Business

Tim Cook ‘cares about nothing else’ than beating Mark Zuckerberg to a pair of truly smart glasses: ‘It’s the only thing he’s really spending his time on from a product development standpoint’

Published

6 days agoon

By

Jace Porter

- Apple and Meta have been pouring significant capital into augmented-reality “smart glasses.” One source told Bloomberg that Tim Cook reportedly “cares about nothing else” from a product development standpoint. If he can beat Mark Zuckerberg to a pair of stylish smart glasses that make an impact in the market, he might just beat the accusations he doesn’t have the same panache for groundbreaking products as his predecessor, Apple cofounder Steve Jobs.

While the iPhone accounts for roughly 56% of Apple’s revenue, according to its quarterly earnings report released in January, the company’s CEO Tim Cook is hot for augmented reality, the technology that underpins the not-nearly-as-popular $3,500 Vision Pro headset. (Production on the Vision Pro reportedly halted in January amid slow demand.)

In fact, according to Bloomberg’s Mark Gurman, a longtime Apple reporter with deep connections inside the company, Cook is “hell-bent” on creating a pair of truly smart glasses before Mark Zuckerberg can at Meta. A source with knowledge of the matter told Gurman “Tim cares about nothing else.”

“It’s the only thing he’s really spending his time on from a product development standpoint,” the person said.

After years of teasing, Apple finally released the Vision Pro in February 2024. The headset offers both virtual and augmented reality experiences: Thanks to an array of cameras on the device that point outward, as well as cameras that track your eye movements inside the goggles, it can appear as if virtual and digital elements exist in your real environment that you can interact with (that’s augmented reality), but you can also enjoy complete immersion in realistic virtual environments (virtual reality). While great for watching movies in virtual environments (like the surface of the moon), it’s also a capable work device, since it can mirror what you’re doing on your Mac computer(s).

Meta, meanwhile, has been working on VR and AR technologies for quite a long time. Facebook acquired Palmer Luckey’s Oculus VR for $2 billion in 2014, and released its first consumer VR headset, the Oculus Rift, two years later in 2016. Meta began laying the groundwork for AR experiences as early as 2017, but its hardware plans really took shape when in 2021 it released Ray-Ban Stories, a pair of smart glasses with cameras and audio built-in. Last year, it unveiled a pair of augmented-reality smart glasses called “Orion” that blew several journalists away, but those are still in development.

Zuckerberg previously said Apple and Meta have a “very deep, philosophical competition” in AR and VR, since Apple’s approach involves a tight integration of hardware and software (as it does with all its devices), whereas Meta’s vision revolves around a device-agnostic experience so its software can live on different types of VR and AR devices, including those not made by Meta. The Meta CEO believes the “metaverse” will be the successor to the mobile internet, where your virtual avatars can move between platforms for work, play, and of course, socializing. (Investors, meanwhile, haven’t been as thrilled with how much money Meta has been pouring into the metaverse.)

Zuckerberg, however, is a major proponent of the technologies. He notably shared a three-minute review of Apple’s Vision Pro on Instagram shortly after its debut, but, as you might expect, he mostly criticized the device and used it as an opportunity to advertise Meta’s Quest 3 headset, saying his company’s device is lighter and cheaper. But the video highlighted the competitive nature between the two companies on this emerging technology. Basically, both Apple and Meta are racing to make their devices’ form factors smaller and more powerful until they finally achieve a hardware product that looks like a normal pair of glasses, albeit much more high-tech.

Cook has been hot on the potential of augmented reality for most of his tenure at Apple—and has been a vocal advocate for the technology, on the record, for roughly a decade. In a quarterly earnings call in July 2016, Cook said “we are high on AR for the long run,” while mentioning the success of Pokémon Go, the hottest mobile game at that time that relied heavily on augmented-reality tech.

Later that year while appearing at Utah Tech Tour, Cook said he predicted “a significant portion of the population on of developed countries” to have AR experiences “every day, almost like eating three meals a day, it will become that much a part of you.

