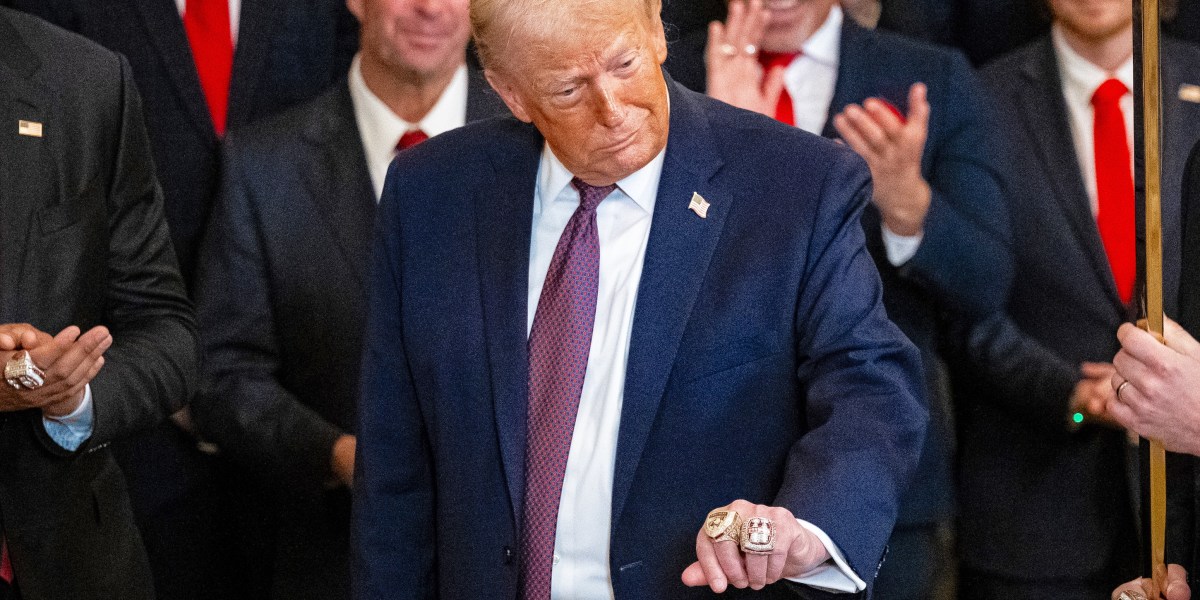

Good morning. President Donald Trump’s proposal to temporarily cap credit card interest rates has both supporters and critics. In a social media post on Jan. 9, Trump called for a one-year cap on credit card interest rates at 10% starting Jan. 20, reviving a pledge from his 2024 campaign as the administration seeks to demonstrate progress on affordability.

Supporters argue a temporary cap could ease pressure on households facing average APRs above 20%.

But economists and bank executives warn that the move requires approval from Congress and that the policy could have unintended consequences by making banks more reluctant to offer credit, thus slowing down consumer spending.

“An artificial cap on credit card interest rates is likely to backfire on the White House by making credit less accessible to the cash-strapped households that most need it,” Columbia Business School economics professor Brett House told me.

Earnings call discussions

The proposal was a major topic this week during the earnings calls of America’s big banks. Executives broadly agree a 10% cap would reduce access to credit for higher-risk borrowers and could have adverse effects on consumer spending and growth, Morningstar director Sean Dunlop told me.

“I think Jane Fraser, CEO of Citigroup, provided the most context among the firms I cover, alluding to a previous time when President Carter tried to impose interest rate ceilings—and the administration had to abandon its efforts within two months, given the severity of the economic impact,” Dunlop said.

Fraser noted that consumers spend roughly $6 trillion annually on credit cards and carry about $1.2 trillion in balances. She warned that making card products unprofitable would curtail spending on those cards as credit availability declines, he said.

Other CEOs and CFOs had similar concerns:

— JPMorgan Chase CFO Jeremy Barnum said the cap would likely reduce access to credit rather than help consumers. He argued that intense competition already compresses margins and that price controls would force broad lending cutbacks — especially for higher-risk borrowers.

— Bank of America CEO Brian Moynihan said the industry is committed to affordability but argued a cap would tighten credit. “You’re going to get restricted credit, meaning less people will get credit cards, and the balance available to them on those credit cards will also be restricted,” he said.

—Citi CFO Mark Mason called affordability an important issue and said Citi looks forward to working with the administration on a constructive solution. “I also say that an interest rate cap is not something that we would or could support,” he said, arguing it would restrict access to credit.

Dunlop said if the proposal is implemented, banks would likely respond by tightening lending standards, competing more aggressively for higher-FICO borrowers, and seeking to offset lost interest income through higher fees.

Higher interest rates compensate lenders for nonpayment risk; without that flexibility, issuers would narrow underwriting and concentrate lending among the least risky borrowers. “For issuers that extend credit to lower-income borrowers, like Bread, the credit card economics simply don’t work out at lower interest rates, and they’d be forced to shrink their lending volumes dramatically,” Dunlop said.

The debate highlights the tension between lowering borrowing costs and preserving access to unsecured credit — a balance policymakers must weigh as affordability concerns collide with market realities.

Have a good weekend.

Quick note: In observance of Martin Luther King Jr. Day, the next CFO Daily will be in your inbox on Tuesday.

