Business

Google is winning the Big Tech AI race as its stock posts 68% gain

Investing in Big Tech companies used to be simple and straightforward. You could simply scoop up a basket of the five Internet giants—Apple, Amazon, Microsoft, Meta and Google’s parent firm Alphabet—and count on them to outperform the market. Their share price didn’t move strictly in tandem, but you could expect a close sector-wide correlation. Now, in the AI era, all that’s gone out the window.

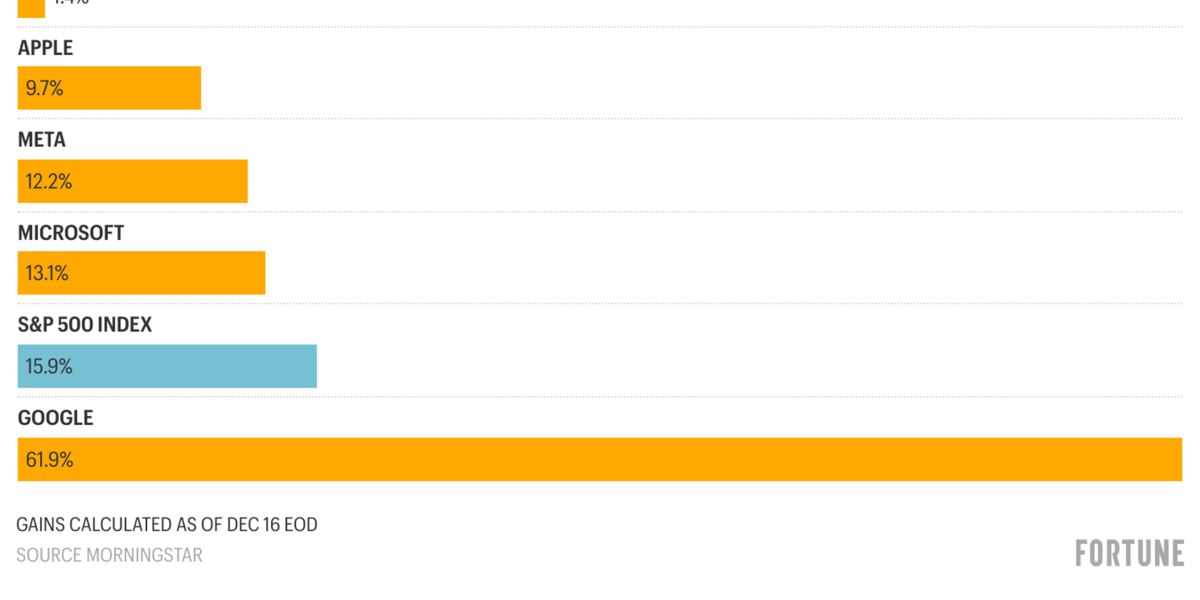

Looking at the share performance of the Big 5 this year, it’s hard to believe these companies are in the same category. Three of the group are lagging slightly behind the overall S&P 500 index, which is on track for a roughly 16% gain this year. The group—Microsoft, Apple and Meta—is instead pacing at around 13%, 12% and 10% respectively. A fourth, one-time market darling Amazon, is floundering far behind with a miserable 1% gain. Then there is Google, whose current gains of around 62% make it one of the best performing stocks of 2025.

This wild divergence among the biggest of the Big Tech players is directly tied to how well they are faring in artificial intelligence. In the last two years, AI has become an overriding fixation for investors, and led all five companies to spend eye-popping sums on talent and infrastructure. Google, though, appears to be the only one that has parlayed its investment into a winning business strategy. This raises the question of how exactly the search giant pulled this off, and whether any of the four laggards can do the same—and deliver a similar win for their suffering shareholders.

Google’s AI flywheel

Google’s AI-fueled stock gains are impressive, especially in light of its early misfires with the technology. The most notable of these came in February of 2024 when, in an attempt to pull even with the capabilities of OpenAI’s wildly popular ChatGPT, Google rebooted its first mediocre AI chatbot, Bard, and launched a rebranded, multimodal AI under the new Gemini name. The new product’s error-filled results and blatant political biases—including the depiction of Nazis as people of color—led investors to punish Google stock, and worry that the company’s leadership had already lost the AI race.

That narrative soon changed, however, when Google took Gemini back to the shop for a deep overhaul, and released vastly improved versions in the second half of last year. Meanwhile, the company has integrated AI features almost seamlessly into its core search product, while creating buzz around new products like image-generating service Nano Banana, which debuted this summer.

These launches have helped boost its share price, but are just one part of a broader AI success story. The reason Google is pulling away is because the company is tapping into various AI strengths, and building a broader flywheel that is generating a constant series of improvements.

For starters, the search giant has a powerful research lab in the form of Google DeepMind that has helped it build a model to compete with the likes of OpenAI. It also has its own in-house cloud service, Google Cloud, which provides the infrastructure to satisfy the insatiable energy and compute demands of running a scaled AI service. Critically, its infrastructure stack also includes its in-house AI chips, called Tensor Processing Units, meaning Google doesn’t have to compete in the global scramble for Nvidia chips. Meanwhile, TPUs are no second-rate technology. The latest version of the chip, known as Ironwood, is the TPU’s seventh iteration, and is being sought out by other leading AI players.

All of this means Google is singularly positioned among its Big Tech rivals to excel in AI technology and know-how. At the same time, its recent performance has allayed fears that broadening its AI offerings meant cannibalizing revenue from its core search business. Instead, Google is showing that AI can be accretive, even allowing the company to charge advertisers more on the ground that clicks tied to tools like AI Overview reflect a high search intent.

