But for Apryl Shackelford, those anxieties have been replaced with opportunity.

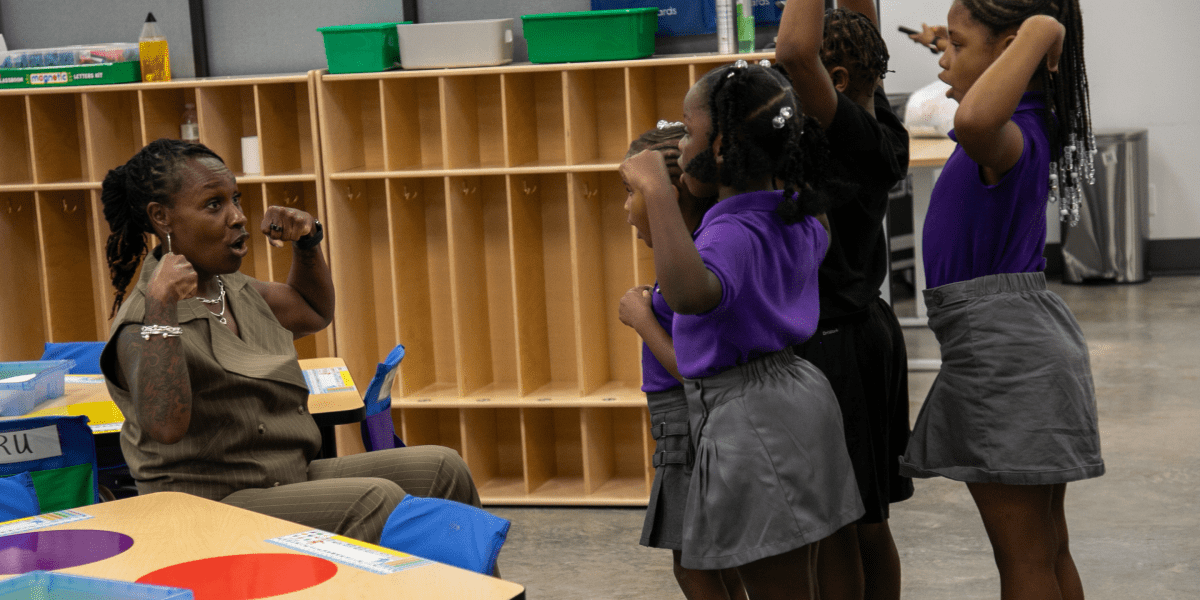

The 55-year-old is beginning her fourth year as the leader of Liberty City Primer, a private microschool in Miami. With just six classrooms and a few dozen students, Shackelford doesn’t have to navigate a politically charged school board or shifting state mandates. Instead, she can pour her energy into what she does best—teaching her first and second graders phonics, reading comprehension, and social skills.

Perhaps just as importantly, the change has given her something teachers in traditional schools often lack: financial security. As an independent school leader, Shackelford now makes $101,000 a year.

That’s a far cry from the $34,000 she brought home in her first year working at a public school in Jacksonville, Florida, in 2003. Even after shifting to the charter school system years later—where her salary rose to $50,000—it still wasn’t enough. Like many educators, she often worried about paying bills and would turn to side work during summer breaks, a discouraging reality considering teachers often act as de facto counselors, social workers, and guardians in addition to their teaching duties.

But with Primer, a venture-backed startup helping teachers establish their own microschools, Shackelford has been able to add the unexpected new title of entrepreneur to that list.

“Primer made me not just a teacher, but an entrepreneur. I’m building a legacy, not just running a school,” she told Fortune.

The organization takes care of the back-end logistics, from payroll and setting tuition to lobbying state legislators and navigating local zoning laws, freeing educators to concentrate on their craft. As a microschool founder, Shackelford shapes her school’s culture, including library selections, after-school activities, and community engagement strategies.

Whenever Shackelford asks for items that were pipedreams in the public system, like certain furniture or books, Primer makes it happen, empowering her entrepreneurial visions to help students thrive.

“It’s never a ‘no,’” she said. “It’s ‘absolutely, we’ll get it there’, and that, by all means, that’s given us full access to everything. It’s my heaven on Earth.”

