Some of Big Tech’s greatest success stories are from college dropouts. Mark Zuckerberg launched Facebook in 2004 from his Harvard University dorm room (and later dropped out). Bill Gates also left Harvard and cofounded Microsoft with Paul Allen in 1975.

But Jeff Bezos, founder of the world’s largest online retailer Amazon, said Zuckerberg and Gates are the “exception” to the idea that all major tech companies were founded by college dropouts and that a degree doesn’t matter as much these days.

While it’s “possible” to be 18, 19, or 20 years old and drop out of college to become a great entrepreneur, Bezos said these tech leaders are an exception.

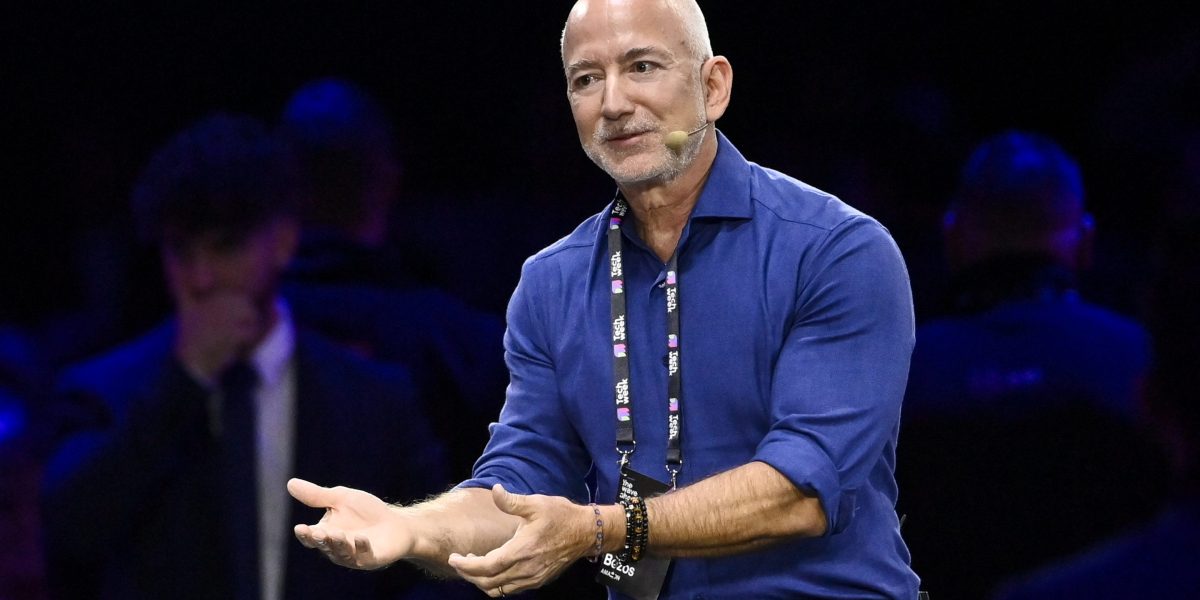

“I always advise to young people: Go work at a best-practices company somewhere where you can learn a lot of basic fundamental things [like] how to hire really well, how to interview, etc.,” Bezos said during an interview at Italian Tech Week last fall. “There’s a lot of stuff you would learn in a great company that will help you, and then there’s still lots of time to start a company after you have absorbed it.”

Working at a company, instead of immediately trying to start one, “increases your odds” of being successful, he added.

Bezos, now the third-richest person in the world at a $268 billion net worth, founded Amazon when he was 30 years old after about a decade of work experience. Both Gates and Zuckerberg, on the other hand, were just 19 years old when they launched Microsoft and Facebook, respectively. Still, Zuckerberg is the sixth-wealthiest person in the world with a $231 billion net worth, and Gates is the 16th-richest at a $118 billion net worth.

But Bezos says that “extra 10 years of experience actually improved the odds that Amazon would succeed.” And succeed it did: Today, the online retailer has a whopping $2.64 trillion market cap.

Not only did Bezos have work experience, but he also finished college. He graduated summa cum laude—the highest honors—from Princeton University in 1986 with a bachelor’s degree in engineering.

He was also elected to honor societies Phi Beta Kappa and Tau Beta Pi, and also served as president of the Princeton chapter of the Students for the Exploration and Development of Space. That academic focus later came to fruition in 2000 with Bezos’s aerospace-tech company Blue Origin, which he’s described as the “most important work” he does. Blue Origin is a private company, so its valuation has never been disclosed, but Bezos has said he thinks it will eventually be bigger than Amazon.

“That would always be my advice: I finished college, and I enjoyed college,” Bezos said. “I think it’s been helpful to me.”

Still, younger generations continue to question the value of a college degree. As the cost of college continues to grow and available jobs for newer grads shrink, many are starting to question the real return on investment for a degree. Even Jim Farley, the CEO of Ford, said during a recent company conference last week, going to college “should be a debate.”

“Nothing in the history of Western civilization has gotten more expensive, more quickly,” added Mike Rowe, a longtime vocational advocate. “Not energy, not food, not real estate, not even health care, [nothing has been inflated more] than the cost of a four-year degree.”

A version of this story was published on Fortune.com on October 6, 2025.

More on entrepreneurship:

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Business8 years ago

Business8 years ago

Tech8 years ago

Tech8 years ago