Last Call – A prime-time read of what’s going down in Florida politics.

First Shot

A new media report appears to confirm that the $10 million Hope Florida received as part of a settlement with Centene should have covered money owed to taxpayers, despite Gov. Ron DeSantis’s denial.

DeSantis and his team have said that a $10 million donation to Hope Florida was extra cash, a “cherry on top,” or a “sweetener” for the deal.

The Tampa Bay Times/Miami Herald obtained a copy of a draft agreement between the state and Centene after Florida’s largest Medicaid contractor overcharged taxpayers by $67 million for medications.

“That’s the exact amount DeSantis officials settled on with Centene last year. But instead of returning all $67 million to state and federal coffers, they sent $10 million of it to the Hope Florida Foundation,” the story published Tuesday said.

“The money was then sent to two nonprofit organizations that aren’t required to report how they spend their funds. Those ‘dark money’ groups later gave $8.5 million to a political committee overseen by DeSantis’ chief of staff in a series of transactions that some Republican lawmakers believe were illegal.”

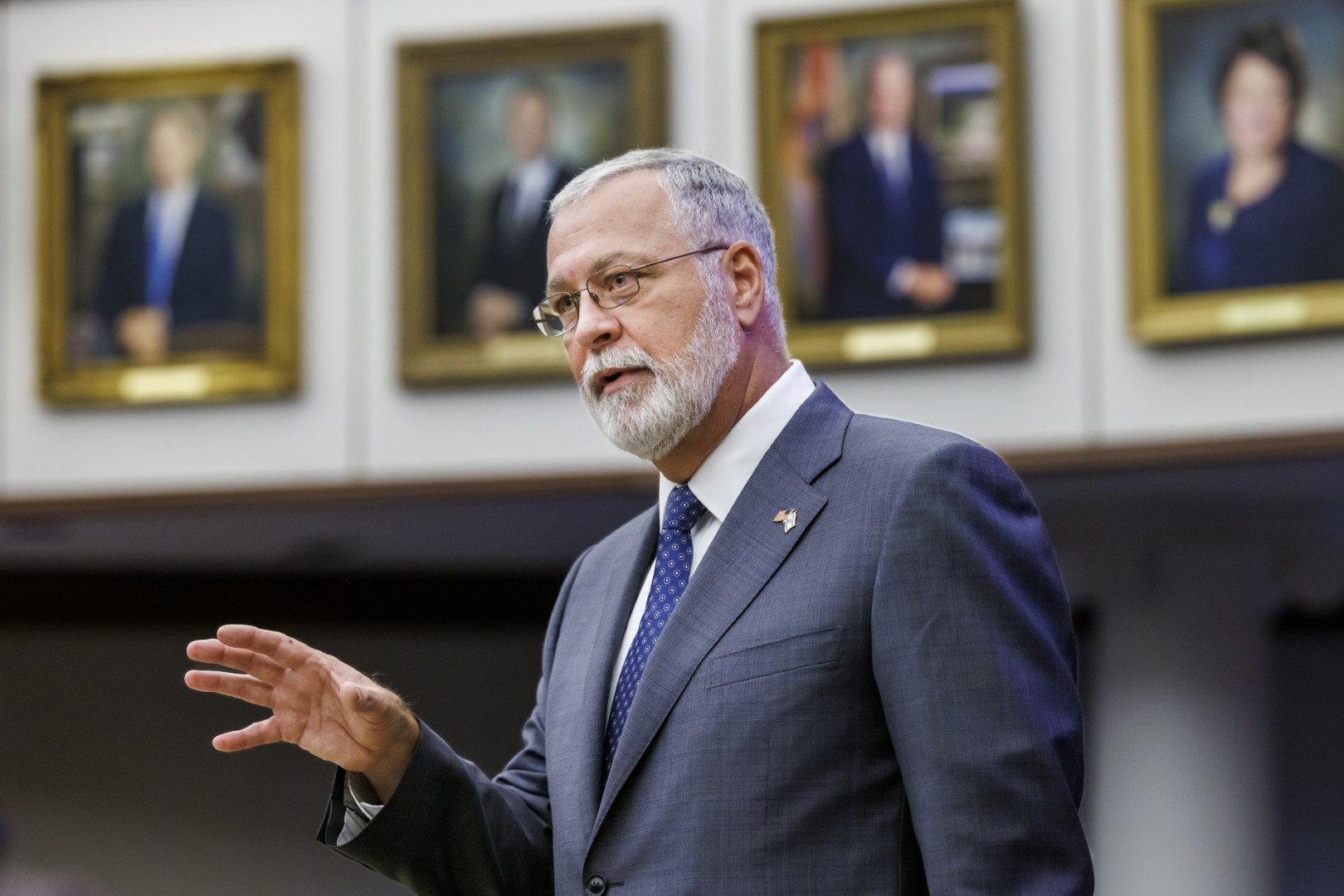

Rep. Alex Andrade, a Republican who chairs the House Health Care Budget Subcommittee, is planning to question Hope Florida officials and others this week.

Read more on Florida Politics.

Evening Reads

—“As controversies pile up, Donald Trump allies increasingly turn on one another” via Chris Megerian and Zeke Miller of The Associated Press

—”An immigrant held in U.S. custody ‘has simply disappeared’” via Miriam Jordan of The New York Times

—”Defending democracy is easier when you listen to voters” via Nate Silver of the Silver Bulletin

—”Under Pete Hegseth, chaos prevails at the Pentagon” via Greg Jaffe and Helene Cooper of The New York Times

—”Why Florida’s public universities are collaborating with ICE” via Devan Schwartz and Sean Rameswaram of Vox

—”Amid AHCA scandal, Medicaid accountability bill heads to Senate floor” via Christine Sexton of the Florida Phoenix

—“Why Florida’s condo owners are so desperate to sell” via Deborah Acosta of The Wall Street Journal

—“Are Q-Pilled family members lost for good?” via Fortesa Latifi of Rolling Stone

—”Gov. Ron DeSantis leaves top offices vacant for weeks with no replacements in sight” via Gray Rohrer of the USA Today Network-Florida

—”Don Gaetz says Joel Rudman has withdrawn bid for Pensacola State College Board” via A.G. Gancarski of Florida Politics