“Few people in here think it’s acceptable to be tethered to a computer,” he said. “We’re all social people at heart. Even introverts are social people,” adding “AR will become really big.”

Over the years, Cook mentioned how he was “incredibly excited by AR” because he could “see uses for it everywhere.”

“I can see uses for it in education, in consumers, in entertainment, in sports. I can see it in every business that I know anything about,” he said at a 2017 event hosted by the University of Oxford.

While Cook has made Apple more successful than the company has ever been from a financial standpoint, the Vision Pro is one of the few original hardware products launched during his tenure as CEO, so it makes sense that it’s one of his sole focuses “from a product development standpoint,” as Bloomberg‘s source told Gurman. Steve Jobs, Cook’s predecessor and Apple’s cofounder, was considered a “visionary,” however, having a major hand in designing and launching Apple’s most iconic products including the iPod, iPhone, iPad, Mac (desktop and laptop configurations, including the wildly popular MacBook Air) and getting the deals done to make the iTunes Store possible. (Music streaming as an industry may not have come to pass without it.)

Cook was Apple’s COO under Jobs: He was considered an operations expert and a key to making Apple’s supply chain in Asia a profitable enterprise. But when Jobs died in 2011, many questioned Cook’s ability to shape landmark products in the same way Jobs could. The Apple Watch and AirPods have been major successes under Cook, but other products like the HomePod or AirTags haven’t created as much hype. On the contrary, those products may have generated undesirable publicity. And with Apple reportedly canceling its plans for a car, Cook is likely feeling more pressure for such a costly investment as the Vision Pro to succeed.

Both Apple and Meta are spending a significant chunk of change on research and development, which is key to getting these AR-powered goggles small enough to look like a stylish pair of high-tech glasses. Apple allocated $31.4 billion to R&D in 2024, a near-5% increase from the year before, while Meta earmarked a whopping $43.9 billion to R&D last year, a 14% jump from the year prior.

This story was originally featured on Fortune.com

Source link

You may like

Business

CEO of $3 billion company asks himself one question before bed every single night—and he urges Gen Z to do the same

Published

51 minutes agoon

April 20, 2025By

Jace Porter

- Like Gen Z, this self-made CEO believes in the power of manifesting success—but he insists that visualization alone isn’t enough. It has to be backed by relentless commitment and daily accountability. That’s why, every single night, he asks himself this one simple but revealing question.

