- US stock futures fell Sunday evening as Wall Street braced for the latest salvo in President Donald Trump’s trade war. The Wall Street Journal reported that advisers have considered a global tariff of up 20% on almost all countries, though reciprocal tariffs are still an option. That follows an earlier report that said Trump is eyeing more aggressive duties to transform the US economy.

Investors are buckling up for a potentially bumpy ride as a critical week for markets and the economy kicks off, with reports indicating President Donald Trump’s trade war could soon get even more intense.

Dow futures were down more than 180 points, or 0.43%, while S&P 500 futures fell 0.5% and Nasdaq futures dropped 0.7%. That follows Friday’s selloff that saw the broad market index sink 2%.

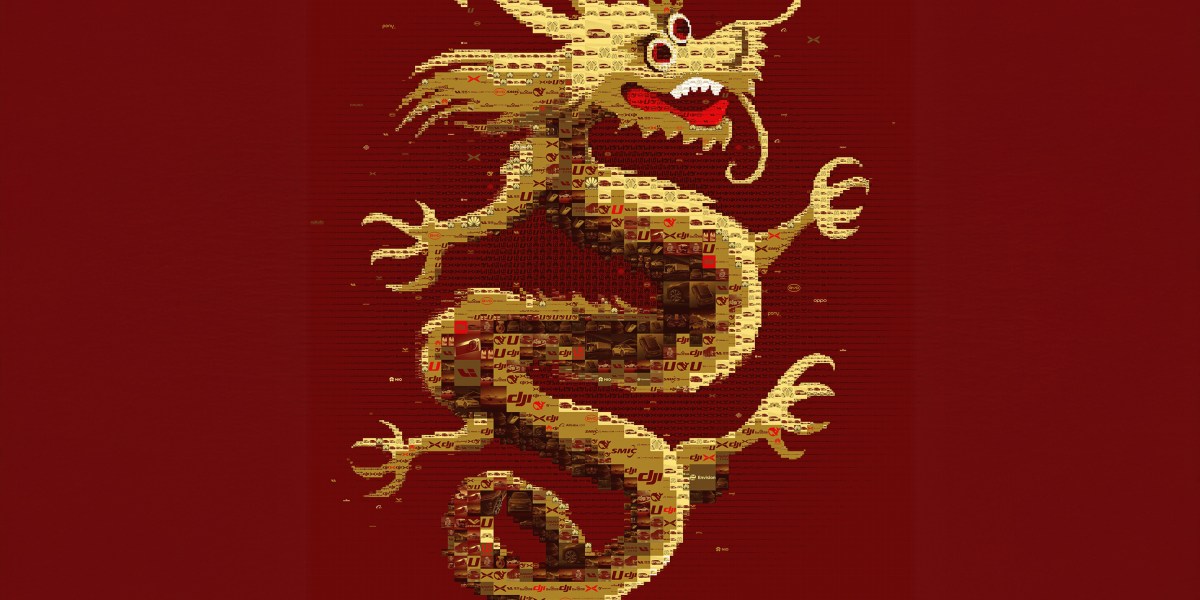

Tariff news dominated the weekend and indicated more escalation is ahead. On Sunday, sources told the Wall Street Journal that Trump has pushed his advisers to get more aggressive on tariffs, including higher rates on a wider set of nations.

One option under consideration in recent days is a global tariff of up to 20% that hits nearly all US trading partners, reviving an idea Trump floated on the campaign trail.

A 20% rate would further up the ante. Fitch Ratings earlier estimated that if Trump carried out all his previously announced plans, the effective US tariff rate could hit 18% on average—the highest level in 90 years.

Reciprocal tariffs, where the US matches duties or trade barriers from other countries, are still an option too, according to the Journal, but one source that said Trump wants a “big and simple” policy.

That suggests the eventual tariff policy will be broader than Treasury Secretary Scott Bessent’s “dirty 15” plan to set tariffs on the 15% of countries that the administration considers the worst trading partners.

The White House didn’t immediately respond to a request for comment.

Similarly, the Washington Post reported on Saturday that Trump is considering a single universal tariff as part of an effort to fundamentally transform the US economy.

That means most imports would face the same rate no matter which country they are from, the report said, adding that Trump views a single duty as less likely to be watered down by exemptions.

Intense discussions are ongoing ahead of Wednesday, which Trump has billed as “Liberation Day,” when his next batch of tariffs will be unveiled.

Trump has already slapped tariffs on China, Canada, Mexico, steel, aluminum and autos, while threatening duties on pharmaceuticals, chips, lumber and the European Union.

Last week, he suggested he would show some “flexibility” on reciprocal tariffs, and earlier reports said those would be more targeted, raising hopes on Wall Street that their impact would be less severe.

But after stocks rallied, his announcement of auto tariffs on Wednesday contributed to another selloff, which was also fueled by signs that tariffs were worsening inflation as well as consumers’ expectations of future inflation.

Also on Saturday, Trump stood by his auto tariffs, telling NBC News that they are permanent and that he doesn’t care of they cause carmakers to hike prices.

“I couldn’t care less if they raise prices, because people are going to start buying American-made cars,” he said. “I couldn’t care less. I hope they raise their prices, because if they do, people are gonna buy American-made cars. We have plenty.”

Trump later said if prices on foreign cars go up, then consumers will buy American cars.

Meanwhile, several big reports are due this week that could reveal how much stress the economy is feeling from Trump’s tariffs and steep federal job cuts.

On Tuesday, the Institute for Supply Management’s manufacturing activity index for March will come out, and the Labor Department will report February job openings and turnover.

On Wednesday, ADP will release private-sector payroll data for March. On Thursday, ISM will publish its monthly services-activity index, and the Labor Department will report weekly jobless claims.

On Friday, the Labor Department will issue its highly anticipated March jobs report, and Federal Reserve Chairman Jerome Powell is also scheduled to speak.

This story was originally featured on Fortune.com

Source link

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Politics8 years ago

Politics8 years ago