Fashion

Clarks targets ‘little dreamers’ with Roald Dahl range

Published

6 hours agoon

By

Maxwell Hart

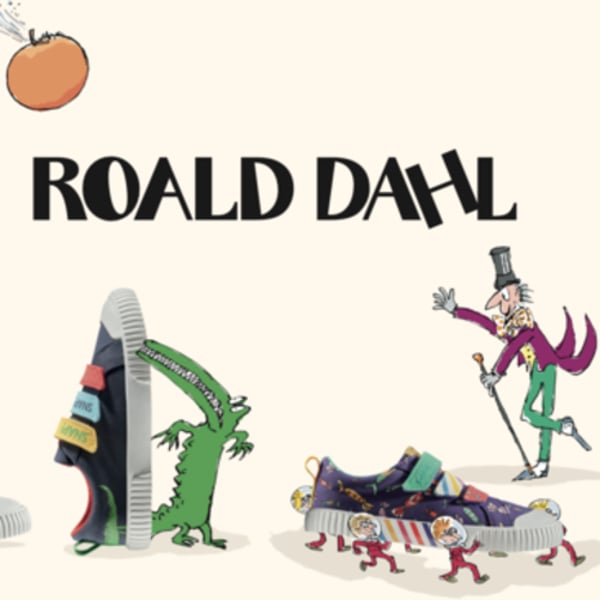

Major footwear brand Clarks is inviting ‘little dreamers’ to step into the world of Roald Dahl with a new kids’ shoe collection, launching in the UK today (3 March) in stores and online.

In collaboration with The Roald Dahl Story Company, the collection includes some of its most beloved children’s stories – Matilda, The Enormous Crocodile, Charlie and the Chocolate Factory and James and the Giant Peach.

Including “designs that celebrate imagination, adventure, and fun”, the exclusive range is “crafted for curious minds and confident steps” featuring vibrant canvas shoes and breathable sandals adorned with Quentin Blake’s unmistakable illustrations.

Foxing Air is available in both toddler and kids’ sizes, these canvas trainers feature a colourful peach pattern, centipede details on the heel tape, and rubber trims adorned with illustrations of James’ insect friends. Hidden peach motifs also come with soles stamped with the words ‘Magnifico!’and ‘Splendifico!’

Foxing Mix and Foxing Hi are vibrant purple canvas trainers feature a sweet-wrapper print, candy-striped rubber trim, and a hidden Golden Ticket detail on the tongue. They channel the magic of Willy Wonka’s factory and both styles have ‘ I’ve Got a Golden Ticket’ scripted across the soles.

Foxing Ace features navy canvas trainers showcasing a fearsome crocodile motif that stretches across both shoes, encouraging kids to join them together to reveal the full illustration. Featuring ‘Munch’ and ‘Crunch’ wording on the soles and ‘Snap! Snap!’ printed across the fastening straps.

Foxing Bow, a tribute to the small-but-mighty Matilda, is an off-white canvas sneaker adorned with an all-over letter print and signature red bows. With ‘Brave’ and ‘Mighty’ scripted on the soles.

Copyright © 2025 FashionNetwork.com All rights reserved.

You may like

Fashion

‘Printemps New York is not a classic department store’

Published

5 minutes agoon

March 3, 2025By

Maxwell Hart

“Not a department store”: in recent weeks, some of New York’s cabs have shed their traditional yellow to be adorned in green and display this graffitied phrase. The first wink from French department store Printemps ahead of its opening. In mid-2022, the French group surprised the department store world by announcing plans to open in the Big Apple.

The project, entrusted to Laura Lendrum (formery of Gucci, Saint Laurent U.S.), was to install Printemps in the imposing 1950s Art Deco building at 1 Wall Street. After months of work, during which architect Laura Gonzalez combined the spirit of the Parisian department store with the heritage of the New York building, the two-storey, 4,000-square-metre space opens its doors this Thursday and will be inaugurated on March 20, to celebrate spring. The opening is part of the building’s renovation, and Printemps is presenting a concept combining fashion, luxury (with French, American and international brands) and gastronomy with a proposal entrusted to American star chef Grégory Gourdet, with no less than five restaurants in its spaces designed to provide visitors with a memorable experience.

