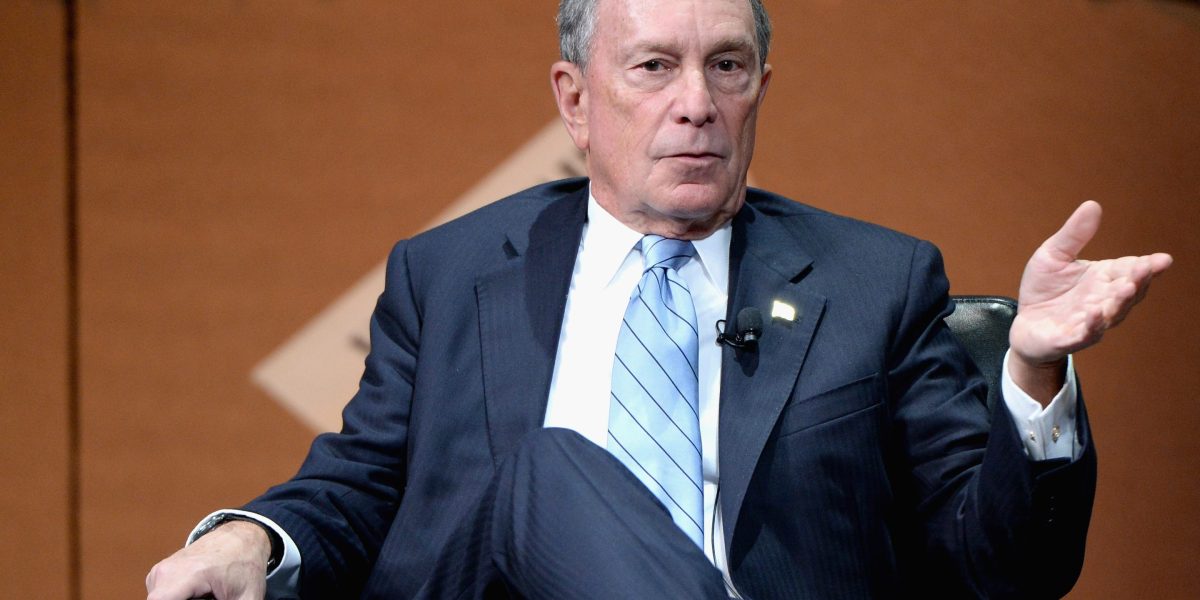

Mike Bloomberg—American media magnate, politician, and philanthropist—was no exception. About 44 years ago, before founding his news company or becoming the 108th Mayor of New York City, the billionaire was let go from his role as partner at investment bank Salomon Brothers. He had spent 15 years working his way up the corporate totem pole, starting as an entry-level clerk earning $9,000 annually. After being laid off amid Salomon Brothers’ acquisition by Phibro Corporation, it would be the last time he worked a traditional full-time job.

“Getting fired from Salomon Brothers drove home a lesson that I’ve carried with me throughout my career in business, government, and philanthropy: Every setback is an opportunity,” Bloomberg tells Fortune. “If I hadn’t gotten fired, I might never have started Bloomberg, never run for mayor, and never had the chance to give back through Bloomberg Philanthropies, which is working to tackle big challenges around the world.”

The now-83-year-old entrepreneur wasted no time wallowing in the pain of being pushed out from a company where he says he would have spent his entire career. The morning after getting laid off, Bloomberg launched an organization named Innovative Market Solutions that would later become Bloomberg LLC: the privately held software, data, and media company with major successes including the Bloomberg terminal and Bloomberg News. He teamed up with Thomas Secunda, Duncan MacMillan, Charles Zegar to cofound the organization in 1981, using his $10 million severance package from Salomon Brothers to get the business off the ground. Bloomberg currently owns 88% of his company, which has estimated annual revenues of nearly $15 billion, according to Forbes. Bloomberg himself is worth an estimated $109 billion.

From his current height as one of the most influential billionaires spanning politics, media, and philanthropy, that rejection is far in the rear-view mirror. But the experience taught Bloomberg setbacks don’t have to be career-crushing, and impacted his philosophy as a leader today.

“Did getting fired sting at the time? Sure. The firm had been such an important part of my life for 15 years,” Bloomberg says. “But when you get knocked down, you have to get up and dust yourself off—and move on.”

“I’ve never been one to look back,” he continues. “You can’t change the past, so why dwell on it? Besides, if you never fail, you’re not setting your sights high enough. Life is too short to stick to the bunny slope.”

What Bloomberg learned from getting fired from Salomon Brothers

While Bloomberg has no hard feelings and doesn’t ruminate on the fact he was laid off, he does carry the lessons he learned from the experience. It taught him invaluable truths about professional careers, and shaped the way he runs his business and philanthropic organizations.

“Getting fired was hard, but I never held it against the people involved, because I had learned so much from them over the 15 years we spent together, including about the importance of giving back,” Bloomberg reminisces. “I took much more from the job than a paycheck.”

One takeaway for Bloomberg is the reality of how much you can actually plan ahead. Succeeding might sound like a straightforward process: joining a company, rising through the ranks, and taking over the throne after years of dedication. But life has a funny way of showing that even a sure thing could always be flipped on its head.

“Getting fired also showed me the limits of long-term planning. I loved working at Salomon and might have spent my whole career there,” Bloomberg continues. “It’s ok to make plans—but never let planning get in the way of doing. The best laid plans often go awry, and you have to be able to roll with changes and adapt to them.”

Bloomberg also garnered a deep admiration for loyalty. As someone who had once dedicated his career to his former employer, he recognizes the power of dedicated workers. At his own company, he shows that gratitude by giving out commemorative pylons when staffers reach tenure achievements. He says that while walking around the office, employees proudly display their statues marking 10, 20, and even 30-year milestones. Bloomberg currently boasts more than 26,000 employees who stay for an average of 7.8 years, as of last year. For reference, wage and salary workers’ overall tenure is about 3.9 years at their employers, according to 2024 data from the Bureau of Labor Statistics.

A part of that longevity may stem from the culture he’s created. He says Bloomberg’s offices across nearly 70 countries foster a sense of “collaboration and creativity” and flatten company hierarchy with its office layouts. Bloomberg explains it was intentional that all workspaces have no walls or private offices with every employee, regardless of position, receiving the same size desk. He says he believes people leave their companies when they don’t feel heard or invested in—especially young people. Setting this standard has kept Bloomberg staffers around for decades.

“The experience also left me with a special appreciation for the value of loyalty and of rewarding hard work,” he says. “That kind of longevity is increasingly rare in business, and it happens because we’ve never stopped investing in people and giving them opportunities to grow their careers.”

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Business8 years ago

Business8 years ago

Tech8 years ago

Tech8 years ago