Quote of the Day

“(Ron DeSantis) is either misinformed by his shrinking circle, or he’s lying.”

— Rep. Alex Andrade, on DeSantis’ statements on the Centene-Hope Florida scandal.

Put it on the Tab

Look to your left, then look to your right. If you see one of these people at your happy hour haunt, flag down the bartender and put one of these on your tab. Recipes included, just in case the Cocktail Codex fell into the well.

Raise a Burning Rubber to the House Commerce Committee for greenlighting a bill that would bump Florida’s speed limit up a notch.

The Commerce Committee also gets a round of Dragnets for sending a bill that would protect minors from online predators to the chamber floor.

It’s not much, but former Rep. Joel Rudman gets an Exit Strategy for withdrawing his nom and not wasting the Senate Ethics & Elections Committee’s time in the waning days of Session.

Breakthrough Insights

Tune In

Seminoles playing again after shooting

For the first time since the mass shooting that left two dead and six injured at the FSU Student Union, Florida State will play a sporting event as the Seminoles host Stetson tonight (6 p.m. ET, ACC Network X).

Florida State (29-7, 11-4 ACC) leads the Atlantic Coast Conference and is ranked fourth in the D1baseball.com poll this week. FSU pitcher Joey Volini was named the national pitcher of the month for March after winning all five decisions in the month and posting an ERA of 1.09 while striking out 50 batters over 33 innings of work.

Seminoles slugger Alex Lodise was named the midseason national player of the year by D1Baseball. The junior from St. Augustine leads the team with a .434 batting average and has slammed 13 home runs with a team-high 47 runs batted in.

Stetson (27-14, 16-2 ASUN) has already clinched a berth in the ASUN conference tournament.

The meeting is scheduled to be the 98th matchup between the two programs, with FSU holding a 70-27 lead in the alltime series, including winning 19 of the last 20 at Dick Howser Stadium in Tallahassee.

Last year, FSU beat the Hatters 7-2 in the NCAA Regionals on the strength of home runs in the first two innings. Florida State went on to win the regional and later the Super Regional, advancing to the College World Series.

___

Last Call is published by Peter Schorsch, assembled and edited by Phil Ammann and Drew Wilson, with contributions from the staff of Florida Politics.

Post Views: 0

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Politics8 years ago

Politics8 years ago