The Red Room, an imposing ten-metre-high space featuring a 1,200-square-metre purple and gold mosaic that was once the reception hall of a bank, referenced for its historical capital, is the pinnacle of the space and will house the department store’s shoe area. Those behind the project are determined to make the site more than just a department store, in a district undergoing transformation. This is a major gamble for the French group, in a complex context for department stores in America and one of globalized commercial tensions. Ahead of the opening, FashionNetwork.com spoke to Jean-Marc Bellaiche, chairman of the department store group, which has been owned by the Qatari Disa fund since 2013.

FashionNetwork.com: You’re opening this New York department store a few days after Donald Trump, the American president, announced plans to impose 25% tariffs (compared with around 10% previously) on goods from the European Union. Is this likely to penalize your project?

Jean-Marc Bellaiche: When we opened this store in New York, we took a long-term view. We don’t stop at short-term issues. Journalists have also told me that if the American economy does well, it will help our business. We don’t carry out a project based on the context of the moment, on the fact that a president announces he’s going to change such and such, or that the local economy is buoyant. Of course, it’s better if the economy is good in the next few years, but if the economy isn’t so good and the store doesn’t do so well, it won’t be the end of the world, because our approach is long-term. Customs duties can change over 10 or 15 years. In the end, what’s important is the store itself. Its offer.

FNW: A rise in customs duties to 25% could have an impact, all the same. No?

JMB: First of all, we have a mix of established and new brands, European and American brands. So, we’re not 100% European or French. What’s more, many European companies rely on production in other regions. And finally, we sell products that customers want. Price is obviously a factor, but the most important thing is not to be penalized in relation to others. If a pair of Dior shoes costs 15% or 25% more because of the price, but it’s the same at Dior, Saks and us, there will be customers who want to buy because it’s a fantastic brand. The customer will then choose the place that has done the best job of attracting them. That’s where we want to fight.

FNW: You had some great French brands, with know-how. They will, therefore, remain in your selection despite this context. You’re not going to adapt your concept from the very first season?

JMB: For us, it’s no small event to open this store in New York, even if, of course, it’s not the same size as Haussmann (Paris). I can tell you right away that next season, there will be a lot of things that didn’t work that we’ll have to change. But there will also be a lot of things that will work, which we’ll need to reinforce. That’s the life of the department store: it’s always adapting. But as far as French brands are concerned, we’re not going to remove them because of customs duties. There are new brands that Americans don’t know about. Take a brand like Joseph Duclos, for example. In the past, this brand served the kings of France. So it has an imaginary value and is being revived. And it’s been worn by Taylor Swift and Beyoncé. Until now, Americans could only buy it in Paris. We’re going to be the first to offer it in the United States. This is part of our French-curation American-hospitality approach.

FNW: You put forward this idea of a bridge between European products and the excellence of American hospitality. But the American department store ecosystem is in a state of disrepair, and in the past, examples of the establishment of foreign department stores in the U.S., such as Galeries Lafayette, have not been crowned with success. We wonder about the genesis of this project.

JMB: American consumers remain very dynamic. Over the long term, the U.S. market is the world leader in terms of the number of millionaires. It’s the country with the most wealthy people in the world, well ahead of the Chinese, even though the Chinese are far more likely to consume luxury goods anywhere in the world, according to studies by Bain or BCG. This means that it’s still a market with potential for fashion, premium, luxury and beauty.

Second thing. I lived in New York for ten years. I can confirm that there is indeed no need for a new department store. But at the same time, all New Yorkers will tell you that the departures of Barneys and Jeffreys have left a void. We humbly believe that, with the right format, we can bring a French and European sophistication to the table. The genesis is there: what if French curation met American hospitality and service levels? With the best of both worlds, would it be possible to forge a path? But that’s why our ambitions have been modest

After the Covid period, we had a proactive strategy aimed at American customers, with targeting at hotels in particular. This enabled us to triple our American clientele in Haussmann. We’re going to use our CRM tools to bring them to New York, but above all we’re going to conquer them. This opening also represents an asset for developing Printemps’ global reputation and attracting tourists to Paris. New York remains a hub for American, Chinese and Brazilian tourists. They all come to this neighborhood at some point, and I hope they’ll come to discover Printemps and buy. But even if they don’t buy, we’ll score points in terms of brand awareness. It’s an incredible advertising opportunity worldwide!

