The Jane Goodall Institute announced the primatologist’s death Wednesday in an Instagram post.

While living among chimpanzees in Africa decades ago, Goodall documented the animals using tools and doing other activities previously believed to be exclusive to people, and also noted their distinct personalities. Her observations and subsequent magazine and documentary appearances in the 1960s transformed how the world perceived not only humans’ closest living biological relatives but also the emotional and social complexity of all animals, while propelling her into the public consciousness.

“Out there in nature by myself, when you’re alone, you can become part of nature and your humanity doesn’t get in the way,” she told The Associated Press in 2021. “It’s almost like an out-of-body experience when suddenly you hear different sounds and you smell different smells and you’re actually part of this amazing tapestry of life.”

In her later years, Goodall devoted decades to education and advocacy on humanitarian causes and protecting the natural world. In her usual soft-spoken British accent, she was known for balancing the grim realities of the climate crisis with a sincere message of hope for the future.

From her base in the coastal U.K. town of Bournemouth, she traveled nearly 300 days a year well into her 90’s to speak to packed auditoriums around the world. Between more serious messages, her speeches often featured her whooping like a chimpanzee or lamenting that Tarzan chose the wrong Jane.

While first studying chimps in Tanzania in the early 1960s, Goodall was known for her unconventional approach. She didn’t simply observe them from afar but immersed herself in every aspect of their lives. She fed them and gave them names instead of numbers, something for which she received pushback from some scientists.

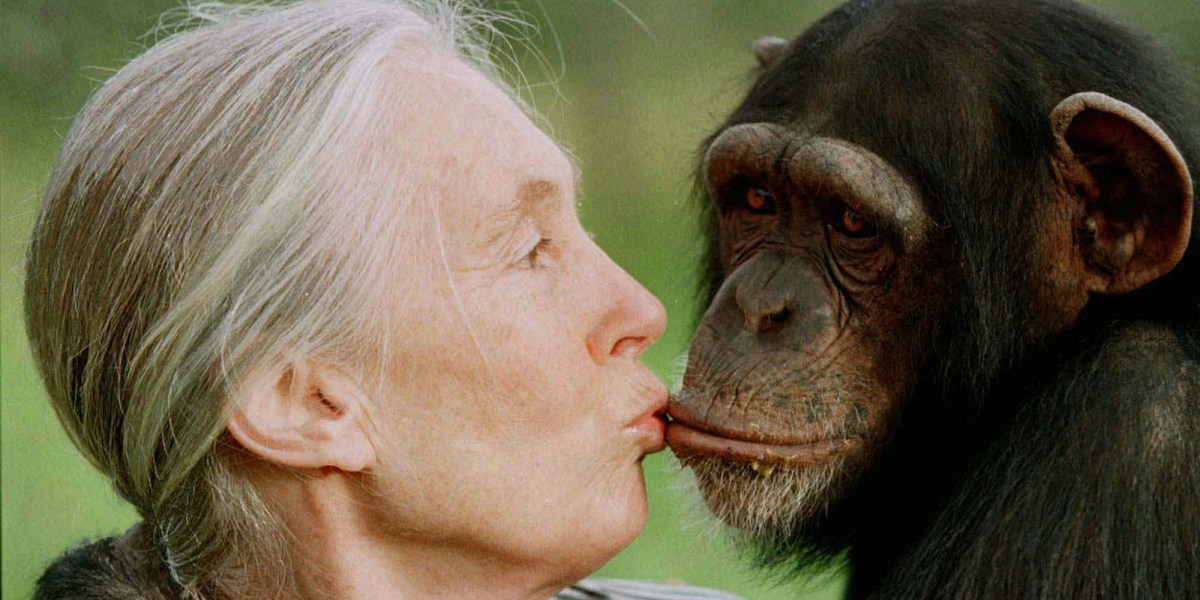

Her findings were circulated to millions when she first appeared on the cover of National Geographic in 1963 and soon after in a popular documentary. A collection of photos of Goodall in the field helped her and even some of the chimps become famous. One iconic image showed her crouching across from the infant chimpanzee named Flint. Each has arms outstretched, reaching for the other.

In 1972, the Sunday Times published an obituary for Flo, Flint’s mother and the dominant matriarch, after she was found face down on the edge of a stream. Flint died about three weeks later after showing signs of grief, eating little and losing weight.

