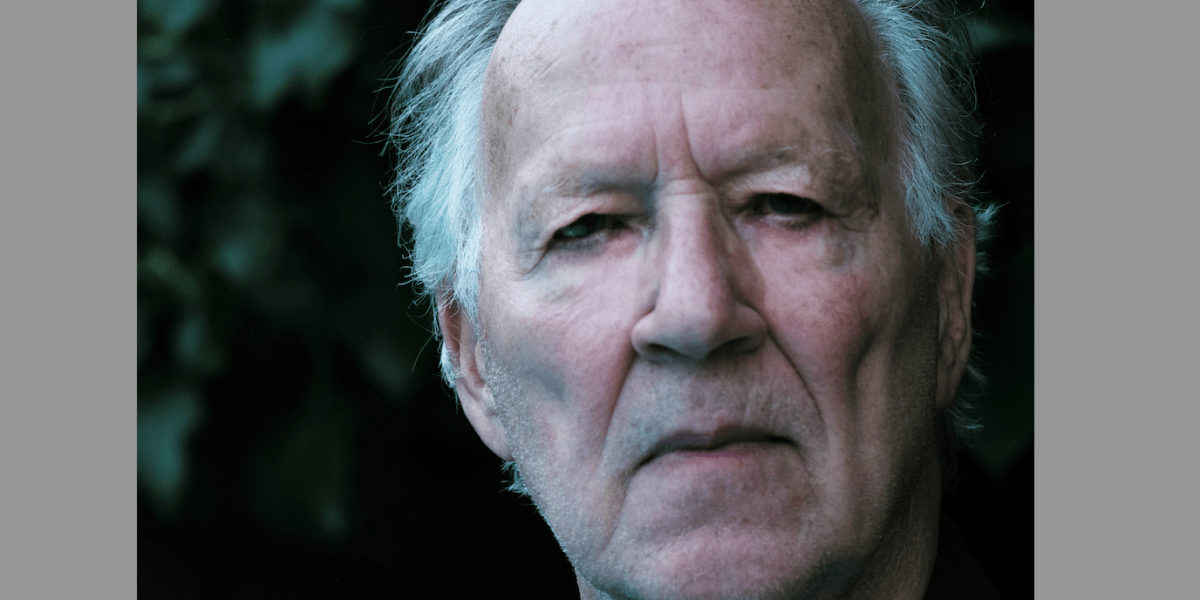

In a wide-ranging conversation with Fortune, the Bavaria-born director refers back often to his history of probing documentaries and feature films on humankind’s unending quest for meaning. “Wrestling with this question” has “engaged my fascination” since very early on, he says: “I think it is something inherent in art or in poetry, or in cinema. What exactly it is, nobody knows.” Herzog is evasive on whether he’s come down anywhere definitive on the question, now that he’s in his 80s. He cites the example of Ghost Elephants, his recent documentary on whether a mysterious giant species of elephant is hiding, somewhere in Africa. “Sometimes to maintain a dream is better than seeing it fulfilled,” he explains.

He cites a survey of 2,000 philosophers seeking to define the concept of truth, and “nobody has a real answer.” Many of Herzog’s films capture that sense of a quixotic, even bizarre quest, an antihero searching for some kind of truth that may be obvious only to himself. At times, the boundaries between art and artist blurred, with Herzog and his creative partner Klaus Kinski taking their dangerous onscreen missions into violent offscreen clashes with each other, as captured in the 1999 documentary, My Best Friend.

But in “The Future of Truth,” Herzog tackles current events: artificial intelligence, fake news and technology. In 11 short chapters, he discusses the difference between facts, truth and trust in the 21st century and links them back to examples from throughout world history. He references, for instance, the fake news that ran rampant throughout ancient Rome, and the bizarre “family romance” business in Japan where firms supply actors who stand in for missing friends or family members on a temporary basis. (Herzog made a film about this, too.)

The director talked to Fortune about his own technophobia, what he sees as the dangers facing Gen Z from the explosion of technological advances, and about why he’s come to love his adopted hometown of Los Angeles so much.

The ‘phenomenal stupidities’ of Los Angeles

These are “incredible times,” he tells Fortune, “more incredible than anything we ever had in human history,” and then he touches upon his adopted home. Los Angeles is “a city with the most substance, most cultural substance, in the United States, maybe even in the world,” he claims. While outsiders may imagine Hollywood’s superficial glamour, Herzog sees a metropolis teeming with artists, writers and inventors.

He says “it all originates” in southern California: the greatest painters, the center of the entertainment business, even the bodybuilders at Gold’s Gym in Venice Beach, all side by side with “abominations like aerobic studios and yoga classes for five-year-olds.” He explains that this duality shapes his worldview. “The artistic richness of LA with the phenomenal stupidities of LA, it happens at the same time. You have to accept it.” He said he thinks this duality “has to do with human nature,” and it relates back to his argument that what you feel to be true and what you know to be literally true are often not the same thing.

