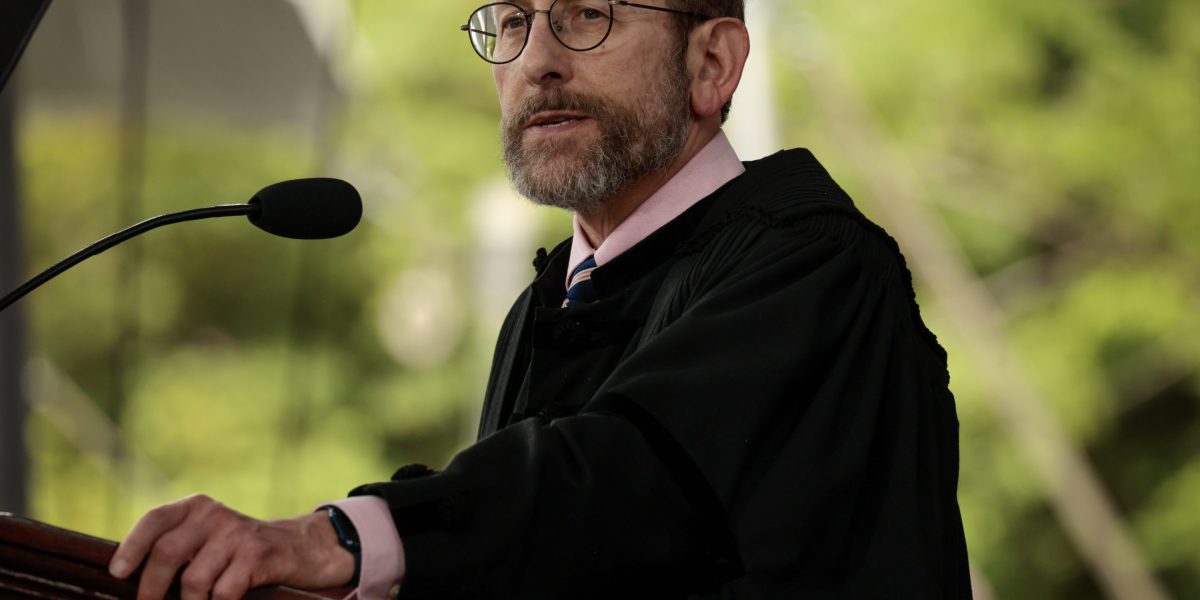

The Trump administration has recently escalated its destructive and illegal attacks on the core freedoms of American colleges and universities, which we have called on it to halt (Fortune, April 8). The demands issued to Harvard University (in an April 11 letter), followed by the freezing of $2.2 billion of federal research funds along with threats to Harvard’s tax-exempt status, violate no less than the freedom of all colleges and universities to admit students, hire faculty, and govern themselves consistently with the law, the First Amendment, Title VI of the Civil Rights Act, and long-standing principles of academic freedom. As current and former presidents of academic institutions, we strongly support Harvard’s President Alan Garber, who has rejected the demands on these grounds while the Trump administration threatens to demand control of numerous other schools. Just over three miles from Harvard Square is the Boston Tea Party site where, in 1773, American patriots fought government tyranny.

When the Trump administration conditions federal grants and contracts to universities on these demands, it threatens all Americans. Higher education is the greatest source of U.S. global competitiveness, cultural enrichment, and learning. By partnering with the federal government for decades, American universities have made lifesaving discoveries and increased the prosperity, safety, security, and creativity of our country. When the Trump administration insists on anyone’s compliance with likely illegal and unconstitutional conditions, it is threatening everyone’s freedom from arbitrary rule. When it insists on controlling the admission of students, faculty hiring, and governance of a university, it is also threatening a prime source of the opportunity and economic prosperity of all Americans. We all know from Martin Neimoller’s haunting lament, this authoritarian incursion does not end with Harvard.