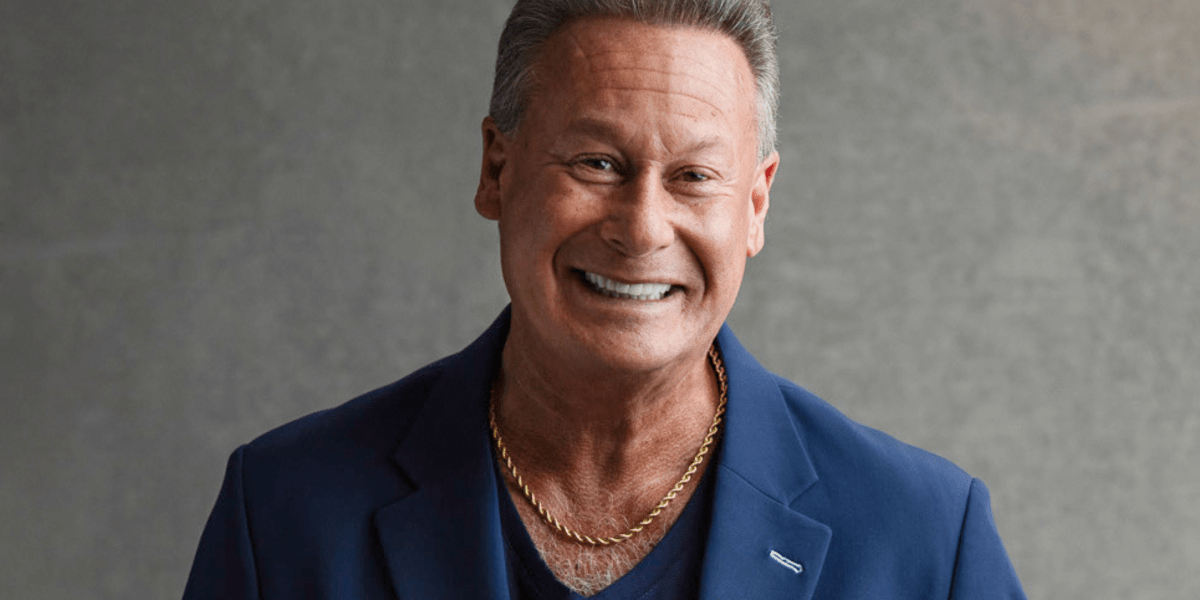

What do you ask yourself before bed? Some list things they’re grateful for. Others frantically run through their never-ending to-do list. Sheldon Yellen, CEO of Belfor, rates his productivity for the day—and urges Gen Z career starters to do the same.

“Every night, when I’m getting ready, washing up, brushing my teeth, I look in the mirror—I physically look in the mirror—and answer one question every night,” the $3 billion-a-year disaster recovery chief exec explains his daily high-performance habit to Fortune.

“That question, it’s a simple question, but it’s a difficult answer: How productive were you today? I ask myself that question every single night and I answer it as honestly as I can.”

Yellen then gives himself a score (1% being the worst)—and he says, he wouldn’t be able to sleep if he got bottom marks. “I’d start working,” the self-made billionaire adds.

“When I mentor young people, I tell them: ‘Every day is your day. Today is your day. But when you look in the mirror tonight, how much of it did you actually make count? Were you productive for 65%? 72%? 81%?”

You are the master of your own success

Of course, the evening exercise is easy to cheat—after all, it’s not a real exam, and you’re the one keeping score. But it serves as a powerful reminder that your success is in your hands.

Yellen is a prime example of this: Growing up in poverty, he started working as a dishwasher at just 11 years old in a Coney Island diner before getting a gig at an affluent men’s health club, Southfield Athletic Club, in Detroit.

“I started out shining shoes and cleaning toilets, urinals and the shower area, and I did the laundry,” the 67-year-old recalls.

“I took full advantage of these opportunities to do whatever I was doing the best I could do. I believed that if you did it long enough, somebody would notice—and they did, and so more opportunity kept presenting itself to me at a young age.”

After dropping out of high school, Yellen says he worked seven days a week—including “on the streets”—to turn his life around. He shined shoes, washed cars, chauffeured entertainers in limousines, and hustled until he landed in the restoration industry at 26 years old.

Since then, he’s climbed the ranks at Belfor (then known as Inrecon) from its 19th employee to CEO of around 12,000 employees worldwide.

Under his helm, Belfor has become the world’s largest disaster recovery company—it receives around 330,000 callouts a year to deal with the fallout from hurricanes, flooding, terrorist attacks, and more. Over the course of four decades at the company, Yellen has overseen the clean-up after 9/11, Hurricane Katrina, and the 2011 Thai floods, to name a few.

“I believe if you lay down at night and you dream it and you visualize it, and then believe it, you can be it—I really do,” Yellen says of his impressive journey to the top. “I came from a family raised on welfare. There was no guarantee I’d be where I’m at. I dreamt. I visualized it. I hear it in song. I believed it. I still believe it.”

But of course, visualizing success—which Yellen describes as mapping out a path forward—is just one piece of the puzzle.

“All that’s needed is the commitment,” he adds. Like holding yourself accountable every night and reviewing your productivity with complete honesty.

“Now, you got to have patience. It doesn’t happen overnight, but if you’re committed and you get others to believe in your commitment, they will help you along.”

This story was originally featured on Fortune.com

Source link

Business

Southeast Asia’s Muslim market comes of age—and authenticity is in

Published

10 hours agoon

April 19, 2025By

Jace Porter

Southeast Asia is showing signs of a potential consumer boom. Incomes in the region have been on the rise, partly owing to increasing foreign investment as global corporations look to reorganize their supply chains. The area’s increasingly affluent population is also quite young: Its median age of around 30.4 years is considerably younger than that of the U.S., Europe, or China.

