“In its failure to grasp this relationship between America and America’s environment lies the moral and practical bankruptcy of any and all forms of isolationism. It is most unfortunate that this virus of isolationist sterility has so deeply infected an influential section of the Republican Party. For until the Republican Party can develop a vital philosophy and program for America’s initiative and activity as a world power, it will continue to cut itself off from any useful participation in this hour of history. And its participation is deeply needed for the shaping of the future of America and of the world.”

While the quote seems modern, it’s taken from Henry R. Luce’s most famous essay, “The American Century,” published in Life magazine in February 1941.

Luce hoped his message would persuade Americans to support Britain in its fight against Hitler and fascism. Although much has changed since it was published 84 years ago, if you substitute Ukraine for Britain and Putin for Hitler, many of his arguments still hold weight.

Luce understood that America had become the world’s most powerful nation. He thought that America needed friends and allies who shared its values, and it was obliged to “defend and even to promote, encourage and incite so-called democratic principles throughout the world.”

Luce was America’s most powerful media executive when he wrote “The American Century.” His magazines—Time, Fortune, and Life—and The March of Time newsreels influenced public opinion, governments, and society. He was a conservative Republican, a capitalist, and a strong anti-communist. He criticized the Democrats for burdening America with “massive government debt, a sprawling bureaucracy, and a whole generation of young people conditioned to rely on the government as the source of all life.” He asserted that Democrats were “sympathetic to various socialist doctrines.”

But Luce—who was born in China to Christian missionary parents—believed that America, as the world’s most powerful nation, had global responsibilities that came with its ambitions. He recognized domestic pressures affecting the economy and society, and he understood that “America cannot be responsible for the good behavior of the entire world.” Nevertheless, he believed it was in America’s interest to assist countries that were too poor to help themselves. He felt that America could and should be “the Good Samaritan of the entire world” and that “for every dollar we spend on armaments, we should spend at least a dime in a gigantic effort to feed the world.”

Since the end of World War II, we have faced our share of setbacks and failures alongside our successes. The Korean War produced a dangerous stalemate, while the conflicts in Vietnam and Afghanistan ended with ignominious retreats. We relied on lies and false pretenses to justify the war in Iraq. Peace in the Mideast remains elusive.

Foreign aid, however, transformed Germany and Japan into allies and democracies with thriving economies. Our ongoing military presence in South Korea helped it become a wealthy ally. The fall of South Vietnam did not weaken democracies in Southeast and South Asia. The so-called “domino theory” was proven wrong, and today Vietnam is a valued trade partner. The collapse of the Soviet Union 35 years ago liberated many of Russia’s satellite nations from its stifling grip. America has benefited from having strong allies who embraced what have traditionally been America’s core beliefs.

American aid has saved millions of lives in the world’s poorest countries. The U.S. Agency for Global Media (USAGM), which includes Voice of America (VOA), Radio Free Europe, and other government agencies, is dedicated to explaining America. Geoffrey Cowan, who led VOA under President Clinton, says the goal was to do so with objective, unbiased information.

Elon Musk’s Department of Government Efficiency has sought to dismantle the USAGM and its operating units, including VOA, with President Trump’s enthusiastic, albeit illogical, backing. Musk has also criticized the National Endowment for Democracy (NED), which has supported non-governmental groups working abroad to promote democratic goals for over 40 years. He claims, without evidence, that the NED is “rife with corruption.” Despite previous congressional approval, Musk has cut the NED’s funding, leading to the closure of many organizations it supported.

One of those organizations is the International Republican Institute (IRI), founded in 1983 with support from then-President Ronald Reagan. The IRI conducts polling worldwide and operates in more than 100 countries, promoting free and fair elections. Marco Rubio was on its board before becoming Secretary of State, and several Republican senators are still on its board, including Tom Cotton, Joni Ernst, Lindsay Graham, Mitt Romney, and Dan Sullivan. None of them have had much to say about the IRI’s funding loss.

Each of these organizations has faced criticism, some of which is legitimate. The IRI, for instance, has been accused by several publications, including The New York Times, of inciting a coup in Haiti. The NED, intended to be nonpartisan, has drawn criticism from both the left and the right. Some of our aid efforts have undoubtedly been wasteful and ineffective, although Elon Musk’s DOGE has not yet proven substantial fraud or waste.

But the proper response is to fix the problems. Instead, the Trump administration has gutted these efforts, freezing foreign assistance, shutting off funding, and forcing their closure. China, Russia, Iran, and other dictatorships couldn’t be happier. Along with cutbacks in support for Ukraine, the Trump administration is making the world a more dangerous place.

