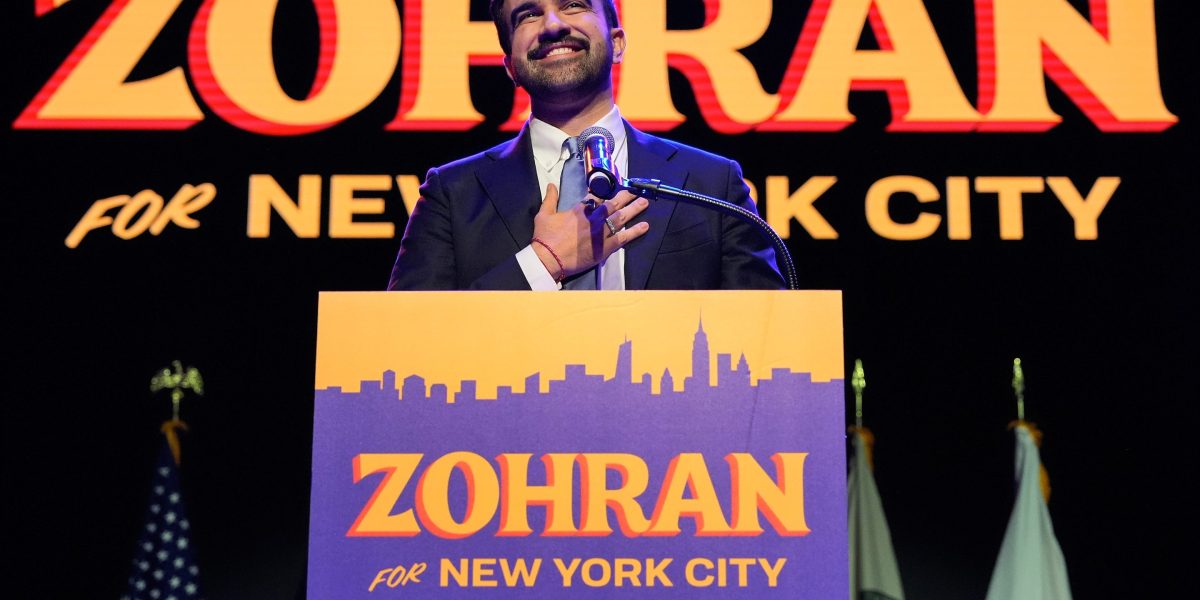

The vivid blue campaign signs with bold orange lettering were impossible to miss as Zohran Mamdani made his historic and improbable run for New York City mayor this summer.

On storefront windows and telephone poles from Queens to the Bronx, the “Zohran for New York City” signs stood out from the standard red, white and blue campaign fodder. The lettering was seen by many as an intentional reference to old-school Bollywood posters — a subtle nod to Mamdani’s Indian heritage.

But Aneesh Bhoopathy, the Philadelphia-based graphic designer behind the visuals, said the campaign also drew from the vibrant primary colors that help bodegas, yellow cabs, hot dog vendors and other small businesses stand out amid the city bustle.

The stylized font — with its drop shadow effect and vintage comic book look — was meant to evoke the old school, hand-painted signs that can still be found in some neighborhoods, he said.

“Succinctly, it’s New York,” said Bhoopathy, who previously lived in New York and helped on past campaigns for Mamdani and the Queens chapter of the Democratic Socialists of America.

It was also trendsetting.

Mamdani’s main adversary, former New York Gov. Andrew Cuomo, even rebranded midcampaign. The Democrat initially launched his mayoral run using a red, white and blue color scheme and a decidedly unfussy font, reminiscent of bumper stickers used by President John F. Kennedy in 1960.

But after his defeat to Mamdani in the June Democratic primary, Cuomo kicked off his general election run as an independent candidate by rolling out a new logo featuring the silhouette of the Statue of Liberty’s crown and a new color scheme: blue and orange — Mamdani’s colors, but also the colors of the Knicks and Mets.

Mamdani, who will be the city’s first Muslim and South Asian mayor, is the son of two prominent Indian American luminaries, Columbia University professor Mahmood Mamdani and filmmaker Mira Nair, who is known for “Monsoon Wedding” and other Hollywood films.

The campaign’s aesthetic wasn’t merely stylistic, observed David Schwittek, a professor of digital media and graphic design at Lehman College, a city-owned college in the Bronx.

“They evoke the working-class fabric of New York City: the bodegas, taxi cabs, and halal carts that not only sustain the city but also reflect its cultural richness,” he said.

The decidedly retro vibe also likely helped foster “positive associations to happier political times,” at least among Democratic voters, suggested Gavan Fitzsimons, a business professor at Duke University who studies the impact of branding on voters and consumers.

“It has the feel of something from a prior era, an earlier time when politics was less divisive and the Democrats were perhaps more organized, more successful,” he said.

The branding was reminiscent of the distinctive campaign font that became a calling card for U.S. Rep. Alexandria Ocasio-Cortez, another youthful liberal New Yorker who shot to political fame, said Richard Flanagan, a political science professor at the College of Staten Island.

The Democrat’s posters during her stunning 2018 victory over U.S. Rep. Joseph Crowley for a seat representing parts of Queens and the Bronx similarly drew on her heritage and working class New York.

The brightly-colored, upward slanting lettering reminded some of prewar labor union designs and others of Mexican “Lucha libre” flyers, particularly since it incorporated the inverted exclamation mark used in written Spanish.

Court Stroud, a marketing professor at New York University, said it’s difficult to quantify how much the campaign visuals contributed to Mamdani’s success, but they certainly made him recognizable and memorable in an initially crowded field of mayoral hopefuls.

“The playfulness of his campaign design created a brand that supporters wanted to wear and share,” he said. “Mamdani’s team showed how using visual design as a secret handshake can make politics feel real and community driven.”

Campaign experts said it’s also too early to say whether Mamdani’s campaign designs will ultimately have the same staying power nationally as Ocasio-Cortez’s distinctive look, which has since become a staple of progressive candidate branding.

“It’s still rare for candidates to move away from the tried and true red, white, and blue,” said Lisa Burns, a professor of media studies at Quinnipiac University in Connecticut. “I don’t see that changing any time soon.”

The popularity of Mamdani’s designs were certainly felt during the New York City mayoral race, helping inspire off-beat, viral campaigns such as the “Hot Girls for Zohran” merch worn by model Emily Ratajkowski and other young celebs.

Schwittek said the key takeaway from Mamdani’s visual coup was that effective branding isn’t generic or safe, but specific and deliberate.

“In a sea of sanitized political messaging, Mamdani’s visuals stand out because they mean something,” he said. “That’s the lesson.”

Good campaign design should also still ring true to the candidate, added Bhoopathy.

“None of the boldness and vibrancy here works without a candidate that is as energetic and full of life as the city that raised him,” he said.

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Business8 years ago

Business8 years ago

Tech8 years ago

Tech8 years ago