This fast-rising group has another distinctive characteristic: About 40% of Southeast Asia’s population, roughly 281 million people, are Muslim, based on Fortune calculations using World Bank data and census figures. And that particular demographic is fast becoming a key consumer group, as both local companies and established multinationals grow even more sensitive to their needs.

The Muslim consumer market in Southeast Asia spreads across Singapore, Brunei, the Philippines, and Thailand. But its largest hubs are in Malaysia, where about 64% of the population identifies as Muslim, and Indonesia, home to more Muslims than any other country—about 242 million, according to 2023 census figures.

The middle class in the Islamic community has been steadily expanding, according to Afra Alatas, a research officer who studies Muslim societies in Southeast Asia for Singapore think tank ISEAS–Yusof Ishak Institute. And as this group of consumers grows richer, Afra notes, “Muslim consumers—particularly those in the middle class—increasingly desire a more ‘Islamic’ lifestyle.”

Afra says this desire is manifest in a growing demand for goods and services that are halal (that is, permissible under Islam). It’s fueling a boom in companies that offer halal-certified non-consumable goods like cosmetics; “modest fashion,” which reflects Islamic values of modesty while still being stylish; and tourism packages.

Globally, Muslim consumers spent $2.29 trillion on halal products and services in 2022, up 41% from $1.62 trillion in 2012, per research from Salaam Gateway, a Dubai-headquartered organization that tracks the global Islamic economy. That total is forecasted to rise to $3.1 trillion by 2027—making observant Muslims a market that few companies in any region can afford to ignore.

“When we divide the world population by religions, the Muslim population is increasing the most,” says Cédomir Nestorovic, a professor at the ESSEC Business School in Singapore who focuses on Islamic business and management. World Bank data shows that many Muslim-majority countries have moved from low-income to middle-income status—including Indonesia and Malaysia.

“The demographics are clearly on the side of Muslim people,” Nestorovic says.

One of the biggest Muslim-consumer success stories in the region is Wardah, an Indonesian cosmetics and personal care brand that makes halal cosmetics.

Many non-practitioners of Islam are aware of the concept of halal as it applies to food and beverages: Observant Muslims are called upon to avoid pork and eschew alcohol, and halal butchers are obliged to slaughter animals in a cruelty free manner. Those concepts, it turns out, are quite relevant when it comes to beauty products, where the use of alcohol (in perfume) and of collagen or gelatin from pigs (in facial products) is not uncommon, and where testing products on animals is often controversial.

Wardah observes these laws and avoids any additives that would be haram (impermissible). Founded in 1995, the company began to see meaningful growth from about 2005, according to Sari Chairunnisa, deputy CEO and vice president of research and development at Paragon Technology and Innovation, Wardah’s parent company. (Sari is also the daughter of Paragon’s founder, Nurhayati Subakat.)

The company was held back in its early years by the fact that regional consumers had less disposable income and lacked knowledge about the availability of halal products, Sari says. And Wardah’s own products needed improvement, she adds: It took time to master the art of making higher-quality lipsticks and foundation that proved durable and long-lasting.

Wardah is a private company and doesn’t publicly report its revenue, but says it currently holds about 30% of Indonesia’s beauty market, which includes personal care and cosmetics. It also sells its products in Malaysia and Brunei.

But Wardah is hardly the only Indonesian brand to find success among Muslim consumers. “Modest fashion” company Buttonscarves, a startup founded in 2016, now has physical stores across Indonesia and Malaysia, and an online store that serves the rest of Southeast Asia and global customers. It found a market gap where few designers catered to “contemporary Muslim women,” according to founder and CEO Linda Anggrea. “I wanted to build something that not only met the fashion needs of Muslim women but also gave them a sense of confidence,” she says. “There weren’t many brands that combined premium quality and design.”

