Good morning. Adobe is doubling down on agentic AI to make creativity more conversational.

At its annual MAX user conference on Tuesday, Adobe (No. 201 on the Fortune 500) announced recent product innovations and how its partnership with Google Cloud will bring the tech company’s latest AI models directly into Adobe apps.

Adobe is expanding its agentic AI capabilities to Photoshop and Adobe Express, giving users access to its AI-powered assistants. The company also previewed plans to extend these conversational capabilities to models like ChatGPT, allowing users to edit and generate content using natural language prompts. An Adobe Express–ChatGPT integration is expected soon.

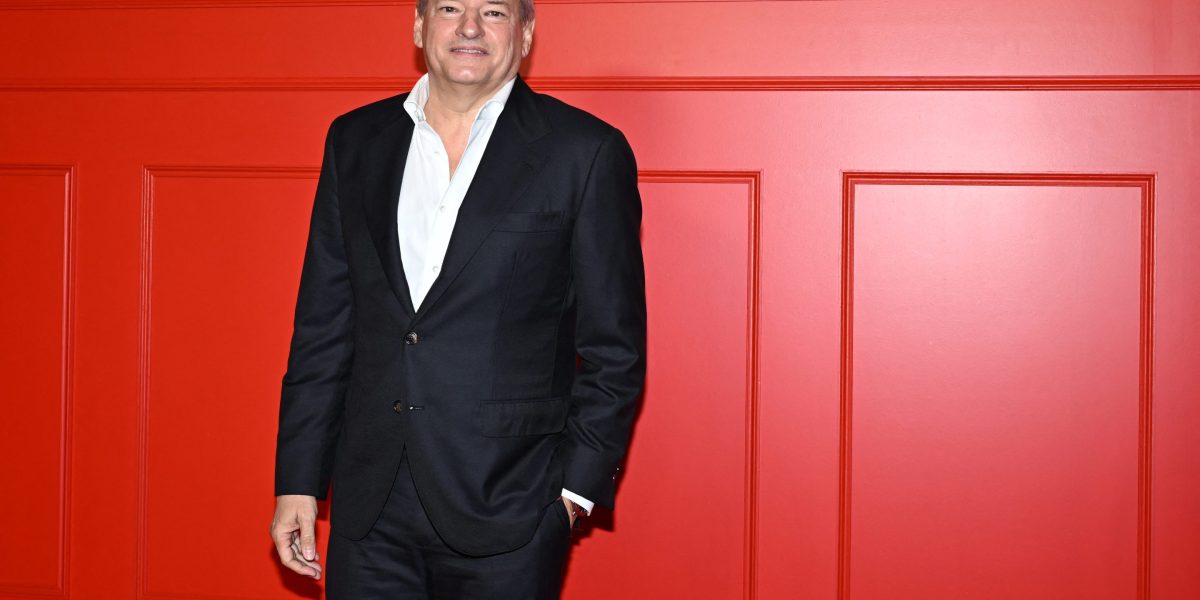

Google brings crucial technical expertise, while Adobe leads in creative solutions, Dan Durn, EVP and CFO at Adobe, told me. By partnering, the companies combine strengths to reach customers, said Durn, who leads finance, technology, security, and operations.

Creative agents and conversational interfaces built into Adobe tools make products like Express and Photoshop more productive and easier to use, he explained. Users no longer need to master complex menus; instead, they simply type what they want the product to do, he said.

Through the partnership, Adobe will be able to integrate Google’s latest AI models — including Gemini, Veo, and Imagen — into Adobe’s applications as they come to market. Enterprise customers will soon be able to customize Google’s AI models using Vertex AI and Adobe Firefly Foundry to create brand-specific AI models for large-scale content generation, Durn said.

Adobe’s expanding AI ecosystem

Adobe is developing proprietary Firefly models but also deeply integrating partner models, Durn explained. More than $5 billion in annual recurring revenue (ARR) now comes from users engaging with Adobe and AI capabilities in their workflows, he added. “We expect that number to keep growing,” he said. “As we proliferate these capabilities, I want AI-influenced ARR to reach 100% of our business.”

The company also held an investor meeting during the MAX event, reaffirming Q4 and FY2025 targets. Adobe reported double-digit subscription revenue growth, non-GAAP operating margins above 46%, and nearly $10 billion in operating cash flow over the past year.

