Business

Ralph Lauren: The emperor has clothes

Published

4 months agoon

By

Jace Porter

Editor’s note: This article appeared in the Nov. 11, 1996 issue of Fortune.

On a brilliantly sunny summer afternoon, the kind of day people dream about to get them through the dreary frigid winter, we’re in a Manhattan office building trying to figure out where Ralph Lauren will sit. Actually, we’re in Lauren’s small, all-white office on Madison Avenue, and with two large, lovely chairs and a big cushy couch laid out before us, the answer is far from obvious. Rather than chance some giant faux pas by claiming his favorite spot as our own, we bravely put the question to him: “Mr. Lauren, is there a particular place you’d like to sit?” His response: “Wherever the light makes me look best.”

That’s Ralph. For nearly 30 years Lauren, 57, has earned a handsome living showing Americans (men especially) how to look good, using himself as the model. And therein lies a puzzle.

Somehow Lauren, who thinks it’s fine for men to wear (as he does) black velvet slippers in the office, has become the designer of choice for guys to whom the mere mention of velvet slippers causes first one and then the other eyebrow to be raised. Men with no tolerance for velvet slippers in the office, at home, in the tool shed, or on the moon. Men whose feelings toward men who do wear velvet slippers may fairly be expressed as: Yikes!

Then consider Ralph in his Rancher guise. Does this look like any real rancher of your acquaintance? Any rancher, that is, who’s willing to break either a sweat or a few vertebrae chasing after cattle? Real cowboys have nicknames for such ranchers. Ralph’s might be “Hopalong Casually.”

And yet mainstream guys bought $2.7 billion in suits, shirts, ties, and other Ralph Lauren garments last year. Add in women’s clothes, eyeglasses, perfume, bedsheets, dinner plates, leather couches, and the rest, and consumers around the globe spent some $5 billion on Lauren goods—making him the best-selling designer in the world. Somehow Lauren—faux cowboy, relentless Anglophile, exponent of yachting and polo—has come to occupy the kind of solid middle ground that Brooks Brothers did in the 1950s: He is the default fashion choice for men who don’t care a whole lot about fashion but nevertheless want to look good in office clothes. “Buying Ralph is like buying a Maytag,” says Hal Reiter, president of the executive search firm Herbert Mines Associates in New York, who owns six pairs of Ralph Lauren trousers and two Ralph Lauren suits. “He’s an established brand that stands for reliability and quality.”

“I try to give people a clean, aspirational quality, with no bullshit. Where’s the negative in that?”

Let other designers—Italians, handbag-toting Frenchmen—urge kilts and capes and corduroy plus fours upon an impressionable public. Lauren stands manfully above the fray, upholding simple, classic good looks (allowing for occasional lapses like those slippers). Risky dressing? Not for Ralph. He is the nation’s leading proponent of safe slacks.

“Ralph’s world is not unapproachable or scary,” says Neil Kraft, former head of advertising for Calvin Klein. “Everything is done with the promise of good taste.” And derivative idealism. When Lauren creates the look of an English country home, the panache of a Savile Row suit, or the luster of some Western belt belonging to an imaginary rancher, his version is always a little cleaner, a little brighter, just a touch more polished. He doesn’t sell socks; he sells his very mildly fevered (98.7º) dream.

Could Martha Stewart have existed without Ralph? He blazed the trail of “lifestyle” merchandising, selling not just items but his own personal context—and at a premium price, no less—at a time when such things weren’t done. He was the first fashion designer to have his own stores. He was the first to sell not only the suit you wear to work but the pajamas you wear to bed and the sheets you sleep on. And indeed, before Martha was Martha, she made gift baskets for Lauren’s clientele in the 1980s. “When people buy his products, it gives them the feeling of having class and stature,” she says. “They’re buying a piece of his world.”

The price of admission is relatively high, as befits a business with aspiration at its soul. A Polo suit might sell for $600 to $900; a woman’s blazer for $1,200; a pair of socks, $11; a leather sofa, $9,000. Even so, there are enough customers to sustain 116 freestanding Polo/Ralph Lauren stores, 62 discount outlets, and some 1,300 boutiques inside department stores all over the world. A new, 45,000-square-foot store—the length of an entire city block—is scheduled to open in London, of all places, late next year.

