If Indiana Republican senators had any doubt about what to do with President Donald Trump’s redistricting proposal, he helped them make up their minds the night before this week’s vote.

In a social media screed, Trump accused the state’s top senator of being “a bad guy, or a very stupid one.”

“That kind of language doesn’t help,” said Sen. Travis Holdman, a banker and lawyer from near Fort Wayne who voted against the plan.

He was among 21 Republican senators who dealt Trump one of the most significant political defeats of his second term by rejecting redistricting in Indiana. The decision undermined the president’s national campaign to redraw congressional maps to boost his party’s chances in the upcoming midterm elections.

In interviews after Thursday’s vote, several Republican senators said they were leaning against the plan from the start because their constituents didn’t like it. But in a Midwest nice rebuttal to America’s increasingly coarse political discourse, some said they simply didn’t like the president’s tone, like when he called senators “suckers.”

“I mean, that’s pretty nasty,” said Sen. Jean Leising, a farm owner from Oldenburg who works at her daughter’s travel agency.

Trump didn’t seem to get the message. Asked about the vote, the president once again took aim at Indiana’s top senator, Rodric Bray.

“He’ll probably lose his next primary, whenever that is,” Trump said. “I hope he does, because he’s done a tremendous disservice.”

Sen. Sue Glick, an attorney from La Grange who also opposed redistricting, brushed off Trump’s threat to unseat lawmakers who defied him.

“I would think he would have better things to do,” she said. “It would be money better spent electing the individuals he wants to represent his agenda in Congress.”

Trump struggled to get traction in Indiana

The president tried to brush off the defeat, telling reporters he “wasn’t working on it very hard.”

But the White House had spent months engaged in what Republican Sen. Andy Zay described as “a full-court press.”

Vice President JD Vance met with senators twice in Indiana and once in Washington. White House aides frequently checked in over the phone.

Holdman said the message behind the scenes was often more soothing than Trump’s social media attacks.

“We were getting mixed messages,” he said. “Two days before the vote, they wanted to declare a truce on Sen. Bray. And the next day, there’s a post on Truth Social that didn’t sound like truce language to me.”

Some of Trump’s other comments caused backlash too. For example, he described Minnesota Gov. Tim Walz as “retarded,” which upset Sen. Mike Bohacek because his daughter has Down syndrome. Bohacek had been skeptical of redistricting and decided to vote no in response.

The White House did not respond to questions about outreach to senators, but it distanced itself from conservative allies who claimed Trump had threatened to withhold money from the state.

“President Trump loves the great state of Indiana,” said spokesman Davis Ingle, who insisted Trump “has never threatened to cut federal funding and it’s 100% fake news to claim otherwise.”

Regardless, Trump had struggled to get traction despite months of pressure.

Holdman said he turned down an invitation to the White House last month because he had a scheduling conflict.

“Plus, by then it was a little too late,” he said.

Leising said she missed a call from a White House official the day before a vote while she was in a committee meeting. She didn’t try to call back because she wasn’t going to change her mind.

Mitch Daniels, a former Indiana governor and a Republican, had a straightforward explanation for what happened.

“Folks in our state don’t react well to being bullied,” he said.

Daniels’ successor as governor, Mike Pence, fielded calls from senators during the redistricting debate, according to a person with knowledge of the situation who requested anonymity to disclose private conversations.

The person declined to describe Pence’s advice. Pence has been at odds with Trump ever since he, while serving as his vice president, refused to help Trump overturn his election defeat to Joe Biden on Jan. 6, 2021.

Senators said their voters didn’t want new districts

Some Republicans lashed out at senators for defying Trump.

“His life was threatened — and he was nearly assassinated,” Indiana Lieutenant Gov. Micah Beckwith wrote on social media. “All for what? So that Indiana politicians could grow timid.”

The message to the president, Beckwith said, was “go to hell.”

But senators who opposed redistricting said they were just listening to their constituents. Some believed the unusual push to redraw districts was the equivalent of political cheating. Others didn’t like that Washington was telling Indiana what to do.

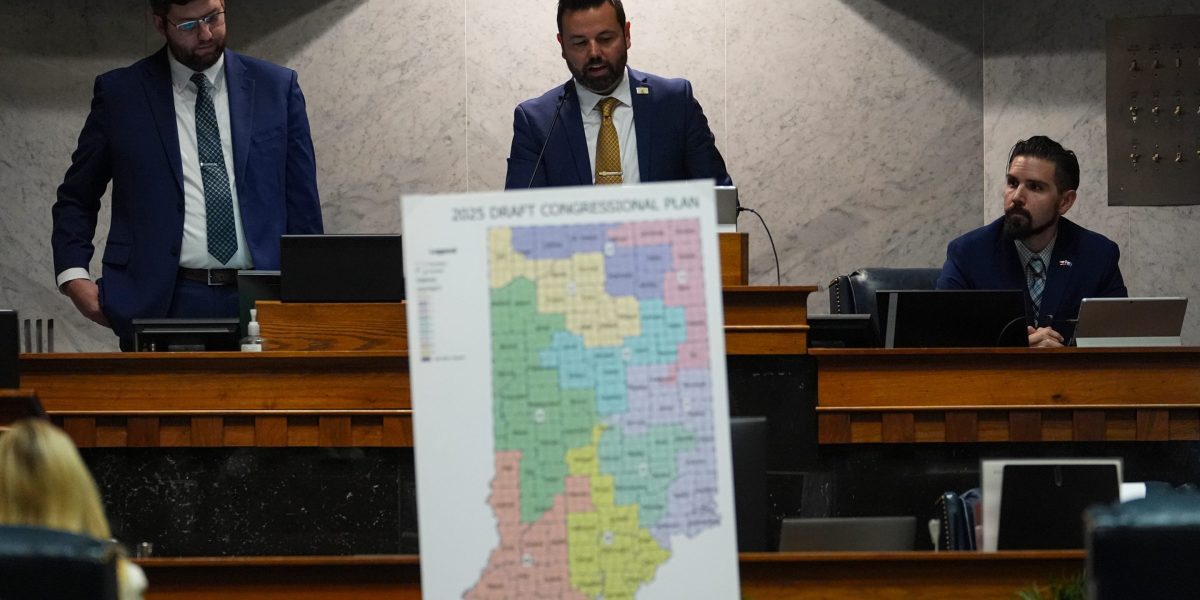

The proposed map would have divided Indianapolis into four pieces, grafting pieces of the city onto other districts to dilute the influence of Democratic voters. But in small towns near the borders with Kentucky and Ohio, residents feared the state’s biggest metropolitan area would gain influence at their expense.

“Constituents just didn’t want it,” Holdman said.

During Thursday’s vote on the Senate floor, some Republicans seemed torn about their decision.

Sen. Greg Goode, who is from Terre Haute, said he had spoken twice to Trump on the phone while weighing the redistricting plan. He declared his “love” for the president but decried “over-the-top pressure.”

Goode said he wouldn’t vote for the proposal.

“I’m confident my vote reflects the will of my constituents,” he said.

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Business8 years ago

Business8 years ago

Tech8 years ago

Tech8 years ago