Dan Romanoff, senior equity analyst at Morningstar, wrote in a Tuesday note that the firm maintains its fair value estimate of $560 per share for wide-moat Adobe and sees shares as attractively valued.

“We don’t think Adobe has erased investor concerns, but we see growing momentum in product innovation and sales execution,” Romanoff wrote. “After good Q3 results and an impressive MAX conference, we sense Adobe has turned the corner.”

Adobe CEO Shantanu Narayen told Bloomberg in an interview that Wall Street undervalues the company, with AI-focused investors overlooking Adobe’s profitability and growth. Narayen expects the market to shift its attention to Adobe’s strength in AI integration in applications.

Heading into 2026, Durn aims to continue driving customer-focused growth. Adobe has more than 700 million monthly active users, up 25% year-over-year in Q3, he said.

“We’re building an AI-first ideation playground with powerful capabilities presented in an approachable way for the next generation of creators,” Durn said.

Sheryl Estrada

sheryl.estrada@fortune.com

Leaderboard

Fortune 500 Power Moves

Paul Kuehneman was appointed interim CFO and controller at Hormel Foods Corporation (No. 352), effective October 27. Kuehneman succeeds Jacinth Smiley, who is leaving the company and will be pursuing other opportunities, according to the announcement. Kuehneman has more than 30 years of business and finance experience at Hormel Foods, holding a variety of leadership roles, including director of internal audit, VP and CFO for the Jennie-O Turkey Store, assistant controller, and, most recently, VP and controller of Hormel Foods.

Every Friday morning, the weekly Fortune 500 Power Moves column tracks Fortune 500 company C-suite shifts—see the most recent edition.

More notable moves

Mala Murthy was appointed EVP and CFO of TriNet (NYSE: TNET), a provider of human resources solutions, effective November 28. Murthy will succeed TriNet’s current CFO, Kelly Tuminelli, who will serve as a special advisor to the CEO through March 16, 2026. Murthy most recently served as CFO of Teladoc Health. Before that, she held several senior executive positions at American Express, including CFO of its global commercial services segment. She also previously served in FP&A, treasury, and corporate development and strategy leadership positions with PepsiCo.

Michelle Turner was appointed CFO of Teradyne, Inc. (Nasdaq: TER), a provider of automated test equipment and advanced robotics, effective November 3. Turner replaces Sanjay Mehta, who has served as Teradyne’s CFO since 2019. Turner brings 30 years of financial and strategic leadership experience. Before joining Teradyne, she was the CFO for L3Harris Technologies. Turner has also held a variety of senior financial management and leadership roles in Johnson & Johnson, BHP Billiton, Raytheon, and Honeywell.

Big Deal

The Federal Reserve lowered its benchmark interest rate by a quarter of a percentage point on Wednesday, a widely anticipated move that comes amid a worsening data blackout, Fortune’s Eva Roytburg reports.

The Fed’s policy rate now stands at roughly 3.75% to 4.00% — its lowest level in three years — and marks the second rate cut since President Trump’s return to office. Markets had fully priced in the move: CME Group’s FedWatch Tool showed nearly a 100% probability of a 25-basis-point reduction heading into the meeting.

“Economic activity has been expanding at a moderate pace,” the Federal Open Market Committee (FOMC) said in a statement. However, the committee acknowledged that job gains have slowed and the unemployment rate has edged higher, even though it “remains low.” Inflation, it noted, “has moved up since earlier in the year and remains somewhat elevated.” Read more here.

Going deeper

“How to Detect Bias in Large Language Models” is a new report in Wharton’s business journal. Research from Wharton’s Sonny Tambe finds that LLMs can make biased hiring decisions that traditional auditing methods might not be able to catch.

Overheard

“While the bears will continue to yell ‘AI bubble’ from their hibernation caves, we continue to point to this tech cap-ex supercycle that is driving this fourth Industrial Revolution into the next few years.”

—Wedbush Securities analysts write in an industry note released this morning.

Politics8 years ago

Politics8 years ago

Entertainment9 years ago

Entertainment9 years ago

Politics9 years ago

Politics9 years ago

Politics8 years ago

Politics8 years ago

Entertainment9 years ago

Entertainment9 years ago

Entertainment9 years ago

Entertainment9 years ago

Business9 years ago

Business9 years ago

Tech8 years ago

Tech8 years ago