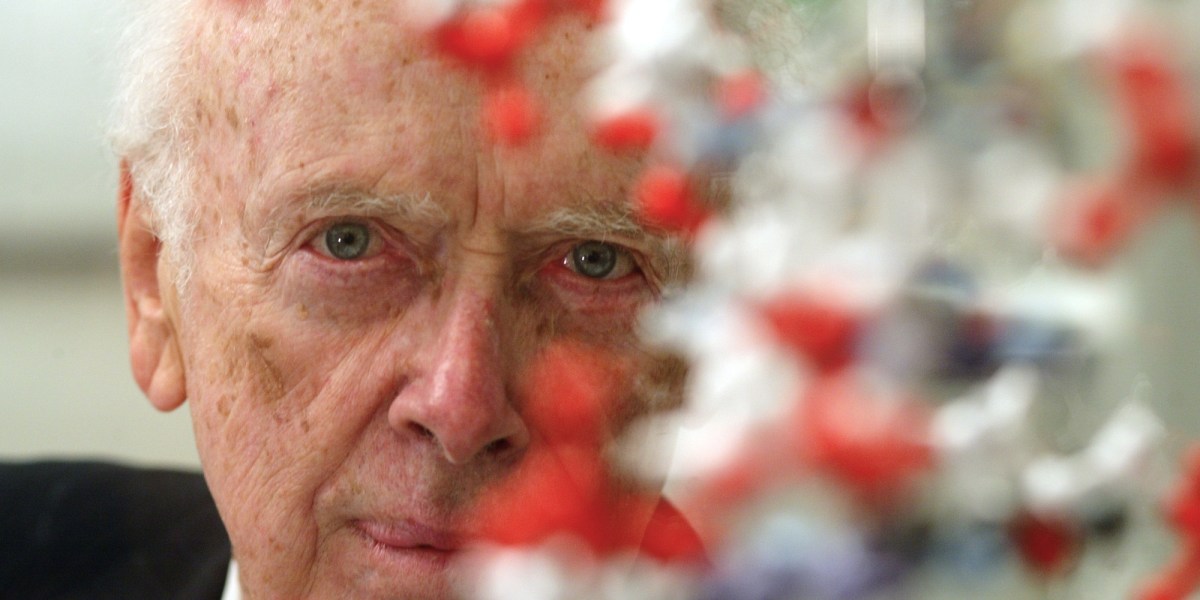

James D. Watson, whose co-discovery of the twisted-ladder structure of DNA in 1953 helped light the long fuse on a revolution in medicine, crimefighting, genealogy and ethics, has died. He was 97.

The breakthrough — made when the brash, Chicago-born Watson was just 24 — turned him into a hallowed figure in the world of science for decades. But near the end of his life, he faced condemnation and professional censure for offensive remarks, including saying Black people are less intelligent than white people.

Watson shared a 1962 Nobel Prize with Francis Crick and Maurice Wilkins for discovering that deoxyribonucleic acid, or DNA, is a double helix, consisting of two strands that coil around each other to create what resembles a long, gently twisting ladder.

That realization was a breakthrough. It instantly suggested how hereditary information is stored and how cells duplicate their DNA when they divide. The duplication begins with the two strands of DNA pulling apart like a zipper.

Even among non-scientists, the double helix would become an instantly recognized symbol of science, showing up in such places as the work of Salvador Dali and a British postage stamp.

The discovery helped open the door to more recent developments such as tinkering with the genetic makeup of living things, treating disease by inserting genes into patients, identifying human remains and criminal suspects from DNA samples, and tracing family trees and ancient human ancestors. But it has also raised a host of ethical questions, such as whether we should be altering the body’s blueprint for cosmetic reasons or in a way that is transmitted to a person’s offspring.

“Francis Crick and I made the discovery of the century, that was pretty clear,” Watson once said. He later wrote: “There was no way we could have foreseen the explosive impact of the double helix on science and society.”

Watson never made another lab finding that big. But in the decades that followed, he wrote influential textbooks and a best-selling memoir and helped guide the project to map the human genome. He picked out bright young scientists and helped them. And he used his prestige and contacts to influence science policy.

Watson died in hospice care after a brief illness, his son said Friday. His former research lab confirmed he passed away a day earlier.

“He never stopped fighting for people who were suffering from disease,” Duncan Watson said of his father.

Watson’s initial motivation for supporting the gene project was personal: His son Rufus had been hospitalized with a possible diagnosis of schizophrenia, and Watson figured that knowing the complete makeup of DNA would be crucial for understanding that disease — maybe in time to help his son.

He gained unwelcome attention in 2007, when the Sunday Times Magazine of London quoted him as saying he was “inherently gloomy about the prospect of Africa” because “all our social policies are based on the fact that their intelligence is the same as ours — where all the testing says not really.” He said that while he hopes everyone is equal, “people who have to deal with Black employees find this is not true.”

He apologized, but after an international furor he was suspended from his job as chancellor of the prestigious Cold Spring Harbor Laboratory in New York. He retired a week later. He had served in various leadership jobs there for nearly 40 years.

In a television documentary that aired in early 2019, Watson was asked if his views had changed. “No, not at all,” he said. In response, the Cold Spring Harbor lab revoked several honorary titles it had given Watson, saying his statements were “reprehensible” and “unsupported by science.”

Watson’s combination of scientific achievement and controversial remarks created a complicated legacy.

He has shown “a regrettable tendency toward inflammatory and offensive remarks, especially late in his career,” Dr. Francis Collins, then-director of the National Institutes of Health, said in 2019. “His outbursts, particularly when they reflected on race, were both profoundly misguided and deeply hurtful. I only wish that Jim’s views on society and humanity could have matched his brilliant scientific insights.”

