As AI sweeps through higher education, a growing number of professors have been drawing a line in the sand—banning AI tools from the classroom and returning to classic “blue book” exams to ensure authentic, human-driven learning. David Joyner of Georgia Tech told Fortune that he’s heard blue-book sales are up something like 50% nationwide. In fact, The Wall Street Journal reported in May that they they’ve risen even higher at some colleges, such as the University of California, Berkeley, whose bookstore reported an 80% surge over the last two years.

But Joyner, who among other things is Georgia Tech’s executive director of online education, where he’s long been a leader in the online education space with an ultra-cheap $7,000 computer science Masters degree, has other ideas. He and Anant Agarwal, an award-winning professor at the Massachusetts Institute of Technology, have cloned Joyner in cyberspace and created an artificial intelligence (AI) professor.

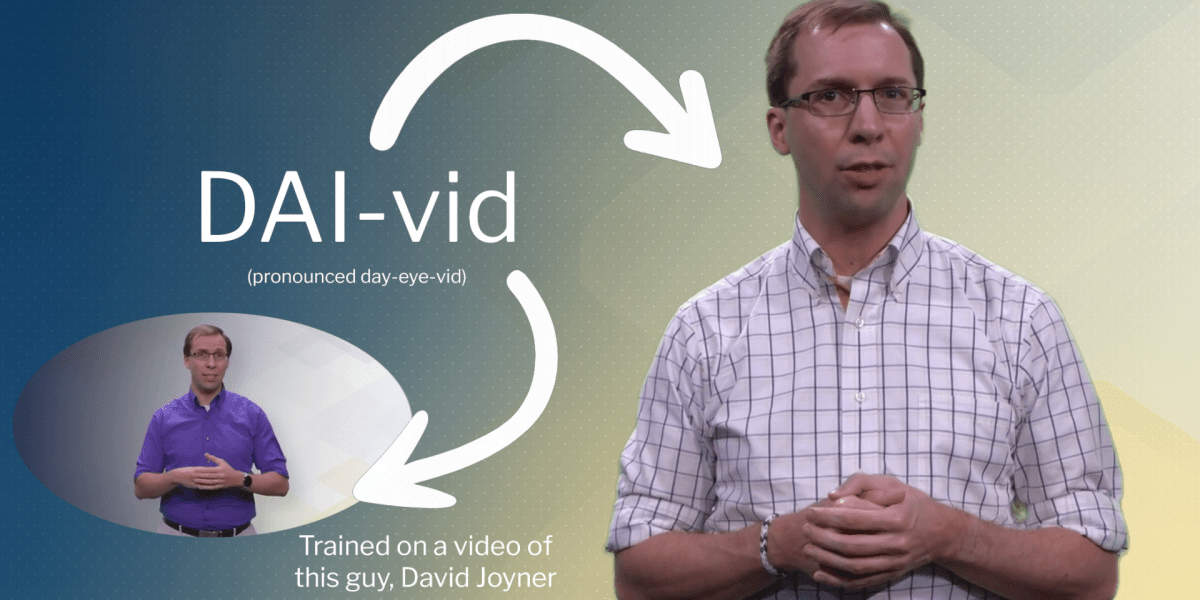

Joyner’s latest project on the online education platform edX, an experimental pilot titled “Foundations of Generative AI,” is something new, Fortune can exclusively reveal. It uses a virtual avatar named DAI-vid, modeled after Joyner’s own appearance and voice. The avatar delivers lectures while wearing a signature binary-coded bracelet. Joyner explained that if you see him onscreen wearing a bracelet, that’s actually DAI-vid talking.

The rise of the ‘super teacher’

Agarwal became CEO of edX in 2012 for exactly this outcome, when Harvard and MIT co-founded the nonprofit based off Agarwal’s MITx initiative. Ever since, he has been using the platform to teach far-reaching “open courses” (also known as MOOCs, or massive online open courses) for years, with the first edX course being an MIT lecture on circuits and electronics that drew 155,000 students from 162 countries within one year, according to edX, and has now surpassed 1 million. The open courses offered by edX have since grown to over 2,000 online courses reaching over 17 million people.