Sheryl Estrada

sheryl.estrada@fortune.com

Leaderboard

Fortune 500 Power Moves this week:

Dennis K. Cinelli was appointed CFO of Paramount, a Skydance Corporation (No. 147), effective Jan. 15, and as such has resigned his board of directors seat. Cinelli will succeed Andrew C. Warren, who has served as EVP and interim CFO since June 2025. Most recently, Cinelli served as CFO of Scale AI. He previously held senior finance and operational roles at Uber, including global head of strategic finance, and later running the U.S. and Canada Mobility (Rides) business. Before Uber, Cinelli was with G.E. Ventures as CFO.

Every Friday morning, the weekly Fortune 500 Power Moves column tracks Fortune 500 company C-suite shifts—see the most recent edition.

Here’s more CFO moves this week:

Clare Kennedy was appointed CFO of Spencer Stuart, a global advisory firm, effective Jan. 12. Kennedy succeeds Christine Laurens as part of a planned succession and in support of Laurens’ retirement from full-time executive work. Kennedy, who is based in London, joins Spencer Stuart from Maples Group, an international advisory firm, where she served as global chief operating officer. She joined Maples Group from Freshfields, an international law firm, where she served as its global CFO. Kennedy previously spent 18 years at Linklaters, an international law firm, where she held a variety of senior finance and commercial leadership roles. She began her career at Arthur Andersen and EY as a chartered accountant, specializing in tax.

Gillian Munson was appointed CFO of Duolingo, Inc. (NASDAQ: DUOL), a mobile learning platform, effective Feb. 23. Matt Skaruppa will step down after nearly six years with the company; he will remain CFO until Munson starts her new role, at which time he will assume an advisory role. Munson assumes the CFO role after serving on the Duolingo board of directors since 2019 as chair of the audit, risk and compliance committee. She was most recently the CFO of Vimeo and previously held CFO positions at Iora Health, Inc. and XO Group Inc.

Betsabe Botaitis was appointed CFO of P2P.org, a non-custodial institutional staking provider. Botaitis brings over 20 years of leadership across financial services, fintech, and Web3, with experience building governance and operations in high-growth organizations. Most recently, Botaitis served as CFO and treasurer at Hedera. Botaitis’ career spans both traditional financial institutions and crypto-native organizations. She began in retail banking before holding senior finance roles at Citigroup and LendingClub, and later co-founding and serving as CFO of a blockchain company.

Julie Feder was appointed CFO of Obsidian Therapeutics, Inc., a clinical-stage biotechnology company. Feder brings over 20 years of strategic finance experience in life sciences and health care. Feder joins Obsidian from Aura Biosciences, where she served as CFO for six years. Before Aura, she was CFO at Verastem. Before that, Feder spent six years at the Clinton Health Access Initiative, Inc., as CFO.

Deborah Ricci was appointed EVP and CFO of Acentra Health, a technology and health solutions company. Ricci joins Acentra Health from Guidehouse Inc., where she most recently served as partner and chief financial and administrative officer. Earlier in her career, Ricci held multiple senior finance leadership roles, including CFO positions at Constellis, Centerra Group, and A-T Solutions, and began her career as a certified public accountant with KPMG.

Rohan Ranadive was appointed managing director and CFO of GTCR, a private equity firm. Ranadive succeeds Anna May Trala, who is retiring. Trala will remain affiliated with the firm, serving as a senior advisor going forward. Ranadive brings more than 20 years of experience. He joins GTCR from Vista Equity Partners, where he was a managing director of finance operations. Before that, he was the CFO of Aviditi Advisors and spent 12 years at TPG Capital in various finance and accounting leadership roles.

Big Deal

Accenture’s latest Pulse of Change research is based on a survey of 3,650 C-suite leaders from the world’s largest organizations across 20 industries and 20 countries.

Companies are pouring resources into AI, with 78% now seeing it as a bigger driver of revenue growth than cost cuts, according to the report. At the same time, 35% of leaders said a solid data strategy and core digital capabilities would do the most to accelerate AI implementation and scale. However, 54% of employees report low‑quality or misleading AI outputs that waste time and hurt productivity. In AI, value follows quality, so trust in outputs and data accuracy remains critical for sustained growth, according to Accenture.

Going deeper

Here are four Fortune weekend reads:

“Exclusive: Former OpenAI policy chief creates nonprofit institute, calls for independent safety audits of frontier AI models” by Jeremy Kahn

“America’s $38 trillion national debt is so big the nearly $1 trillion interest payment will be larger than Medicare soon” by Shawn Tully

“Worried about AI taking your job? New Anthropic research shows it’s not that simple” by Sharon Goldman

“America’s hottest job opening right now is in the NFL—no degree is required, you won’t be fixed to a desk and it pays up to $20 million” by Preston Fore

Overheard

“We have transitioned from a K-shaped recovery into a Barbell Economy, a system heavily weighted at the extremes of wealth and precarity, connected by a middle class that is rapidly snapping.”

—Katica Roy, a gender economist and the CEO and founder of Denver-based Pipeline, a SaaS company, writes in a Fortune opinion piece.

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics9 years ago

Politics9 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment9 years ago

Entertainment9 years ago

Business8 years ago

Business8 years ago

Tech8 years ago

Tech8 years ago