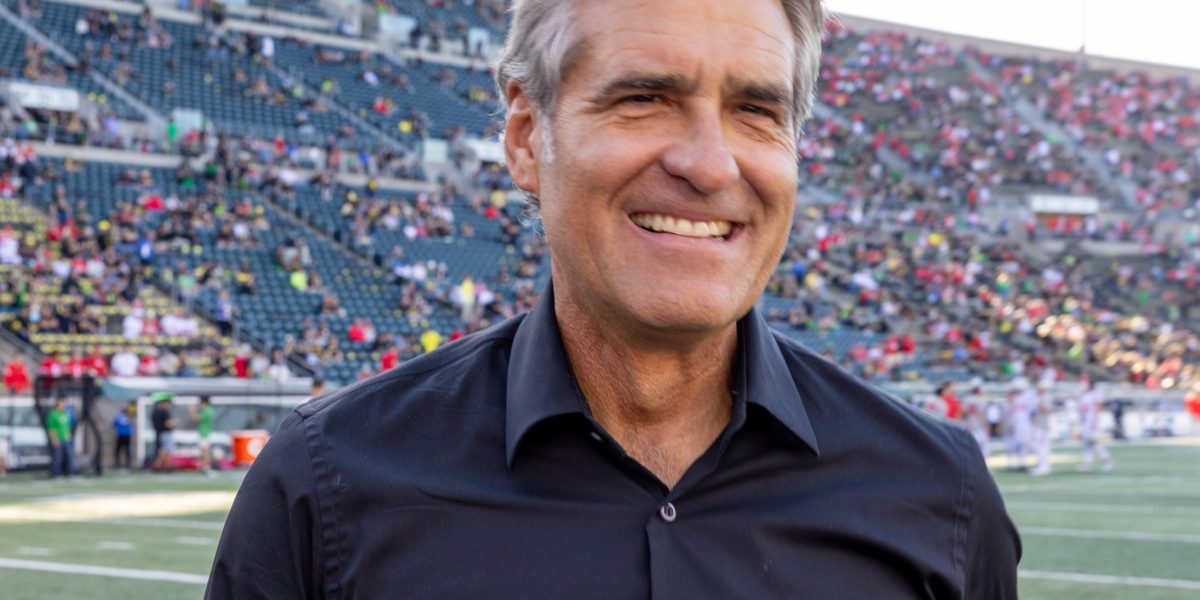

- Nike CEO Elliott Hill said the iconic sports-and-sneakers retailer will refocus on appealing to China’s 1.3 billion consumers with a boost from investments in the country’s basketball, track and field, and football teams. Nike is also aiming to wow consumers with a forthcoming spring collection and its partnership with Kim Kardashian’s shapewear line in NikeSkims as it redoubles efforts to focus on product portfolios.

Nike CEO Elliott Hill, who has less than six months on the job, asked Ohio State Buckeyes football coach Ryan Day how to stay on offense.

Day told Hill the national championship team applies pressure constantly in all three phases of the game, no matter what team they’re playing against: Get vertical down the field on offense; play suffocating man-to-man coverage so no throw is easy; and, go after punts and have the best athletes returning kicks. For Hill, it describes precisely how he’s thinking about Nike’s strategy right now.

“Success for Nike has never been about protecting our turf,” Hill said on Thursday. “We force others to play our game. We drive trends, grow markets, we lead.”

Still, right now Hill is weaving Nike through the hairpin curves of a harrowing turnaround. “It’s been a tough couple of years,” said Hill, and the difficulty has continued into 2025 and is expected to spread into 2026.

The sneaker-and-sportswear chain saw third quarter revenues tumble 9% to $11.3 billion and net income down 32% compared to the prior year. As Hill said Thursday on a call with analysts, the company has committed to its new strategic path, but so far the early efforts haven’t been enough to offset the continued headwinds of its classic franchises.

“While we met the expectations we set, we’re not satisfied with our overall results,” Hill said on Thursday during the earnings call. “We can and will be better.”

Nike tapped Hill last year to return and lead a turnaround at the company following his departure as an executive after 32 years. Hill’s strategic plan is called “Win Now” and involves five initiatives, three countries, and five cities. According to Hill, the initiatives involve focusing on building Nike’s hustle culture; sharpening the brand; expanding its offerings beyond the classics like Air Force Ones and Air Jordans; rebalancing its go-to market process and Nike Digital arm; and, focusing on local athletes with a more grassroots approach.

Hill recounted some of the renewed steps Nike has taken in the past three months in doubling down on the brand. Philadelphia Eagles quarterback Jalen Hurts wore red-and-black Jordan cleats during the Super Bowl, where Nike debuted its first advertisement in 27 years. During the halftime show, musical performer Kendrick Lamar wore coach Deion Sanders retro sneakers, and tennis champion Serena Willias wore Chuck Taylors along with musician SZA—all three Nike brands.

Hill added that Nike brands also “dominated” the NBA all-star weekend in the Bay Area, and said the “passion of sneaker culture” is alive and kicking.

As for the three countries in the 5-5-3-5 strategic plan, Hill is eying the U.S., United Kingdom, and China as another source of renewed growth. The five key cities are New York, Los Angeles, London, Beijing, and Shanghai.

In the third quarter, revenue declined 15% in Greater China, said chief financial officer Matt Friend. But despite the challenge in the macro environment, sports are a growth area in China and the company is planning to pick up the pace. Nike leases an office complex in Shanghai, which is its headquarters for the Greater China geography. It also has a distribution facility in Taicang, China. Last year, the company’s China revenues increased 8% on a currency-neutral basis due to higher revenues in categories including Men’s, Women’s, the Jordan Brand, and Kids.

Hill said the company has made significant investments in major sports teams in China and now has a product creation arm called GEO Express Lane. One caveat is Hill said he noticed during a trip in December that the competition there was more aggressive than he remembered 4.5 years ago.

“Good news is, we’re still the No. 1 brand there,” he said. “We’ve just got to accelerate our pace.”

This story was originally featured on Fortune.com

Source link

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Politics8 years ago

Politics8 years ago