Authors:

Edward Ayers, University of Richmond (Virginia)

Kimberly Benston, Haverford College (Pennsylvania)

Katherine Bergeron, Connecticut College (Connecticut)

Henry Bienen, Northwestern University (Illinois)

Lee Bollinger, Columbia University (New York), University of Michigan (Michigan)

Phil Boroughs, SJ, College of the Holy Cross (Massachusetts)

William Brody, Salk Institute, The Johns Hopkins University (Maryland)

Robert Brown, Boston University (Massachusetts)

Alison Byerly, Carleton College (Minnesota)

Albert Carnesale, University of California – Los Angeles (California)

Carol T. Christ, University of California – Berkeley (California)

Mary Sue Coleman, University of Michigan (Michigan), University of Iowa (Iowa)

Ron Crutcher, Wheaton College (Massachusetts)

Nicholas Dirks, University of California – Berkeley (California)

Adam Falk, Williams College (Massachusetts)

Jonathan Fanton, The New School (New York)

Drew Gilpin Faust, Harvard University (Massachusetts)

Wayne A. I. Frederick, Howard University (Washington DC)

Amy Gutmann, University of Pennsylvania (Pennsylvania)

Phil Hanlon, Dartmouth College (New Hampshire)

Robert Head, Rockford University (Illinois)

Mark A. Heckler, Valparaiso University (Indiana)

John Hennessy, Stanford University (California)

Catharine Bond Hill, Vassar College (New York)

Jonathan Holloway, Rutgers University (New Jersey)

Freeman Hrabowski, The University of Maryland, Baltimore County (Maryland)

Nan Keohane, Duke University (North Carolina), Wellesley College (Massachusetts)

Brit Kirwan, University System of Maryland (Maryland)

Bernie Machen, University of Florida (Florida)

Gail Mellow, LaGuardia Community College – City University of New York (New York)

Pat McGuire, Trinity Washington University (Washington DC)

Anthony Monaco, Tufts University (Massachusetts)

Richard Morrill, Centre College (Kentucky)

M. Duane Nellis, Ohio University (Ohio), Texas Tech University (Texas), University of Idaho (Idaho)

Lynn Pasquerella, Mount Holyoke College (Massachusetts)

Laurie Patton, Middlebury College (Vermont)

Susan Poser, Hofstra University (New York)

Steven Poskanzer, Carleton College (Minnesota)

Gregory Prince, Hampshire College (Massachusetts)

Stuart Rabinowitz, Hofstra University (New York)

L. Rafael Reif, Massachusetts Institute of Technology (Massachusetts)

L. Song Richardson, Colorado College (Colorado)

Michael S. Roth, Wesleyan University (Connecticut)

George Rupp, Rice University (Texas), Columbia University (New York)

Leonard A. Schlesinger, Babson College (Massachusetts)

Mark Schlissel, University of Michigan (Michigan)

Jake Schrum, Emory & Henry College (Virginia), Southwestern University (Texas), Texas Wesleyan University (Texas)

Allen Sessoms, Queens College, City University of New York (New York), Delaware State University (Delaware), University of the District of Columbia (Washington DC)

Donna Shalala, University of Miami (Florida), University of Wisconsin-Madison (Wisconsin), Hunter College of the City University of New York (New York)

Robert Sternberg, University of Wyoming (Wyoming)

Beverly Daniel Tatum, Spelman College (Georgia)

Lara Tiedens, Scripps College (California)

Steve Trachtenberg, George Washington University (Washington DC)

Laura Walker, Bennington College (Vermont)

Daniel H. Weiss, Haverford College (Pennsylvania), Lafayette College (Pennsylvania)

Julie Wollman, Widener University (Pennsylvania)

Meredith Woo, Sweet Briar College (Virginia)

The opinions expressed in Fortune.com commentary pieces are solely the views of their authors and do not necessarily reflect the opinions and beliefs of Fortune.

This story was originally featured on Fortune.com

Source link

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Politics8 years ago

Politics8 years ago