But we know it’s a complicated market. Under no circumstances did we want to arrive with 50,000 square meters and crush everyone else. We think that with a proportionate store of 4,000 square meters of sales area, it’s a good format. And it’s a very dynamic e-commerce market. After the physical opening phase, we will launch our online proposition in September.

FNW: This concept is 15 times smaller than Hausmann or 10 times smaller than the opening you did in Doha. How did you build the offer for this condensed format? What were the reactions of the brands?

JMB: Obviously, when you open a store, it’s never alone. Initially, the reflex of most brands was to say that they didn’t need a new outlet, but when we were able to present our initial intentions, some said “Now you’re hitting it big. We’re interested”. That’s the case with Dior in shoes. They don’t do all the categories because some brands have a retail logic and this store is a wholesale concept. But we have conceptualized a program around ephemeral spaces that allows brands to come in corner format. The process of building the offer has been carried out over several years. We created a mix of major brands such as Valentino in all categories, Bottega Veneta and Tom Ford in shoes, and our Red Room attracted players such as Manolo Blánik and Roger Vivier. But we also have Jil Sander, Margiela, Comme des Garçons, who can clearly generate traffic in store. And alongside this, we’ll have brands that are either coming to the U.S. for the first time, such as Joseph Duclos or Pinel Pinel, in another segment we have Ben Simon, Figaret and we’re bringing along our own brand Saison 1865. And in beauty, we’re offering perfumes and cosmetics with the idea of bringing the best secrets of the French, with brands like Nuxe, which is very hard to find in the U.S., and Mimétique. In all, we’re presenting some 450 brands. Nearly a quarter of these are new to the U.S., or have very limited distribution. It’s this mix that we believe will generate interest.

FNW: What exclusive propositions have you developed to create the event?

JMB: We’ll have a lot of exclusive propositions. But for example, at the opening, we’ll have a room customized by Nike – everyone knows the brand. Everyone knows the brand, so if they come in, it’s to present a highly specialized offer and collaborations that our buyers have selected with them. We’ll also have Coperni in the store. But the brand will also be setting up a pop-up to present an exclusive collection created with Disney. We also have a different collaboration. Most of the shoe brands present in the red room have decided to create exclusive red products.

FNW: In terms of location, with this emblematic Red Room, but also with the very strong concepts of the different universes, this store seems to want to position itself as a destination, rather than a commercial space.

JMB: Other assets were added when we found the location. In particular, when we discovered the Red Room, which is a major architectural asset. But we had to know what we were going to do there. On site, I quickly recruited Laura Lendrum, who has very strong expertise in the American market. Teams on both sides of the Atlantic worked on the concepts. We went from setting up a restaurant, to proposing a salon specifically for Cartier, to a multi-brand jewelry space. And finally, we decided to install the shoes.

Then, in our vision, the expression of this French curation and American hospitality went through the “food” component. On Haussmann, we have 15 restaurants, 1,000 seats and 400 with an Eiffel Tower view. Of course, New York doesn’t have such a view. But we’re putting the emphasis on five cafés and restaurants. Which is enormous for the surface area. The choice of Greg Bourdet seems really appropriate. He’s won a number of awards, been a top chef and enjoys a high profile. But his restaurant, which is always fully booked, is in Portland, Oregon. So for him too, it’s a New York location. Finally, I must mention the choice of architect. We’re very happy to have worked with Laura Gonzalez. We wanted someone with a French sensibility, particularly in Art Nouveau, but who had also worked in New York. She had already designed the Cartier mansion on 5th Avenue. It was important for her to have this experience, as the building is listed. But it was also important that her style matched ours. Laura is a maximalist, she’s very proud. And we were looking for a woman because Printemps is a feminine brand. Printemps was created by a man, but with money from a woman, who was an actress at the Comédie Française and who paid for the store (Jules and Augustine Jaluzot created Printemps in Paris in 1865). We’d also like to pay tribute to Augustine by entrusting this French apartment project to an architect.

