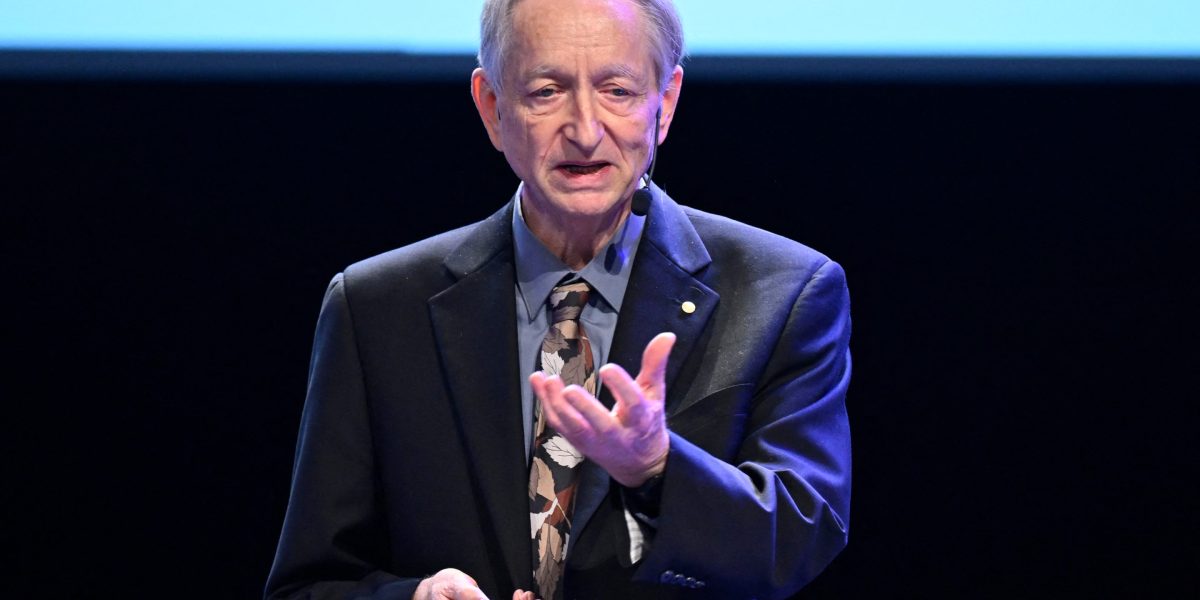

Pioneering computer scientist Geoffrey Hinton, whose work has earned him a Nobel Prize and the moniker “godfather of AI,” said artificial intelligence will spark a surge in unemployment and profits.

In a wide-ranging interview with the Financial Times, the former Google scientist cleared the air about why he left the tech giant, raised alarms on potential threats from AI, and revealed how he uses the technology. But he also predicted who the winners and losers will be.

“What’s actually going to happen is rich people are going to use AI to replace workers,” Hinton said. “It’s going to create massive unemployment and a huge rise in profits. It will make a few people much richer and most people poorer. That’s not AI’s fault, that is the capitalist system.”

That echos comments he gave to Fortune last month, when he said AI companies are more concerned with short-term profits than the long-term consequences of the technology.

For now, layoffs haven’t spiked, but evidence is mounting that AI is shrinking opportunities, especially at the entry level where recent college graduates start their careers.

A survey from the New York Fed found that companies using AI are much more likely to retrain their employees than fire them, though layoffs are expected to rise in the coming months.

Hinton said earlier that healthcare is the one industry that will be safe from the potential jobs armageddon.

“If you could make doctors five times as efficient, we could all have five times as much health care for the same price,” he explained on the Diary of a CEO YouTube series in June. “There’s almost no limit to how much health care people can absorb—[patients] always want more health care if there’s no cost to it.”

Still, Hinton believes that jobs that perform mundane tasks will be taken over by AI, while sparing some jobs that require a high level of skill.

In his interview with the FT, he also dismissed OpenAI CEO Sam Altman’s idea to pay a universal basic income as AI disrupts the economy and reduce demand for workers, saying it “won’t deal with human dignity” and the value people derive from having jobs.

Hinton has long warned about the dangers of AI without guardrails, estimating a 10% to 20% chance of the technology wiping out humans after the development of superintelligence.

In his view, the dangers of AI fall into two categories: the risk the technology itself poses to the future of humanity, and the consequences of AI being manipulated by people with bad intent.

In his FT interview, he warned AI could help someone build a bioweapon and lamented the Trump administration’s unwillingness to regulate AI more closely, while China is taking the threat more seriously. But he also acknowledged potential upside from AI amid its immense possibilities and uncertainties.

“We don’t know what is going to happen, we have no idea, and people who tell you what is going to happen are just being silly,” Hinton said. “We are at a point in history where something amazing is happening, and it may be amazingly good, and it may be amazingly bad. We can make guesses, but things aren’t going to stay like they are.”

Meanwhile, he told the FT how he uses AI in his own life, saying OpenAI’s ChatGPT is his product of choice. While he mostly uses the chatbot for research, Hinton revealed that a former girlfriend used ChatGPT “to tell me what a rat I was” during their breakup.

“She got the chatbot to explain how awful my behavior was and gave it to me. I didn’t think I had been a rat, so it didn’t make me feel too bad . . . I met somebody I liked more, you know how it goes,” he quipped.

Hinton also explained why he left Google in 2023. While media reports have said he quit so he could speak more freely about the dangers of AI, the 77-year-old Nobel laureate denied that was the reason.

“I left because I was 75, I could no longer program as well as I used to, and there’s a lot of stuff on Netflix I haven’t had a chance to watch,” he said. “I had worked very hard for 55 years, and I felt it was time to retire . . . And I thought, since I am leaving anyway, I could talk about the risks.”

Politics9 years ago

Politics9 years ago

Entertainment9 years ago

Entertainment9 years ago

Politics9 years ago

Politics9 years ago

Politics9 years ago

Politics9 years ago

Entertainment9 years ago

Entertainment9 years ago

Entertainment9 years ago

Entertainment9 years ago

Business9 years ago

Business9 years ago

Tech9 years ago

Tech9 years ago