President Donald Trump’s coming wave of tariffs is poised to be more targeted than the barrage he has occasionally threatened, aides and allies say, a potential relief for markets gripped by anxiety about an all-out tariff war.

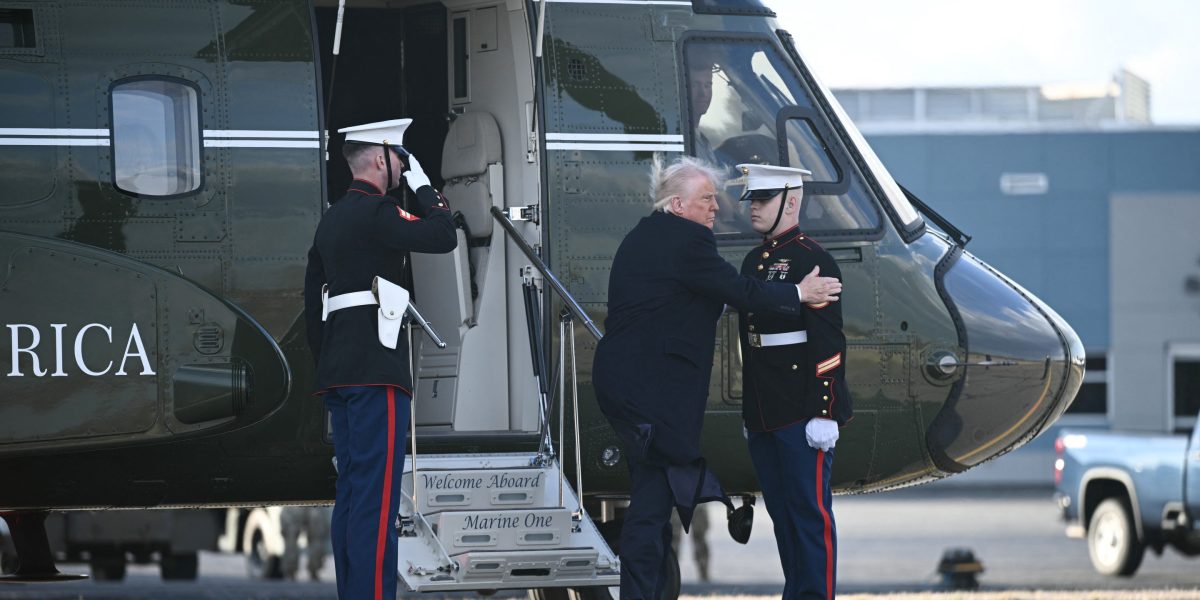

Trump is preparing a “Liberation Day” tariff announcement on April 2, unveiling so-called reciprocal tariffs he sees as retribution for tariffs and other barriers from other countries, including longtime US allies. While the announcement would remain a very significant expansion of US tariffs, it’s shaping up as more focused than the sprawling, fully global effort Trump has otherwise mused about, officials familiar with the matter say.

Trump will announce widespread reciprocal tariffs on nations or blocs but is set to exclude some, and — as of now — the administration is not planning separate, sectoral-specific tariffs to be unveiled at the same event, as Trump had once teased, officials said.

Still, Trump is looking for immediate impact with his tariffs, planning announced rates that would take effect right away, one of the officials said. And the measures are likely to further strain ties with allied nations and provoke at least some retaliation, threatening a spiraling escalation. Only countries that don’t have tariffs on the US, and with whom the US has a trade surplus, will not be tariffed under the reciprocal plan, an official said.

As with many policy processes under Trump, the situation remains fluid and no decision is final until the president announces it. One aide last week referred repeatedly to internal “negotiations” over how to implement the tariff program — and some of the most regularly hawkish signals come from Trump himself, underscoring his avowed interest in sharply raising import taxes as a revenue stream.

“April 2nd is going to be liberation day for America. We’ve been ripped off by every country in the world, friend and foe,” Trump said in the Oval Office Friday. It would bring in “tens of billions,” he added, while another aide said recently the tariffs could bring in trillions of dollars over a decade.

But the market reaction to initial tariffs imposed on Canada, Mexico, and China — as well as certain metals — has hung heavy over a West Wing serving a president who has long used major indexes as a measuring stick of his success.

Trump officials publicly acknowledged in recent days the list of target countries may not be universal, and that other existing tariffs, like on steel, may not necessarily be cumulative, which would substantially lower the tariff hit to those sectors. That includes comments from Trump himself, who has increasingly focused his remarks on the reciprocal measures.

