Muhammad Ali once joked that he should be a postage stamp because “that’s the only way I’ll ever get licked.”

Now, the three-time heavyweight champion’s quip is becoming reality.

Widely regarded as the most famous and influential boxer of all time, and a cultural force who fused athletic brilliance with political conviction and showmanship, Ali is being honored for the first time with a commemorative U.S. postage stamp.

“As sort of the guardian of his legacy, I’m thrilled. I’m excited. I’m ecstatic,” Lonnie Ali, the champ’s wife of nearly 30 years, told The Associated Press. “Because people, every time they look at that stamp, they will remember him. And he will be in the forefront of their consciousness. And, for me, that’s a thrill.”

A fighter in the ring and compassionate in life

Muhammad Ali died in 2016 at the age of 74 after living with Parkinson’s disease for more than three decades. During his lifetime and posthumously, the man known as The Greatest has received numerous awards, including an Olympic gold medal in 1960, the United Nations Messenger of Peace award in 1998 and the Presidential Medal of Freedom in 2005.

Having his face on a stamp, Lonnie Ali said, has a particular significance because it’s a chance to highlight his mission of spreading compassion and his ability to connect with people.

“He did it one person at a time,” she said. “And that’s such a lovely way to connect with people, to send them a letter and to use this stamp to reinforce the messaging in that life of connection.”

Stamp to be publicly unveiled

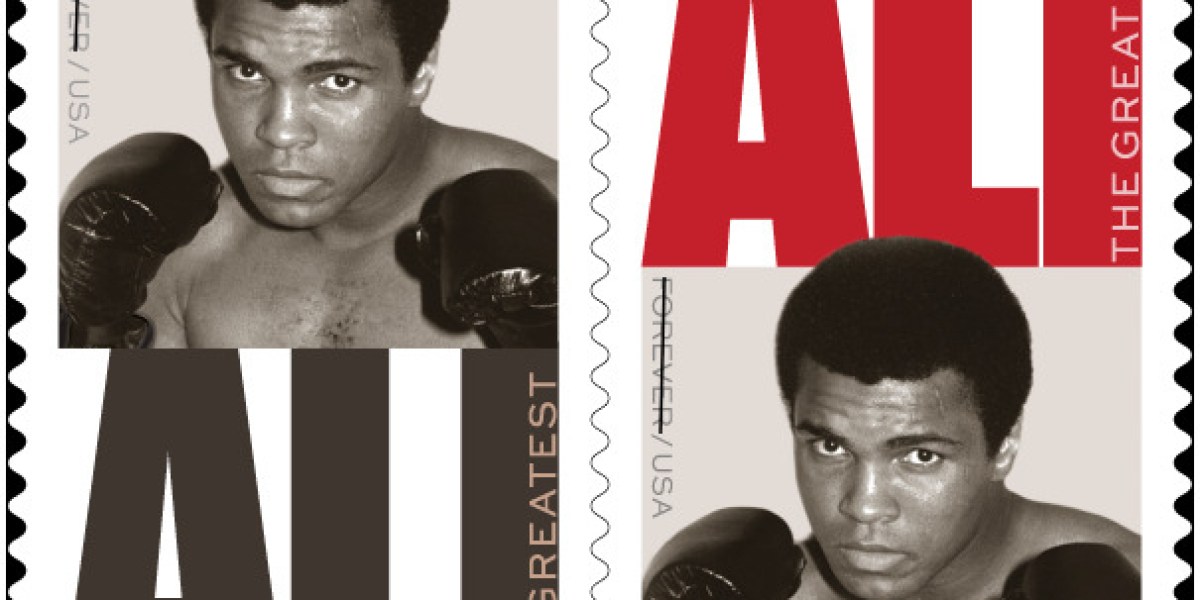

A first-day-of-issue ceremony for the Muhammad Ali Forever Stamp is planned for Thursday in Louisville, Kentucky, the birthplace of the famed boxer and home to the Muhammad Ali Center, which showcases his life and legacy. That’s when people can buy Muhammad Ali Forever Stamps featuring a black-and-white Associated Press photo from 1974 of Ali in his famous boxing pose.

Each sheet of 20 stamps also features a photo of Ali posing in a pinstripe suit, a recognition of his work as an activist and humanitarian. Twenty-two million stamps have been printed. Once they sell out, they won’t be reprinted, U.S. Postal Service officials said. The stamps are expected to generate a lot of interest from collectors and noncollectors.

Because they’re Forever Stamps, the First-Class Mail postage will always remain valid, which Lonnie Ali calls an “ultimate” tribute.

“This is going to be a Forever Stamp from the post office,” she said. “It’s just one of those things that will be part of his legacy, and it will be one of the shining stars of his legacy, getting this stamp.”

Creating a historic stamp

Lisa Bobb-Semple, the USPS director of stamp services, said the idea for a Muhammad Ali stamp first came about shortly after his death almost a decade ago. But the process of developing a stamp is a long one. The USPS requires people who appear on stamps to be dead for at least three years, with the exception of presidents.

As the USPS was working behind the scenes on a stamp, a friend of Ali helped to launch the #GetTheChampAStamp campaign, which sparked public interest in the idea.

“We are really excited that the stars were able to align that allowed us to bring the stamp to fruition,” said Bobb-Semple, who initially had to keep the planned Ali stamp secret until it was official. “It’s one that we’ve always wanted to bring to the market.”

Members of the Citizen Stamps Advisory Committee, appointed by the postmaster general, are responsible for selecting who and what appears on stamps. Each quarter, they meet with Bobb-Semple and her team to review suggestions submitted by the public. There are usually about 20 to 25 commemorative stamp issues each year.

Once a stamp idea is selected, Bobb-Semple and her team work with one of several art directors to design the postage. It then goes through a lengthy final approval process, including a rigorous review by the USPS legal staff, before it can be issued to the public.

Antonio Alcalá, art director and designer of the Muhammad Ali stamp, said hundreds of images were reviewed before the final choices were narrowed to a few. Finally, the AP image, taken by an unnamed photographer, was chosen. It shows Ali in his prime, posing with boxing gloves and looking straight into the camera.

Alcalá said there’s a story behind every USPS stamp.

“Postage stamps are miniature works of art designed to reflect the American experience, highlight heroes, history, milestones, achievements and natural wonders of America,” he said. “The Muhammad Ali stamps are a great example of that.”

A candid figure on war, civil rights and religion

Beyond the boxing ring, Ali was outspoken about his beliefs when many Black Americans were still fighting to be heard. Born Cassius Clay Jr., Ali changed his name after converting to Islam in the 1960s and spoke openly about race, religion and war. In 1967, he refused to be inducted into the U.S. Army, citing his religious beliefs and opposition to the Vietnam War.

That stance cost Ali his heavyweight championship title and barred him from boxing for more than three years. Convicted of draft evasion, he was sentenced to five years in prison but remained free while appealing the case. The conviction was overturned by the U.S. Supreme Court in 1971, further cementing his prominence as a worldwide figure.

Later in life, Ali emerged as a global humanitarian and used his fame to promote peace, religious understanding and charitable causes, even as Parkinson’s disease limited his speech and movement.

Ali’s message during a time of strife

The commemorative postage stamp comes at a time of political division in the U.S. and the world. Lonnie Ali said if her husband were alive today, he’d probably “block a lot of this out” and continue to be a compassionate person who connects with people every day.

That approach, she said, is especially important now.

“We have to mobilize Muhammad’s life and sort of engage in the same kinds of acts of kindness and compassion that he did every day,” she said.

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Business8 years ago

Business8 years ago

Tech8 years ago

Tech8 years ago