The organization has grown from a nonprofit, jointly founded by Harvard and MIT with $30 million investments from each, into a for-profit entity following its acquisition by 2U for $800 million in 2021, when Agarwal became 2U’s chief academic officer. With edX now firmly in the for-profit area of open courses, competing against players such as Coursera, profit is a consideration but edX reiterated to Fortune that this AI pilot is not part of monetization efforts.

In the years since, Agarwal told Fortune, edX has grown to reach millions of people, in line with its mission. For instance, he noted that Harvard’s David Malan has taught an online course on edX that has drawn over 7 million users, while Agarwal’s own circuits course has been taken by at least a million students worldwide. Agarwal said he strongly believes that AI technology will help more professors reach similar millions of people, and that’s why he approached Joyner about the idea of an AI-generated open course.

Agarwal said Joyner is his “go-to person for things like this” and mentioned how much Joyner has done to democratize online learning, including his computer science degree recognized by, among others, Fast Company for its low-cost accessibility. Stressing that the course was developed as an experimental pilot, they said rhey want to harvest feedback and learnings.

At the time, Joyner was developing a new generative AI module for the aforementioned online computer science program, specifically the Master of Science degree. He had two bad options: a text-based format that could be easily updated but boring, and a filmed course that would be outdated within months, at the rate of technological progress. Using AI tools offered a way for him to do both, he realized. The result is Foundations of Generative AI: a three-week course on edX that feels like a timely video course but can be edited and updated by Joyner with the help of AI tools at any point.

The course introduces Joyner’s avatar—DAI-vid—upfront, so students know they’re watching AI-generated instruction. The avatar is clearly identified with a visible indicator: a bracelet created by Joyner’s daughter (which spells AI in binary digits) ensures students always know when the presenter is the AI. Joyner used HeyGen, a generative AI video platform, to create his avatar, training it with a five-minute studio recording that captured his appearance and speech patterns.

Agarwal said he was excited by the results: “AI is augmenting the teacher and turns teachers into super teachers.” Far from eliminating teachers, it is multiplying their reach and impact, he said. “It democratizes teaching.” Everybody can be a great teacher with these AI tools, he insisted, but there’s a catch: these AI tools still don’t substitute for human skills and knowhow.

“If you’re a bad teacher, this isn’t going to make you a good teacher,” Agarwal said. “But if you’re a good teacher, this is going to make it so you can teach a lot more people and teach a lot more subjects and teach in a lot more contexts. But you still have to have that expertise.”

Joyner agreed, clarifying that AI gets added to the relationship after all the intellectual heavy lifting by (the human version of) him is done: “This is an AI assisting an instructor, but the instructor ultimately [is] the author and responsible party for everything.” He said it’s definitely not the case that he’s telling a robot to design his course, it’s more like he’s working with robots to amplify the course delivery once he’s done designing it himself.

Agarwal said he knows many professors “who can write quite well, but are tongue-tied in front of a camera,” lacking the kind of hand gestures, enthusiasm, and even voice inflection that makes for a successful instructor. He explained that he sees AI as part of a natural progression in teaching, noting the huge advances in course instruction from even 10, 20 years ago. The richest colleges and universities were able to improve education, taking one professor’s wonky scribblings and turning them into slick presentations with the help of “graphic designers, video editors, text writers, amazing teaching assistants, all kinds of people—a professor could have a huge team,” Agarwal said. A lot of those functions can now be done by AI, he added, “and every teacher at every college, poor or rich, can have an amazing team and a supporting cast.” He said that instead of harming education, AI will “democratize” it.

For Joyner, working with AI has made course creation a more personal process: “The analogy I have is when I do a traditional course production, it feels like a Marvel big-budget movie production… This [AI process] feels more like an auteur indie film.” He said he feels like this course “captures” him much more—even though it’s DAI-vid talking, not David.

