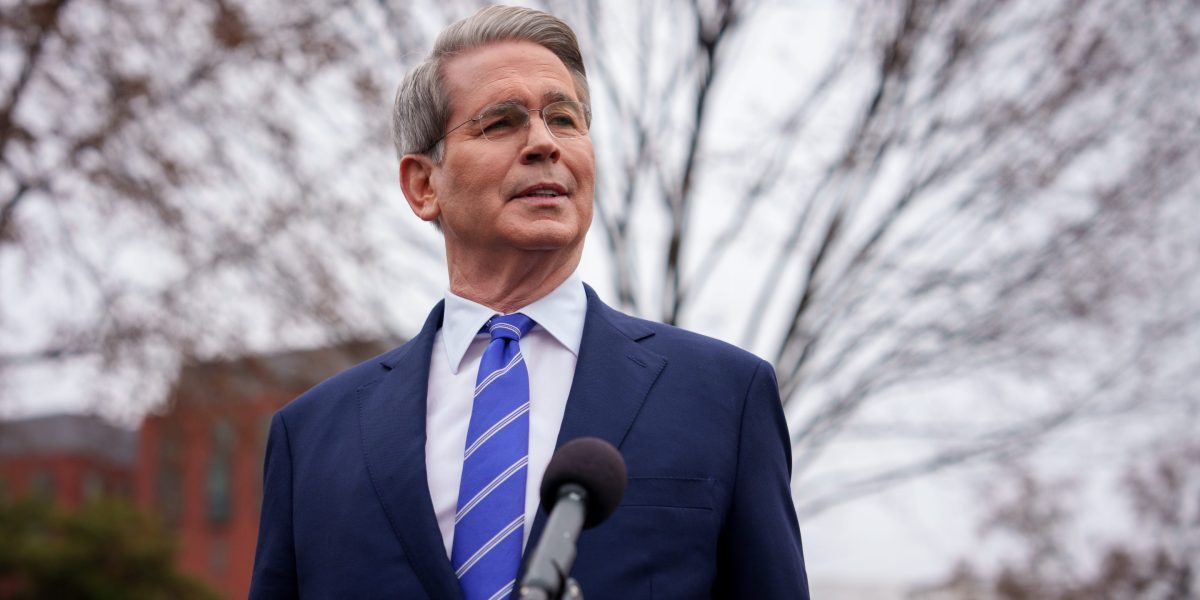

- Treasury Secretary Scott Bessent said he was not worried about the stock market, as the S&P 500 faced its first market correction since 2023 last week. Bessent said “corrections are healthy,” adding the Trump administration’s policies, largely seen as driving market uncertainty, are necessary for long-term sustainability.

Treasury Secretary Scott Bessent is not worried about the first stock-market correction since 2023, and he says it’s actually “healthy” to have a downturn now to avoid a crisis later.

The S&P 500, which tracks the broader market, fell into a correction last week by dropping 10% from the all-time-high it set earlier this year. The tech-heavy Nasdaq and Dow Jones also fell on March 13, before all three major indexes closed up on Friday.

Still, Bessent in an interview with NBC’s “Meet the Press” said there were “no guarantees” there won’t be a recession. He said he wasn’t worried about stock-market swings and added a downturn now could be a positive in the long term.

“I’ve been in the investment business for 35 years, and I can tell you that corrections are healthy. They’re normal,” he told NBC. “What’s not healthy is straight up, that you get these euphoric markets. That’s how you get a financial crisis. It would have been much healthier if someone had put the brakes on in ’06, ’07. We wouldn’t have had the problems in ’08.”

Bessent’s comments come as the Trump administration’s policies on tariffs and DOGE efficiencies, including mass layoffs and spending cuts, rattle investor confidence. Since the Fed is unlikely to make major changes to its stance on interest rates at this week’s FOMC meeting, a clear message from the administration could be key to reversing the falling market, according to a note by Goldman Sachs analysts.

“If the Administration were to give a clear message that they were prepared to adjust policy to support the economy or that they would prioritize more growth-friendly parts of their agenda, that could provide more immediate relief,” the analysts wrote.

It’s unclear if the Trump administration is willing to stray from its tariff policy, which has seen it impose a broad 25% tariff on steel and aluminum imports that sparked reciprocal tariffs from countries like Canada. Despite the falling market, though, Trump and his officials like Bessent seem unbothered by the prospect of an extended downturn.

In Trump’s first month in office, spending decreased but it still outweighed revenue, with the federal deficit increasing $307 billion in February, up 3.7% year-over-year. Bessent told NBC that had the U.S. remained at its large spending levels, it would have a guaranteed financial crisis. He added the Trump administration’s recent actions are necessary to prevent a future crisis.

“We are resetting, and we are putting things on a sustainable path,” he told NBC.

Despite the recent market setback, analysts at Evercore still see the S&P 500 skyrocketing to 6,800 from its current 5,690 by the end of 2025. Yet, in the worst case, slowing GDP growth of 1.5% and core inflation above 3% may bring on a period of stagflation that could see the S&P 500 collapse to 5,200—even lower than the 5,700 level it recorded when Trump was elected in November.

“A material move below 5,700 without reprieve from Washington signals Trump is less concerned with stocks, more concerned with Radical Change regardless of the asset market fallout,” the Evercore analysts wrote.

For now, Bessent shook off any fears of a long-term shock to markets and said he believed the Trump administration would win over Americans with its policies.

“I’m not worried about the markets. Over the long term, if we put good tax policy in place, deregulation and energy security, the markets will do great,” Bessent said. “I say that one week does not the market make.”

This story was originally featured on Fortune.com

Source link

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Politics8 years ago

Politics8 years ago