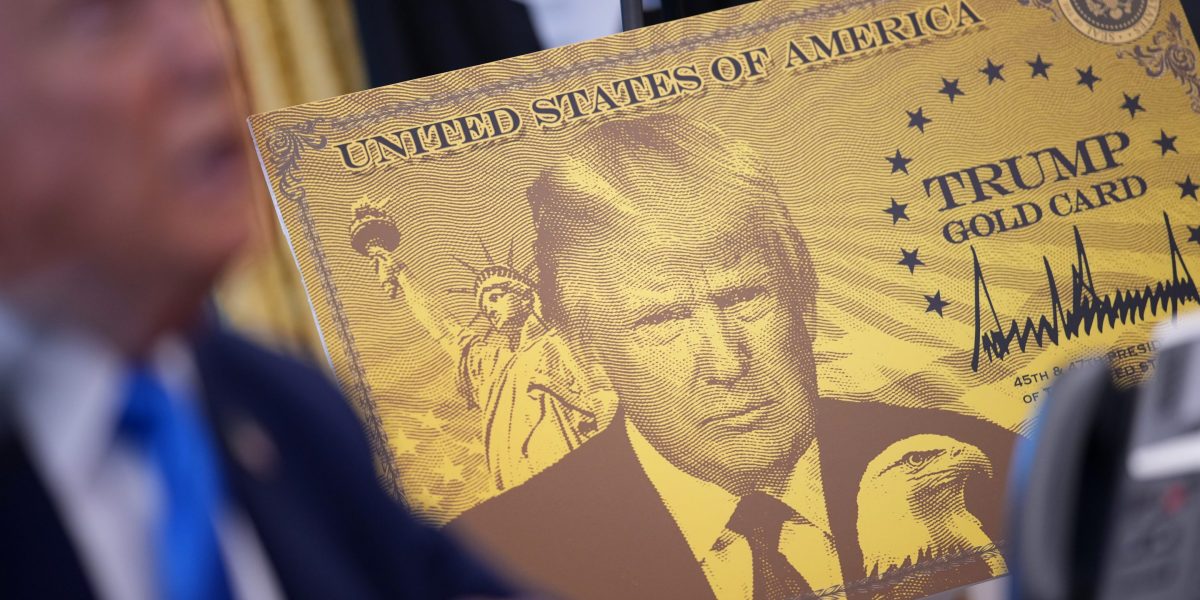

While President Donald Trump is creating new options for the world’s wealthy to move to the US, Europe has been heading in the opposite direction.

The continent is pulling back on its so-called golden visa programs after they failed to deliver the hoped-for benefits and in some cases backfired. That’s especially true for Portugal, where one of Europe’s most popular programs led to foreigners bidding up homes at the expense of locals.

In most but not all cases, the threshold for residency in Europe was much lower than the $1 million price tag on the Trump Gold Card — part of a broader upheaval of US immigration policy, which includes charging companies a $100,000 to hire college-educated workers from abroad.

Here’s an overview of Europe’s golden visa programs:

Portugal

The country ended the real estate path to a residency permit in 2023 in a bid to ease property prices. But an alternative route still exists.

Aimed at bolstering Portugal’s capital base, applicants must put at least €500,000 ($590,000) into an approved investment or venture capital fund. To qualify, the entities need to have more than 60% of resources in domestic assets, including bonds, stocks or local projects like farming and solar panels.

If opting to donate to a non-profit group, the amount goes down to €250,000, or as low as €200,000 if the organization benefits an area with a low-population density. The program has been popular with US, Brazilian and Chinese nationals.

Wealthy foreigners only have to spend one week a year in Portugal for the first year, and 14 days every subsequent two-year period to qualify for a fast-track to residency.

It’s had some strange effects like increasing the value of avocado farms and contributing to stock market gains. A classic-car museum in a small village has also raised money to improve its collection.

UK

A special visa for foreigners who invest significant sums in Britain has been discussed as part of Prime Minister Keir Starmer’s plans to blunt the economic blow from recent tax hikes and wider curbs on work permits.

An investor visa is possible for people willing to fund sectors seen as strategically important, such as artificial intelligence, clean energy and life sciences, Bloomberg previously reported.

While the British government is wary about reviving problems associated with past golden visa programs, an investor visa could signal that the UK is charting a different course from the EU, which is trying to curb migration incentives aimed at the rich.

Separately, the UK is considering plans to waive some visa fees for top global talent, the Financial Times reported on Monday.

Greece

Investors from outside the European Union can obtain a golden visa in Greece by buying residential property worth €800,000 in Athens, the second-largest city of Thessaloniki or on islands with a population of more than 3,100 people.

