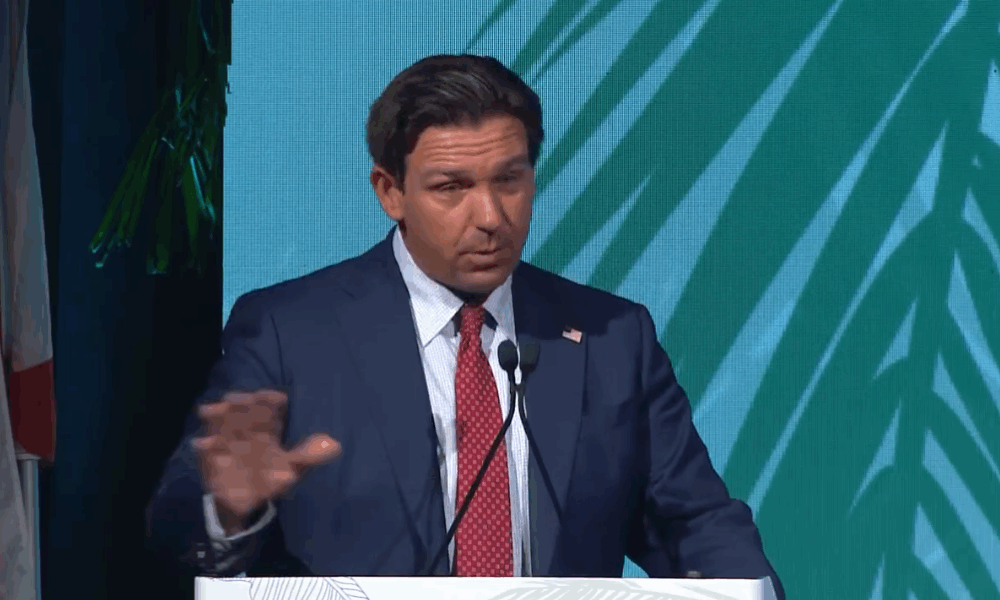

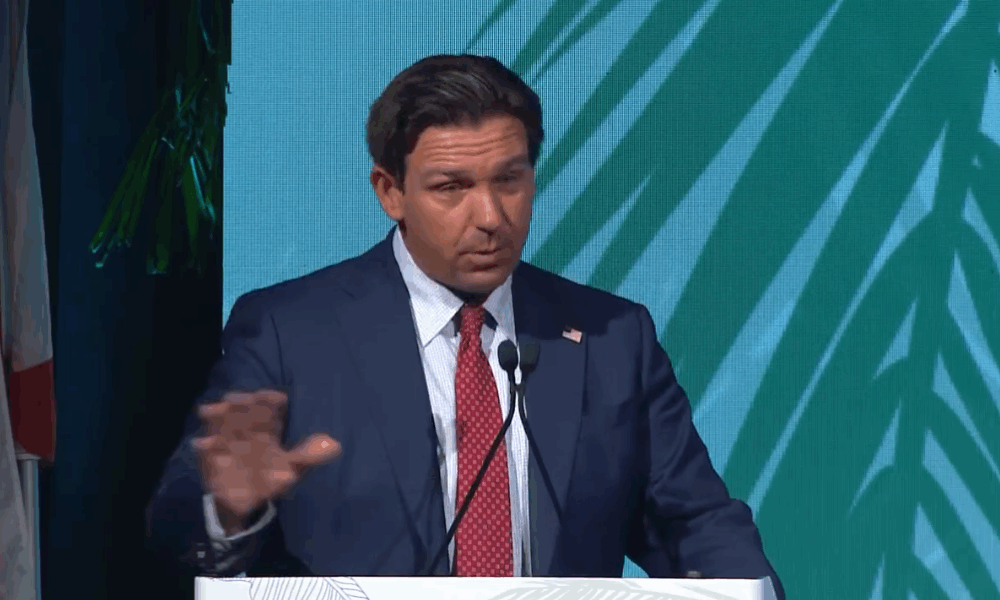

Gov. Ron DeSantis isn’t surprised by gold and silver surging in value. And he’s laying blame at the feet of the Federal Reserve.

“The trajectory of gold (and silver) = investors lack confidence in fiat currencies. An indictment of the Fed,” DeSantis posted to social media.

Gold topped $4,200 an ounce Wednesday morning, a new record price. Silver topped $53 an ounce but it is down slightly at this writing.

DeSantis, who this year signed legislation making gold and silver legal tender, said commodities offer independence from fiat currency devalued by a federal government dedicated to “borrowing and spending.”

“And it’s something that is very likely to hold its value. Certainly compared to fiat currency,” he remarked.

The Governor has been a frequent critic of the Federal Reserve, especially as the group lowered interest rates while former President Joe Biden’s administration expanded the money supply earlier this decade.

“I think the Fed has done a horrible job over these last few years and they really are creating potential significant turmoil in the economy going forward. I mean, think about what they did for all of 2022, they were hiking rates, taking money out of the economy because there was too much money that had been printed,” DeSantis contended in 2023.

“They’re creating, I think, a lot of perverse incentives. And here’s the thing, you can’t just do policies like we’ve seen over the past few years and think that somehow nobody is going to have to pay the piper. Somebody is going to have to pay the piper. You can’t just print money out of thin air like they did and expect that it’s all going to be hunky dory.”

DeSantis has waded into economic issues more of late, including taking the position that artificial intelligence stocks are experiencing a valuation bubble.