Education system frustrations brought an opening for microschools

The pandemic shined a relentless light on the deep struggles in the American education system. It’s one thing for a teacher to manage a roomful of energetic eight-year-olds, but during remote learning, it became a matter of overseeing two dozen Zoom screens, each with its own challenges and distractions. Suddenly, all bets were off.

This disruption fueled a crisis in teacher turnover and burnout, with one survey finding that nearly a quarter of all teachers were considering leaving or retiring because of COVID-19 lockdowns. Yet, it was also a wake-up call for families working from home about the rigid constraints of standardized public school learning. Many began seeking alternatives outside the traditional system, and policymakers—particularly in Republican-leaning states—intensified efforts to expand school choice programs.

In this atmosphere, microschools blossomed as a reinvention of the one-room schoolhouse that allowed one educator to teach a small group of students.

Today, it is estimated that between 750,000 and 2 million students attend microschools full-time, with many more attending part-time. Nearly 40% of the schools use state-funded school choice programs, according to the National Microschooling Center. Florida, Arizona, and Indiana are among the states with the biggest growth. However, accessibility largely depends on policy, and tuition typically ranges from $5,000 to $10,000 a year.

According to Ryan Delk, the cofounder and CEO of Primer, microschooling is a return “to what we know has already worked, but with a twist: empowering these teachers as entrepreneurs, giving them incredible software that allows you to personalize learning experience for every kid.”

In fact, he argued massive public school systems represent a grand “experiment” that hasn’t met the mark over the last few decades of ensuring every student is equipped for success.

“This idea that you can put 5,000 kids into a school and have this extremely homogeneous education experience across every state and try to industrialize the whole process—I think that’s the experiment, and I think the verdict is out on that,” Delk said.

Nevertheless, the microschool model is not without criticism. Equity advocates warn that the expansion of microschools, especially those reliant on tuition or vouchers, could drain resources and diversity students from neighborhood public schools. Some researchers also point to major gaps in accountability. This past week, researchers from Rand concluded they were unable to comprehensively measure students’ academic performance in microschools.

From $12.50 an hour to embracing the changing tides

Across the education system, from pre-k to college, smaller class sizes have been a wish for students and teachers alike with numerous studies finding more individualized learning boosts test scores and attendance.

For educator LaKenya Mitchell-Grace, the shift away from personalized to standardized learning has done more harm than good.

“You basically are teaching to test. There’s no creativity; the only creativity that I could provide is how I presented the material,” she told Fortune. “And so I would sometimes have to rush students because we have pacing guides.”

The 47-year-old has spent the last 22 years teaching in Alabama schools, but Mitchell-Grace’s patience was wearing thin on the career she loved. At one private school, falling enrollment forced her to manage a combined fifth and sixth grade classroom for just $12.50 an hour.

After later returning to the public school system, she heard about the rise of microschools last December and immediately became interested. While shifting away from traditional education might seem scary, Mitchell-Grace compared it to how the world is changing with AI: you can either accept change or be left behind.

“We have to ensure that our children are in spaces and places where they can compete with one another that none feels left behind,” she said. “So I would ultimately say, give them an opportunity to feel seen, supported and challenged on the levels as other children who already have these tools available to them.”

Last month, Mitchell-Grace opened her own Primer microschool in Montgomery, Alabama, with about two dozen students ranging from kindergarten to eighth grade.

“It feels like the beginning of my career all over again,” Mitchell-Grace said speaking to Fortune the day before the first day of class.

“Primer gave me the chance not just to teach—but to lead,” she added. “I still can’t believe I’m saying it—I’m an entrepreneur now. I’m building something meaningful in my city.”

Politics8 years ago

Politics8 years ago

Entertainment9 years ago

Entertainment9 years ago

Politics9 years ago

Politics9 years ago

Politics8 years ago

Politics8 years ago

Entertainment9 years ago

Entertainment9 years ago

Entertainment9 years ago

Entertainment9 years ago

Business9 years ago

Business9 years ago

Tech8 years ago

Tech8 years ago