Since 1993, Polo/Ralph Lauren’s revenue—including its share of worldwide licensing income—has increased 30%, to some $900 million; operating profit has grown nearly 70%, to around $110 million. Not surprisingly, perhaps, the buzz is that Ralph is contemplating going public. Over the past year investors have been attracted to designers and department stores like lint to a sweater: Witness such high-profile IPOs as Gucci and Saks Fifth Avenue. In June, Donna Karan finally dropped the veil. Now, with the possible exception of Calvin Klein, no private company gets investment bankers’ mouths watering quite like Lauren.

Lauren himself admits an IPO is “in the realm of possibility,” but adds “I doubt if I’m going to do it. I like my privacy. I have no reason to do it unless I want to buy something else. And I sort of have everything I want.”

Darn it, he pretty much does. His car collection includes a 1929 blower Bentley, a 1937 Alfa Romeo, a 1938 Bugatti, and a 1962 Ferrari GTO. He has a 13,748-acre ranch in Colorado, a duplex apartment on Fifth Avenue in Manhattan, beachfront homes in Jamaica and Long Island, a 240-acre estate in Bedford, New York—and a company-owned Gulfstream II to get from one home to another. His estimated net worth? Better than $1 billion.

Lauren admits an IPO is “in the realm of possibility,” but adds, “I doubt if I’m going to do it. I like my privacy. I have no reason to do it unless I want to buy something else.”

Lauren has Goldman Sachs largely to thank for his current comfort. Two years ago, when Polo/Ralph Lauren needed money to open new stores and overhaul older ones, it raised $135 million by selling a 28.5% stake to the investment house.

With its minority stake, Goldman doesn’t get involved in the day-to-day running of the business. “They’re in my hands, I’m not in theirs,” Lauren says firmly. But few on Wall Street believe Goldman isn’t needling Lauren for an IPO. Says Richard Friedman, the partner at Goldman who heads GS Capital Partners, the investment pool that purchased Polo: “Both Ralph Lauren and Goldman Sachs would be remiss in not looking at the possibility. But there’s no pressing need to do one other than the strength of the market.”

How does Lauren keep coining money? His accomplishment depends partly on magic, mostly on machinery. The magic part he expresses as a question: “Did you ever see a man or a woman walk into a room and they look great, but you don’t know exactly why they do? You just know that you want to look like that?”

The machine is driven by licensing. No fewer than 26 companies pay to make, ship, and advertise Lauren’s goods. Lauren provides the design and creative talent, getting in return a cut of sales (around 6%) plus minimum guaranteed payments. Polo/Ralph Lauren still manufactures its top-of-the-line men’s and women’s clothes, but the bulk of its profit comes from these licensing agreements. Example: Cosmair, a division of L’Oréal, which makes Lauren scents, is one of the biggest licensees; fragrance industry expert Allan Mottus figures this one license could put as much as $20 million in Lauren’s pocket this year alone. He sews not much, but damn if Ralph don’t reap!

Just last August, Lauren launched two big new licensing ventures, Polo jeans and a line of women’s clothing called Lauren. Both are priced far below what Lauren’s clothes have sold for in the past—jeans at roughly $48, women’s pants and jackets mostly below $250. The idea is to reach a whole new category of customer, the ones who couldn’t afford Ralph Lauren before.

Both the jeans and the Lauren line are scoring well with shoppers; the latter has retailers particularly giddy. “It’s just been remarkable. Overwhelming,” says LaVelle Olexa, a senior vice president at Lord & Taylor. “The clothes hit the floor, and they just go.” A big part of the attraction is that consumers are in love with status brands again, especially if they can get them for under four figures. The Lauren line features Ralph’s best-known styles—crested navy blazers, tartan plaid skirts, and crisp oxford shirts—but all done up in less expensive fabrics with fewer details.

