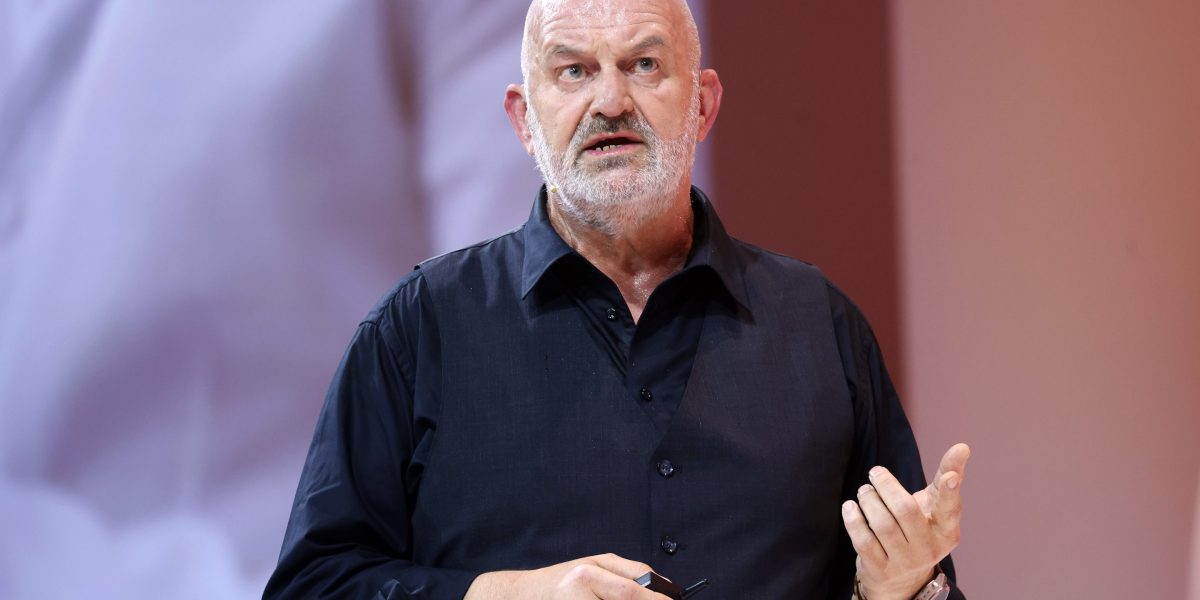

Several years ago, Amazon Chief Technology Officer Werner Vogels began sharing predictions on how technology would likely impact our lives the following year. In the past, he has foreseen the impact of digital technology in sports, of AI assistants in developer productivity, machine learning embedded in production lines, and ‘fem tech’ on women’s health.

As CTO of Amazon (No. 2 on the Fortune 500) since 2005, he occupies a unique perch to see and even shape what’s next. Vogels also has a vested interest, of course, in embracing the technologies that his company creates. In this year’s forecast, Vogels predicts 2026 will be the year in which “interdisciplinary cooperation influences discovery and creation at a pace we haven’t seen since the Renaissance.” He sees technology becoming a force that will reduce loneliness, empower a new breed of developers, accelerate personalized learning, and spawn military technology that will quickly cross over to areas like health care. On a more cautionary note, he warns that breakthroughs in quantum computing will force a shift in how we handle cybersecurity.

Vogels’s 2026 predictions:

- Companionship is redefined for those who need it most

- The dawn of the renaissance developer

- Quantum-safe becomes the only safe

- Defense technology changes the world

- Personalized learning meets infinite curiosity

Vogels spoke with Fortune about the thinking behind this year’s predictions.

This interview has been edited and condensed for clarity.

Going through some of your past predictions, this set feels a little more somber this year. Is that fair to say?

I understand what you mean, but I do find that there is quite a bit of positivity in there. I think that the personalized learning one is a very interesting one. And I do think that the way that developers are going to change is a very positive thing.

You phrase it as the ‘dawn of the renaissance developer.’ What is that?

The Renaissance came after—what was it?—1000 years of the Dark Ages. The tools that were developed in those days were just incredible and I think that we’re going to see a similar kind of evolution, with more people inventing new technologies but also new applications.

I know loneliness sounds negative, but we’re getting older and the younger generation doesn’t want to take care of their parents so technology can help. Japan has really been inventing in that space.

Japan has been a first mover, given its demographics. As you point out, technology can also cause loneliness. Can it help younger generations, too?

Definitely. Younger people with autism, for example, have trouble touching other people but don’t have any trouble touching a mechanical device. The way that they communicate with that device is way more natural than how they communicate with adults or parents. Given my own background in the medical world, [Vogels previously worked in both health care and academic research, plus a startup, prior to joining Amazon in 2004] I’ve seen in the past how hard it was for kids to talk to a doctor. Having this huggable device with them gives them a lot more confidence to express what they’re feeling.

Amazon has built this little robot [the Amazon Astro] that can take on a lot of tasks but also goes looking through the house for you to ask you if you’ve taken your medicine. There’s a lot of things that go beyond loneliness.

There’s some concern that, with AI therapists or friends, people may find it easier to engage with a machine versus another human being. How do we make sure that technology doesn’t become a substitute for human interaction?

This is not my biggest concern. I’ve seen people prepare themselves before they go to a therapist by talking when there is nobody in the room. We can say whatever you want, and this device won’t judge you. A concern I have is that there may be companies in the future that will use these devices as advertising that suggest to you to buy product X, Y or Z. Given the amount of trust that you put into this device, that’s a big risk. We need to really be aware of that and either try to avoid it or detect it.

We already have advertising in our ambient world, especially with smart homes. Does it really matter if our robots also express some of those things that our fridge, our stove and our phones are already telling us?

