Supplies of high-demand obesity treatments are improving, but that doesn’t mean it’s easier to get them.

Many employers and insurers are scaling back coverage of Wegovy and Zepbound and a key government program, Medicare, doesn’t cover the drugs for obesity. Meanwhile, some big employers are adding coverage, but their commitment isn’t guaranteed.

Treatment prices that can top hundreds of dollars monthly even after discounts make it hard for many people to afford these drugs on their own. That can make the life-changing weight loss that patients seek dependent on the coverage they have and how long it lasts.

Coverage complications are not unusual in the U.S. health care system. But the challenge is magnified for these obesity treatments because a wide swath of the population could be eligible to take them, and patients have to stay on the drugs to keep the weight off.

“There are a lot of people right now who want access to the medication and can’t get it,” said Katherine Hempstead, a Robert Wood Johnson Foundation senior policy adviser.

Coverage varies depending on who pays the bill

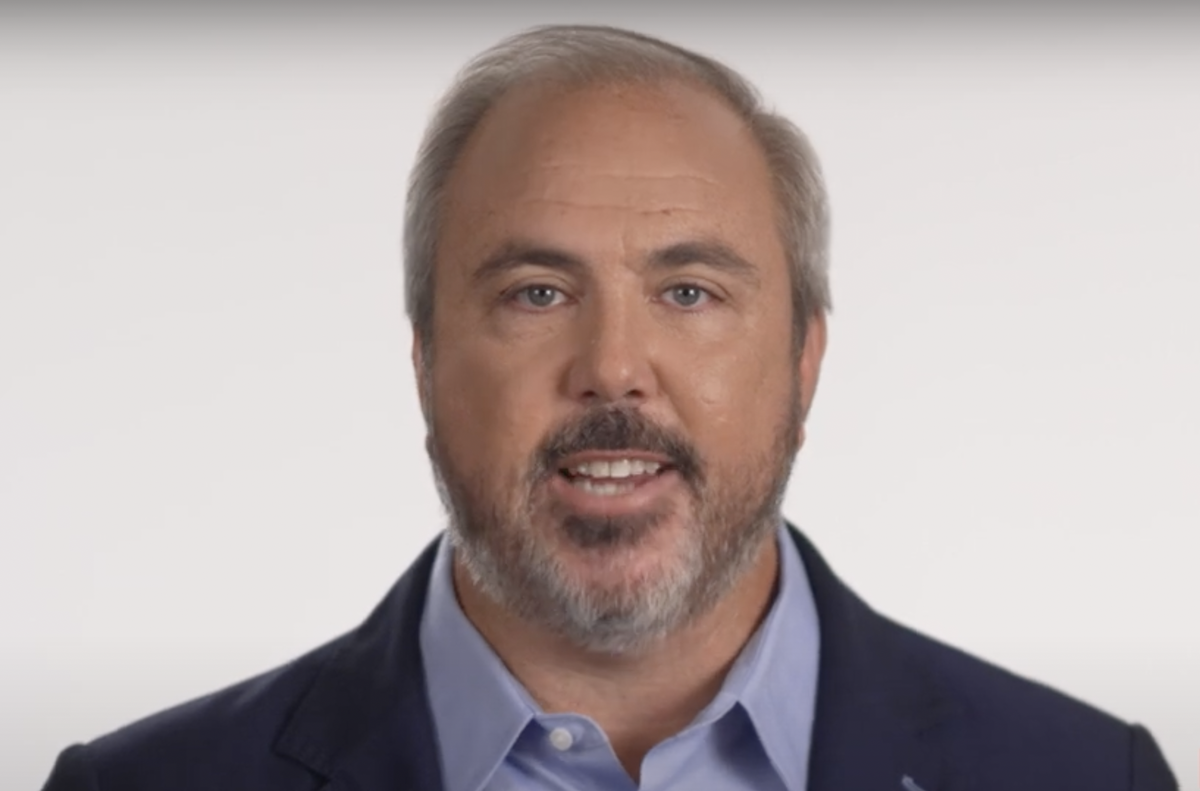

Paul Mack dropped about 70 pounds after he started taking Wegovy. The Redwood City, California, resident said food noise — constant thoughts of eating — faded, and he was able to have a heart procedure.