The director’s affection for America extends beyond cosmopolitan centers, too. He laments the mistreatment of what he calls “the heartland,” made up of “good people, but undereducated, underpaid, disadvantaged, not ever mentioned in the media, pushed to the margins.” These people, he warned, “are the majority, and you have to acknowledge it and do something about it.” He added that he is “outraged” when he hears talk of “flyover states.” He says he keeps telling his friends who were raised in a place like Kansas: “When was the last time you spoke to your old buddies from high school, when was that? When did you show you are interested in them?” (Herzog’s interview with Fortune took place before the Charlie Kirk murder, and a representative declined to comment on those developments.)

Despite his reputation for being bohemian in his art, Herzog in espouses some values that could be called old-fashioned. He even defends mainstream Hollywood cinema: “the collective dreams of the world come from here,” he says, adding that “it’s not my thing, but you cannot ignore it. It’s given us wonderful, wonderful things.”

For Herzog, this simultaneous coexistence of high art and triviality is part of LA’s twisted genius. This duality “has to do with human nature,” he says—and that’s part of what concerns him so much about artificial intelligence.

The ‘meaningless twaddle’ of AI and the ancient origins of fake news

Herzog said he sees artificial intelligence and fake news blending together to create the post-truth age we live in, noting that he and a “Slovenian philosopher,” unnamed but presumably Slavoj Zizek, are carrying on an AI-generated conversation on the internet that has no parallel in real life. It’s entirely fake, their famous voices captured in a conversation that never took place—and yet it also exists. “Our voices are mocked up very accurately,” he writes, “but our conversation is meaningless twaddle … Our sentences are grammatically correct and have the right vocabulary, but our dialogue is soulless, is dead.”

Herzog tells Fortune that he doesn’t let AI into his life. “It hasn’t affected me, really, because I do not use it.” He says he doesn’t even own a cell phone. Instead, “I find new ideas and new thinking—on foot,” stressing the pains he takes to engage with the real world on a daily basis. He makes one big exception: “there’s one phenomenon visible for me, because I use email … unknown people write to me.” He said he has fans as young as 15 years old and they write to him, wanting to “know certain things: intelligent, unusual questions.” He said he’s happy to engage with a young fan “if it’s a serious request.”

Herzog reminds Fortune that fake news is as old as time, citing examples from ancient Egypt and ancient Rome. He mentions the example of the Roman Emperor Nero, who lived on after he committed suicide, with “fake Neros [appearing] in Asia Minor, into northern Greece,” and the imposters were “wined and dined” by gullible subjects.

Herzog’s book goes into more detail on the parade of fake Neros, as he conjures a time long before the internet, when a canny purveyor of fake news could impersonate a dead emperor, gain a substantial following and indulge in some excellent banquets along the way. The first two of these were found out and, unfortunately for them, beheaded, but fake news had a strong grip. “The popular belief that Nero would return, march on Rome, and become emperor again, endures into the fifth century,” Herzog writes—a full 400 years after the original’s death. It’s not unlike Elvis Presley, Herzog adds: “In Tokyo to this day, it is possible to admire the competing Elvises in costume and guitar in public parks, a hundred of them or more … We will always have Elvis, a sleeping king in the mountain.”

For Herzog, history’s parade of lies only further supports his need for continual vigilance, and his book’s final chapter is concise: “Truth has no future, but truth has no past either. But we will not, must not, cannot, give up the search for it.”

Herzog expresses concern for younger generations growing up in a world dominated by screens and apps. “There’s a generation that … will really struggle in their lives if they have depended too much on social media and on their cell phones,” he warns. Their experience of reality, Herzog argues, becomes “only on a secondary level, from applications on their cell phones.”

He recounts the story of an acquaintance from a recent job who was unable to navigate five blocks in LA without Google Maps, having never learned the actual streets. “That is a thing that really concerns me when I think about this generation. They will have a very hard time to adapt to the reality, to the real reality, to the basic reality, to the barefoot reality.”

He is worried, he adds, about just how much we want to delegate to technology. “Do you want to delegate your dreams to artificial intelligence?”

Politics8 years ago

Politics8 years ago

Entertainment9 years ago

Entertainment9 years ago

Politics9 years ago

Politics9 years ago

Politics8 years ago

Politics8 years ago

Entertainment9 years ago

Entertainment9 years ago

Entertainment9 years ago

Entertainment9 years ago

Business9 years ago

Business9 years ago

Tech8 years ago

Tech8 years ago