It’s already a retreat from his original plans for a global across-the-board tariff at a flat rate, which later morphed into his “reciprocal” proposal that would incorporate tariffs and non-tariff barriers. It’s not clear which countries Trump will include under his more targeted approach. He has cited the European Union, Mexico, Japan, South Korea, Canada, India and China as trade abusers when discussing the matter, an official said.

While narrower in scope, Trump’s plan is still a much broader push than in his first term and will test the appetite of markets for uncertainty and a raft of import taxes.

“There will be big tariffs that will be going into effect, and the president will be announcing those himself,” White House Press Secretary Karoline Leavitt said Thursday.

Markets Overestimating

Kevin Hassett, Trump’s National Economic Council director, said markets are overestimating the scope.

“One of the things we see from markets is they’re expecting they’re going to be these really large tariffs on every single country,” he told Fox Business host Larry Kudlow, who held Hassett’s job during Trump’s first term.

“I think markets need to change their expectations, because it’s not everybody that cheats us on trade, it’s just a few countries and those countries are going to be seeing some tariffs.”

Read more: Trump’s Trade War and the Economic Impact: Tariff Tracker

Trump has also pledged to pair those with sectoral tariffs on autos, semiconductor chips, pharmaceutical drugs and lumber. The auto tariffs, specifically, he said would come in the same batch. “We’re going to do it on April 2nd, I think,” he said in a February Oval Office event.

But plans for those remain unclear and, as of now, they aren’t set to be launched at the same “liberation day” event, officials said.

An auto tariff is still being considered and Trump has not ruled it out at another time, officials said. But excluding the measure from the April 2 announcement would be welcome news to the auto sector, which faced the prospect of as many as three separate tariff streams straining supply chains.

The “liberation day” event might also include some tariff rollbacks, though that’s uncertain. Trump imposed, then heavily clawed back, tariffs on Canada and Mexico for what the US said was a failure to slow shipments of fentanyl destined for the US. The fate of those remains deeply unclear: a Trump pause on swathes of those tariffs is due to expire, but the tariffs could be lifted entirely and replaced with the reciprocal number, officials said.

‘Dirty 15’

Treasury Secretary Scott Bessent said last week that steel and aluminum tariffs may not necessarily add on to the country-by-country rates. “I will have a better sense as we get closer to April 2nd. So, they could be stacked,” he told Fox Business last week.

In the same interview, he said it’s roughly 15% of countries that are the worst offenders.

“It’s 15% of the countries, but it’s a huge amount of our trading volume,” he said, referring to it as the “dirty 15” and signaling they are the target. “And they have substantial tariffs, and as important as the tariff or some of these non-tariff barriers, where they have domestic content production, where they do testing on our — whether it’s our food, our products, that bear no resemblance to safety or anything that we do to their products,” he said.

Trump aides considered, before abandoning, a three-tiered option for global tariffs, where countries were grouped in based on how severe the administration considered their own barriers, people familiar with the plans said. That option was reported earlier by the Wall Street Journal.

Trump sees tariffs as a key tool both to steer new investment to the US and to tap new sources of revenue, which he hopes to offset tax cuts Republicans are considering.

“Tariffs will make America more competitive. They will incentivize investment into America,” Stephen Miran, Trump’s Council of Economic Advisers chairman, said in an interview, declining to detail the steps.

The White House has also argued that trillions of dollars in pledged announcements by foreign countries and companies provides evidence Trump’s plans are working. Miran told Fox Business last week that talks are ongoing ahead of April 2nd deadline.

“I do think that it’s perfectly reasonable to expect that we could raise trillions of dollars from tariffs over a 10-year budget window and like I said before, using those revenues to finance lower rates on American workers, on American businesses,” he said.

Still, economists have questioned whether the tariffs would meaningfully impact the deficit, particularly considering the risk of inflation or an economic slowdown.

Read more: Trump’s Tariff Plan Falls Well Short of Filling His Budget Hole

Companies could also adapt, especially if not all countries are subject to the levies. US customs revenues from China surged after the tariffs were imposed in 2018, according a survey last year by the Peterson Institute for International Economics, but then peaked in 2022 and dropped sharply in 2023.

This story was originally featured on Fortune.com

Source link

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Politics8 years ago

Politics8 years ago