The treatment was covered by California’s Medicaid program, Medi-Cal. Then the 50-year-old security guard got a raise. He no longer qualified for Medi-Cal and lost coverage of the drug for several months starting last summer.

He regained two pants sizes.

“I couldn’t control the eating,” he said. “All the noise came back.”

Coverage of these drugs remains patchy more than a year after Zepbound entered the market to challenge Wegovy.

The benefits consultant Mercer says 44% of U.S. companies with 500 or more employees covered obesity drugs last year. It’s even more common with bigger employers.

More than a dozen government-funded Medicaid programs for people with low incomes also cover obesity treatments.

But few insurers cover the drugs on individual insurance marketplaces. And some plans restrict their coverage with things like requests for prior authorization or pre-approval.

The lack of Medicare coverage remains a concern as well, especially for people who retire and move to the government-funded program from employer-sponsored coverage.

“Patients come to us terrified about switching to Medicare and losing coverage,” said Dr. Katherine Saunders, an obesity expert at Weill Cornell Medicine and cofounder of the obesity treatment company FlyteHealth. “We start talking about backup plans a year before they transition.”

Cost and uncertain payoff loom as concerns payer concerns

Philadelphia-area insurer Independence Blue Cross dropped coverage of the drugs solely for weight loss for some customers starting this year. Company officials say the insurer worried about premium hikes it would have to impose on all customers if it continued.

Cost also was a factor in decisions by West Virginia and North Carolina officials to end similar programs that provided coverage for state employees.

These concerns make Vanderbilt University researcher Stacie Dusetzina wonder how long employers who have added coverage will keep it, now that the drugs are no longer in short supply.

“That’s probably going to spike spending,” said Dusetzina, a health policy professor who studies drug costs.

Drugmakers tout the savings these drugs can provide by improving patient health and warding off future serious medical conditions like heart attacks or strokes.

But health care experts note that there are no guarantees that the employer or insurer who covers the drug will eventually reap those benefits because people may change jobs or insurers.

Will coverage ever become consistent?

There’s no clear path toward widespread coverage of these drugs for obesity, even as polls show Americans favor having Medicaid and Medicare cover the costs.

Leaders at Zepbound maker Eli Lilly have seen coverage grow steadily for their drug, and they’re optimistic that will continue.

Former President Joe Biden’s administration proposed a rule that would allow for Medicare and broader Medicaid coverage. Its fate remains uncertain in President Donald Trump’s administration.

A bill calling for Medicare coverage has been floating around Congress for years. But it isn’t scheduled for a vote.

Drugmakers are currently testing several additional obesity treatments. Such potential competition could reduce prices and prompt more coverage.

Patchy coverage complicates treatment plans

Dr. Amy Rothberg says the lack of consistent coverage leaves her conflicted about writing prescriptions because she’s not sure how long patients will be able to take the drug.

“We know from the studies that people go off these medications, they regain their weight,” said Rothberg, director of the University of Michigan’s weight-management program. “I don’t want to do harm.”

Some insurers require diet and exercise changes for the patient before they will cover a weight-loss medication. Those changes should happen in conjunction with starting the medicine, said Dr. Lydia Alexander, President of the Obesity Medicine Association.

She’s also seen requirements for a body mass index of 40 or more, which equates to severe obesity, before coverage can start.

“We’re saying that obesity is a disease, but we’re not treating it like a disease,” she said.

___

Republished with permission of The Associated Press.

Post Views: 0

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Politics8 years ago

Politics8 years ago

Tech8 years ago

Tech8 years ago