SoftBank sold 32.1 million Nvidia shares in October, the company disclosed Tuesday alongside fiscal second-quarter earnings showing net profit more than doubling to 2.5 trillion yen, or approximately $16.6 billion. The windfall represented SoftBank’s best quarterly performance since July-September 2022, driven primarily by valuation gains in its OpenAI holdings, which totaled 2.16 trillion yen for the quarter.

Exiting Nvidia—again

This marks SoftBank’s second complete exit from the chipmaker. The firm previously sold its entire $3.6 billion Nvidia stake in 2019, only to re-enter the position in 2020 before this latest departure. That earlier sale has become something of a cautionary tale in investment circles: Had SoftBank retained those original shares, they would now be worth more than $150 billion.

Asked during an earnings call about the timing of the Nvidia sale, SoftBank’s CFO Yoshimitsu Goto suggested the company needed liquidity to fund its OpenAI commitments.

“This year our investment in OpenAI is large, more than $30 billion needs to be made,” he said. “For that, we do need to divest our existing assets.”

Goto declined to specify whether the October timing held particular significance, but described the sale as part of SoftBank’s ongoing cycle of “divesting and reinvesting,” calling it the company’s “fate” to continually reallocate capital. Notably, he added the decision had “nothing to do with Nvidia itself.”

Nvidia out, OpenAI in

As SoftBank turns away from Nvidia, its involvement with OpenAI has grown much deeper, especially over this past year. In March, the company agreed to lead a funding round of up to $40 billion at a valuation of $300 billion. Under the arrangement, SoftBank committed to an initial closing of $10 billion in April, with a second tranche of up to $30 billion scheduled for December. The company plans to syndicate $10 billion to co-investors, bringing its effective investment to $30 billion.

In October, SoftBank’s board approved the second installment of $22.5 billion, contingent on OpenAI completing a corporate restructuring that would enable a future public listing. If the restructuring fails to materialize by year-end, SoftBank’s total investment would drop to $20 billion. By the end of December, SoftBank’s total investment in OpenAI is expected to reach $34.7 billion.

OpenAI’s valuation has rapidly climbed over the past year, rising from $157 billion last October to $300 billion in March and then to $500 billion following an employee share sale last month. The dramatic appreciation has positioned OpenAI as the world’s most valuable private company, surpassing Elon Musk’s SpaceX.

SoftBank’s aggressive financing of its OpenAI stake has included selling down equity holdings—including T-Mobile shares worth $9.17 billion between June and September—as well as issuing bonds and securing bridge loans. The company also recently expanded the terms of a margin loan backed by shares of Arm Holdings from $13.5 billion to $20 billion.

The big picture for SoftBank

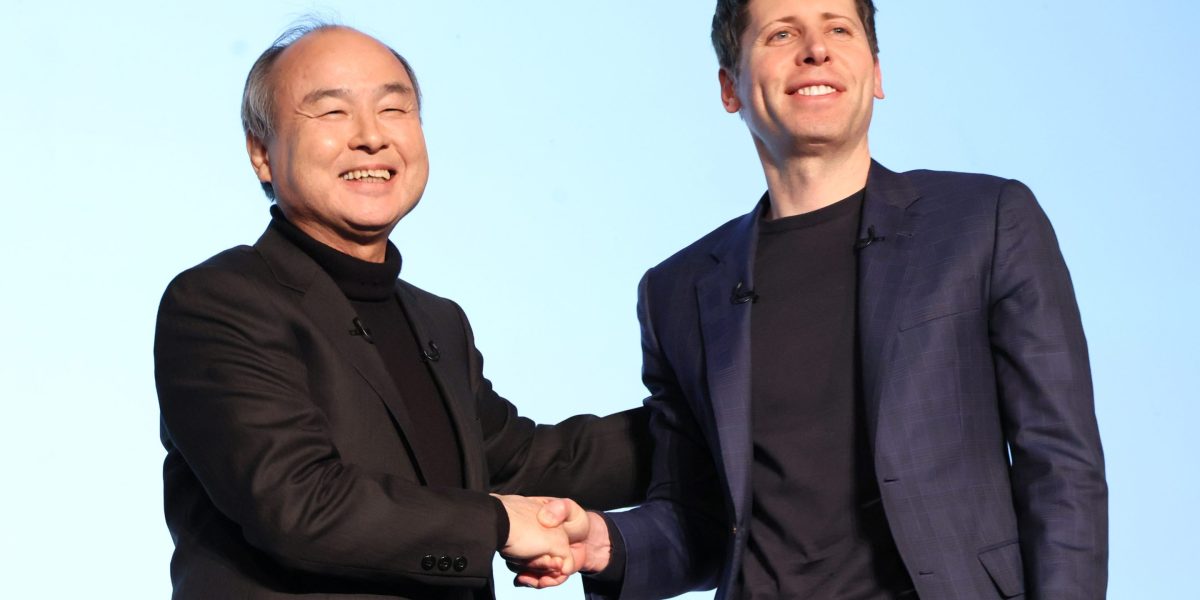

The investment is central to several sprawling AI initiatives. In January, Son joined President Donald Trump, OpenAI CEO Sam Altman, and Oracle’s Larry Ellison in announcing the Stargate Project, a $500 billion initiative to develop AI infrastructure across the United States. SoftBank assumed financial responsibility for the project, with Son serving as chairman, while OpenAI took operational control.

Despite the scale of the commitment, the Stargate rollout has encountered delays. During a September briefing, Goto acknowledged that progress was taking longer than anticipated, citing the need to build consensus among partners including Oracle and Abu Dhabi’s MGX.

“We need to take our time to prepare a model case for Stargate,” Goto told analysts and reporters. “A lot of parties are involved. Time is needed to form a consensus.”

In September, OpenAI announced the first Stargate data center in Abilene, Texas, had begun operations, with five additional facilities planned across Texas, New Mexico, Ohio, and the Midwest. The buildout is projected to create 7 gigawatts of data center capacity and more than $400 billion in investments over three years, aiming for a total of 10 gigawatts.

The Nvidia sale has freed SoftBank to pursue additional AI-related acquisitions. The company is finalizing a $6.5 billion acquisition of chip designer Ampere Computing and recently acquired ABB’s robotics division for about $5.4 billion. It also took a $2 billion stake in Intel to support development of AI chips based on Arm’s architecture.

Yet, concerns persist about the sustainability of AI valuations and whether the enormous capital commitments will generate commensurate returns.

“There are various opinions, but SoftBank’s position is that the risk of not investing is far greater than the risk of investing,” Goto said during Tuesday’s presentation.

Betting the house

SoftBank’s stock has nearly tripled in 2025 as investors have treated the company as a proxy for OpenAI’s success. The company also announced a four-for-one stock split effective Jan. 1, 2026, to improve accessibility for retail investors. But questions remain about financing.

David Gibson at MST Financial told The Financial Times SoftBank has committed approximately $113 billion in investments but possesses funding capacity of only $58.5 billion. The shortfall has prompted the company to leverage existing assets aggressively, including raising a $5 billion margin loan backed by Arm shares and securing $8.5 billion in bridging loans for OpenAI.

Son’s investment philosophy has always centered on long-term, transformative technologies. His early bet on Alibaba in 2000 yielded $58 billion when the Chinese e-commerce giant went public in 2014. But the track record is mixed—SoftBank’s backing of WeWork ended in a high-profile collapse, and the premature exit from Nvidia has become a painful reminder of opportunities lost.

For now, Son appears willing to stake SoftBank’s future on AI.

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Business8 years ago

Business8 years ago

Tech8 years ago

Tech8 years ago