Elsewhere in the country, the home has to be worth at least €400,000. Alternatively, an investment of €250,000 can be made in a commercial property that is converted for residential use.

In all cases, the properties can’t be used for short-term rentals and must be larger than 120 square meters (1,300 square feet).

Other options for obtaining residency include making investments of varying amounts in Greek government bonds, technology startups or renovating historical buildings.

Citizens from China and Turkey are the top two groups who have received Greek golden visas, while demand from the UK increased after Brexit. Israeli applications have risen amid the ongoing Gaza conflict, while more recently demand from the US has grown, according to official figures.

The residence permit is issued for five years and can be renewed indefinitely, provided the investment is maintained. Investors who obtain the visa aren’t obliged to reside in Greece.

Hungary

The country shut down its original golden visa program in 2017 amid corruption concerns, but brought back a new version last year. The relaunch aimed to attract wealthy foreigners while addressing some of the criticisms levelled at the earlier program. It also sought to channel investment into the local economy without overheating the housing market.

Applicants can now qualify in two ways. One option is putting at least €250,000 into an approved real estate investment fund. These investments must be held for five years, and the fund is required to invest at least 40% of its net assets in Hungarian residential property.

The second path involves a €1 million donation to a higher-education institution operated by a public-interest trust.

The permit is granted for up to 10 years and can be renewed once for another decade, making it one of the longest-term residency options in Europe.

Importantly, Hungary scrapped the earlier €500,000 direct residential property purchase route at the start of this year, meaning investors can no longer qualify by buying real estate outright.

Italy

The country introduced a special visa aimed at attracting foreign investors in late 2017. In exchange for a strategic investment, the program allows non-EU citizens a renewable two-year residency permit.

Investments that count toward the visa include at least €2 million in Italian state bonds, €500,000 in an Italian company or €250,000 in an innovative Italian startup. Alternatively, applicants can also make a philanthropic donation of at least €1 million in sectors of public interest.

The Investor Visa for Italy — suspended for citizens from Russia and Belarus — is only for individuals, but recipients can apply for residency permits for spouses, children and elderly parents.

Numbers on the program are scarce. As of the end of 2021, there had been 64 applications from 20 different nationalities and 50 people were accepted for a total of €40 million in investments. Prime Minister Giorgia Meloni’s administration has not provided further updates on the program.

Spain

Prime Minister Pedro Sanchez’s government last year ended its golden visa program for foreign property buyers in a bid to increase the amount of affordable housing available to locals.

The program, which granted residence permits to non-EU citizens who invest at least €500,000 in a house in Spain, attracted thousands of people. Investors were mainly from China, Russia, the US and UK.

Like some similar programs, it was launched in the wake of the 2008 financial crisis, when Spain was desperate for funds, but it became a political liability for Sanchez with the economy growing and Spaniards struggling to afford homes.

Ireland

With a now-thriving economy, Ireland ended its golden visa program in February 2023 following a review of its “appropriateness.” Introduced by the Irish government in 2012 for non-EU nationals with a personal wealth of at least €2 million, applications were dominated by wealthy Chinese individuals.

The government continued to process applications received by the Feb. 15 deadline, approving 535 visas in 2024 — 97% of which were from Chinese nationals. In the first six months of 2025, Ireland approved 208 applications including 185 Chinese and 11 US individuals.

It’s expected to take a number of years to process the remaining applications received up to the deadline, the Department of Justice said.

The Netherlands

A program to attract foreign investors by offering residency in exchange for a €1.25 million investment was discontinued in April last year because of a lack of interest.

Less than 10 permits were issued over the past years, according to the Dutch Immigration Service’s website. Even after rules were relaxed, the Netherlands didn’t receive more applicants.

Malta

Europe’s top court banned a program by Malta that provided a so-called golden passport, in other words offering ciitizenship in exchange for investment. It was last the EU member state that had such a program.

The European Court of Justice decision from late April specified that an EU member state could not issue a passport unless an applicant had a “genuine link” to the nation, addressing a key criticism of loose rules.

The European Commission, the EU’s executive branch, has long warned that golden visa programs expose the bloc to money laundering and security risks. The war in Ukraine also generated concern that sanctioned individuals may have used them to acquire access to the bloc.

North Macedonia

The country has a citizenship-by-investment program, allowing foreigners to get citizenship if they invest in North Macedonia, which is a candidate for EU membership. The amount ranges from €200,000 in a government-approved fund to €400,000 in a new business facility that creates at least 10 jobs — retail and hospitality sectors are excluded.

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Business8 years ago

Business8 years ago

Tech8 years ago

Tech8 years ago