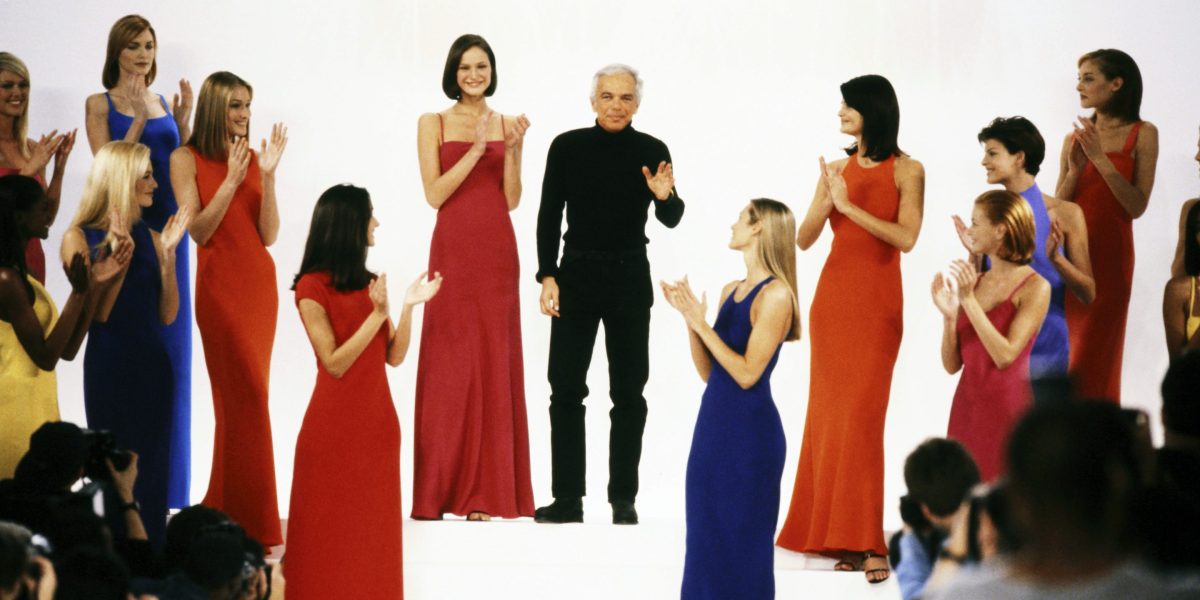

Other designers have gone down the licensing road, of course, and quite a number have lurched into a ditch when they let their licensees get control of their brand. That isn’t likely to happen to Lauren: His need to protect everything bearing on his company’s image, and his own, is palpable, unsleeping, electric, scary. While we were shooting the studio photographs for this story, Lauren weighed in on lighting, backdrops, props—even on the height of the tripod holding the camera taking his picture. (He stands about 5 foot 6.)

More than any other designer, he grasped early the importance of protecting his brand. Back in 1967, as he struggled to build a business out of his line of wide men’s ties, he refused to sell to Bloomingdale’s. The retailer wanted him to make the ties narrower and take his name off the label. “We’re talking a quarter of an inch. That’s all they wanted,” Lauren explains. “And as for my name being on them, well, no one could care less who Ralph Lauren was. But I said no. When I left the store, I thought, ‘What am I, crazy?’ I was dying to sell Bloomingdale’s, but I didn’t because I really wanted to do what I believed in.” Months later, Bloomingdale’s came knocking on Lauren’s door. It saw how briskly his ties were selling in competitors’ stores and agreed to carry the ties exactly as Lauren had designed them.

Emboldened by this early success, Lauren next designed a line of men’s shirts, then turned his attention to suits, favoring wide lapels—to go along with his ties—and natural shoulders. It wasn’t long before Lauren branched off into women’s clothes (partly to suit the tastes of his wife, Ricky).

In 1971 he opened the first Polo/Ralph Lauren store on Rodeo Drive in Beverly Hills. More stores soon followed.

In 1983 he started his home collection of sheets, towels, flatware, and furniture. Rather than simply putting out new colors or patterns like others in the field, Lauren created products that revolved around themes, like New England Cottage and English Countryside. The recent Serape collection, for instance, features aged solid-oak tables and chests as well as distressed leather chairs and couches tooled, as the brochure points out, “in the tradition of fine leather boot making.”

“I bought some Ralph Lauren sheets last year, and I just love them,” says Sheri Kersch-Schultz, wife of Starbucks (SBUX) founder Howard Schultz, from their summer home in New York’s tony East Hampton. “And he has a sleigh bed that is just to die for. “

The most recent addition to the home line: paint, produced under license by Sherwin-Williams. “I was a little skeptical at first,” says Bernard Marcus, CEO of Home Depot, whose stores have carried the line since early this year. “But we’re happy with the progress it’s making. When I first heard about it, I thought it was just paint with a big designer name on it.”

That’s exactly what it is.

“Look,” says Mort Kaplan, head of Creative Licensing, a firm that brings together licensing partners, “I’m sure the paint is good, but azure blue is azure blue is azure blue. The difference here is that Ralph Lauren stands for something. He knows how to package it, how to set it up in stores so it conveys his image.” Walk into any Home Depot, and you’ll see what Kaplan means: Behind each mixing counter stands a Ralph display, all lit up. Brochures group paint hues by theme—Safari, Desert Hollywood, Santa Fe—and show not just paint swatches but evocative bits of Laurentian context: a horse, a sideboard, a pair of satin gloves. One brochure displays 32 shades of white. Don’t laugh: Lauren’s home furnishings business rings up retail sales of $535 million a year worldwide, vastly outselling any other designer’s.