FNW: What was her challenge?

JMB: There are two things that completely distinguish Printemps New York from a classic department store. The first is that we didn’t want a building with a central aisle. Here, the customer enters a lounge with a space magnified by a ceiling height of over 10 meters and the possibility of strolling around. The second element of the apartment concept is that one room can be painted pink, another green. We wanted each room to reflect its own approach. For example, the playroom was a new exercise for her, with a gamified universe. At 1 Wall Street, we’ll have a range of major brands and more niche brands, some of which will be available for the first time in the U.S., as well as food, services and programming. All in all, we’ve got a great cocktail.

FNW: And who will this concept be aimed at? What are the questions surrounding this opening?

JMB: When a store opens, everything is done to make it work. But to answer your question. There’s both a challenge and an opportunity linked to the neighborhood. The challenge is that it wasn’t a destination neighborhood. When I lived in New York, I used to go there from time to time, but that was because I was a bit of a tourist, but New Yorkers can go a year without going there. At least that was the case in the past. Saks had an outlet not far away, Neiman Marcus didn’t manage to establish itself. We’re aware of this context and that’s why we’re moving forward with humility. But I see it more as an opportunity, as the area is undergoing a major transformation.

I like to draw a parallel between the gamble taken by our founder in 1865. At the time, the Saint-Lazare station had just opened and was dedicated to goods traffic, and there was no Opéra and, of course, no Galeries Lafayette. When he saw the Madeleine, he thought the bourgeoisie could come into his stores. The area went on to become the successful neighborhood it is today. For me, New York is a bit like that. There are more residents. My team tells me that the number of residents has tripled in five years. In fact, we’re standing at the foot of a building with 560 apartments. It’s becoming a living space.

The other aspect is that this financial district, which used to be the banking district, is now attracting players in the tech, fashion and media industries. There’s Condesa, Gucci and SMCP headquarters. We’re also going to talk to the commuter population. Finally, the most important change is that the neighborhood is becoming attractive to Upper East Side residents. Michelin-starred restaurateur Jean-Georges bought a whole complex to create his Tin Building restaurant complex, which is ten minutes away, Cipriani opened Downtown, and the Performing Arts Center opened a year-and-a-half ago as a project of Mike Bloomberg, who should be pleased to be here for the inauguration. This district is changing, and with Printemps we’re going to be part of this dynamic, which continues to be an incredible tourist area.

FNW: What investment does this project represent, and what goals have you set yourself?

JMB: We’re not communicating on this. But it’s a magnificent store, so you’ll deduce that these are major investments. What I can say is that we’ve been fairly reasonable, precisely because this is a neighborhood in the making. We’re giving ourselves time to build up the store, with measured objectives for the first three years.

FNW: As far as the Printemps group is concerned, in recent months you’ve said that you’ve returned to pre-Covid business levels. At that time, the group posted sales of 1.7 billion euros. Are you on top?

JMB: We don’t give our figures, but the data concerned our performance on a like-for-like basis. Obviously, the figures you gave included the stores we closed, notably the Louvre, which was a major store. The composition of our business is also very different. We rely much less on Chinese groups. On the other hand, we have made very strong progress with individual Chinese visitors. We’re making progress with the French, Americans and Koreans, even if it’s been more complicated in recent months, as well as in the Middle East.

FNW: In the Middle East, you opened Doha. Did this give you any particular experience before New York?

JMB: Everything is very different. In Doha, it’s a very big store and the concept doesn’t match at all. When you open a department store, you have to think local.

Over there, they were opening the Place Vendôme megacentre, so it had to be a large-scale project. But beyond the concept, it’s a franchise, run by a company related to our owner. This store in Doha is a real architectural success, a real success in terms of merchandising and the alignment of the offer. On the other hand, as far as the location is concerned, we wanted to develop a district where there are also museums. So that takes time. For Printemps New York, we are directly managing the project.

