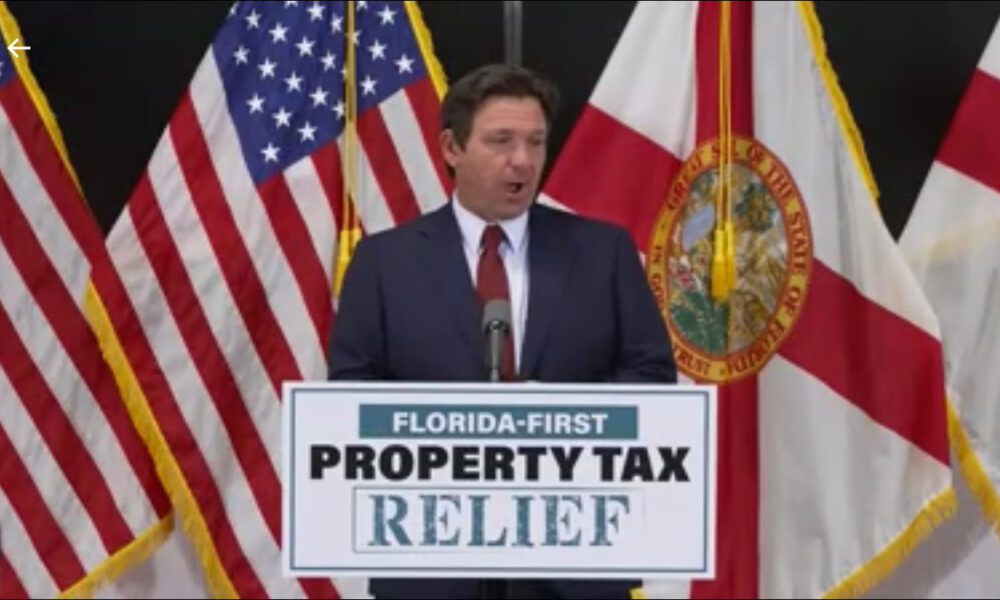

Gov. Ron DeSantis continues to leverage property tax as a political issue, arguing that the funding mechanism reduces Floridians to being “wards of the local government.”

But he doesn’t feel the same about a House proposal to cut sales taxes by 3/4 of a penny to 5.25%.

During a press conference, the Governor again argued that property taxes have emboldened local governments at the expense of homeowners who may relocate for jobs.

“We have a relatively mobile workforce. I mean, if you’re somebody that has a job in Tampa and then you have a better offer to come to Orlando, you sell that house. But then now you’re buying a new house at a higher value. You’re locked into a higher tax base right there. And so that has been something that’s been very difficult for a lot of people to afford,” DeSantis said.

DeSantis also said again that foreign tourists could make up for the elimination of property taxes, via efforts to “offload the tax burden to non-Floridians.”

“I want Canadian tourists and Brazilian tourists subsidizing the state and making it so Florida residents pay less taxes. I don’t want to give Canadians a tax cut,” DeSantis said, referring to out-of-staters paying sales taxes.

Though Canadians aren’t flying to Florida as much as they were before Donald Trump began to float annexing the country, DeSantis says they still love the state and him.

“They said the Canadians weren’t going to come. I’m with my kids, you know, we were down in Spring Break and we’re at Legoland. And all these people are coming up to me for pictures, which is fine. I normally do that” DeSantis said.

“I’d say like 80% of them were Canadians. And I’m like, I thought you guys weren’t coming to Florida anymore. ‘Oh, no, we love Florida.’ No, so we’re going to continue to be a destination.”

To that end, he voiced his objections to the sales tax cut proposed by the House.

“The issue with that is people, one, are not clamoring for sales tax if they’re clamoring for property tax reliefs. There’s no property tax relief in that proposal. But it also allows relief for foreigners. It allows relief for visitors and part-time residents. I think the tax relief needs to be focused on Floridians,” he said.

DeSantis lauded the House for looking to cut the budget by $5 billion, but said it should go to property tax relief for homesteaded properties, “likely about $1,000 per homesteaded property.”

That said, he did leave an opening for sales tax relief contingent on a millage break, saying there was a scenario where he could support lower sales taxes also.

“Well, we’re going to support lower taxes. And so I veto higher taxes when they come down the pike and I support lower taxes. I’m fine with doing sales tax reductions. Heck, I’ve proposed sales tax reductions and enacted many sales tax reductions since I’ve been governor, and I’m happy to do that, but I also think that how are you cutting taxes? Are you going to focus on what gets you the most banging for the Buck to help Florida residents? That is where I think the focus needs to be. So you got to do property relief. If you want to do sales on top of that, I’m all for tha. But this property stuff needs to be addressed.”

DeSantis would like a ballot initiative during next year’s General Election to eliminate property taxes altogether. He argues that local budgets have ballooned in recent years and that increased property taxes, which burden homeowners of modest means, have helped that happen. Yet he also says that rural counties without tourism might have a different property tax scheme than places in South Florida to where visitors flock.

Tim Weisheyer of the Florida Realtors said his group of 240,000 real estate agents backed the property tax proposal as a way of trying to “preserve the American dream,” to “open up the marketplace,” and to protect people on fixed incomes.

The American dream notwithstanding, elimination of property taxes would leave holes in current budgets.

As the Florida Policy Institute noted in a criticism of the tax cut concept, property taxes make up roughly a sixth of county and city revenue and more than half of school district revenue. If the taxes were eliminated, it would leave a revenue hole of more than $2,000 for every man, woman and child in the state.

That money would not come from the state, DeSantis said earlier this year.

“Don’t let anyone tell you we’re going to seek to raise state taxes because this body will not pass tax increases, and this Governor will not sign any tax increases,” he said during the State of the State address.

In lieu of state support and property taxes, local option taxes may be an option. These include extra levies on hotels, food and fuel, along with other discretionary sales surtaxes. But state law caps many of these, and some areas are more maxed out than others, complicating this potential workaround.

Post Views: 0