Ever since his first in-store shop opened in Bloomingdale’s in 1971, Lauren has insisted that retailers sell his goods his way, in boutiques set up with his props and fixtures. Most of the time he gets what he wants. Says Kenneth Walker, an architect who has worked for department stores installing Polo in-store shops: “Ralph’s people are hard but fair. They don’t throw hissy fits, but they know exactly what they want.” And they walk when they don’t get it. Last year when Bergdorf Goodman’s men’s store in New York refused to build a Polo boutique to the company’s specifications, Lauren pulled his business from the store.

Nowhere is his need for image control as evident as in his flagship store at 72nd Street and Madison Avenue in Manhattan. The store, opened in 1986 in the landmark Rhinelander Mansion, marked the first time Lauren had gathered all his goods under one (slate) roof. He oversees presentation, service, decor, even fragrance (which, the day Fortune visited, seemed to be a compound of patchouli, cloves, and leather-bound sets of Scott’s Waverley Novels).

The store is quite simply over the top in its Englishness, lacking only an Anglican bishop, a Simpson’s meat cart, and Dr. Johnson buried under the tie counter. Practically everything is for sale. If, for instance, you should find yourself humming a Ralph-sanctioned tune while shopping (“Pennies From Heaven” was playing as we warmed ourselves against the air conditioning’s chill, rubbing our hands beside a gas-fired hearth), $15 buys it: Ralph Lauren’s Black Tie Collection CD from Sony.

Looking the place over, it’s a wonder there’s a single cricket bat left in England—or set of sculling oars, or antlers, or silver croquet trophy, or oil painting of a dog smoking a pipe. (Where does all this stuff come from? It’s just as you suspected all along: Lauren has a giant warehouse in New Jersey jammed with props and antiques. A team of 75 people has traveled the world and filled the 25,000-square-foot space with antique mahogany chests, hundreds of bed frames, antique Persian rugs, a hay bale, thousands of hardcover books, golf clubs, baseballs, a lobster trap, an elk’s head, polo helmets, saddles, suitcases, ship’s wheels, and chunks of coral. Lauren periodically prunes the inventory: Last year a pair of tapestry-upholstered Queen Anne walnut settees, circa 1710, sold for $54,625 at Sotheby’s.)

With access to a corporate attic like that, the 72nd Street flagship store makes an indelible impression—but not money. A former high-ranking Polo executive figures that what with fresh flowers, antiques, blazing gas hearths, and payments on a long-term lease, the place loses $1 million a month. “I’m not going to comment on exact numbers,” says vice chairman Michael Newman. “I can tell you that it meets the budget we plan for it. When I look at it that way, the fact [the store loses money] doesn’t trouble me.”

The store does trouble some WASPs who see it as a rip-off of their heritage. Explains one patrician young woman: “It’s like this: People who buy Ralph Lauren are trying to keep up with the Joneses. We are the Joneses.” Among her set, Lauren will never be anything more than a parvenu. It will be easier for his camel’s-hair coat to go through the eye of a needle than for Ralph to get invited to Newport (as if that mattered to him).

Which raises the question: Who is he?

Lauren was born Ralph Lifshitz in the Bronx. His father was an artist who painted houses for a living; his mother raised the kids (Ralph was the youngest of four). He played stickball, dated girls, did all the normal stuff. He didn’t grow up sketching clothes, and he didn’t go to fashion school. “I don’t know, from the time I was 12 years old I looked cool,” he explains. “My father was a painter, so maybe I got some sense of color from him. I do know that whatever I had on, other kids would say, ‘Hey, where’d you get that?’ “

As he got older and worked after school, Lauren would use his paychecks to buy expensive clothes. “If I saved $100 to buy a suit, which in those days was a lot of money, my parents would say, ‘Why didn’t you go to this place? It’s cheaper.’ And I would say no.”

Lauren pursued a business degree at City College in Manhattan, taking night classes, but dropped out after two years. He worked as a salesman for two glove companies and then for tie manufacturer A. Rivetz & Co. While working at Rivetz he started designing his wide ties, and before long he decided to go into business for himself. In 1968, Norman Hilton, a clothing company executive, took a chance on Lauren and backed him with a $50,000 loan. Lauren called his company Polo Fashions, a name that he and his older brother Jerry (now executive vice president of Polo men’s design) liked because it connoted money, style, and a sort of international mystique.