I would have a different level of trust with devices that are there to help you with your loneliness or with your disease. I remember a guy in the early stages of dementia who could see that his caregivers were getting frustrated, because he kept asking, ‘What day is it today?’ The moment he got an Alexa, he only needed a sticker on it to say that she’s called Alexa, and he could ask her anything and Alexa would never get annoyed at being asked the same thing 10 times. There’s so much to help those who are suffering.

Do you worry about our ability to connect as human beings?

I have a great trust in humans. We enjoy social contact. I saw Jensen (Huang) recently and he was asked the question: Will AI eventually take over? He said, in some of our jobs, 10 to 20% may go to AI; in some of our jobs, it could be 50% but probably that’s it. As a job taker and as an efficiency tool, absolutely. As a social tool, no. We’re having a conversation, and we’re enjoying that, triggering parts of our brain that normally don’t get triggered. We are social animals.

Let’s move on to your optimism about developers.

The tools won’t take over. It is still our creativity, our understanding of the bigger picture, that will never be taken over by tools. A little task can be completed automatically. Systems consist of hundreds, if not thousands, of tasks. We are going to find new and better ways to design our systems, but there is still a significant human part in there.

There are people like you, who have a deep embedded knowledge of tech, as opposed to people like me, who now think we can vibe code our way to the next big thing, right?

If you want a one- or two-page website with a little database and you’re not terribly concerned about security; what would normally have taken you three weeks, now takes two hours? Absolutely. But that’s not what I want the guys in my bank to do. I want them to be deeply expert, both on the tech side as well as on the financial side, and understand how these things communicate with each other.

When you think of health care or financial systems, tools are strictly controlled through regulatory requirements. If something goes wrong, you can’t come to the regulator and say, ‘That was AI. That was not me.’ As such, I do think that there are things that we’ve done for years and will continue to do them. The fundamental skills for developers shouldn’t disappear.

In the past, we rewarded developers who had one really good skill, let’s say back-end developers. You still need to have this deep background, but you also need to understand what your technology is being used for and that is absolutely a renaissance approach. You need polymorphs like Da Vinci. It’s no longer enough to know one thing, you need to understand in what context this is happening, systems thinking. How do we create feedback loops? How do we make sure that, if you have all these different pieces, we make sure that if something happens here, it doesn’t go down the drain there?

That ties to your prediction about personalized learning-meets-infinite curiosity. People worry about AI users outsourcing their analysis and the sort of systems thinking that you’re advocating for.

I hope that with technology, we can bring more individualized learning to people. Our current educational system is driven towards conformity. Everybody needs to do the same thing. Creativity gets lost. Curiosity. We hammer that out of our children. We have all different interests, different capabilities. You need to educate kids on how to use these tools in order to unleash their potential.

Do you think this is a pivotal year for quantum?

Yes, but not necessarily for the quantum devices itself. We need to realize that bad actors are harvesting our data, not because they can decrypt it already now, but in four or five years they will. Everything you have encrypted now can be decrypted in five years’ time. Amazon has open-sourced technology such that you can encrypt your data so it will be safe on the quantum. The biggest challenge is not the big companies that have CIOs and CTOs and tons of developers, but all the home devices we have. How often have you updated the operating system on your home device? On my TV, never. There are major risks in the future if we do not address the quantum issue of encryption.

I’m curious about your prediction that we’ll see a compressed timeline from battlefield to civilian applications of defense technology. How transformational is that?

There are things in our civil world that would never have reached us if they had not been defense technology first, including the internet, GPS, the EpiPen. Usually it takes years to get the cost reductions and technology to be commercially viable. We’re now seeing a lot more military investment, and we’re seeing some defense companies start to operate more like tech startups than traditional defense contractors.

You’ve been CTO since 2005. How has your role or your mission evolved?

When I joined Amazon 21 years ago, there were different roles for CTOs. There are CTOs that report to the CIO and manage data centers. Startups sometimes have a CTO as their first employee and coder. I actually think CTOs are horrible managers. You should never put a CTO in charge of people.

Why not?

VPs of engineering wake up in the morning, thinking ‘Do I have the best team in the best situation? Can I shield them from all the things that are politics and stuff like that? The CTO thinks about, ‘What’s the next technology that we should be building?’ Actually, that was my role for many years within Amazon. Then you become a technology provider, and then your role changes again. You have to understand how your customers are actually using your technology. What kind of problems are you hearing from five or six different customers that are all the same, and you should be building technology for that.

What are you seeing that excites you?

I travel quite a lot because I like to know not only how the U.S. companies are using us, but how people in the Philippines and elsewhere use us. I’m seeing many young businesses that aren’t interested in becoming unicorns. They’re really interested in solving hard problems, things they saw in their own neighborhoods. In Kenya, for example, sometimes people make enough money for food but don’t have money left for the gas to cook it. So this young business, KOKO Networks, built a sort of ATM machine where you can go with a canister and put in 10 cents worth of gas. That interests me tremendously. How can we solve some of the world’s hardest problems by using technology? Especially in Africa, I’ve met so many motivated engineers that don’t want to come to the U.S.. They don’t want to go work for a large company. They want to solve the problem in their country. I love that. That’s where the real progress lies.

Politics9 years ago

Politics9 years ago

Entertainment9 years ago

Entertainment9 years ago

Politics9 years ago

Politics9 years ago

Politics9 years ago

Politics9 years ago

Entertainment9 years ago

Entertainment9 years ago

Entertainment9 years ago

Entertainment9 years ago

Business9 years ago

Business9 years ago

Tech9 years ago

Tech9 years ago