Tech billionaires are making plans to bail on California ahead a possible ballot measure that would tax their assets to help pay for healthcare.

Sources told the New York Times that venture capitalist Peter Thiel has explored spending more time outside California and opening an office for his Los Angeles-based personal investment firm, Thiel Capital, in another state.

Meanwhile, Google cofounder Larry Page has discussed leaving the state by year’s end, sources told the Times, while three limited liability companies associated with him have filed documents to incorporate in Florida.

The Thiel Foundation and Google parent Alphabet didn’t immediately respond to requests for comment. Representatives for Thiel and Page did not respond to the Times.

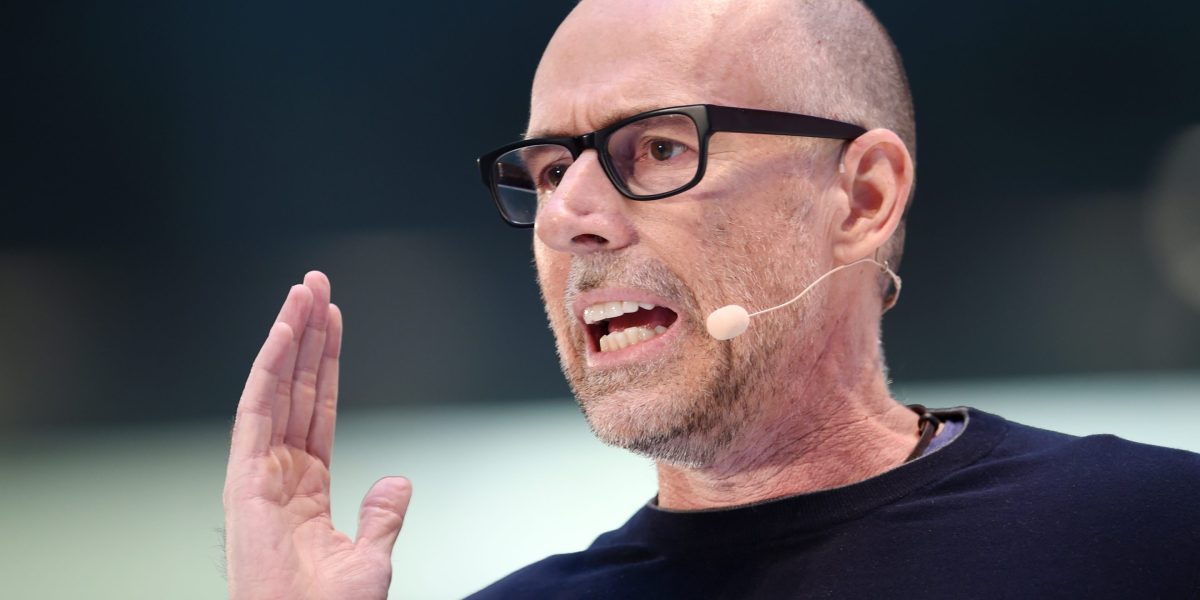

Tech investor Chamath Palihapitiya has warned on the risk of a wealth tax in California, saying it will eventually bankrupt the state.

“The inevitable outcome will be an exodus of the state’s most talented entrepreneurs who can and will choose to build their companies in less regressive states,” he posted on X on Monday. “All that will be left behind is the middle class. The tax burden, then, will fall to the middle class because after the ‘richest’ choose to leave, the middle class are both (a) the only ones left and (b) are the largest source of state income to extract taxes from.”

On Friday, he posted in a reply to Sen. Ted Cruz, who urged him to move to Texas, that it’s “under serious consideration.”

Backers of the potential wealth tax must still gather enough signatures before it can qualify for the ballot in November 2026.

The proposal calls for California residents worth more than $1 billion to pay a one-time tax equivalent to 5% of their assets. According to the Bloomberg Billionaires Index, Page is worth $270 billion and Thiel is worth $27.2 billion.

The healthcare union pushing the measure, the Service Employees International Union-United Healthcare Workers West, estimated the wealth tax could raise $100 billion in revenue and offset federal cuts.

But California Gov. Gavin Newsom, a Democrat who is also considered a top presidential hopeful, has come out against it.

Companies have already been leaving California for places with lower taxes and less red tape. Elon Musk moved Tesla and SpaceX to Texas.

And while leading AI companies are based in California, new data centers and AI infrastructure are being built outside the state, where land, water and electricity are more available.

New Yorkers aired similar worries about an exodus after democratic socialist Zohran Mamdani was elected the city’s mayor last month. But so far, that has yet to materialized as luxury home sales in Manhattan surged in November.

Democratic Rep. Ro Khanna, who represents part of Silicon Valley, said tax dollars helped build the AI industry and dismissed the idea that tech entrepreneurs wouldn’t start companies in the state due to a 1% tax, adding that innovators are drawn to the area’s talent.

“We cannot have a nation with extreme concentration of wealth in a few places but where 70 percent of Americans believe the American dream is dead and healthcare, childcare, housing, education is unaffordable,” he said on X. “What will stifle American innovation, what will make us fall behind China, is if we see further political dysfunction and social unrest, if we fail to cultivate the talent in every American and in every city and town.”

Still, he acknowledged lack of accountability and fraud concerns over state tax dollars, saying Sacramento needs anti-corruption measures.

Blake Scholl, founder and CEO Boom Supersonic, pointed to the billions spent by California for a high-speed rail project that’s over-budget and behind schedule.

“This is morally wrong and ends poorly for everyone,” he said about the wealth tax in response to Khanna on X.

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Business8 years ago

Business8 years ago

Tech8 years ago

Tech8 years ago