By the early 1970s sales were nearly $4 million, and the company was expanding too quickly. Lauren bought out Norman Hilton’s stake and hired a boyhood chum as his treasurer and CFO. The friend turned out to be “somewhat in over his head,” Lauren says, and the business, though booking lots of orders, was hemorrhaging money.

Unlike other designers, Lauren didn’t make his runway models look like hookers from space.

To save the company, Lauren poured in his life savings—$150,000 —and hired one of Hilton’s key executives, Peter Strom, to help run it. Strom liked Lauren and agreed to come aboard if Lauren gave him a 10% equity stake in the business. “When I joined the company, it had 800 accounts, was doing about $5 million in sales, and wasn’t making a dime,” recalls Strom, who retired from Polo in April 1995. “I thought we’d be lucky if we ever broke $20 million in sales,” he says. “Ralph loves to remind me that I said that.”

There wasn’t really any breakthrough that thrust Lauren’s clothing into the nation’s fashion consciousness; the closest his work came to making a splash was when Diane Keaton wore his clothing in Annie Hall. Lauren did runway shows, but rather than make the models look like hookers from space, he dressed them in clothing you could wear to the office. From one year to the next, changes were of degree, not of kind. In retrospect, he was formulating the Ralph Doctrine: clothing that isn’t shocking, just incrementally nicer, with snob appeal prominently in the weave.

That’s his same m.o. today, of course, and its latest expression is his Purple Label line of “mostly handmade” suits, shirts, and ties. In the late 1980s, during the height of Giorgio Armani and the Italian power suit look, Polo’s preppy garments started to look a little dull. “Polo had been the power suit back in the early 1980s,” concedes Lance Isham, head of Lauren’s men’s wear business. “But it was difficult to hold onto that because of the influence from Italy.” Lauren puts it another way: “I was selling the Madison Avenue and Wall Street guys, and Armani was selling the Hollywood agents—the Mike Ovitzes of the world.”

Lauren saw that his suit business was stagnating. “I wanted something not Italian-looking, just more sophisticated.” He envisioned elegant hand-sewn garments cut from fine fabrics, then shaped closer to the body. Lauren wanted a tasteful look for someone with a well-toned body who isn’t shy about showing it off—himself, in other words.

Buttons wouldn’t just be sewn onto jacket sleeves but would have real buttonholes. (We wondered: Does that really make the suit fit any better? No, admits Stanley Tucker, fashion director at Saks Fifth Avenue in New York. “It’s just a little bit of snobbism. If you leave one of the buttons undone and someone notices, they’ll see you have actual buttonholes. It’s just very Savile Row.”)

It’s those incremental touches, however, that make Ralph Ralph. Some Purple Label suits, for example, sport a discreet tab on the top of their left lapel. “That’s a wind tab,” explained a salesman in the flagship store. A wind tab? we asked. “That’s so that when you’re walking home from church across the moors on a windy day, you can pull that lapel over and button it to a corresponding button on the jacket collar.” Oh.

A suit like that costs an ungodly amount, of course: between $1,500 and $2,500. But like the flagship store itself, the Purple Label line is intended more to cast a long shadow of opulence than to be much of a moneymaker.

How does Lauren come up with a thing like a wind tab? In New York City and elsewhere, Lauren’s scouts comb vintage clothing shops, looking for garments (or for details on garments) that they think Ralph might like. Some of them he does. After experiment and prototyping, an old green-striped broadcloth shirt from the 1930s, say, may get a new lease on life.

Ralph has had his share of duds. For more than a decade, for instance, he has been stumped by—of all things—blue jeans. His first try at that market, in partnership with the Gap (GAP) in the late 1970s, bombed badly. One Gap executive says of the venture: “Every possible mistake that could have been made, was made.” Over the years Lauren made other blunders: Either the jeans were cut too narrow for women of normal size (meaning those who actually possess hips) or deliveries were late or the products were not properly merchandised in the stores.

Lauren’s last foray was three years ago with a line of weathered, vintage-looking jeans and shirts called Double RL, named after his ranch in Colorado (which is short for Ralph and Ricky Lauren). These clothes, aimed at the college crowd, turned out to be way overpriced. Jeans and flannel shirts cost as much as $78, and weathered leather jackets upwards of $300. “They totally misjudged the demographics,” says Jerry Magnin, owner of the Polo/Ralph Lauren store in Beverly Hills.