Even better for the company, it has numerous products where it can test and fine-tune its AI offerings, including YouTube, Maps and its core search product. And while not known as an enterprise company, products like Google Docs, Sheets and Gmail mean it has millions of opportunities to test out AI in the workplace. Finally, Google has a strong foothold in the devices sector—where many think the future fight for AI dominance will play out—thanks to Pixel phones and long involvement in the Android operating system.

All of Google’s Big Tech rivals, meanwhile, lack some or most of the components making up its AI flywheel. But the story of Silicon Valley is one of constant disruption, meaning any of the other firms still has a shot to build or buy their way back into the lead.

Can the rest of the Big Tech 5 catch up?

The value of Big Tech firms is, like any company, determined by multiple factors. Still, the relatively poor performance of shares in Amazon, Apple, Microsoft and Meta appears to be entirely a function of their failing to show big returns on their massive AI investments.

Amazon, the worst of the laggards by far, does have one obvious attribute that makes it a contender: its industry-leading AWS cloud, which means the firm is well positioned to run AI operations at scale. Unfortunately, the Seattle firm is falling far short on other fronts.

In the case of chips, Amazon has been producing its own, known as Trainium, for some time in order to reduce reliance on Nvidia. The chips, however, appear far from best in class—an assessment reflected in the decision of Amazon’s close partner, Anthropic, to deploy Google’s chips as well.

On the LLM front, Amazon has its own models, but has also invested $8 billion in Anthropic, reflecting its ongoing need to build strategic capacity to keep up with other big AI players. Meanwhile, Amazon has few options when it comes to deploying the AI expertise it acquires. Shopping, which is the company’s bread-and-butter, is just one narrow application in a far broader field, while Amazon’s Alexa and Echo devices have nowhere near the reach of numerous Google products. At the same time, Amazon has not made the most of the device opportunities it does have; reviews of its new AI-branded AIexa+ have been lukewarm.

Then there is Meta, which is the second worst stock performer of the Big 5 this year, despite flashing early promise in AI. That potential has been most prominent in the company’s family of open source Llama models, which Meta is deploying across its various properties, including Facebook, WhatsApp and Instagram. The most recent versions of Llama, however, have failed to keep up with rivals’ newer models, even as the company is spending eye-watering amounts of money to poach prominent AI researchers.

Less encouraging for Meta’s AI efforts are its lack of a cloud and limited in-house chip capacity, which has led it to turn to Google as a supplier. And while its huge social media footprint is a natural distribution platform, tech observers note that Meta has already deployed AI extensively to boost ad performance—and that it may have already reaped most of the significant gains on this front. Worse, according to the New York Times, the splashy new hires have created internal company friction between the researchers who want to push the bounds of AI science, and company executives who want to see concrete financial gains.

As for Microsoft, the Big Tech firm that has come closest among the laggards in keeping pace with the S&P 500, it has the same cloud advantage as Amazon and Google. It is also a relatively early mover in the AI field, thanks to its large investment in OpenAI and early ties to the startup. Lately, though, the tie-up between Microsoft and OpenAI’s Sam Altman has been strained, which could complicate the software giant’s future path.

Unlike its arch-rival Google, Microsoft is not known for its chip prowess and has largely relied on Nvidia GPUs over its in-house chips. And while the company has a huge distribution footprint—think Office, Bing, LinkedIn and more—it has failed to rack up early wins. That includes in the enterprise sector, which Microsoft traditionally dominates, but where its CoPilot AI tool has failed to impress.

Finally, there is Apple, whose AI record has been sparse and disappointing. This is perhaps surprising given the iPhone maker’s extensive hardware expertise, and long experience with cloud services. Apple, however, faces distinct challenges from other Big Tech firms. Those include making privacy a core part of its brand appeal. This may appeal to consumers, but it’s also not conducive to the sort of massive data-gobbling that goes with building large AI models.

Two potential game-changers for investors

The growing perception that Google is pulling away with the AI game is reflected both in vibes and in the company’s share price. At the same time, there is another key metric that suggests the stock price could go higher still.

Namely, the P/E ratio—a metric that has long been useful in determining whether a company is over-valued—is currently around 30 for Google. That is around the same level as Meta and Amazon, and significantly lower than that of Microsoft and Apple, which means the market may not have yet baked in the possibility of Google translating its AI performance into revenue growth.

Even as Google is enjoying front-of-the-pack status among its longtime Internet peers, there are two developments that could significantly shake up the AI race in Big Tech.

The first is one of its rivals carrying out a major acquisition to boost their standing in AI, and more effectively take on Google. This may be easier said than done, however, since there are relatively few big AI startups left on the board. The most tempting target may be Anthropic, but its valuation has grown so large that it may be too big even for a Big Tech firm to swallow.

The other factor that could shake up the AI race is shifting consumer behavior. There is wide speculation that people will come to embrace new ways to interact with AI, including through new types of wearable or embedded devices. Startups like Friend are selling AI pendants, and Meta is making a major bet on Ray-Ban style glasses with built-in AI screens.

Sales of these wearable AI devices, however, have been modest at best and it’s not clear they will ever fully catch on. Instead, it’s not hard to imagine consumers choosing to stick with their phones and watches for the foreseeable AI future, until a new paradigm emerges—perhaps one involving internal chips and biometrics.

The upshot is that the contours of the AI economy are still emerging, and that new technologies and companies will arrive to serve it en masse. Until then, however, the companies at the core of Big Tech will continue to have a big AI presence—especially Google.