N. General Assembly because of his participation in a protest where he called on American soldiers to stop following Trump’s commands. “I ask all the soldiers of the United States’ army, don’t point your rifles against humanity” and “disobey the orders of Trump,” Petro said.

Petro said a Colombian man was killed in a Sept. 16 strike and identified him as Alejandro Carranza, a fisherman from the coastal town of Santa Marta. He said that Carranza has no ties to drug trafficking and that his boat was malfunctioning when it was hit.

“U.S. government officials have committed murder and violated our sovereignty in territorial waters,” Petro wrote on X. “The Colombian boat was adrift and had a distress signal on, with one engine up. We await explanations from the US government.”

Petro said that he has alerted the attorney general’s office and demanded that it act immediately to initiate legal proceedings internationally and in U.S. courts. He continued to post a flurry of messages into early Sunday about the killing.

“The United States has invaded our national territory, fired a missile to kill a humble fisherman, and destroyed his family, his children. This is Bolívar’s homeland, and they are murdering his children with bombs,” Petro wrote.

Meanwhile, Noticias Caracol, a Colombian news program, reported that the man injured in the most recent strike was hospitalized after he was repatriated and remains in serious condition.

It quoted Colombian Interior Minister Armando Benedetti as saying that the Colombian “will be prosecuted, he will be received — forgive the harsh expression — as a criminal, because so far what is known is that he was carrying a boat full of cocaine, which in our country is a crime, and despite the fact that it was in international waters, his repatriation will be as if he were being prosecuted in the United States.”

Petro said the man had been aboard a “narco submarine.”

Ecuador’s Ministry of the Interior confirmed in a statement sent to The Associated Press on Sunday that the U.S. had repatriated an Ecuadorian man injured in the most recent strike. Officials identified him as Andrés Fernando Tufiño Chila and said a doctor found him to be in good health.

The ministry noted that two prosecutors met with Tufiño Chila and determined he had not committed any crimes within the country’s borders and that there was no evidence to the contrary.

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Business8 years ago

Business8 years ago

Tech8 years ago

Tech8 years ago