This fall Lauren is trying again, as you may have noticed: He’s got a whopping $20 million advertising budget, provided by Sun Apparel, the licensee for Polo jeans. The print ads are visually startling: They feature clean-cut, healthy-looking men and women, without tattoos or nose rings, who aren’t naked, underage, or anorexic, and don’t grope one another. Calvin Klein won’t be making any noise about Lauren stealing his ideas. Says Lauren: “Look, I’m not anti-sex. But what’s sexy to younger people may not be sexy to everyone else. It might be the right time not to cater to the kids.”

Lauren surrounds himself with seasoned executives, most of whom have been with him for years—a rarity in the fashion business. They understand what Lauren wants, usually without his having to spell it out. Says Buffy Birrittella, senior vice president of women’s designs and a 25-year veteran of the company: “When Ralph says he wants something white, I know what kind of white he means.”

Or the kind of brown. Last year Birrittella, Lauren, and a few other executives were in Europe looking for fabrics that would be used for the fall clothes now in the stores. During this particular trip, they felt they had been seeing way too much of one color: gray. Says Birrittella: “I don’t know why I said it first—sometimes Ralph will feel something first—but I just looked at him and said, ‘brown.’ And he said, ‘Yeah, I’m feeling brown too.’ We were just both … well, just feeling brown.” As we said before, it ain’t all science.

A question of authenticity has dogged Lauren much of his career. Chatting with him late one sunny afternoon on the porch of his Colorado ranch house, it’s clear he’s weary of the charge that somehow his work, and by extension his life, are phony. “I slept in a room with two brothers growing up,” he recalls. “I couldn’t wait for one of them to move out so I could have half the drawers. That molded me. But do I want to live like that today? No, I don’t. I don’t think it’s a comfortable way to live. So is it phony, then, to say I want to live out west, or I want to live in the country? If you’re born in the Bronx, does that mean you have to stay in the Bronx?

“I’ve tried to do things honorably in my business. I think I’ve added something to America. I don’t rip people off. I don’t downgrade children,” he says, getting in a parting dig at Calvin Klein. “I try to give people a clean, aspirational quality, with no bullshit. Where’s the negative in that?”

To which we answer: There isn’t one. Our economy is kept wound by aspirations of the sort young Ralph held (hell, old Ralph holds). No wonder business people like to buy his clothing: In Lauren they recognize a brother under the skin (those velvet slippers notwithstanding).

Reporter Associate: Joe McGowan

You may like

Business

On Netflix’s earnings call, co-CEOs can’t quell fears about the Warner Bros. bid

Published

1 hour agoon

January 20, 2026By

Jace Porter

When it comes to creating irresistible storylines, Netflix, the home of Stranger Things and The Crown, is second to none. And as the streaming video giant delivered its quarterly earnings report on Tuesday, executives were in top storytelling form, pitching what they promise will be a smash hit: the acquisition of Warner Brothers Discovery.

The company’s co-CEOs, Ted Sarandos and Greg Peters, said the deal, which values Warner Brothers Discovery at $83 billion, will accelerate its own core streaming business while helping it expand into TV and the theatrical film business.

“This is an exciting time in the business. Lots of innovation, lots of competition,” Sarandos enthused on Tuesday’s earnings conference call. Netflix has a history of successful transformation and of pivoting opportunistically, he reminded the audience: Once upon a time, its main business entailed mailing DVDs in red envelopes to customers’ homes.

Despite Sarandos’ confident delivery, however, the pitch didn’t land with investors. The company’s stock, which was already down 15% since Netflix announced the deal in early December, sank another 4.9% in after-hours trading on Tuesday.

Netflix’s financial results for the final quarter of 2025 were fine. The company beat EPS expectations by a penny, and said it now has 325 million paid subscribers and a worldwide total audience nearing 1 billion. Its 2026 revenue outlook, of between $50.7 billion and $51.7 billion, was right on target.

Still, investors are worried that the Warner Bros. deal will force Netflix to compete outside its lane, causing management to lose focus. The fact that Netflix will temporarily halt its share buybacks in order to accumulate cash to help finance the deal, as it disclosed towards the bottom of Tuesday’s shareholder letter, probably didn’t help matters.

And given that there’s a rival offer for Warner Bros from Paramount Skydance, it’s not unreasonable for investors to worry that Netflix may be forced into an expensive bidding war. (Even though Warner Brothers Discovery has accepted the Netflix offer over Paramount’s, no one believes the story is over—not even Netflix, which updated its $27.75 per share offer to all-cash, instead of stock and cash, hours earlier on Tuesday in order to provide WBD shareholders with “greater value certainty.”)

Investors are wary; will regulators balk?