Anggrea started with a single product—scarves—and has since moved into selling clothing and other accessories. Buttonscarves is now the flagship in a group of eight brands that fall under the umbrella of the Modinity Group; a company spokesperson says Modinity earned revenue of $80 million to $100 million for 2024.

Rising incomes aren’t the only factor driving the rise of the Muslim consumer in Southeast Asia; technology and government initiatives have also played a role.

In this region, as elsewhere in the world, smartphones have changed the consumer landscape as they’ve become more accessible. The proliferation of technology allows Muslim entrepreneurs to promote halal products, and social media has increasingly enabled companies to lean on influencers to market their wares.

“Religious preachers, online influencers, and Muslim entrepreneurs use their platforms to market their products—and in some cases to explain or justify their permissibility according to religious precepts—to their followers,” says Afra, the researcher in Singapore.

Anggrea of Buttonscarves says her business has benefited from the changing perception of modest fashion in the past decade. Social media influencers who advocate modest fashion have shown that wearing a hijab is something that can also be fashionable; so, too, have widely promoted fashion shows. If you’re an observant Muslim woman, “you can be as stylish as you want,” Anggrea says.

But government initiatives are arguably an even bigger driver for the adoption of a halal economy. Much like governments in the Middle East, those of Muslim majority countries like Indonesia and Malaysia have introduced various policies to promote the halal economy or greater compliance with sharia, or Islamic law, by businesses.

Consider that Indonesia wants all cosmetics sold in the country to be halal certified from October of next year. The move stems from the Halal Product Assurance law of 2014, which requires products like food, cosmetics, and apparel to be halal-certified. Regulation like this arguably benefits companies like Wardah that already have a head start in ensuring product compliance and have built up trust among the community. (Non-Muslims, of course, can and do also buy halal products.)

Consumer banking, too, has become more proactive in serving the Muslim community. Islamic finance is already big business in the Middle East, driven by economies like Saudi Arabia and the United Arab Emirates.

In Southeast Asia, Malaysia is the leading economy for Islamic finance. Malaysia’s government first began promoting the sector as an alternative to the conventional finance system following the Asian Financial Crisis of the late 1990s. Interest in Islamic finance offerings gained traction again after the Global Financial Crisis of 2008: Islamic banks were viewed as more robust and safer than conventional banks because they didn’t trade in junk bonds or take part in short-selling or speculation—all seen as factors that had destabilized the global financial system.

In order to be sharia-compliant, banks must avoid investments in companies whose products do harm; they are also obligated to avoid companies that make or sell haram products like pork or alcohol. More significantly, Islamic banking can’t rely on interest payments, which are barred under some interpretations of Islamic law.

Malaysia’s biggest bank, Maybank, is the parent company of the Asia-Pacific region’s largest Islamic financial operation. Maybank, as a group, has banking services more often associated with traditional finance. But Islamic banking contributed about 28% to the group’s pretax profits. Maybank Group reported revenues of $14.2 billion in 2023, placing it at No. 17 on the Fortune Southeast Asia 500.

“From a Muslim perspective, if I invest or save money and I get an interest, it’s very difficult for them to accept. We want to ease that,” says Dato Muzaffar Hisham, who oversees the group’s Islamic finance operations.

While interest is forbidden, there are still sharia-compliant methods to grow wealth. Among them is the financial principle of murabaha. This involves a bank customer purchasing an approved sharia-compliant asset and selling that asset to the bank at an agreed-upon marked-up price. The markup takes the place of the interest that would be involved in a traditional fixed deposit. (A similar process is used when a customer seeks financing options.)

Islamic finance in Southeast Asia amounted to roughly $859 billion in 2023, up from $754 billion in 2020, according to the latest study by the Islamic Corporation for the Development of the Private Sector and the London Stock Exchange Group. The total global market for Islamic finance was estimated to be worth around $4.9 trillion in 2023.

Muzaffar sees an opportunity for Maybank to further expand from Malaysia into Indonesia either through wealth management or financing as the population becomes wealthier.