Long before that, Watson scorned political correctness.

“A goodly number of scientists are not only narrow-minded and dull, but also just stupid,” he wrote in “The Double Helix,” his bestselling 1968 book about the DNA discovery.

For success in science, he wrote: “You have to avoid dumb people. … Never do anything that bores you. … If you can’t stand to be with your real peers (including scientific competitors) get out of science. … To make a huge success, a scientist has to be prepared to get into deep trouble.”

It was in the fall of 1951 that the tall, skinny Watson — already the holder of a Ph.D. at 23 — arrived at Britain’s Cambridge University, where he met Crick. As a Watson biographer later said, “It was intellectual love at first sight.”

Crick himself wrote that the partnership thrived in part because the two men shared “a certain youthful arrogance, a ruthlessness, and an impatience with sloppy thinking.”

Together they sought to tackle the structure of DNA, aided by X-ray research by colleague Rosalind Franklin and her graduate student Raymond Gosling. Watson was later criticized for a disparaging portrayal of Franklin in “The Double Helix,” and today she is considered a prominent example of a female scientist whose contributions were overlooked. (She died in 1958.)

Watson and Crick built Tinker Toy-like models to work out the molecule’s structure. One Saturday morning in 1953, after fiddling with bits of cardboard he had carefully cut to represent fragments of the DNA molecule, Watson suddenly realized how these pieces could form the “rungs” of a double helix ladder.

His first reaction: “It’s so beautiful.”

Figuring out the double helix “goes down as one of the three most important discoveries in the history of biology,” alongside Charles Darwin’s theory of evolution through natural selection and Gregor Mendel’s fundamental laws of genetics, said Cold Spring Harbor lab’s president, Bruce Stillman.

Following the discovery, Watson spent two years at the California Institute of Technology, then joined the faculty at Harvard in 1955. Before leaving Harvard in 1976, he essentially created the university’s program for molecular biology, scientist Mark Ptashne recalled in a 1999 interview.

Watson became director of the Cold Spring Harbor lab in 1968, its president in 1994 and its chancellor 10 years later. He made the lab on Long Island an educational center for scientists and non-scientists, focused research on cancer, instilled a sense of excitement and raised huge amounts of money.

He transformed the lab into a “vibrant, incredibly important center,” Ptashne said. It was “one of the miracles of Jim: a more disheveled, less smooth, less typically ingratiating person you could hardly imagine.”

From 1988 to 1992, Watson directed the federal effort to identify the detailed makeup of human DNA. He created the project’s huge investment in ethics research by simply announcing it at a news conference. He later said it was “probably the wisest thing I’ve done over the past decade.”

Watson was on hand at the White House in 2000 for the announcement that the federal project had completed an important goal: a “working draft” of the human genome, basically a road map to an estimated 90 percent of human genes.

Researchers presented Watson with the detailed description of his own genome in 2007. It was one of the first genomes of an individual to be deciphered.

Watson knew that genetic research could produce findings that make some people uncomfortable. In 2007, he wrote that when scientists identify genetic variants that predispose people to crime or significantly affect intelligence, the findings should be publicized rather than squelched out of political correctness.

James Dewey Watson was born in Chicago on April 6, 1928, into “a family that believed in books, birds and the Democratic Party,” as he put it. From his birdwatcher father he inherited an interest in ornithology and a distaste for explanations that didn’t rely on reason or science.

Watson was a precocious child who loved to read, studying books like “The World Telegraph Almanac of Facts.” He entered the University of Chicago on a scholarship at 15, graduated at 19 and earned his doctorate in zoology at Indiana University three years later.

He got interested in genetics at age 17 when he read a book that said genes were the essence of life.

“I thought, ‘Well, if the gene is the essence of life, I want to know more about it,’” he later recalled. “And that was fateful because, otherwise, I would have spent my life studying birds and no one would have heard of me.”

At the time, it wasn’t clear that genes were made of DNA, at least for any life form other than bacteria. But Watson went to Europe to study the biochemistry of nucleic acids like DNA. At a conference in Italy, Watson saw an X-ray image that indicated DNA could form crystals.

“Suddenly I was excited about chemistry,” Watson wrote in “The Double Helix.” If genes could crystallize, “they must have a regular structure that could be solved in a straightforward fashion.”

“A potential key to the secret of life was impossible to push out of my mind,” he recalled.

In the decades after his discovery, Watson’s fame persisted. Apple Computer used his picture in an ad campaign. At conferences, graduate students who weren’t even born when he worked at Cambridge nudged each other and whispered, “There’s Watson. There’s Watson.” They got him to autograph napkins or copies of “The Double Helix.”

A reporter asked him 2018 if any building at the Cold Spring Harbor lab was named after him. No, Watson replied, “I don’t need a building named after me. I have the double helix.”

His 2007 remarks on race were not the first time Watson struck a nerve with his comments. In a speech in 2000, he suggested that sex drive is related to skin color. And earlier he told a newspaper that if a gene governing sexuality were found and could be detected in the womb, a woman who didn’t want to have a gay child should be allowed to have an abortion.

More than a half-century after winning the Nobel, Watson put the gold medal up for auction in 2014. The winning bid, $4.7 million, set a record for a Nobel. The medal was eventually returned to Watson.

Both of Watson’s Nobel co-winners, Crick and Wilkins, died in 2004.

___

Ritter is a retired AP science writer. AP science writers Christina Larson in Washington and Adithi Ramakrishnan in New York contributed to this report.

___

The Associated Press Health and Science Department receives support from the Howard Hughes Medical Institute’s Department of Science Education and the Robert Wood Johnson Foundation. The AP is solely responsible for all content.

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Business8 years ago

Business8 years ago

Tech8 years ago

Tech8 years ago