Warner Brothers investors are not the only audience that Netflix needs to win over. The deal must be blessed by antitrust regulators—a prospect whose outcome is harder to predict than ever in the Trump administration.

Sarandos and Peters laid out the case Tuesday for why they believe the deal will get through the regulatory process, framing the deal as a boon for American jobs.

“This is going to allow us to significantly expand our production capacity in the U.S. and to keep investing in original content in the long term, which means more opportunities for creative talent and more jobs,” Sarandos said.

Referring to Warner Brothers’ television and film businesses, he added that “these folks have extensive experience and expertise. We want them to stay on and run those businesses. We’re expanding content creation not collapsing it.”

It’s a compelling story. But the co-CEOs may have neglected to study the most important script of all when it comes to getting government approval in the current administration; they forgot to recite the Trump lines.

The example has been set over the past 12 months by peers such as Nvidia’s Jensen Huang and Meta’s Mark Zuckerberg. The latter, with his company facing various federal regulatory threats, began publicly praising the Trump administration on an earnings call last January.

And Nvidia’s Huang has already seen real dividends from a similar strategy. The chip company CEO has praised Trump repeatedly on earnings calls, in media interviews, and in conference keynote speeches, calling him “America’s unique advantage” in AI. Since then, the U.S. ban on selling Nvidia’s H200 AI chips to China has been rescinded. The praise may have been coincidental to the outcome, but it certainly didn’t hurt.

In contrast, the president went unmentioned on Tuesday’s call. How significant Netflix’s omission of a Trump call-out turns out to be remains to be seen; maybe it won’t matter at all. But it’s worth noting that its competitor for Warner Bros., Paramount Skydance, is helmed by David Ellison, an outspoken Trump supporter.

It’s a storyline that Netflix should have seen coming, and itmay still send the company back to rewrite.

Business

Americans are paying nearly all of the tariff burden as international exports die down, study finds

Published

3 hours agoon

January 20, 2026By

Jace Porter

After nearly a year of promises tariffs would boost the U.S. economy while other countries footed the bill, a new study shows almost all of the tariff burden is falling on American consumers.

Americans are paying 96% of the costs of tariffs as prices for goods rise, according to research published Monday by the Kiel Institute for the World Economy, a German think tank.

In April 2025 when President Donald Trump announced his “Liberation Day” tariffs, he claimed: “For decades, our country has been looted, pillaged, raped, and plundered by nations near and far, both friend and foe alike.” But the report suggests tariffs have actually cost Americans more money.

Trump has long used tariffs as leverage in non-trade political disputes. Over the weekend, Trump renewed his trade war in Europe after Denmark, Norway, Sweden, France, Germany, the United Kingdom, the Netherlands, and Finland sent troops for training exercises in Greenland. The countries will be hit with a 10% tariff starting on Feb. 1 that is set to rise to 25% on June 1, if a deal for the U.S. to buy Greenland is not reached.

On Monday, Trump threatened a 200% tariff on French wine, after French President Emmanuel Macron refused to join Trump’s “Board of Peace” for Gaza, which has a $1 billion buy-in for permanent membership.

“The claim that foreign countries pay these tariffs is a myth,” wrote Julian Hinz, research director at the Kiel Institute and an author of the study. “The data show the opposite: Americans are footing the bill.”

The research shows export prices stayed the same, but the volume has collapsed. After imposing a 50% tariff on India in August, exports to the U.S. dropped 18% to 24%, compared to the European Union, Canada, and Australia. Exporters are redirecting sales to other markets, so they don’t need to cut sales or prices, according to the study.

“There is no such thing as foreigners transferring wealth to the U.S. in the form of tariffs,” Hinz told The Wall Street Journal.

For the study, Hinz and his team analyzed more than 25 million shipment records between January 2024 through November 2025 that were worth nearly $4 trillion.They found exporters absorbed just 4% of the tariff burden and American importers are largely passing on the costs to consumers.

Tariffs have increased customs revenue by $200 billion, but nearly all of that comes from American consumers. The study’s authors likened this to a consumption tax as wealth transfers from consumers and businesses to the U.S. Treasury.

Trump has also repeatedly claimed tariffs would boost American manufacturing, butthe economy has shown declines in manufacturing jobs every month since April 2025, losing 60,000 manufacturing jobs between Liberation Day and November.

The Supreme Court was expected to rule as soon as today on whether Trump’s use of emergency powers to levy tariffs under the International Emergency Economic Powers Act was legal. The court initially announced they planned to rule last week and gave no explanation for the delay.