Maybank’s Islamic banking window through Unit Usaha Syariah PT Bank Maybank Indonesia grew its assets by 4.7% year on year in 2024 to reach 42.96 trillion rupiah ($2.6 billion) and contributed about 25% to Maybank Indonesia’s total assets. Its Islamic banking window made up about 5% of Maybank Indonesia’s total assets 10 years ago.

To be sure, many multinationals have long been playing to the Muslim community. The food and beverage sector has been the front-runner in this space, according to Nilakshi Medhi, head of strategic planning at advertising giant Publicis’ Indonesia office. Not only do these companies ensure halal

certification, but chains like McDonald’s and KFC introduce special menu

offerings during Ramadan, along with pre- and post-fasting meals.

Big beauty and fashion brands like L’Oréal of France and Sweden’s H&M have also made efforts to cater to the growing Muslim consumer class with halal cosmetics and modest fashion apparel in specific markets. Even travel platforms are now offering packages that ensure compliance with halal standards in accommodations and food in a bid to capture a share of a values-driven market.

Islamic consumers have made their buying power known in other ways—such as withholding their dollars from companies over political disputes. The recent conflict in Gaza has provided one vivid example.

Activists in both the Islamic world and the West called for boycotts as a way to take a stand against what they saw as unjust treatment of Palestinians in Gaza by Israel and some brands’ perceived complicity in that mistreatment. Last October, Unilever’s Indonesia unit reported an 18% drop in revenue for its third quarter to 8.4 trillion rupiah ($533 million). The conglomerate previously said that its growth in Southeast Asia had been hurt by shoppers in Indonesia who were engaged in geopolitically focused consumer-facing campaigns.

Berjaya Food, which franchises Starbucks coffee shops in Malaysia, has taken a particularly sharp hit from boycotts. Starbucks doesn’t currently operate in Israel, and has said it doesn’t financially support Israel in any way. But in October 2023, the company criticized and sued a union aiming to organize Starbucks workers after the union posted pro-Palestinian comments on social media; Starbucks was subsequently included in consumer boycotts.

The coffee chain accounts for about 90% of Berjaya Food’s revenue. In March 2024, Berjaya’s owner spoke out in exasperation. He argued that boycotting Starbucks in Malaysia is unnecessary because it’s essentially a local operation. “We don’t even have one foreigner working in the head office or stores,” Vincent Tan said. “In the stores, 80% to 85% of employees are Muslim.”

Tan’s words hardly lessened the impact. Revenue for Berjaya’s Starbucks franchise declined to 676 million ringgit ($152.4 million) for its fiscal 2024, compared with 1 billion ringgit ($225.4 million) the year before. Berjaya Food blamed the decline on the negative impact of the ongoing conflict on consumer sentiment.

Medhi from Publicis Indonesia says authenticity is “nonnegotiable” when it comes to catering to Muslim consumers. That creates openings on which companies like Wardah and Buttonscarves can capitalize.

Anggrea, the Buttonscarves CEO, describes her typical aspirational customer as a Muslim woman who now has more money and may want to buy a better-quality, more fashionable scarf to use as a hijab. Italian fashion house Loro Piana has been selling scarves in Southeast Asia for decades, Anggrea notes, but a middle-income person in a place like Indonesia may not be able to afford that level of luxury.

That is the market Anggrea positions her brand to operate in, and she sees a market not only in Indonesia and across Southeast Asia, but even as far as Turkey. Her goal is to create products that specifically speak to the Muslim consumer but are still accessible to the mainstream market. She argues that her brand is really a lifestyle apparel company, and not exclusively a hijab-making one.

A well-designed and good-quality scarf is versatile, she says. “Some non-Muslims wear scarves as an accessory; Muslims choose to wear it on their heads.” She adds that while Muslims make up the bulk of Buttonscarves customers, sales do go up during Christmas.

“Other societies can relate with this lifestyle,” Anggrea says, including modest fashion apparel that covers wearers to the wrist or ankles.

Sari Chairunnisa of Wardah strikes an even more ambitious tone. She explains that halal products, whether food or cosmetics, emphasize responsible resource use and a commitment to sustainability.