FNW: Do you have any plans to adjust the network? To open new stores directly or with franchise partners?

JMB: We tend to deal with projects one after the other. We don’t have a vision of conquest where we open 10 stores at once. Internationally, we’re looking at opportunities in all formats, but for the moment we don’t have any concrete plans to announce. In France, we all know that it’s a complicated business. The closures of Galeries Lafayette in Marseille, involving 150 employees, is sad news for the industry. This is an opportunity for our Printemps stores, both for customers in Marseille and for brands. But at the same time, we have had to cease operations at the Polygone Riviera in Cagnes-sur-mer (opened in 2015 on 9,000 square meters, editor’s note).

FNW: For many groups, the question of debt, particularly in relation to repayment of state-guaranteed loans, weighs heavily. What is the situation for the group, and what is the relationship with the owner?

JMB: The group returned to profitability more than two years ago, and it was important to regain this financial health. But, like many other companies, we have debt. So we have to either repay or renew our loans. And indeed, we have an EMP that needs to be repaid. There is a four-year repayment schedule, and we have repaid almost two-thirds of it. We have a very good relationship with our shareholder. He takes a long-term view and has been able to support us when we needed help. Right now, we’re in a phase with refinancing issues that sometimes make for short nights.

FNW: But your shareholder could sell the group?

JMB: He’s given us his support over the last few years. Of course, as with any shareholder, their support is not unlimited. It would be their legal right to decide to sell. But there are currently no such plans. We have major projects requiring investment. And here again, our shareholder has validated the first stages of this project. Given the global context, I’m not going to say that we’re totally out of the woods, but things are looking good.

FNW: How do you see 2025 as a whole?

JMB: We’re rather optimistic. Firstly, because there’s a mechanical effect compared with 2024, when the Olympic Games meant that we didn’t have a good summer. In fact, the summer will be better and Paris will be more attractive. The giant publicity stunt represented by the Paris Olympics will pay off. What’s more, we had a good Chinese New Year.

In fact, we are making strong progress in three key areas. We will be launching initiatives aimed at our very important customers. These are customers who spend more than 10,000 euros a year, or even more than 60,000 euros, and we have tripled our sales with them. We can go even further in welcoming these customers. In the course of the year, we’re also going to have some nice surprises with brands that have placed their trust in us. We’re also making progress in personal shopping, which we’re also going to develop in New York. And, having overhauled our e-commerce fundamentals, we’re ready to seize online opportunities. When I arrived in 2020, this represented 6% of the group’s sales. Now we’re up to 10%.

So despite the uncertainty of French politics and international uncertainties, I’m still very optimistic. China’s situation will remain complicated this year, but with a strong dollar, it’s becoming interesting for American exports and consumption in Paris. We’re entering a new phase for the group, with an even stronger focus on the customer, commerce, digital and agility.

Copyright © 2025 FashionNetwork.com All rights reserved.

Fashion

Versace owner Capri jumps on Prada moving closer to purchase

Published

36 minutes agoon

March 3, 2025By

Maxwell Hart

By

Bloomberg

Published

March 4, 2025

Capri Holdings Ltd. shares jumped as the U.S. company moves closer to a sale of its Italian luxury brand Versace to Prada SpA.

The Italian family-owned company and Capri have agreed to a price of as much as €1.5 billion ($1.6 billion) for the fashion house founded by the late Gianni Versace in 1978, people familiar with the matter said late Sunday.

Capri Holdings rose as much as 9.6% before the start of regular trading in New York on Monday. Prada shares gained as much as 4.1% in Hong Kong, where the stock was listed in 2011 in a nod to the importance of the Chinese market.

A potential acquisition of the fashion house renowned for its flashy ready-to-wear clothing designed by Donatella Versace — sister of the founder — would allow Prada to create a larger Italian player to compete with global luxury groups such as LVMH and Kering SA.

Capri, which also owns the Michael Kors and Jimmy Choo brands, has been struggling to revive sales growth and last month provided revenue guidance that missed analysts’ estimates, saying a turnaround will take some time.