Although justices appeared skeptical of the administration’s authority during oral arguments in November, economists predict the Trump administration will find alternative ways to keep the tariffs.

Business

Selling America is a ‘dangerous bet,’ UBS CEO warns as markets panic

Published

4 hours agoon

January 20, 2026By

Jace Porter

Investors are “selling America” in spades Tuesday: The 10-year Treasury yield is at its highest point since August; the U.S. dollar slid; and the traditional safe-haven metal investments—gold and silver—surged once again to record highs.

The CEO of UBS Group, the world’s largest private bank, thinks this market is making a “dangerous bet.”

“Diversifying away from America is impossible,” UBS Group CEO Sergio Ermotti told Bloomberg in a television interview at the World Economic Forum in Davos, Switzerland, on Tuesday. “Things can change rapidly, and the U.S. is the strongest economy in the world, the one who has the highest level of innovation right now.”

The catalyst for the selloff was fresh escalation from U.S. President Donald Trump, who has threatened a 10% tariff on eight European allies—including Germany, France, and the U.K.—unless they cede to his demands to acquire Greenland.

Trump also threatened a 200% tariff on French wine and Champagne to pressure French President Emmanuel Macron to join his Board of Peace. Trump’s favorite “Mr. Tariff” is back, and bond investors are unhappy with the volatility.

But if investors keep getting caught up in the volatility of day-to-day politics and shun the U.S., they’ll miss the forest for the trees, Ermotti argued. While admitting the current environment is “bumpy,” he pointed to a statistic: Last year alone, the U.S. created 25 million new millionaires. For a wealth manager like UBS, that is 1,000 new millionaires a day. To shun that level of innovation in U.S. equities for gold would be a reactionary move that ignores the long-term innovation of the U.S. economy.

“We see two big levers: First of all, wealth creation, GDP growth, innovation, and also more idiosyncratic to UBS is that we see potential for us to become more present, increase our market share,” Ermotti said.

But if something doesn’t give in the standoff between the European Union and Trump, there could be potential further de-dollarization, this time, from Europe selling its U.S. bonds, George Saravelos, head of FX research at Deutsche Bank, wrote in a note Sunday. Indeed, on Tuesday, Danish pension funds sold $100 million in U.S. Treasuries, allegedly owing to “poor” U.S. finances, though the pension fund’s chief said of the debacle over Greenland: “Of course, that didn’t make it more difficult to take the decision.”

Europe owns twice as many U.S. bonds and equities as the rest of the world combined. If the rest of Europe follows Denmark’s lead, that could be an $8 trillion market at risk, Saravelos argued.

“In an environment where the geo-economic stability of the Western alliance is being disrupted existentially, it is not clear why Europeans would be as willing to play this part,” he wrote.

Back in the U.S., the markets also sold off as the Nasdaq and S&P both fell 2% Tuesday, already shedding the entirety of Greenland’s value on Trump’s threats, University of Michigan economist Justin Wolfers noted. Analysts and investors are uneasy, given the history of Trump declaring a stark tariff before negotiating with the country to take it down, also known as the “TACO”—Trump always chickens out—effect. Investors have been “burnt before by overreacting to tariff threats,” Jim Reid of Deutsche Bank noted. That’s a similar stance to the UBS bank chief: If you react too much to headlines, you’ll miss the great innovation that’s pushed the stock market to record highs for the past three years.

“I wouldn’t really bet against the U.S.,” he said.

Swarovski appoints new North America general manager

Lamar Odom Had Bloodshot Eyes, Vehicle Smelled Like Marijuana During DUI Arrest, Cops Say

Bourrienne Paris X and its shirts aim to stand test of time

Trending

-

Politics8 years ago

Politics8 years agoCongress rolls out ‘Better Deal,’ new economic agenda

-

Entertainment9 years ago

Entertainment9 years agoNew Season 8 Walking Dead trailer flashes forward in time

-

Politics9 years ago

Politics9 years agoPoll: Virginia governor’s race in dead heat

-

Politics8 years ago

Politics8 years agoIllinois’ financial crisis could bring the state to a halt

-

Entertainment9 years ago

Entertainment9 years agoThe final 6 ‘Game of Thrones’ episodes might feel like a full season

-

Entertainment9 years ago

Entertainment9 years agoMeet Superman’s grandfather in new trailer for Krypton

-

Business9 years ago

Business9 years ago6 Stunning new co-working spaces around the globe

-

Tech8 years ago

Tech8 years agoHulu hires Google marketing veteran Kelly Campbell as CMO