- Super Micro Computer, the AI-adjacent tech firm that manufactures servers packed with Nvidia’s prized GPUs, has named a general counsel. The appointment is a key recommendation the company’s board made after an independent investigation into management and accounting practices last year. For the high-profile position, Super Micro tapped its current senior vice president of corporate development, who will now also double as general counsel.

Beleaguered Fortune 500 company Super Micro Computer continues to try to clean up and modernize its internal functions and has named a general counsel, the company announced on Monday.

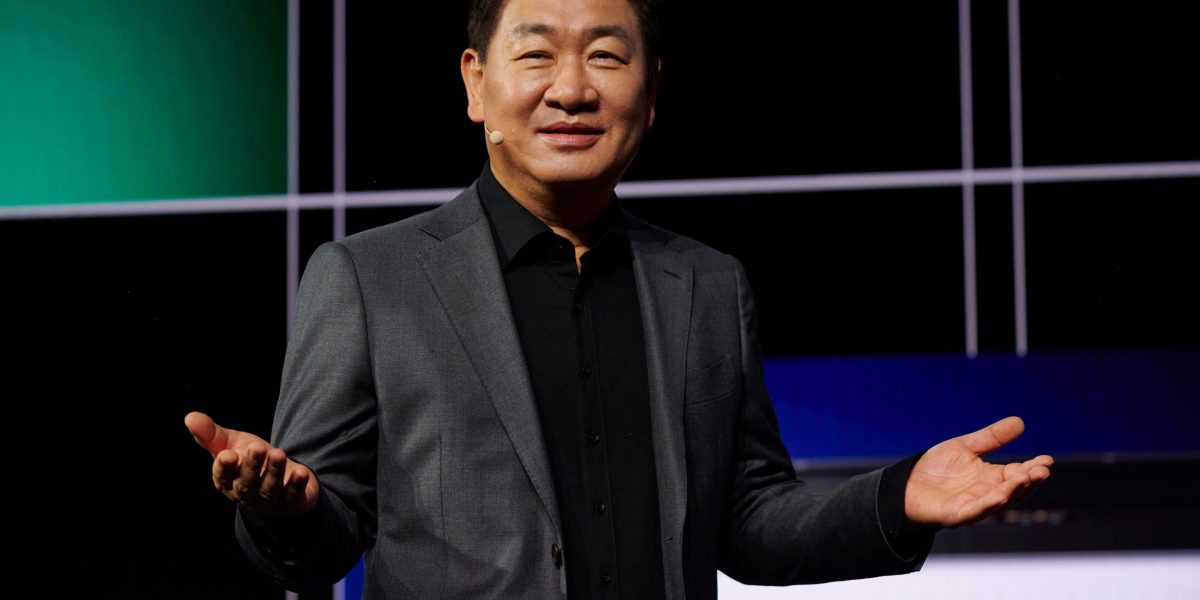

Current senior vice president of corporate development, Yitai Hu, will now also serve as chief legal officer at the $20 billion tech manufacturer. According to his LinkedIn bio and California state records, Hu is also a manager of Eponym Investments, a general investment firm.

Hu’s hiring was announced in conjunction with the appointment of Scott Angel, a new independent director on Super Micro’s board. Angel spent 37 years in audit and assurance at Deloitte until he retired in December 2017. The timing is notable: Super Micro spent the past five months enmeshed in a sprawling accounting mess after its former auditor, EY, quit abruptly last October, raising red flags about the company’s financial controls.

“Supermicro’s explosive growth has positioned us as a clear industry leader with tremendous opportunities for further value creation, and the appointments of Scott as an independent director and Yitai as General Counsel will support our continued growth,” said Charles Liang, CEO and founder, in a press release.

Angel is an audit committee financial expert, and spent 25 years as an audit partner in Silicon Valley, according to Super Micro. He served clients in tech and led Deloitte’s semiconductor industry practice from 1993 until 2017. Deloitte & Touche LLP previously served as Super Micro’s independent registered public accounting firm from 2003 until it was dismissed in 2023 when Super Micro hired EY.

A Super Micro spokesman declined further comment.

The appointments come at a critical time for the hardware manufacturer, which builds high-efficiency servers and data centers and recently partnered with Elon Musk’s xAI Grok team to build a 750,000-square-foot data center in Memphis. Super Micro is a key player in the AI ecosystem, and its star and its stock price rose along with Nvidia, OpenAI, and Anthropic. However, investors’ faith in Super Micro was shaken following its accounting problems, and its share price is down more than 17% the past six months.

Financial data company S3 Partners told Fortune Super Micro is the second largest short in the technology hardware and equipment industry group with 22.3% of its floating shares shorted—a short interest valued at $3.89 billion. So far this year, short sellers in the company’s stock added 31.2 million shares worth $1.1 billion, an increase of 38%, S3 Managing Director Ihor Dusaniwsky said in a statement. In the past 30 days, short sellers added 10.7 million shares to their positions, an uptick of 10% in total shares shorted.

“Shorting SMCI has not been a profitable trade for the full year, but recently it has been very profitable,” wrote Dusaniwsky in a statement. Short sellers lost $263 million year to date in mark-to-market losses for a -7.1% return, but they are up $7 million in March alone in profits, an 18.2% return, he said.

Despite bets that the stock price will continue to fall, Liang has said finally issuing financial filings, after being delinquent for months, marked an important milestone and an end to the distractions. In a call with analysts last month, Liang said the company was focused on meeting a $40 billion revenue target for 2025. However, the fallout from the accounting kerfuffle continues to reverberate; since August, Super Micro and Liang have been hit with at least five lawsuits and face probes from the Department of Justice and the Securities and Exchange Commission. Super Micro has said it is cooperating with regulators.

The company’s troubles reached a boiling point when EY resigned last summer after it brought concerns to the board’s audit committee about Super Micro’s internal controls, governance, and transparency, which resulted in the board forming a special committee and launching an investigation. Last August, the board recruited veteran lawyer Susie Giordano to join the board and serve as the sole member of the special committee to oversee the investigation. As the investigation continued, Super Micro delayed filing its annual financial report to investors as well as two quarterly reports, which prompted Nasdaq to warn the company it was in danger of being delisted from the exchange.

Super Micro has since wrapped the investigation, issued its financial statements, and announced in February that it was in compliance with Nasdaq rule requirements. The company hired BDO USA as its auditor and named a principal accounting officer and chief accounting officer, promoting two internal finance executives to the roles. Super Micro is also searching for a new chief financial officer with more experience to replace sitting CFO David Weigand, a recommendation also borne from the special committee investigation.

Hiring a general counsel and a new CFO were two of six key measures the committee pressed following the probe. Furthermore, the board recommended expanding the legal department with more in-house attorneys “to a level commensurate for a company of Super Micro’s size and complexity, particularly in light of its recent rapid growth and future growth ambitions.”

Hu will report directly to Super Micro CEO Charles Liang, the company told investors. He is licensed in California, where Super Micro is headquartered, and has been with the tech firm for five months. Hu previously spent a year at law firm Norton Rose Fulbright, two years at Wilson Sonsini Goodrich & Rosati, and 10 years at Alston & Bird.

This story was originally featured on Fortune.com

Source link

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Politics8 years ago

Politics8 years ago