On Tuesday, Microsoft, Nvidia, and Anthropic announced strategic partnerships that Microsoft CEO Satya Nadella summed up this way: “We are increasingly going to be customers of each other.”

How very “Here we go round the mulberry bush,” right? Microsoft buys Anthropic’s models; Anthropic runs Claude on Microsoft’s Azure cloud; Anthropic buys Nvidia’s chips; and both Microsoft and Nvidia invest in Anthropic. If that sounds like a big circle going round and round and back again… that’s because it is. And honestly, it’s making me dizzy.

But this trio-loop-de-loop isn’t an anomaly. These days, it’s becoming the dominant business model of the AI industry. Hyperscalers, model labs and infrastructure companies are increasingly forming closed-loop partnerships that function as a kind of AI mutual-assurance pact: everyone is a partner, a vendor, and a customer at the same time.

For Nvidia, which blew past revenue targets in its Q3 earnings yesterday, posting a 62% surge in revenue growth, this kind of circle game has been a key to its success over the past three years. As Fortune’s Shawn Tully recently detailed, the company has been building its own circular ecosystem by investing in—and sometimes financing—its own customers, from OpenAI to CoreWeave. The goal is to engineer a perpetual-motion machine of GPU consumption—a way to guarantee demand in a world where hyperscalers are trying to build their own chips. For example, in September Nvidia committed to investing up to $100 billion in OpenAI. As part of the agreement, OpenAI would purchase “at least 10 gigawatts worth of capacity in Nvidia AI chips. “It’s very murky,” Seaport analyst Jay Goldberg said recently. ““It’s very unclear what the motivation here is … To what degree is Nvidia investing versus buying demand or subsidizing demand [for its chips]?”

There are plenty of other non-Nvidia loops as well. Anthropic, for instance, has long had a similar arrangement with Amazon: Amazon is a major investor in Anthropic, which instantly gave Anthropic access to AWS infrastructure, Amazon’s custom Tranium chips, and a major partner for training and running its AI models. Amazon, in turn, gets a revenue boost in its cloud and AI chip businesses. More recently, OpenAI announced a multiyear partnership in October with AMD—OpenAI gets 6 gigawatts of AMD GPUs, while AMD gives OpenAI the option to buy up to 10% of the company. AMD gets guaranteed demand; OpenAI gets a second chip supplier. Another loop.

There are sovereign loops, too: Just yesterday, AMD, Cisco and Saudi-backed HUMAIN formed a joint venture to build up to 1 gigawatt of AI infrastructure in the Saudi Kingdom. Each company is both an investor and an exclusive supplier—AMD and Cisco put money into the joint venture, and the joint venture is then contractually designed to buy AMD’s GPUs and Cisco’s networking gear, all inside HUMAIN’s Saudi data centers. It’s the same circular logic: investors fund the suppliers, the suppliers buy from the investors, and everyone gets to tout massive growth.

And Nvidia isn’t absent from this one either: it also announced a partnership with HUMAIN yesterday —alongside Elon Musk’s xAI—to build a major new AI data center in Saudi Arabia.

Is “loopification” bad? Well, Nvidia has long profited from it, and startups like OpenAI and Anthropic likely would not be where they are today without it. But there are inherent risks: Concentrated power within a tiny group of players; huge debt among companies that haven’t yet proven sustainable business models; blurry real market signals that makes it harder to tell whether there is real demand. What would happen if one of the players in the circle stumbles? And what happens to the players left out of the circle?

Circle games, after all, are fun. But we all know what happens at the end of “Ring Around the Rosy” — they all fall down. Nvidia’s strong quarterly results may have calmed AI bubble fears–for now–but how long can this loop-de-loop business model continue? I don’t know the answer. But at this point, I might need some Dramamine.

With that, here’s more AI news.

Sharon Goldman

sharon.goldman@fortune.com

@sharongoldman

FORTUNE ON AI

Nvidia says it has ‘visibility to a half a trillion dollars’ in revenue through 2026. That would make it one of America’s biggest companies — Matthew Heimer

