Rob Reiner’s younger son, Nick Reiner, was in jail Monday after being booked for what investigators believe was the fatal stabbing of the director-actor and his wife at their Los Angeles home a day earlier, authorities said.

It was not immediately clear what charges Nick Reiner, 32, would face. A police statement said he was being held without bail and the case will be presented to the district attorney’s office on Tuesday.

Representatives for the Reiner family did not immediately respond to a request for comment, and it wasn’t immediately clear if Nick Reiner had an attorney who could speak on his behalf.

Nick Reiner has spoken publicly of his struggles with addiction. By 18, he had cycled in and out of treatment facilities with bouts of homelessness and relapses in between. Rob and Nick Reiner explored their difficult relationship and Nick Reiner’s struggles with drugs in a semi-autobiographical 2016 film, “ Being Charlie.”

Rob and Michele Singer Reiner were found dead Sunday afternoon at their home in Los Angeles, and investigators believe they were stabbed, a law enforcement official told The Associated Press. The official, who was briefed on the investigation, could not publicly discuss the details and spoke to the AP on condition of anonymity.

Nick Reiner was arrested Sunday around 9:15 p.m., police said.

Reiner was long one of the most prolific directors in Hollywood, and his work included some of the most memorable movies of the 1980s and ’90s, including “This is Spinal Tap,” “A Few Good Men,” “When Harry Met Sally” and “The Princess Bride.”

His role as Michael “Meathead” Stivic in Norman Lear’s 1970s TV classic “All in the Family” as a liberal foil to Carroll O’Connor’s Archie Bunker catapulted him to fame and won him two Emmy Awards.

The son of comedy legend Carl Reiner, Rob Reiner married photographer Michele Singer Reiner in 1989. The two met while he was directing “When Harry Met Sally.” They had three children together: Nick, Jake and Romy.

Reiner told The New York Times in 1989 that the cinematographer on “When Harry Met Sally,” Barry Sonnenfeld, predicted he would marry her. “I look over and I see this girl, and whoo! I was attracted immediately,” Reiner said.

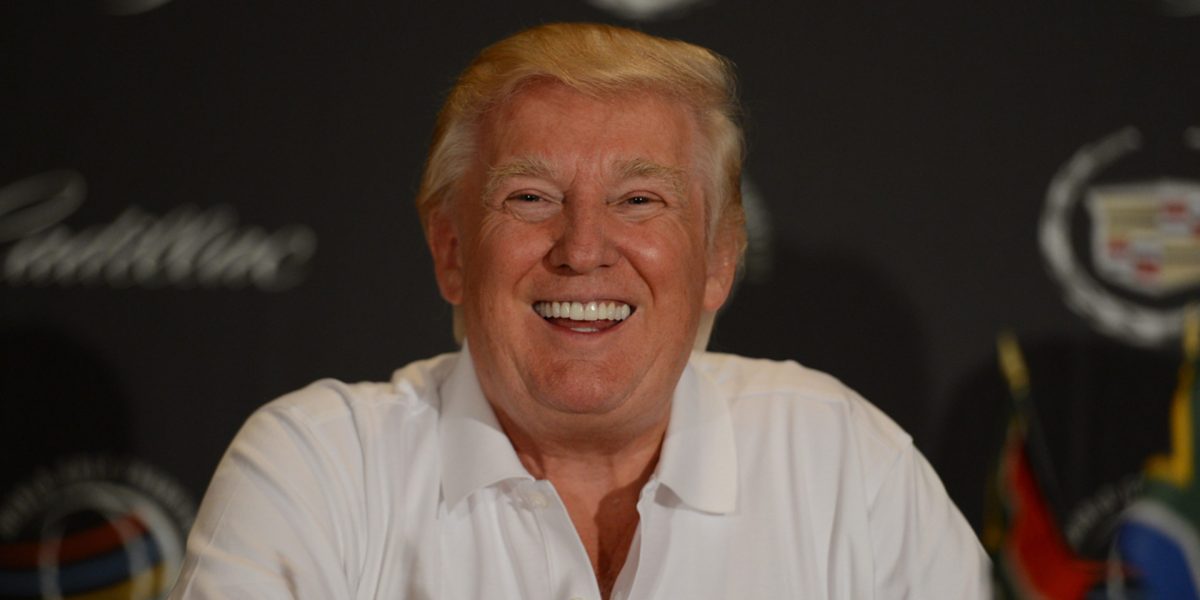

Michele Singer Reiner was a producer for “Spinal Tap II: The End Continues,” “God & Country,” “Albert Brooks: Defending My Life” and “Shock and Awe,” according to IMDB. Earlier in her career, she photographed the cover image of President Donald Trump’s 1987 bestseller “The Art of the Deal.”

Trump on Monday blamed Rob Reiner’s outspoken opposition to the president for the actor-director’s killing, delivering the unsubstantiated claim in a social media post that seemed intent on decrying his opponents even in the face of a tragedy.

Relatives of Lear, the legendary producer who died in 2023, said the Reiners’ deaths left them bereft.

“Norman often referred to Rob as a son, and their close relationship was extraordinary, to us and the world,” a Lear family statement said. “Norman would have wanted to remind us that Rob and Michele spent every breath trying to make this country a better place, and they pursued that through their art, their activism, their philanthropy, and their love for family and friends.”

Los Angeles Mayor Karen Bass called the deaths a devastating loss for the city.

“Rob Reiner’s contributions reverberate throughout American culture and society, and he has improved countless lives through his creative work and advocacy fighting for social and economic justice,” Bass said in a statement. “An acclaimed actor, director, producer, writer, and engaged political activist, he always used his gifts in service of others.”

Reiner was previously married to actor-director Penny Marshall from 1971 to 1981. He adopted her daughter, Tracy Reiner. Carl Reiner died in 2020 at age 98 and Marshall died in 2018.

Killings are rare in the Brentwood neighborhood. The scene is about a mile from the home where O.J. Simpson’s wife Nicole Brown Simpson and her friend Ron Goldman were killed in 1994.

__

Balsamo reported from Washington. Associated Press Entertainment Writer Andrew Dalton in Los Angeles contributed.

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Business8 years ago

Business8 years ago

Tech8 years ago

Tech8 years ago