- Rare-earth metals form the powerful magnets crucial to producing fighter jets, smartphones, and the motors that power the arms of Tesla’s humanoid robot, called Optimus. CEO Elon Musk is optimistic the company will have thousands of Optimus units by the end of the year, but the company may be waiting on an export license from China, which controls over 90% of the market, for six months or more.

Elon Musk is confident Tesla will churn out one million of its humanoid Optimus robots by the end of the decade—or even 2029. For now, however, production will only move “as fast as the slowest and least lucky component in the entire thing,” he told investors Tuesday—and President Donald Trump’s tariff battle with China has created a significant roadblock.

As part of its retaliation against Trump’s trade barbs, Beijing has tightened export controls on seven rare-earth metals, a move that underlines China’s dominance in a market essential for making everything from fighter planes to smartphones. Notably for Tesla, these metals are critical to the small but powerful motors Musk says will soon enable Optimus robots to perform household chores and work on the electric-vehicle maker’s assembly lines.

“I’m confident we’ll overcome these issues,” Musk said Tuesday during Tesla’s first-quarter earnings call. “And we’ll, by the end of this year, have thousands of Optimus robots.”

Still, Tesla has seemingly no choice but to go through China. The country controls nearly 70% of all U.S. imports of rare earths, according to S&P Global Market Intelligence.

But that stat only begins to describe the scale of China’s minerals supremacy. The motors in Optimus, like smartphone chips, require these metals because of their ultra-magnetic properties. According to a 2023 report from the Aspen Institute, Beijing controls 92% of global magnet production from rare earths.

These so-called “permanent magnets” are also generally crucial in the production of electric vehicles, but Musk said Tesla, “on the whole,” does not need them. He said the design of Optimus, however, does require these magnets to power the robot’s arms with motors that won’t overheat or break in a small space.

“Those were affected by the supply chain by basically China requiring an export license to send out any rare-earth magnets,” Musk said. “So we’re working through that with China. Hopefully, we’ll get a license to use the rare-earth magnets.”

Those licenses for shipments to the U.S. won’t likely be processed for at least six months, Yang Jie, an export control lawyer at Shanghai law firm Huiye, told The New York Times.

“China wants some assurances that these are not used for military purposes, which obviously they’re not,” Musk said. “They’re just going into a humanoid robot.”

Tariffs hurt Tesla

Musk may have spent more than $250 million and plenty of his time to help Trump win the presidency, which Wedbush Securities’ Dan Ives called a “poker move for the ages” at the time, but it’s clear the administration’s chaotic tariff rollout has done Tesla few favors.

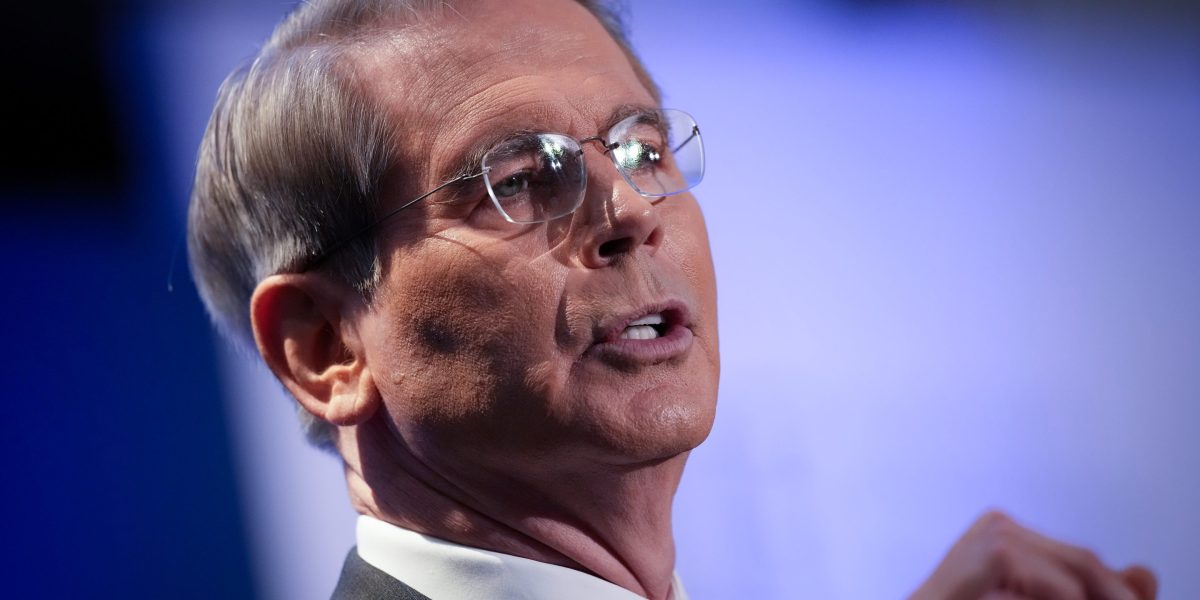

While Musk has headed the controversial Department of Government Efficiency (DOGE)—he told investors he would soon back away from that role to refocus on Tesla—his pleas to avoid escalating trade tensions seem to have largely fallen on deaf ears. The world’s richest man has repeatedly sparred with Peter Navarro, one of Trump’s top trade advisors, who Musk has called a “moron” and “dumber than a sack of bricks.”

Tesla’s net income decreased 71% year-over-year in the first quarter as auto revenues fell below $14 billion for the first time in nearly three years.

Musk said the company’s localized supply chains in markets like America, Europe, and China put Tesla in a better position than competitors to weather escalating trade tensions. Still, he acknowledged tariffs are tough on a company when margins are still low. Tesla’s gross margin fell to 16.3% in Q1, down from 17.4% in the same period last year.

“I’ve been on the record many times saying that I believe lower tariffs are generally a good idea for prosperity,” Musk said. “But this decision is fundamentally up to the elected representative of the people being the president of the United States. So I’ll continue to advocate for lower tariffs rather than higher tariffs, but that’s all I can do.”There are signs Musk’s message is getting more traction in Washington: In a closed-door event hosted by JPMorgan Chase, Treasury Secretary Scott Bessent signaled a possible “de-escalation” with China. Trump also indicated tariffs will come down substantially if a trade deal is reached.

This story was originally featured on Fortune.com

Source link

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago