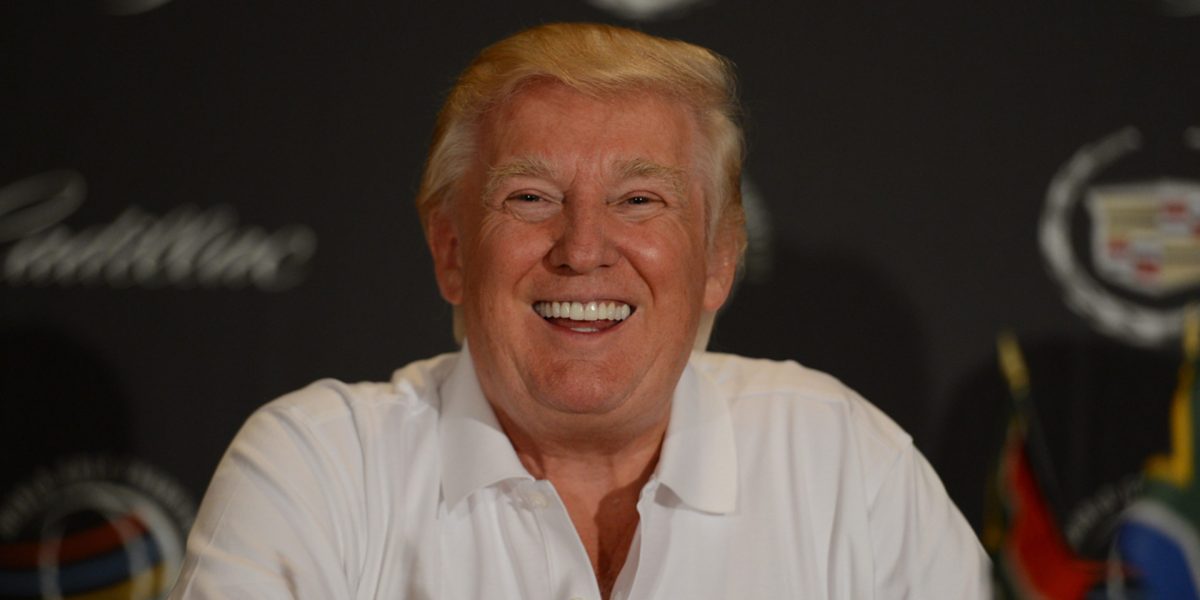

Paramount Skydance Corp.’s hostile bid to snatch Warner Bros. Discovery Inc. from under the nose of Netflix Inc. encapsulates the themes that have shaped a banner year for mergers and acquisitions: renewed desire for transformative tie-ups, massive checks from Wall Street, the flow of Middle East money and US President Donald Trump’s role as both disruptor and dealmaker.

Global transaction values have risen around 40% to about $4.5 trillion this year, data compiled by Bloomberg show, as companies chase ultra-ambitious combinations, emboldened by friendlier regulators. That’s the second-highest tally on record and includes the biggest haul of deals valued at $30 billion or more.

“There’s a sentiment in boardrooms and among CEOs that this is a potential multi-year window where it’s possible to dream big,” said Ben Wallace, co-head of Americas M&A at Goldman Sachs Group Inc. “We’re at the beginning of a rate-cutting cycle so there’s anticipation that there will be more liquidity.”

Beyond Netflix’s purchase of Warner Bros., this year’s blockbusters include Union Pacific Corp.’s acquisition of rival railroad operator Norfolk Southern Corp. for more than $80 billion including debt, the record leveraged buyout of video game maker Electronic Arts Inc., and Anglo American Plc’s takeover of Teck Resources Ltd. to reshape global mining.

“When you look around and you see your peers doing these big deals and taking advantage of the tailwinds, you don’t want to be left out,” said Maggie Flores, partner at law firm Kirkland & Ellis LLP in New York. “The regulatory environment is in a position that is very conducive to dealmaking and people are taking advantage of it.”

The tally also shows a level of exuberance in certain pockets that some advisers and analysts worry is unsustainable. Global trade tensions are ongoing, and market observers are increasingly warning of a selloff in the white-hot equity markets that have underpinned the M&A resurgence.

Top executives at Goldman Sachs, JPMorgan Chase & Co. and Morgan Stanley have all flagged the risk of a correction in the months ahead, in part tied to concerns about an overheated artificial intelligence ecosystem, where huge amounts of investment have juiced technology stocks.

“These equity returns are really coming out of AI, and AI spend is not sustainable,” said Charlie Dupree, global chair of investment banking at JPMorgan. “If that pulls back, then you are going to see a broader market that isn’t really advancing.”

The AI buzz led to some the year’s standout transactions. Sam Altman’s OpenAI took in major investments from the likes of SoftBank Group Corp., Nvidia Corp. and Walt Disney Co., and a consortium led by BlackRock Inc.’s Global Infrastructure Partners agreed to pay $40 billion for Aligned Data Centers. In March, Google parent Alphabet Inc. framed its $32 billion acquisition of cybersecurity startup Wiz Inc. as a way to provide customers with new safeguards in the AI era.

“Everyone needs to be an AI banker now,” said Wally Cheng, head of global technology M&A at Morgan Stanley. “Just as software began eating the world 15years ago, AI is now eating software. You have to be conversant in AI and understand how it will affect every company.”

The technology sector more broadly has already notched a record year for deals, thanks to a series of big-ticket takeovers across public and private markets. The trend extended to the White House over the summer, when the US government took a roughly 10% stake in Intel Corp. in an unconventional move aimed at reinvigorating the company and boosting domestic chip manufacturing.

It was one of the clearest indications of Trump’s willingness to blur the lines between state and industry and insert himself into M&A situations during his second term, particularly in sectors deemed mission critical. His administration also acquired a stake in rare-earth producer MP Materials Corp. and Commerce Secretary Howard Lutnick has hinted at similar deals in the defense sector.

Trump has separately been positioning himself as kingmaker on high-profile transactions. The government secured a so-called golden share in United States Steel Corp. as a condition for approving its takeover by Japan’s Nippon Steel Corp., and the president recently signaled he’ll oppose any acquisition of Warner Bros. that doesn’t include new ownership of CNN.

“The Trump administration’s approach to merger regulation today is markedly different compared to the first time around,” said Brian Quinn, a professor at Boston College Law School. Quinn said he couldn’t think of a member of the Republican Party from 15 to 20 years ago who would now believe the US government “is involved in the business of picking winners.”

To be sure, bankers will be wondering if they could have achieved more in 2025 had it not been for the chaotic period earlier in the year, when deals were put on hold after Trump’s trade war hobbled markets. And in a sign that persistent economic challenges are still impacting some parts of M&A, the number of deals being announced globally remains flat.

Many small and mid-cap companies have lagged the broader stock market and are opting to pursue their own strategic plans instead of weighing inorganic options, according to Jake Henry, global co-leader of the M&A practice at consultancy McKinsey & Co.

“They’re thinking ‘I’m better off just operating my business and getting there.’ It has to be an explosive offer for them to come to the table,” he said.

Meanwhile, private equity firms, whose buying and selling is a key barometer for M&A, are still having a harder time offloading certain assets because of valuation gaps with buyers. This has had a knock-on effect on their ability to raise funds and spend on new acquisitions. But bankers are starting to see a recovery here too as interest rates come down and bring more potential acquirers to the table.

“What’s motivating sponsors more than anything is their need to return cash to investors,” said Saba Nazar, chair of global financial sponsors at Bank of America Corp. “We have been in bake-off frenzy for the last couple of months.”

Road to Record

Dealmakers began the year whispering of M&A records under Trump’s pro-business administration. While they will just miss out on the milestone in 2025, there is a strong sense on Wall Street that those early bumps only delayed the inevitable.

Brian Link, co-head of North America M&A at Citigroup Inc., said that after ‘Liberation Day’ in April, he expected to spend more time figuring out the impact of tariffs on different business and how to adjust around that.

“That has not been the case,” he said. “Unless fear creeps back into the market, there doesn’t seem to be anything in the near term that’s going to change the dynamic here.”

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Business8 years ago

Business8 years ago

Tech8 years ago

Tech8 years ago