″What the chimps have taught me over the years is they’re so like us. They’ve blurred the line between humans and animals,″ she told The Associated Press in 1997.

Goodall has earned top civilian honors from a number of countries including Britain, France, Japan and Tanzania. She was awarded the Presidential Medal of Freedom in 2025 by then-U.S. President Joe Biden and won the prestigious Templeton Prize in 2021.

“Her groundbreaking discoveries have changed humanity’s understanding of its role in an interconnected world, and her advocacy has pointed to a greater purpose for our species in caring for life on this planet,” said the citation for the Templeton Prize, which honors individuals whose life’s work embodies a fusion of science and spirituality.

Goodall was also named a United Nations Messenger of Peace and published numerous books, including the bestselling autobiography “Reason for Hope.”

Born in London in 1934, Goodall said her fascination with animals began around when she learned to crawl. In her book, “In the Shadow of Man,” she described an early memory of hiding in a henhouse to see a chicken lay an egg. She was in there so long her mother reported her missing to the police.

She bought her first book — Edgar Rice Burroughs’ “Tarzan of the Apes” — when she was 10 and soon made up her mind about her future: Live with wild animals in Africa.

That plan stayed with her through a secretarial course when she was 18 and two different jobs. And by 1957, she accepted an invitation to travel to a farm in Kenya owned by a friend’s parents.

It was there that she met the famed anthropologist and paleontologist Louis Leakey at a natural history museum in Nairobi, and he gave her a job as an assistant secretary.

Three years later, despite Goodall not having a college degree, Leakey asked if she would be interested in studying chimpanzees in what is now Tanzania. She told the AP in 1997 that he chose her “because he wanted an open mind.”

The beginning was filled with complications. British authorities insisted she have a companion, so she brought her mother at first. The chimps fled if she got within 500 yards (457.20 meters) of them. She also spent weeks sick from what she believes was malaria, without any drugs to combat it.

But she was eventually able to gain the animals’ trust. By the fall of 1960 she observed the chimpanzee named David Greybeard make a tool from twigs and use it to fish termites from a nest. It was previously believed that only humans made and used tools.

She also found that chimps have individual personalities and share humans’ emotions of pleasure, joy, sadness and fear. She documented bonds between mothers and infants, sibling rivalry and male dominance. In other words, she found that there was no sharp line between humans and the animal kingdom.

In later years, she discovered chimpanzees engage in a type of warfare, and in 1987 she and her staff observed a chimp “adopt” a 3-year-old orphan that wasn’t closely related.

Goodall received dozens of grants from the National Geographic Society during her field research tenure, starting in 1961.

In 1966, she earned a Ph.D. in ethology — becoming one of the few people admitted to University of Cambridge as a Ph.D. candidate without a college degree.

Her work moved into more global advocacy after she watched a disturbing film of experiments on laboratory animals at a conference in 1986.

″I knew I had to do something,″ she told the AP in 1997. ″It was payback time.″

When the COVID-19 pandemic hit in 2020 and halted her in-person events, she began podcasting from her childhood home in England. Through dozens of “Jane Goodall Hopecast” episodes, she broadcast her discussions with guests including U.S. Sen. Cory Booker, author Margaret Atwood and marine biologist Ayana Elizabeth Johnson.

“If one wants to reach people; If one wants to change attitudes, you have to reach the heart,” she said during her first episode. “You can reach the heart by telling stories, not by arguing with people’s intellects.”

In later years, she pushed back on more aggressive tactics by climate activists, saying they could backfire, and criticized “gloom and doom” messaging for causing young people to lose hope.

In the lead-up to 2024 elections, she co-founded “Vote for Nature,” an initiative encouraging people to pick candidates committed to protecting the natural world.

She also built a strong social media presence, posting to millions of followers about the need to end factory farming or offering tips on avoiding being paralyzed by the climate crisis.

Her advice: “Focus on the present and make choices today whose impact will build over time.”

___

The Associated Press’ climate and environmental coverage receives financial support from multiple private foundations. AP is solely responsible for all content. Find AP’s standards for working with philanthropies, a list of supporters and funded coverage areas at AP.org.

Politics8 years ago

Politics8 years ago

Entertainment9 years ago

Entertainment9 years ago

Politics9 years ago

Politics9 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment9 years ago

Entertainment9 years ago

Business9 years ago

Business9 years ago

Tech8 years ago

Tech8 years ago