China pledged to retaliate against Donald Trump’s latest tariff threat and stepped up efforts to support the market, raising the risk of a prolonged trade war between the world’s two largest economies.

“The U.S. threat to escalate tariffs on China is a mistake on top of a mistake,” the Chinese Ministry of Commerce said in a Tuesday statement. “If the U.S. insists on its own way, China will fight to the end.”

The Chinese response came hours after Trump vowed to slap additional 50% import taxes on China unless it withdraws its tit-for-tat retaliation against his earlier levies. The blunt reaction suggests Beijing intends to resist the U.S. president’s pressure campaign, dimming the prospect of a deal in the short term.

“The rhetoric from China is strong,” said Michelle Lam, greater China economist at Societe Generale SA. “Without Trump backing down investors may need to prepare for trade decoupling between both countries.”

Chinese authorities have signaled their determination to support markets. The central bank has loosened its grip on the yuan to boost the appeal of its exports and a group of state-linked funds known as the national team scooped up assets. Officials also promised loans to help stabilize the market and were reported to have considered frontloading some stimulus.

The onshore yuan slid to the weakest level since September 2023, while the offshore unit hit a two-month low Tuesday. The Hang Seng China Enterprises Index jumped as much as 3.7% after capping its worst loss since the financial crisis in the previous session.

Trump’s latest charge would pile onto a 34% “reciprocal” duty set to kick in April 9, as well as a 20% hike implemented earlier this year, according to a White House official. That takes the cumulative tariff rate announced this year to 104%—effectively doubling the import price of any goods shipped from China to the U.S.

The Chinese Ministry of Commerce also called for dialogue to resolve disputes in its statement, despite Trump’s warning that “all talks with China” about a meeting will be terminated if Beijing doesn’t take action, without specifying what would be required.

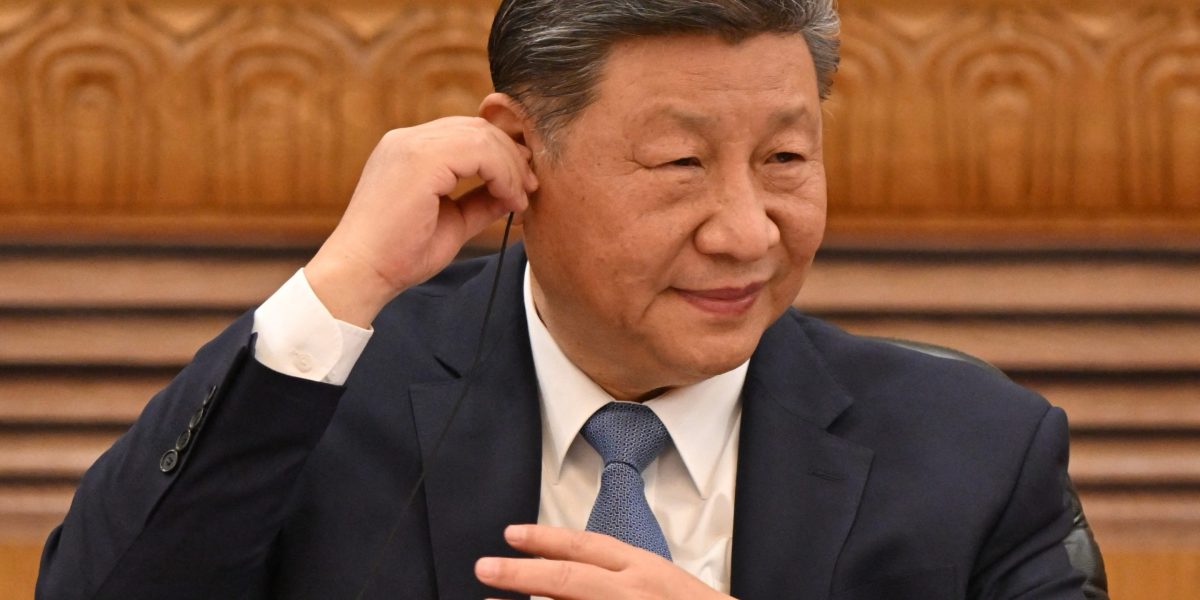

The escalation in tensions makes any imminent call between the two world leaders less likely. Trump hasn’t spoken with Chinese President Xi Jinping since returning to the White House, the longest a U.S. president has gone without talking to his Chinese counterpart post-inauguration in 20 years.

The Communist Party’s official newspaper this week published an editorial declaring that Beijing is no longer “clinging to illusions” of striking a deal. Instead, officials are focusing on shielding the economy. Xi has vowed to boost domestic consumption with tariffs expected to hurt exports, a sector responsible for a third of China’s economic growth last year.

Underscoring Beijing efforts to stem an equities rout, a basket of eight exchange-traded funds favored by the so-called national team saw record net inflow of 42 billion yuan ($5.7 billion) Monday.

A weaker yuan could also offset the effect of higher tariffs. The Chinese central bank’s fixing on Tuesday— past the keenly-watched 7.20 per dollar level—signals more tolerance for depreciation. Bets on monetary stimulus have supported demand for China bonds, as 10-year sovereign yield hovered close to a record low set in early February.

China will hit back at new U.S. tariffs with equivalent measures as any fresh U.S. levies will add limited pain to the Asian nation, according to Ding Shuang, chief economist for Greater China & North Asia at Standard Chartered.

“The marginal effect of raising tariffs further from the existing level of about 65% will shrink,” he said of additional U.S. tariffs. “Most Chinese exports to the U.S. have already been affected. For goods that are not price sensitive, tariffs won’t work no matter how high they go.”

In response to the latest U.S. move, China’s embassy in Washington called U.S. threats “not the right way to engage” with China.

“The U.S. hegemonic move in the name of reciprocity serves its selfish interests at the expense of other countries’ legitimate interests and puts ‘America first’ over international rules,” embassy spokesman Liu Pengyu said.

This story was originally featured on Fortune.com

Source link

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Tech8 years ago

Politics8 years ago

Politics8 years ago