Rating cut

Its planned $8.5 billion merger with Coach owner Tapestry Inc. collapsed last November after a judge agreed with the Federal Trade Commission’s opposition to the deal — adding to Capri’s difficulties. Its debt was downgraded to below investment grade by S&P Global Ratings in February.

Milan-based Prada and Capri could finalize a deal for Versace this month, said the people, asking not to be identified because discussions are private. Talks are progressing after initial due diligence didn’t find any risks, the people said.

The timing and valuation could change and negotiations could still fall apart, the people added. Capri, which bought Versace in 2018 for about €1.8 billion, didn’t immediately respond to requests for comment on Sunday. Prada declined to comment.

Prada emerged as one of the luxury sector’s winners amid a global downturn for high-end fashion items, and is set to report earnings Tuesday. Its sales surged in the third quarter of last year on the back of its Miu Miu brand, a label popular with younger consumers.

A purchase would run counter to a decades-long trend of Italian fashion groups, including Gucci and Valentino, being taken over by foreign firms.

“Prada would be well positioned to realise Versace’s brand potential in the long term, potentially paving way for the group to become Italy’s answer to the French luxury conglomerates,” UBS Group AG’s analysts led by Susy Tibaldi said in a Feb. 28 note.

The aesthetics of the minimalistic Prada and “maximalist” Versace “are polar opposites” and wouldn’t run the risk of cannibalization, the UBS analysts said in a note.

Fashion

Anthropologie launches fellowship program with Nest

Published

1 hour agoon

March 3, 2025By

Maxwell Hart

Anthropologie announced on Monday an expanded partnership with Nest, a nonprofit dedicated to empowering artisans and makers, as part of Women’s History Month.

The enhanced collaboration will include a six-month fellowship program, which will provide five recipients with mentorship from key Anthropologie team members and the opportunity to sell their work commission-free through Anthropologie’s stores and digital marketplace beginning in the fall.

To celebrate the launch of this expanded partnership and to honor Women’s History Month, Anthropologie will also host a series of special events. On March 6 in New York City, Anthropologie will hold a Women’s History Month panel discussion featuring key executives from both Anthropologie and Nest, alongside local artisans and makers, to explore the impact of creative entrepreneurship.

Likewise, on March 8, Anthropologie stores in New York City, Los Angeles, and Chicago will host Nest artisans and makers for exclusive community pop-up markets, offering customers a chance to shop unique products while supporting local women-led businesses.

Lastly, as part of its ongoing commitment to women’s empowerment, Anthropologie is also pledging a $100,000 annual corporate donation to support Nest’s mission.

“We’re honored to kick off Women’s History Month by announcing the expansion of our partnership and fellowship program with Nest,” said Kate Haldy, head of PR, communications, and Impact at Anthropologie Group.

“Over the past two years, we have been deeply inspired by the incredible work our friends at Nest are doing to uplift and empower artists and makers across the country. We are excited to deepen our commitment to this impactful journey, expanding our support and creating even greater opportunities for these talented communities in 2025 and beyond.”

Copyright © 2025 FashionNetwork.com All rights reserved.

Tennis Babes Making A Racket For World Tennis Day!

‘Printemps New York is not a classic department store’

New Camera Angle Shows Horrible Aftermath of Angie Stone’s Van Crash

Trending

-

Entertainment8 years ago

Entertainment8 years agoThe final 6 ‘Game of Thrones’ episodes might feel like a full season

-

Entertainment8 years ago

Entertainment8 years agoMod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Politics8 years ago

Politics8 years agoCongress rolls out ‘Better Deal,’ new economic agenda

-

Entertainment8 years ago

Entertainment8 years agoNew Season 8 Walking Dead trailer flashes forward in time

-

Tech8 years ago

Tech8 years agoMicrosoft Paint is finally dead, and the world Is a better place

-

Tech8 years ago

Tech8 years agoHulu hires Google marketing veteran Kelly Campbell as CMO

-

Tech8 years ago

Tech8 years agoFord’s 2018 Mustang GT can do 0-to-60 mph in under 4 seconds

-

Politics8 years ago

Politics8 years agoIllinois’ financial crisis could bring the state to a halt