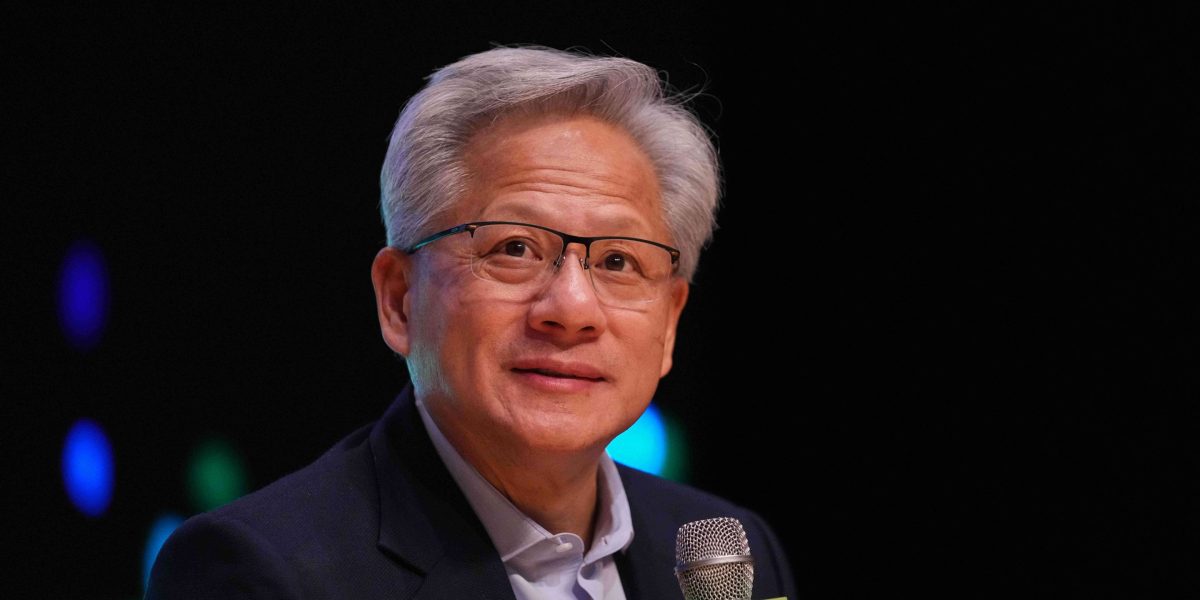

Nvidia CEO Jensen Huang earnings call namechecked Saudi AI company Humain three times. Here’s why — Jeremy Kahn

The stock market is barrelling toward a ‘show me the money’ moment for AI—and a possible global crash — Jim Edwards

AI’s power and water consumption is worrying the agriculture sector: ‘Don’t forget that it is also required for us to grow food’ — Angelica Ang

Nvidia blows past revenue targets and forecasts trillions in AI infrastructure spending by end of decade — Sharon Goldman

AI IN THE NEWS

Trump’s draft executive order targets state AI Laws. President Donald Trump is weighing a challenge to state AI regulations, according to a leaked draft reported by Reuters. The executive order aims to override state AI laws through litigation and by conditioning access to federal funding. The draft specifically criticizes California’s SB 53, calling it “complex and burdensome.” The order would create an AI Litigation Task Force to sue states and could withhold broadband funding from those with stringent AI rules. The proposal follows Trump’s push to attach similar preemption measures to the upcoming Defense Authorization Act bill. It is likely to face pushback at the state level and has already sparked MAGA backlash. Read more in Reuters.

Meta will partner with Yann LeCun’s new startup. Meta’s long-serving AI chief is leaving the company for his own startup. LeCun said in a post on LinkedIn that he was building a startup to carry forward the Advanced Machine Intelligence (AMI) research he had been working on at Meta’s FAIR and NYU. Last week, the Financial Times reported that LeCun was planning to launch his own start-up and was in early talks to raise funding for it. He called the creation of FAIR—Meta’s AI research Lab—his proudest non-technical accomplishment. Read the full post here.

Google DeepMind expands its robotics push with a new hire. Google DeepMind hired the former chief technology officer of Boston Dynamics, Aaron Saunders, as the company’s new VP of hardware engineering earlier this month, according to a report from Wired. The move is part of CEO Demis Hassabis’ DeepMind’s ambition to transform Gemini into an operating system for physical robots. Hassabis has previously said DeepMind is trying to build an AI system that can work “out-of-the-box, across any body configuration.” Boston Dynamics, known for its advanced legged robots, was actually briefly owned by Google, which acquired the company in 2013 and sold it four years later. While at the company, Saunders worked on an amphibious six-legged prototype before becoming CTO in 2021. Read more in Wired.

Europe scales back its privacy and AI laws. The EU has proposed a series of changes to its landmark privacy rules, GDPR, and a delay to major provisions of the AI Act. The proposal would ease data-sharing restrictions, allow personal data to be used for AI training under certain conditions, extend compliance deadlines for high-risk AI systems, and cut down on Europe’s ubiquitous cookie pop-ups. The Commission frames the changes as pro-innovation simplification, but leaked drafts have already sparked backlash from civil rights groups and lawmakers who say the EU is caving to pressure from Big Tech. Read more in The Verge.

AI CALENDAR

Nov. 26-27: World AI Congress, London.

Dec. 2-7: NeurIPS, San Diego.

Dec. 8-9: Fortune Brainstorm AI San Francisco. Apply to attend here.

Jan. 7-10: Consumer Electronics Show, Las Vegas.

March 12-18: SWSW, Austin.

March 16-19: Nvidia GTC, San Jose.

April 6-9: HumanX, San Francisco.

EYE ON AI NUMBERS

60%

That’s the percentage of adults in the U.S. who have tried generative AI since the launch of OpenAI’s ChatGPT, according to a new report from the Computer and Communications Industry Association. This also makes it the fastest-adopted technology in history.

According to the 2025 SPICE AI Report, roughly three in five U.S. adults have now used GenAI in less than three years, outpacing the adoption curves of both smartphones and the internet. Daily use of GenAI among U.S. adults jumped from 12% to 17% over just eight months, while workplace integration is accelerating even faster. Around 40% of workers now use AI tools at work, reporting an average 15% boost in productivity. Among AI-using employees, daily usage surged from 21% to 31% between March and July 2025. Most AI-users, 77%, also have a favorable impression of the technology—a feeling that is trending more positive over time, according to the report.

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Business8 years ago

Business8 years ago

Tech8 years ago

Tech8 years ago