The Federal Reserve cut rates for a third straight meeting on Wednesday in what analysts call a “hawkish” move: an attempt to support a softening labor market while signaling reluctance to keep cutting.

The move was widely anticipated, but the tone was not. Officials paired it with with firmer language about the “extent and timing” of additional adjustments, phrasing that, in what economists call Fed-speak, raises the bar for further cuts and underscores the committee’s unease about inflation, which the statement noted has “moved up” and “remains somewhat elevated.”

The decision also exposed the widening fractures inside the central bank toward the end of Chair Jerome Powell’s term. Three officials dissented, but in opposite directions: Stephen Miran pushed for a larger 50-basis-point cut, while Austan Goolsbee and Jeffrey Schmid argued the Fed should hold rates steady. It’s the rare meeting where hawks and doves both object, a scenario analysts had warned was increasingly probable as disagreements sharpened over how quickly the labor market is cooling, and how much restraint inflation still requires.

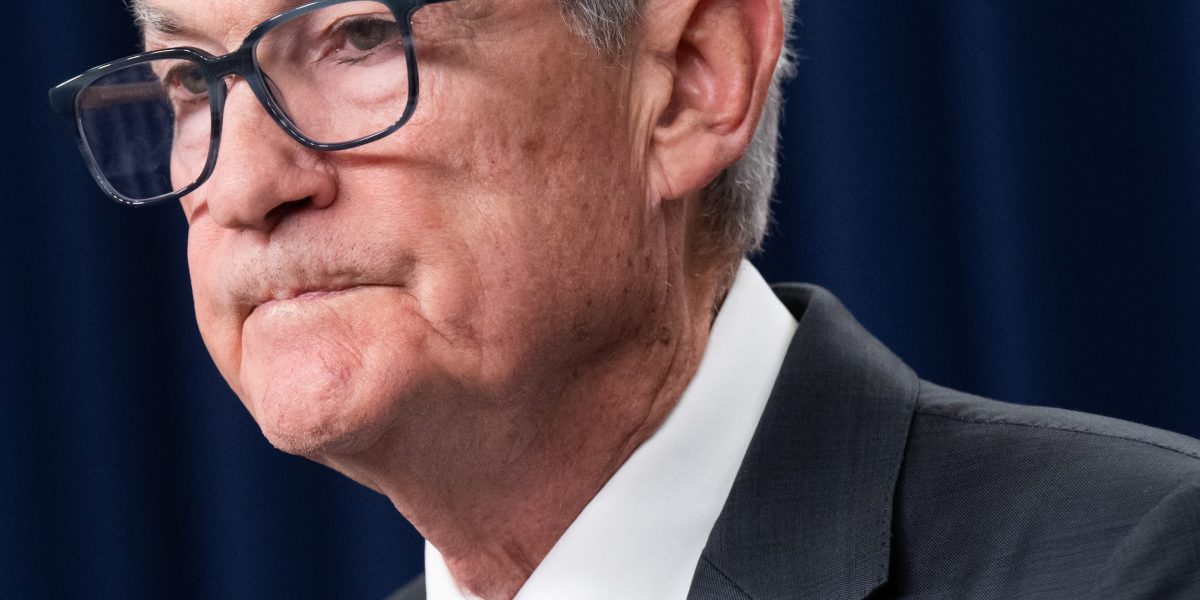

The December meeting also carries unusual weight because it may be the final one in which Powell still has his authority as Fed chair. His term expires in May, but President Donald Trump has already vowed to announce a successor early in 2026, effectively creating a “shadow chair” before Powell leaves.

“Feels like in a way the last Powell Fed meeting,” Bloomberg’s Conor Sen wrote on X. Powell is slated to speak at the conference shortly after the announcement.

Labor market concerns drove the cut

Wednesday’s decision was justified primarily by weakening conditions in the job market. Hiring has slowed markedly since the summer, while unemployment has ticked up and businesses across industries have begun signaling greater caution, even though the layoffs themselves have not yet surged in the official data.

Private-sector signals have flashed more urgency. ADP’s November report showed employers shedding a net 32,000 jobs, the sharpest decline in more than two years. Nearly all of those losses came from small businesses, which cut 120,000 positions, while medium and large firms kept adding workers. Economists view that pattern as a warning sign: small businesses are the most sensitive to rising costs and weakening demand, and they often pivot first when conditions deteriorate.

The government’s long-delayed JOLTS report, released Tuesday, added another layer. Job openings in October rose modestly, but remained far below last year’s levels; the quit rate fell to 1.8%, the lowest since early 2021; and hiring remained stuck at 3.2%, consistent with what economists and Powell himself have called a “low hire, low fire” labor market. Companies aren’t slashing staff outright—but they aren’t expanding either. That’s enough to worry economists.

“Low hiring on its own is bad news,” top economist and Fed-watcher Claudia Sahm told Fortune. “It puts upward pressure on unemployment, and that’s the dynamic the Fed is trying to get ahead of.”

A deliberately cautious message

The Fed sought to balance labor-market concerns with the political sensitivity of cutting rates while inflation is still elevated.

Fed officials will want more flexibility than signalling the cutting cycle is open-ended. Unemployment remains low by historical standards; consumption has been resilient among high-income households; and financial markets have surged on expectations of easier policy next year. Powell has warned markets over-read his intentions this year.

Still, Powell cannot declare victory or signal a pause with confidence. The November jobs report arrives just days after the meeting, and he will want flexibility in case that comes out worse than expected, so he doesn’t look “flat-footed,” Sahm said.

The limits of preemption

For the Fed, the goal is to smooth out the cycle—to cut early enough to prevent a deeper downturn without abandoning the fight against inflation, still sticky at 2.8%, higher than the Fed’s preferred rate of 2%. Sahm, who helped design the Fed’s framework for interpreting labor-market inflection points, argues timing is crucial.

“If the Fed waits to cut until they see clear deterioration, they’ve waited too long,” she said. Initial jobless claims remain low, she noted, but they are not predictive. As a lagging indicator, they tend to spike only after a recession has begun.

The central bank’s challenge now is to navigate between those competing risks while markets, the White House, and Congress push for clarity the Fed cannot yet provide.

If the Fed has to continue easing into early 2026, Sahm argues, it will not be a bullish signal.

“If they end up doing a lot more cuts,” she said, “then something has gone wrong.”

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Business8 years ago

Business8 years ago

Tech8 years ago

Tech8 years ago