The world has clearly changed since Luce wrote “The American Century.” We will have to share power with other nations, particularly China, India, and their Asian neighbors. Our actions will determine whether the American Century gives way to a Pacific Century that includes the U.S. or an Asian Century that, whenever possible, leaves us on the sidelines. While much of the world may dislike China’s authoritarian government, it increasingly distrusts us. The Trump administration’s efforts to initiate tariff wars while cutting off U.S. government efforts to assist developing nations have tragically worsened that distrust.

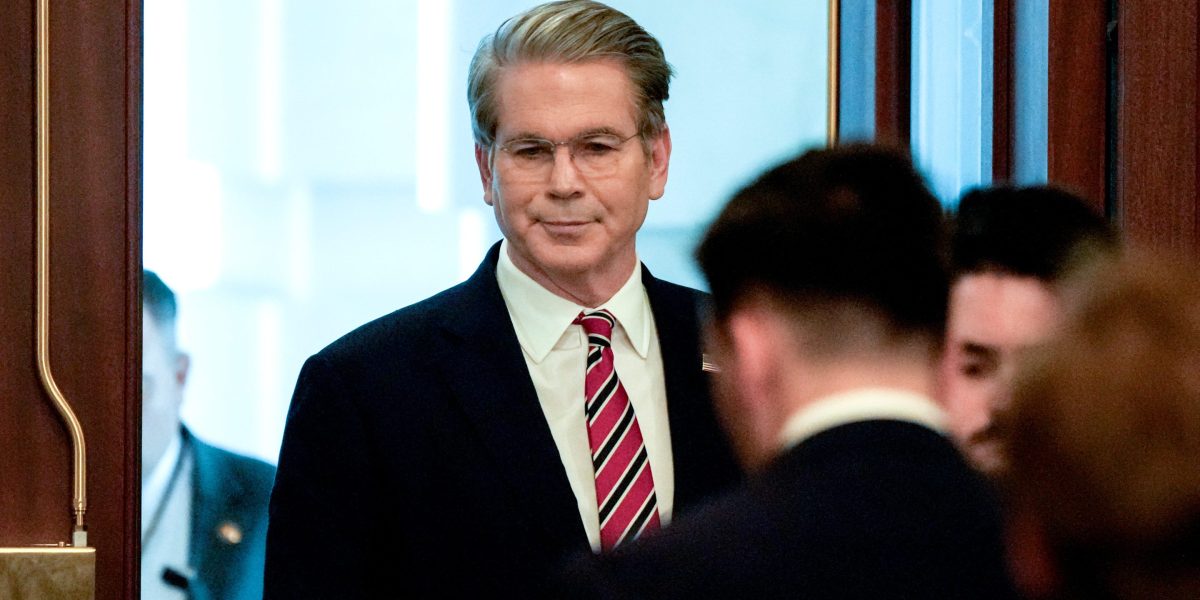

I never met Henry Luce. He wrote “The American Century” the year before I was born, and he died in 1967, the year before I became a working journalist. But during my 15 years at Time Inc., including eleven as its Editor in Chief, I sat on the executive floor of the iconic Time-Life building he had built in midtown Manhattan. While there, Time Inc. owned more than 150 magazines. Time and Fortune, now privately held by different owners, remain influential global brands. We might have disagreed on many issues if we had been contemporaries, but I came to appreciate many of his values. I admired his willingness to speak out against autocrats and Washington politicians he opposed, including Franklin Roosevelt and, through the pages of Time, Joe McCarthy.

I regret that so many media properties are now controlled by conglomerates or billionaires hesitant to confront Trump. The public benefits from journalism that aims to hold governments accountable. However, Trump’s delight in retaliation has made owners and CEOs timid, especially if their other businesses depend on government contracts or are subject to government regulation.

I have no doubt that Henry Luce would have been unafraid of Donald Trump, appalled by the president’s narrow-minded retreat from global commitments, disgusted by his embrace of authoritarian dictators, and shocked by his attacks on allies who are still dedicated to democratic values. Rather than making America great again, he would think Trump’s policies are more likely to “Make America Small Again,” as he rushes to dismantle the underpinnings of Luce’s American Century.

The opinions expressed in Fortune.com commentary pieces are solely the views of their authors and do not necessarily reflect the opinions and beliefs of Fortune.

This story was originally featured on Fortune.com

Source link

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Politics8 years ago

Politics8 years ago