AI-assisted grading

Fortune has previously reported on the thorny question of education in the age of AI. Jure Leskovec, a computer science professor at Stanford and himself a startup founder, told Fortune that he shifted two years ago to completely hand-written and hand-graded essays. Students, especially his teaching assistants, were asking for it because they wanted to be sure they were really learning about the subject and that required a manual process given AI’s capabilities. He said that instead of saving him time, AI has made it so exams take “much longer” to grade, creating “additional work” and “fewer trees in the world” from all the paper he’s printing out.

To be sure, an intensive, semester-long course at Stanford like this one is very different from a three-week open course like Joyner’s. Still, Joyner is taking nearly the opposite tack, prioritizing scale and efficiencies through AI-assisted grading, with safeguards built into the process. Essays are evaluated through a tool called “GradyAI,” and the key thing, according to Agarwal, “is that students learn better from rapid feedback cycles.” He explained that traditionally, students submit an essay, wait a week, and get feedback, but GradyAI makes feedback nearly instant. “And anything a TA would need to escalate, a human can still take over. We see this as a crucible to experiment with the best of both AI and human teaching.”

When asked about potential mistakes or even hallucinations in the grading of papers through AI technology, Agarwal explained that the grading tool provides very detailed feedback, and students can ask for a regrade if they disagree. “Within a minute, GradyAI will have regraded them based on the feedback. And the students can escalate to a faculty member for a live look, if they want to.”

Regarding the subject of cheating and whether students might use AI to write essays, edX told Fortune that GradyAI has cheating detection built into its algorithms that can be turned on or off depending on the application. This works by extracting a student’s skills from their submitted assignments and flagging inconsistencies with the skills that are subsequently displayed. It uses the same skills extraction algorithms to report a student’s skill development over a course as a demonstration of learning progress.

Agarwal said the system was also designed to accommodate privacy laws and newly emerging regulations in areas like Europe, and this is a bit difficult as it’s such a nascent space. “The laws are changing so fast.”

One of the most transformative aspects is accessibility. The tools allow courses to be instantly translated and altered to fit many different learning styles and needs—including learners with disabilities, or those needing support in different languages. “With one course, I can explode it exponentially a million-fold and truly customize learning to each student,” Agarwal said. He said he envisioned a future where every learner can “zap” a course into their preferred level, language, or pace—radically personalizing education at scale.

The coming tsunami

In a separate interview, Agarwal made clear that he’s a big believer in AI, having spent decades exploring its potential, from building energy-efficient “organic computing” models in the early 2000s to pioneering online learning with edX’s nearly 100 million global learners today. He is incredibly bullish on AI, telling Fortune that this will be “the decade to beat all decades” in terms of technological advancement.

He acknowledged the recent finding from colleagues at MIT that 95% of corporate AI pilots are failing to generate a return on investment, but added that that’s just part of how science works: “I’m not surprised. I mean, I’ve been a technologist long enough [to wonder] why is that even news? Remember, I was becoming an MIT professor in the mid-’80s when the first mobile phone just came out, and it was as big as a coffee machine.” The real breakthrough came decades later. Agarwal said he was able to access the internet in 1987 through his research and “it was crappy, crummy, text-based.” AI, he added, is going to be “bigger than microwave ovens. It’s bigger than the automobile. It’s bigger than, probably the thing that comes closest would be the computer.”

Agarwal also acknowledged the chaos unleashed in job markets and among students, pointing to coding as a specific example. “The boot-camp business completely imploded and … does not exist anymore, pretty much. And it’s because all those entry-level coding jobs went away because coding moved to a higher level.”

Agarwal predicted a “tsunami of people that are coming who are hell-bent on upskilling with AI,” and said he’s working with major corporate clients who “want to upskill tens of thousands of people within their own company … It is much, much easier to upskill an existing employee than try to lay off and hire somebody else. So my sense is that this upskilling tsunami is coming.” (Agarwal declined to name the client, citing confidentiality.)

In other words, millions of people will need new skills, and they might be getting them from a professor’s avatar, wearing a bracelet, with a name like DAI-vid.

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Business8 years ago

Business8 years ago

Tech8 years ago

Tech8 years ago