She recounts conversations she had about halal cosmetics at a beauty expo in September in Boston, noting that consumers were beginning to associate halal with sustainable production. “When they see a halal logo, even though they’re not Muslims, they ask if it’s a sustainable or a natural product, so they already have their own definition,” Sari says. “Fifteen years ago they might have asked, ‘What is this logo?’”

Sari thinks that with enough education—and with a growing Muslim consumer class buying up halal products—the concept of halal will gain global mainstream acceptance outside of Islamic communities.

“I believe halal will become like ikigai in Japan,” says Sari, referring to the Japanese term for a passion that provides value and joy in life. “It’s a Japanese concept, but foreigners can also buy into it.”

This article appears in the April/May issue of Fortune with the headline “The new Muslim consumer.”

This story was originally featured on Fortune.com

Source link

Business

Firing Powell would hurt the dollar and U.S. economy, France says

Published

13 hours agoon

April 19, 2025By

Jace Porter

President Donald Trump would put the credibility of the dollar on the line and destabilize the US economy if he fired Federal Reserve Chair Jerome Powell, French Finance Minister Eric Lombard warned.

“Donald Trump has hurt the credibility of the dollar with his aggressive moves on tariffs — for a long time,” Lombard said in an interview published in the La Tribune Dimanche newspaper. If Powell is pushed out “this credibility will be harmed even more, with developments in the bond market.”

The result would be higher costs to service the debt and “a profound disorganization of the country’s economy,” Lombard said, adding that the consequences would bring the US sooner or later to talks to end the tensions.

Lombard’s comments come after Trump, frustrated with Powell’s caution to cut US interest rates, posted on social media Thursday that Powell’s “termination couldn’t come quickly enough.” It wasn’t clear whether he meant he wanted to fire Powell or was eager for the end of his term, which is May 2026. National Economic Council Director Kevin Hassett said Friday Trump was studying whether he could fire him.

President Emmanuel Macron has opposed Trump on a series of issues including Ukraine, trade and even offered refuge in France for US-based scientists whose federal research funding has been cut.

Even so, Lombard’s comments are unusually direct about US domestic matters.

Read more: Trump Studying If Removing Powell Is Option, Hassett Says

On tariffs, France’s finance minister said the 10% tariffs Trump has imposed on imports from the EU don’t constitute “common ground” and that Europe’s goal is for a free trade zone with the US.

The 10% level is “a huge increase that isn’t sustainable for the US economy and represents major risks for global trade,” Lombard said.

The finance minister also called on European CEOs to show “patriotism” and work with their governments so the region doesn’t lose out.

On Thursday, French billionaire Bernard Arnault, whose group LVMH owns Champagne labels like Moët & Chandon and Veuve Clicquot as well as Hennessy Cognac, seemed to suggest that EU leaders weren’t pushing hard enough for an accord on tariffs.

This story was originally featured on Fortune.com

420 Celebrity Scramble Guess Who!

Guess Who These Easter Cuties Turned Into!

CEO of $3 billion company asks himself one question before bed every single night—and he urges Gen Z to do the same

Trending

-

Entertainment8 years ago

Entertainment8 years agoThe final 6 ‘Game of Thrones’ episodes might feel like a full season

-

Politics8 years ago

Politics8 years agoCongress rolls out ‘Better Deal,’ new economic agenda

-

Entertainment8 years ago

Entertainment8 years agoNew Season 8 Walking Dead trailer flashes forward in time

-

Entertainment8 years ago

Entertainment8 years agoMod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Tech8 years ago

Tech8 years agoMicrosoft Paint is finally dead, and the world Is a better place

-

Tech8 years ago

Tech8 years agoHulu hires Google marketing veteran Kelly Campbell as CMO

-

Tech8 years ago

Tech8 years agoFord’s 2018 Mustang GT can do 0-to-60 mph in under 4 seconds

-

Politics8 years ago

Politics8 years agoIllinois’ financial crisis could bring the state to a halt